What Apr Is Too High For A Credit Card

The allure of a new credit card, promising rewards and purchasing power, can quickly turn sour when the Annual Percentage Rate (APR) becomes a crippling financial burden. As inflation lingers and interest rates climb, the question of what constitutes an unacceptably high APR is becoming increasingly urgent for consumers across the economic spectrum.

Determining a “too high” APR isn’t a straightforward calculation. It hinges on a complex interplay of factors including credit score, the prevailing economic climate, and individual spending habits. This article delves into these factors, exploring how consumers can navigate the credit card landscape to avoid falling victim to predatory interest rates and crippling debt.

Understanding the APR Landscape

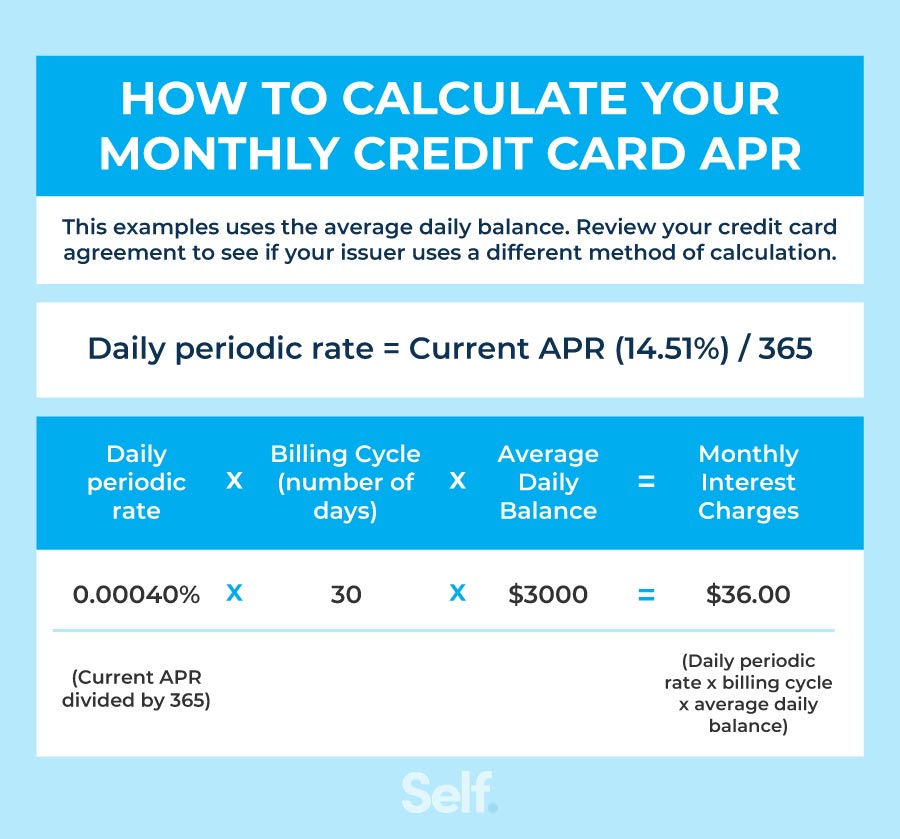

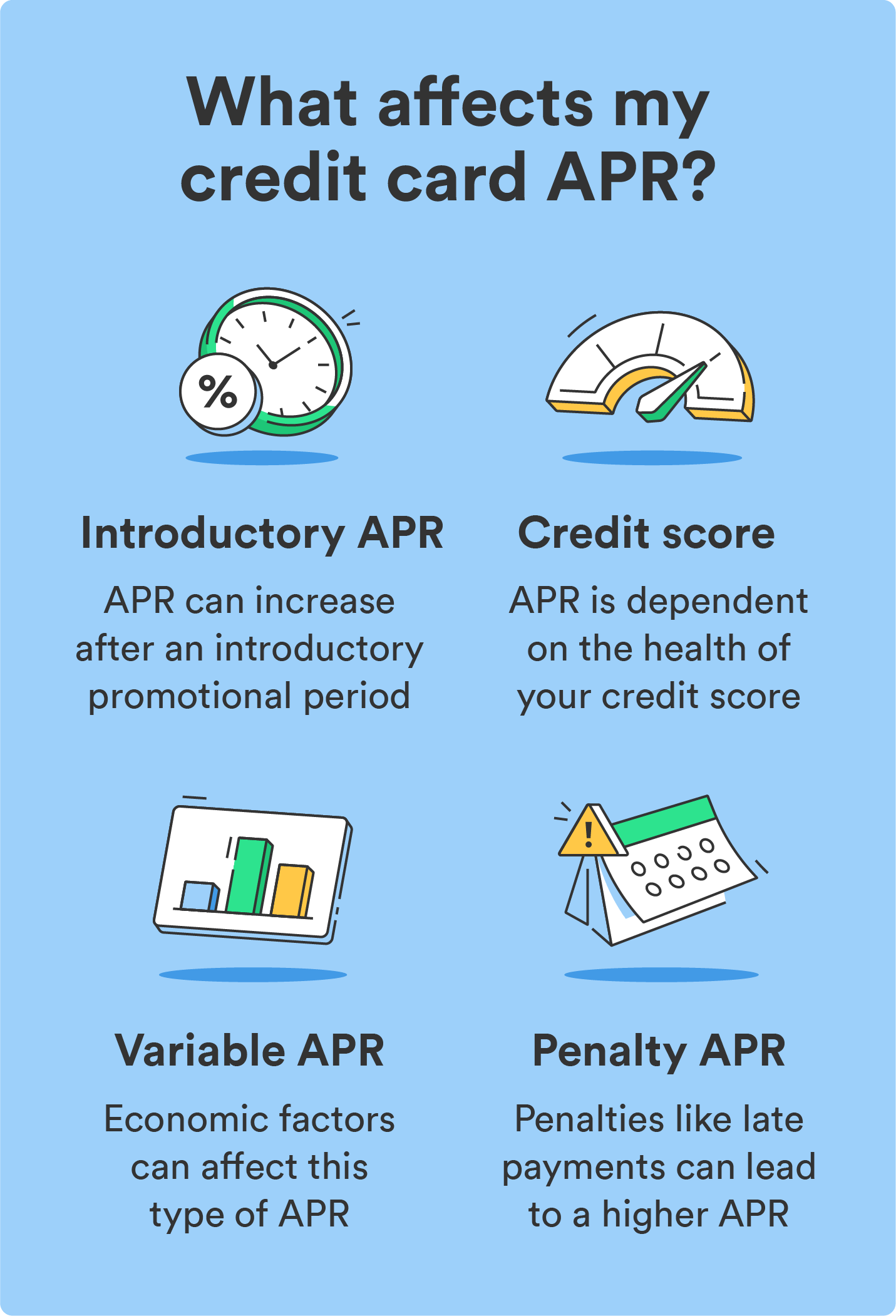

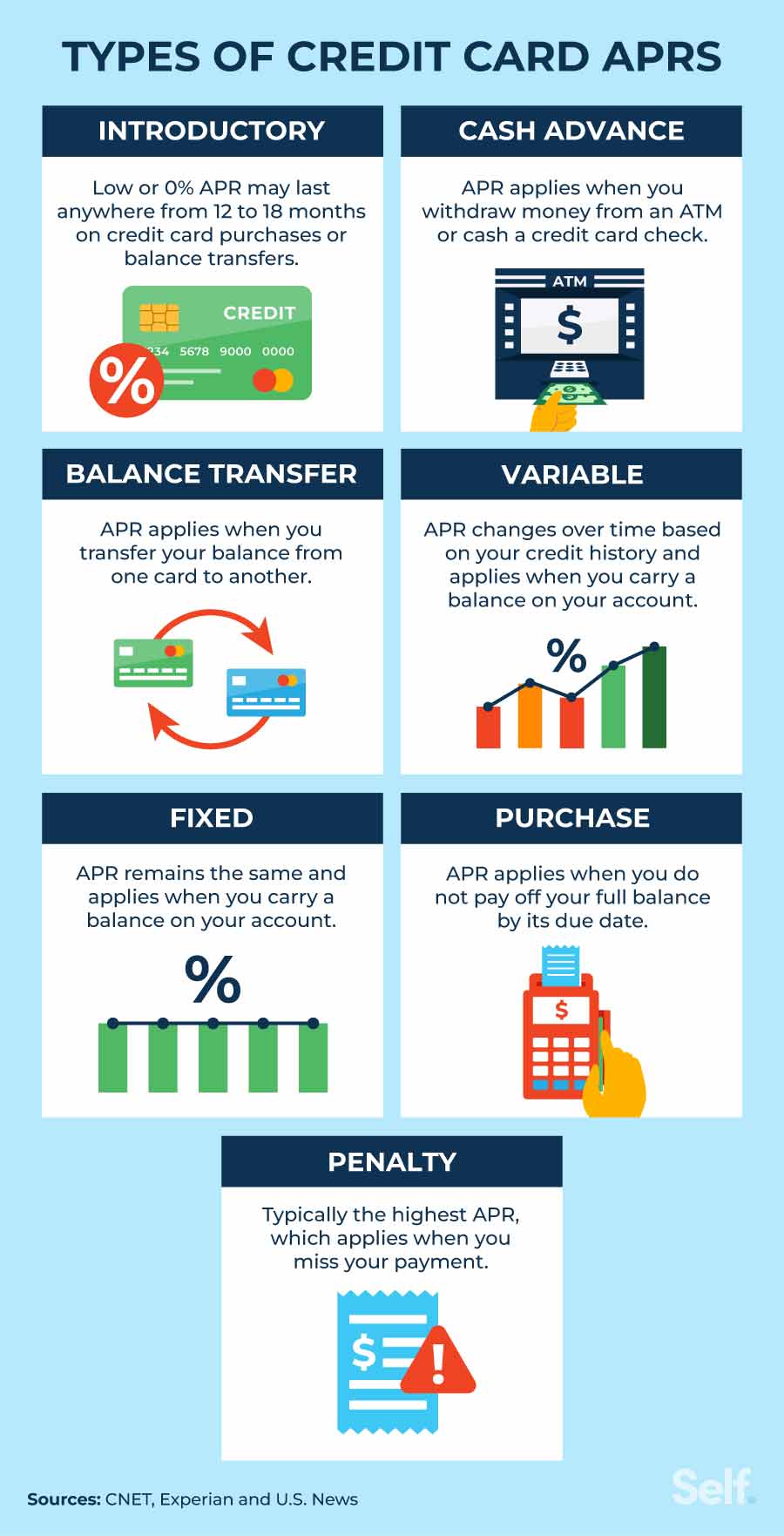

APR represents the annual cost of borrowing money, expressed as a percentage. It includes the interest rate and other fees associated with the credit card. Different types of APR exist, including purchase APR, balance transfer APR, and cash advance APR, each potentially carrying different rates.

According to data from the Federal Reserve, the average credit card interest rate has been steadily increasing. As of late 2023, the average APR hovered around 20%, but rates can climb much higher for those with lower credit scores.

Factors Influencing "Too High"

Credit Score: A primary determinant of your assigned APR is your creditworthiness. Those with excellent credit scores (750 and above) typically qualify for the lowest rates, while those with fair or poor credit scores (below 670) face significantly higher APRs.

Economic Conditions: The overall economic environment, particularly the prime rate set by the Federal Reserve, impacts credit card APRs. When the prime rate increases, credit card companies often raise their APRs accordingly, making borrowing more expensive for everyone.

Spending Habits: How you use your credit card also plays a role. If you consistently carry a balance, the APR becomes a much more significant factor. Individuals who pay off their balance in full each month are less affected by high APRs, as they avoid incurring interest charges.

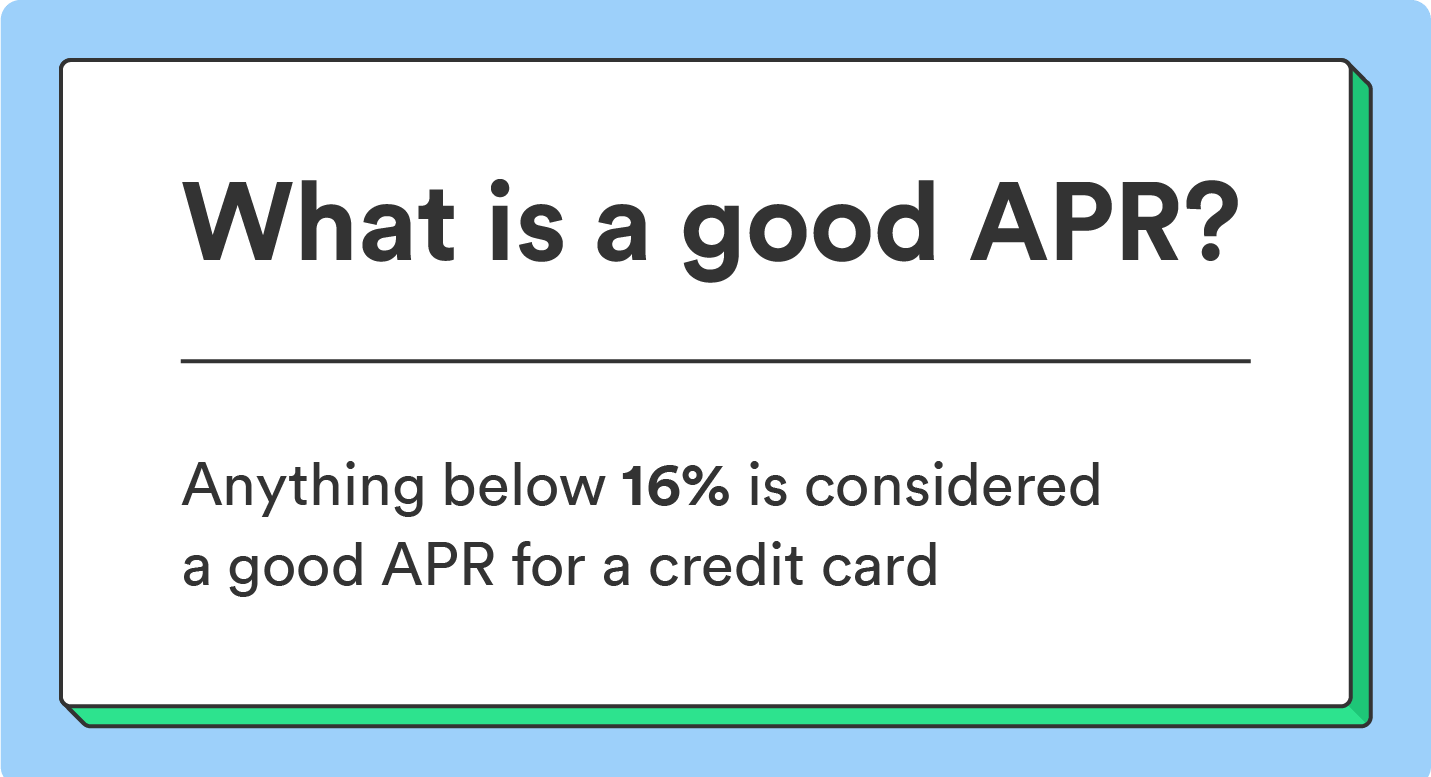

Defining the Threshold

So, what APR is objectively "too high"? Financial experts generally agree that any APR exceeding 25% should raise serious concerns. Ted Rossman, a senior industry analyst at CreditCards.com, suggests that consumers actively seek lower-rate alternatives if their APR surpasses this threshold. "A high APR can quickly negate any rewards or benefits offered by the card," Rossman warns.

However, even an APR below 25% might be considered excessive depending on individual circumstances. If you're carrying a large balance, even a seemingly moderate APR can lead to substantial interest payments over time. Consumers should use online calculators to estimate interest accrual with different APRs.

"The best APR is always the lowest one you can qualify for, but don't let that come at the expense of a card with fees or features you don't need," advises Linda Johnson, a certified financial planner.

Strategies for Securing Lower Rates

Negotiating with your credit card issuer is often a viable option. A polite request, highlighting your responsible payment history, can sometimes lead to a lower APR.

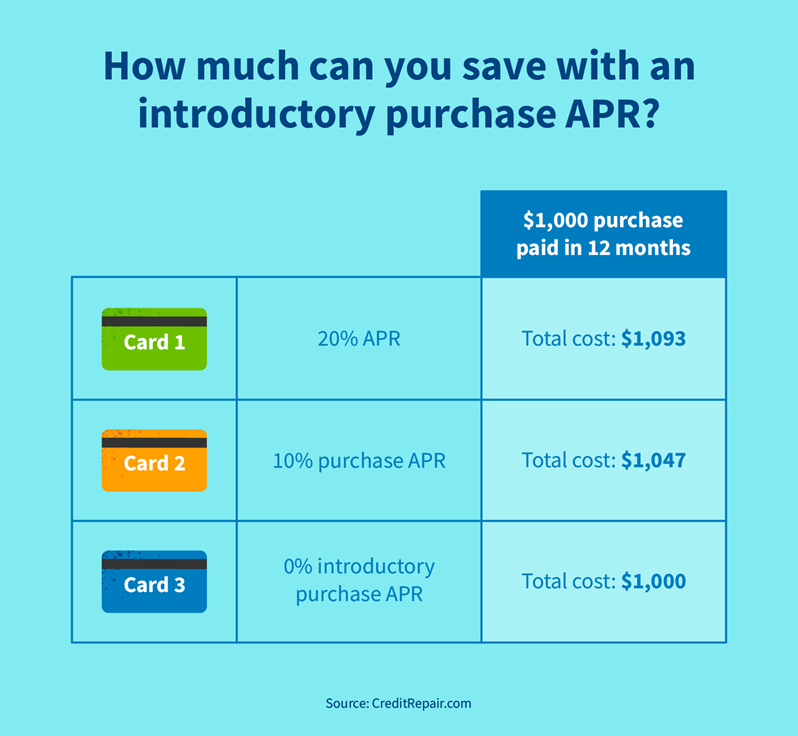

Balance transfer cards offer another avenue for reducing interest charges. These cards typically feature a 0% introductory APR for a limited time, allowing you to transfer high-interest debt and pay it down without incurring additional interest.

Consider improving your credit score. Paying bills on time, reducing your credit utilization ratio (the amount of credit you're using compared to your total available credit), and correcting any errors on your credit report can all boost your score and make you eligible for lower APRs.

The Future of Credit Card APRs

With ongoing economic uncertainty, predicting future credit card APR trends is challenging. However, experts anticipate that rates will likely remain elevated in the near term. TransUnion's latest credit industry insights report projects continued increases in credit card balances and delinquency rates, suggesting that consumers should remain vigilant about managing their credit card debt.

Moving forward, financial literacy and responsible credit card management will be crucial. By understanding the factors that influence APRs, exploring strategies for securing lower rates, and carefully monitoring their spending habits, consumers can avoid falling victim to excessive interest charges and maintain their financial well-being. Ultimately, the "too high" APR is the one that prevents you from achieving your financial goals.

![What Apr Is Too High For A Credit Card Average Credit Card Interest Rates & APR - Stats [2022]](https://upgradedpoints.com/wp-content/uploads/2022/02/Average-Credit-Card-Interest-Rates-by-Issuer-2048x1372.png)

![What Apr Is Too High For A Credit Card Average Credit Card Interest Rates & APR - Stats [2022]](https://upgradedpoints.com/wp-content/uploads/2021/11/APR-Ranges-and-Averages-for-Credit-Cards-732x791.png)