Explain Methods Of Measuring Business Performance

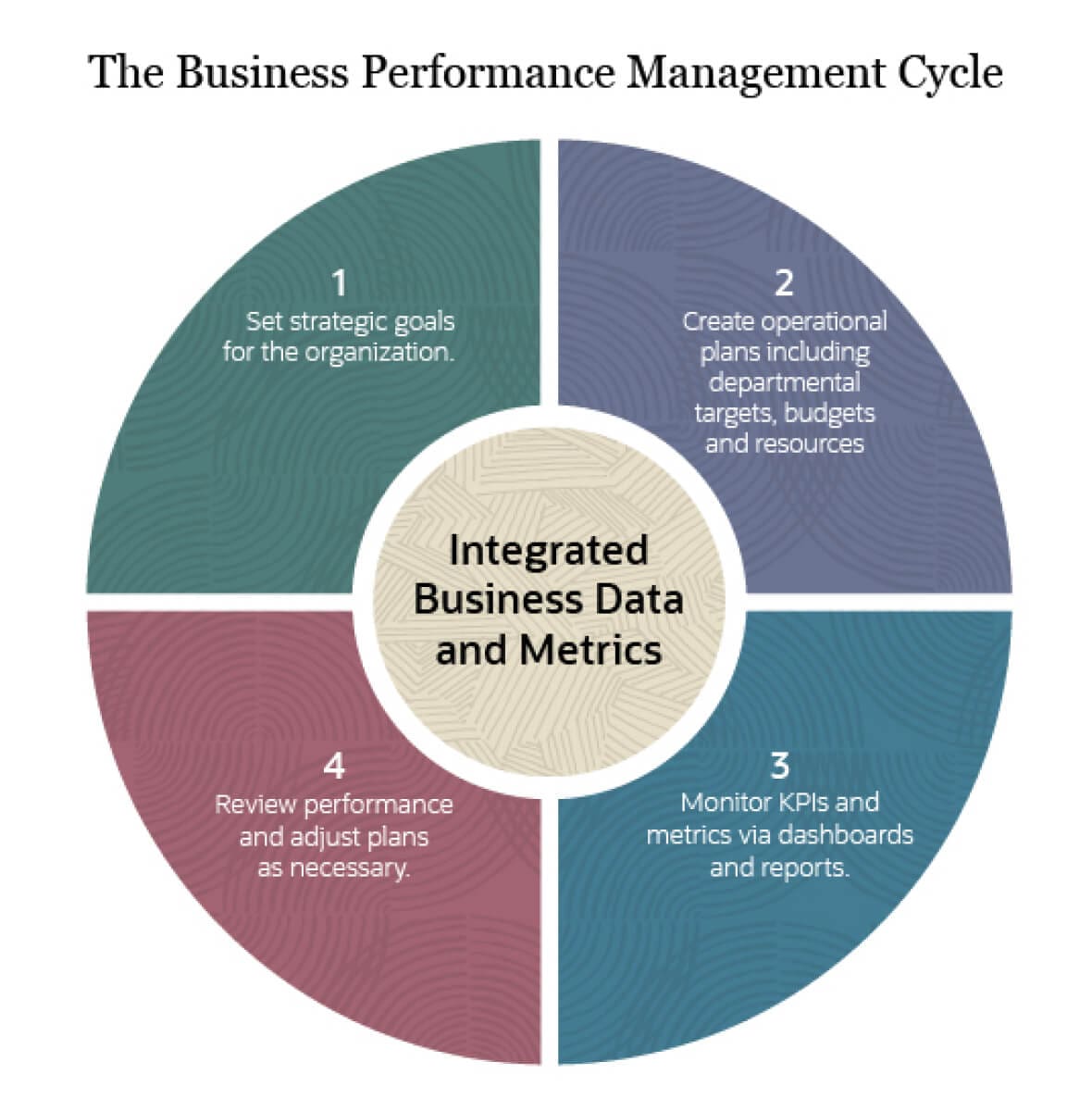

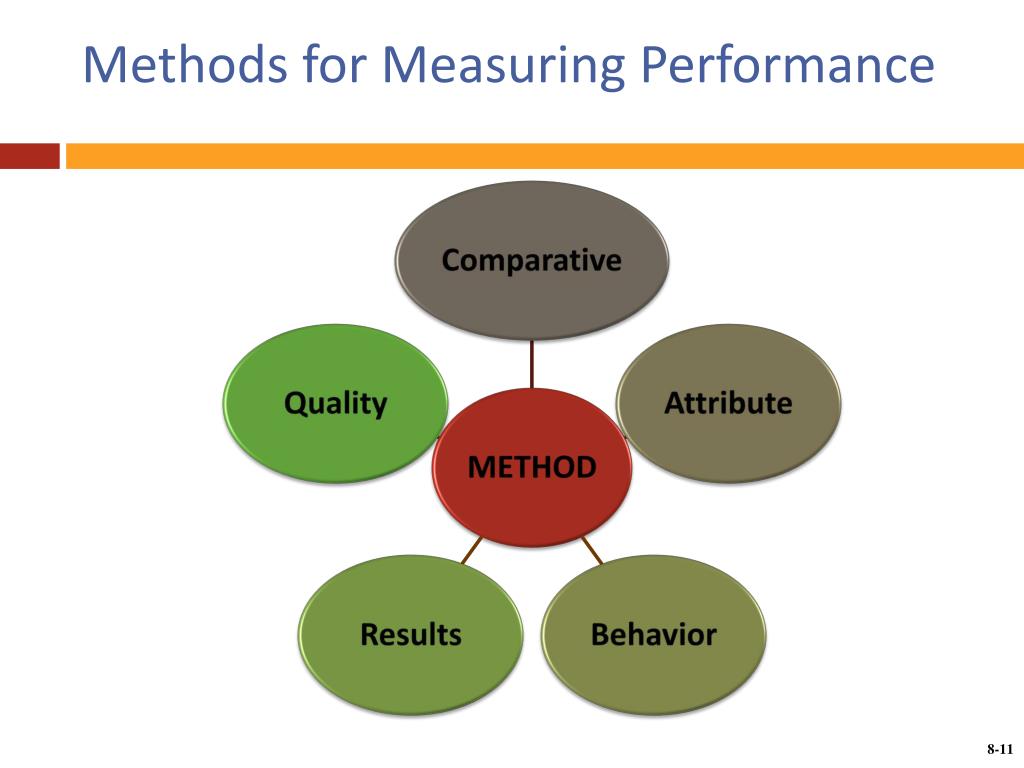

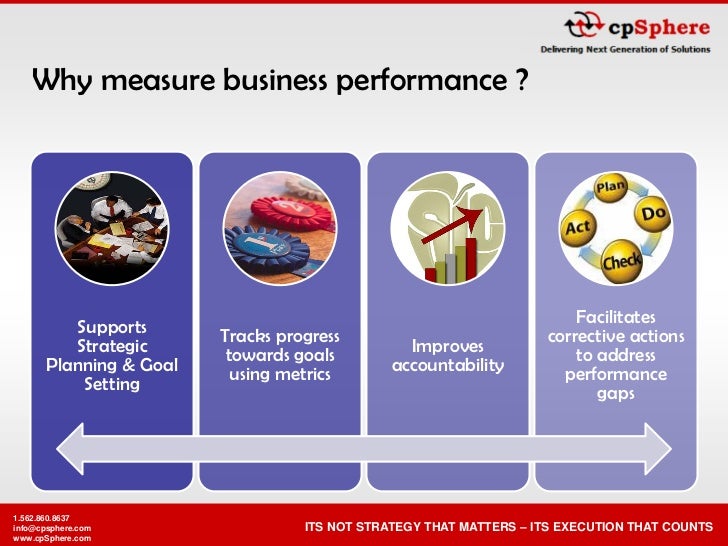

Businesses rely on various methods to gauge their success and identify areas for improvement. These metrics provide critical insights into profitability, efficiency, and overall health, allowing organizations to make informed decisions and adapt to changing market conditions.

Understanding these measurement techniques is crucial for business owners, investors, and employees alike.

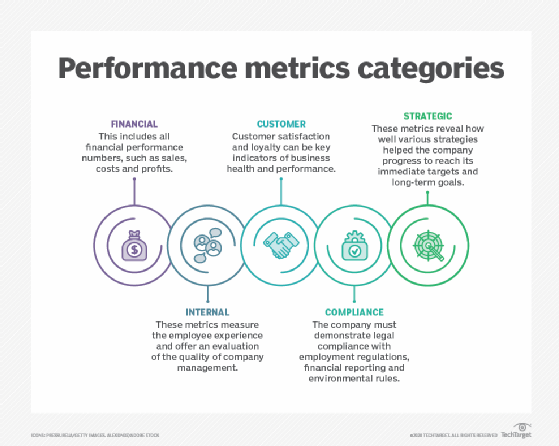

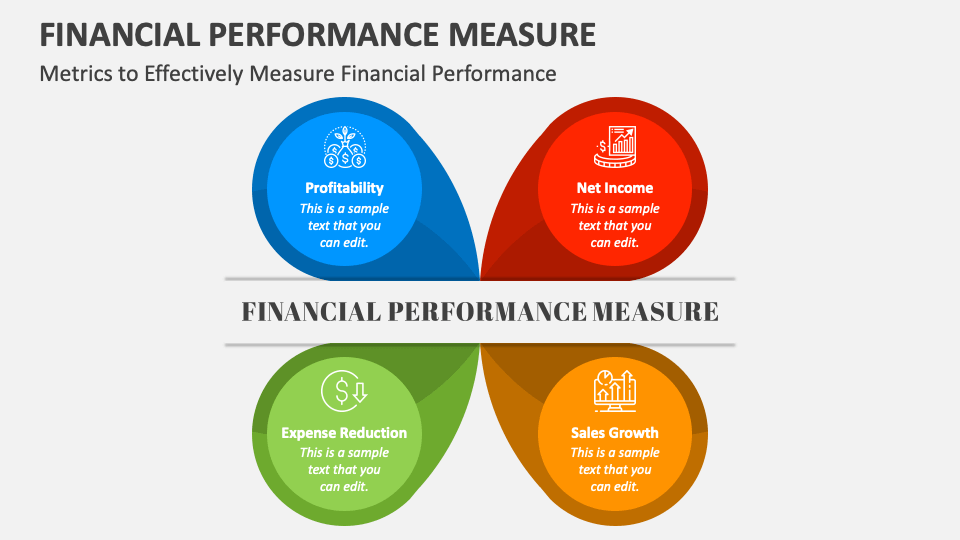

Financial Performance Metrics

Perhaps the most widely used methods involve analyzing a company's financial statements. These metrics offer a quantifiable view of its profitability and stability.

Revenue and Profit

Revenue, also known as sales, is the total income generated from business activities. Profit, on the other hand, represents the revenue remaining after deducting all expenses, including the cost of goods sold, operating expenses, interest, and taxes.

Tracking both metrics provides a basic understanding of a company’s earning power.

Profit Margins

Profit margins, such as gross profit margin (gross profit divided by revenue) and net profit margin (net profit divided by revenue), offer a more nuanced view. They indicate the percentage of revenue remaining as profit after accounting for specific costs.

Higher margins suggest greater efficiency in managing expenses.

Return on Investment (ROI)

ROI measures the profitability of an investment relative to its cost. It's calculated as (Net Profit / Cost of Investment) * 100.

ROI helps businesses evaluate the effectiveness of different investments and allocate resources accordingly.

Liquidity Ratios

These ratios assess a company's ability to meet its short-term obligations. The current ratio (Current Assets / Current Liabilities) and the quick ratio (Quick Assets / Current Liabilities) are commonly used.

A higher ratio indicates a stronger ability to pay off short-term debts.

Debt-to-Equity Ratio

This ratio (Total Debt / Total Equity) reveals the proportion of a company's financing that comes from debt versus equity. A high ratio may indicate higher financial risk.

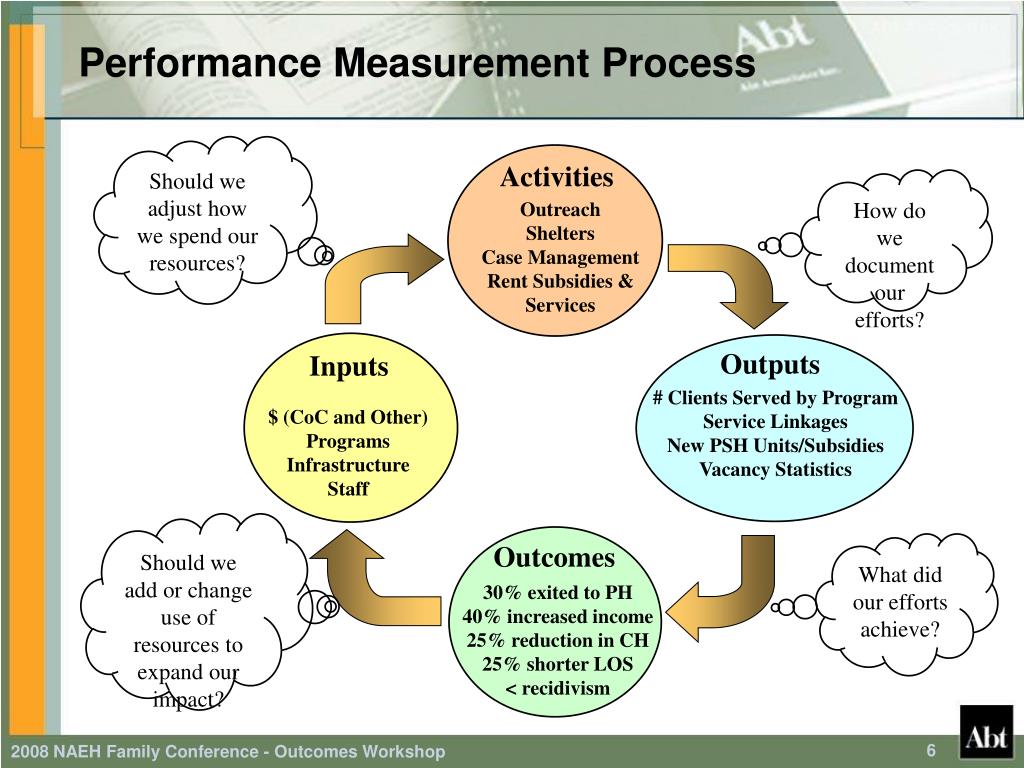

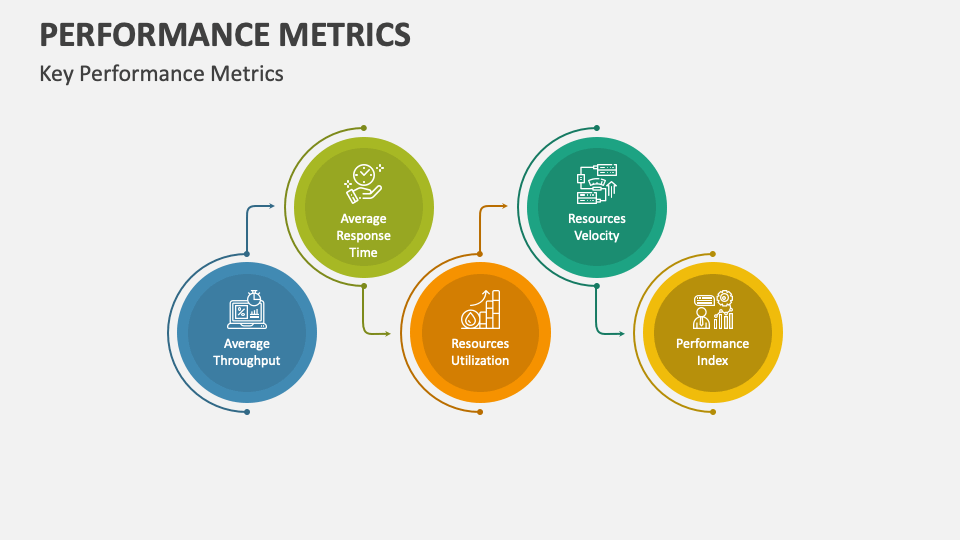

Operational Performance Metrics

Beyond financials, operational metrics provide insight into the efficiency and effectiveness of internal processes.

Customer Satisfaction (CSAT)

CSAT scores reflect the degree to which customers are satisfied with a company's products or services. Surveys, feedback forms, and online reviews are common methods for gathering this data.

High CSAT scores are often linked to customer loyalty and positive word-of-mouth referrals.

Employee Satisfaction

Happy and motivated employees are crucial for business success. Employee satisfaction can be measured through surveys, performance reviews, and employee retention rates.

Inventory Turnover

Inventory turnover measures how quickly a company sells its inventory. A higher turnover rate generally indicates efficient inventory management.

Sales Cycle Length

Tracking the time it takes to convert a lead into a customer is essential for sales performance. A shorter sales cycle implies greater sales efficiency.

Market Performance Metrics

These metrics focus on a company's position and performance within its target market.

Market Share

Market share represents the percentage of total market sales captured by a company. Increasing market share suggests growing competitiveness.

Customer Acquisition Cost (CAC)

CAC measures the cost of acquiring a new customer. Optimizing marketing and sales efforts to lower CAC is a key objective for many businesses.

Brand Awareness

Brand awareness refers to the extent to which customers are familiar with a brand. Surveys, social media monitoring, and website traffic analysis can provide insights into brand awareness levels.

Selecting the right metrics depends on the specific industry, business model, and strategic goals of the organization. Regularly monitoring and analyzing these measures allows businesses to identify trends, make data-driven decisions, and ultimately improve their performance and achieve long-term success.