Explain How A Company May Raise Capital

Companies urgently need capital to fuel growth, innovation, or simply stay afloat. Understanding how to secure this funding is crucial for survival and success in today's competitive market.

This article cuts through the complexity to deliver a concise overview of the primary methods businesses use to raise capital, from bootstrapping to sophisticated equity financing.

Bootstrapping: The Self-Funded Path

Bootstrapping is the most basic form of funding. It involves using personal savings, revenue generated from initial sales, and careful management of cash flow. It's a slow and steady approach emphasizing organic growth.

This method allows complete control over the company but limits the speed of expansion.

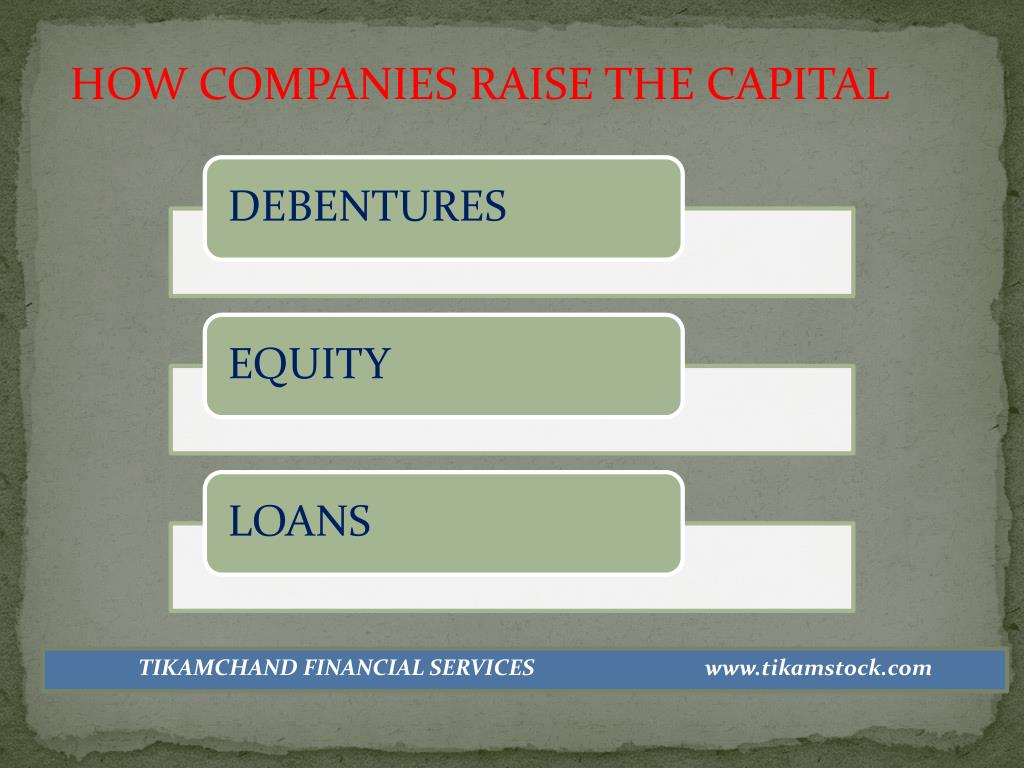

Debt Financing: Borrowing for Growth

Debt financing involves borrowing money from lenders, such as banks or credit unions. This typically comes in the form of loans, lines of credit, or issuing bonds.

The company repays the loan with interest over a set period. While retaining ownership, debt financing requires regular payments regardless of profitability.

Bank Loans

Banks offer various loan products, including term loans and lines of credit. These require a strong credit history and collateral to secure the loan.

Bonds

Larger companies can issue bonds to the public, essentially borrowing money from investors. Bondholders receive interest payments, and the principal is repaid at maturity.

Equity Financing: Selling a Piece of the Pie

Equity financing involves selling a portion of the company ownership in exchange for capital. This can occur through various methods, diluting the ownership stake of the existing founders and shareholders.

However, it provides significant capital without the burden of immediate repayment obligations.

Angel Investors

Angel investors are high-net-worth individuals who invest in early-stage companies. They often provide both capital and mentorship.

Venture Capital (VC)

Venture capital firms invest in high-growth potential companies, typically in exchange for a significant equity stake. VCs often provide multiple rounds of funding as the company scales.

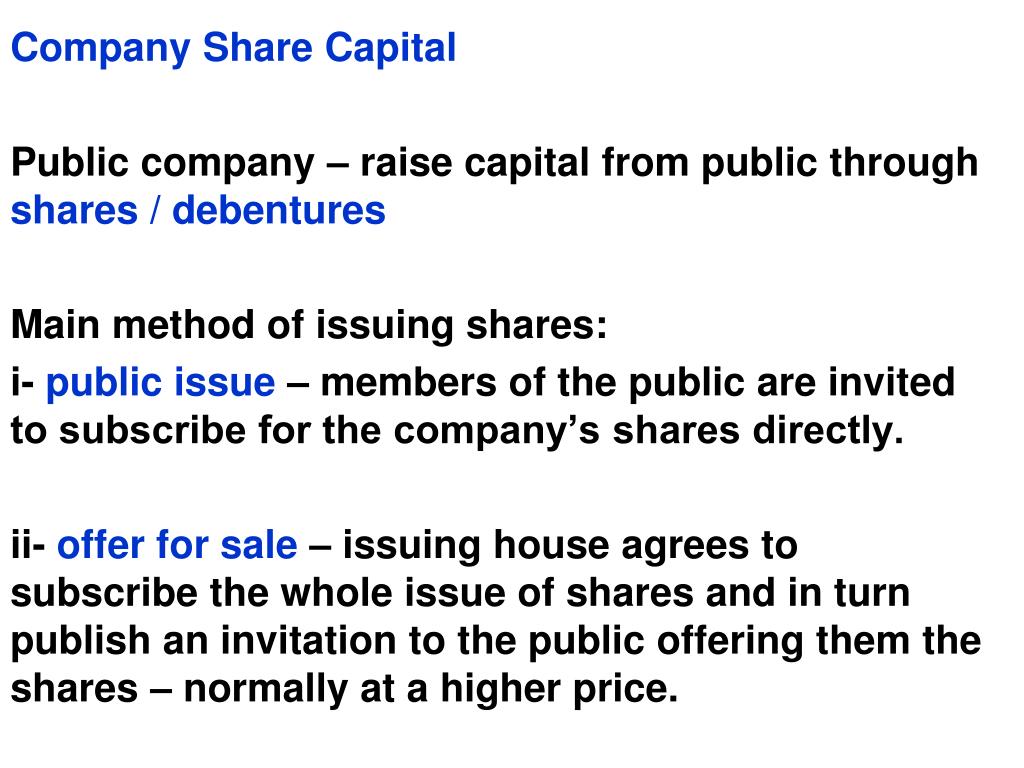

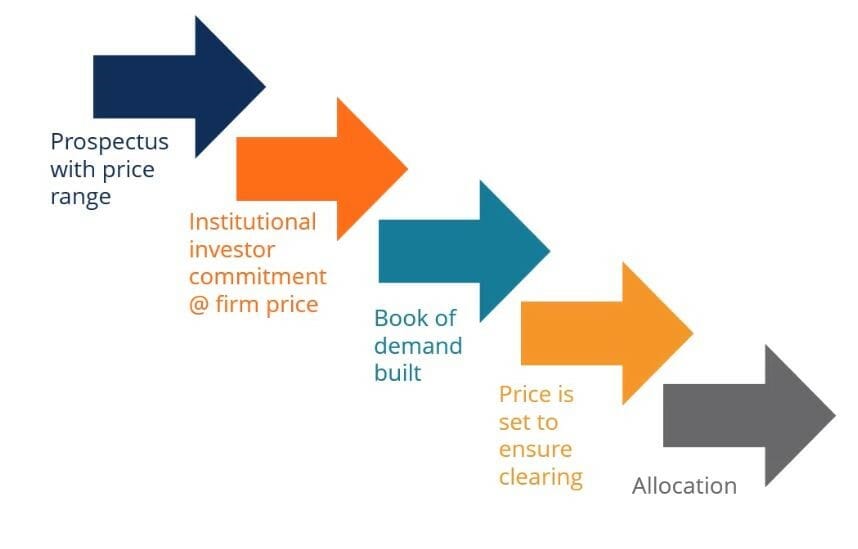

Initial Public Offering (IPO)

An IPO involves selling shares of the company to the public on a stock exchange. This is a complex and expensive process, but it can raise substantial capital and provide liquidity for early investors.

Alternative Funding Options

Crowdfunding platforms, like Kickstarter and Indiegogo, allow companies to raise small amounts of capital from a large number of individuals. Grants from government agencies or private foundations are also available for specific types of projects.

Recent Trends and Data

According to a report by PitchBook, venture capital investment in Q1 2024 saw a slight increase compared to the previous quarter, signaling a potential rebound in the market. However, deal sizes remain smaller, and investors are more cautious.

The Small Business Administration (SBA) reported a significant increase in loan applications in the last quarter, indicating a strong demand for debt financing among small businesses.

Conclusion: Navigating the Funding Landscape

Choosing the right method to raise capital depends on the company's stage, industry, and specific needs. Consult with financial advisors and legal professionals to determine the best course of action.

Keep an eye on market trends and investor sentiment to maximize your chances of success in securing the necessary funding for growth.