Explain The Phases Of The Business Cycle

Economic storm clouds are gathering. Understanding the business cycle is now critical for navigating the turbulent waters ahead.

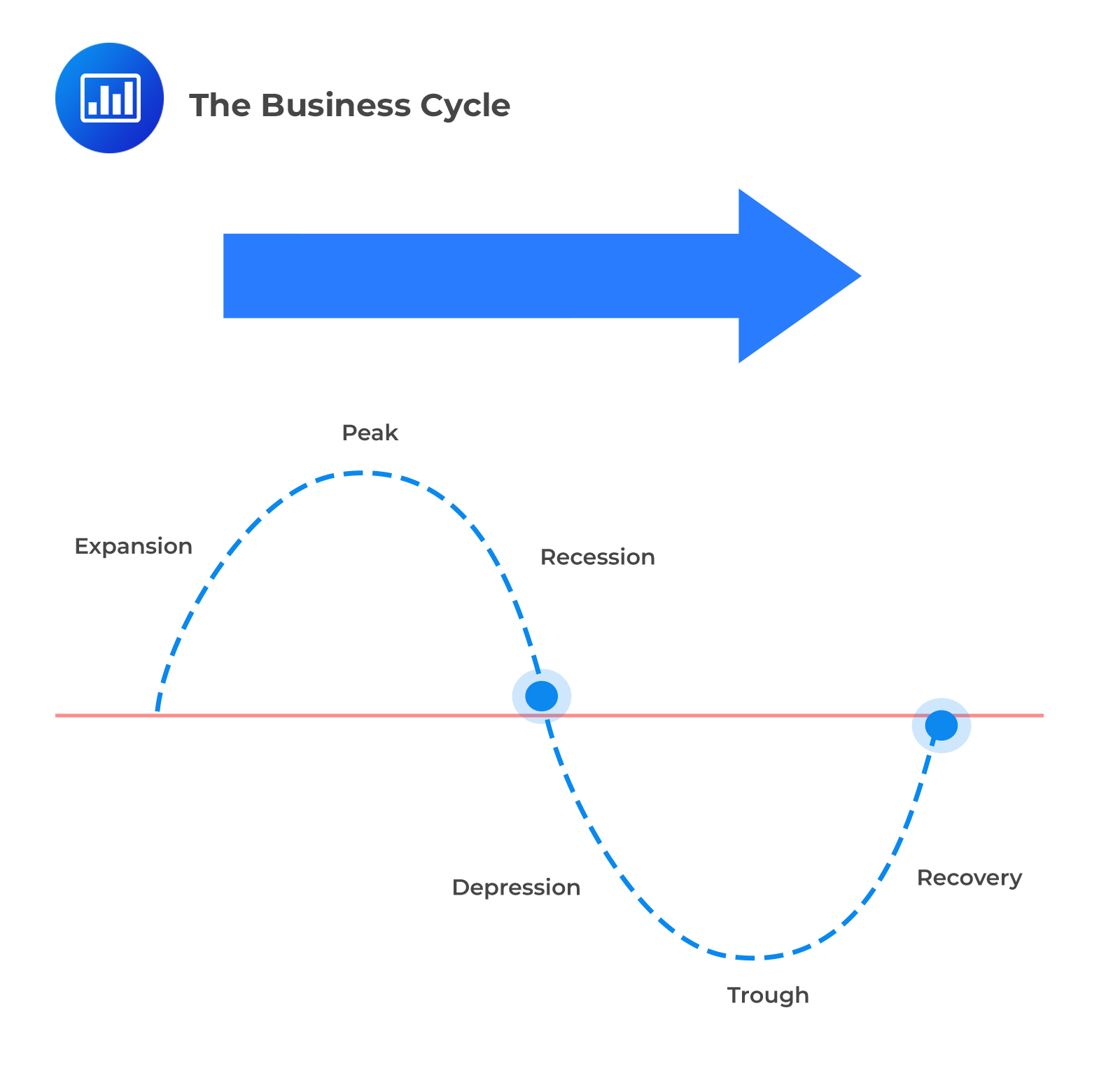

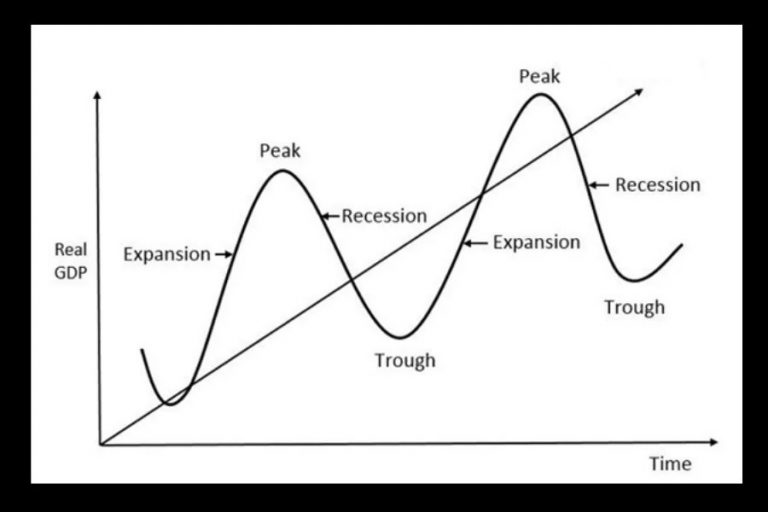

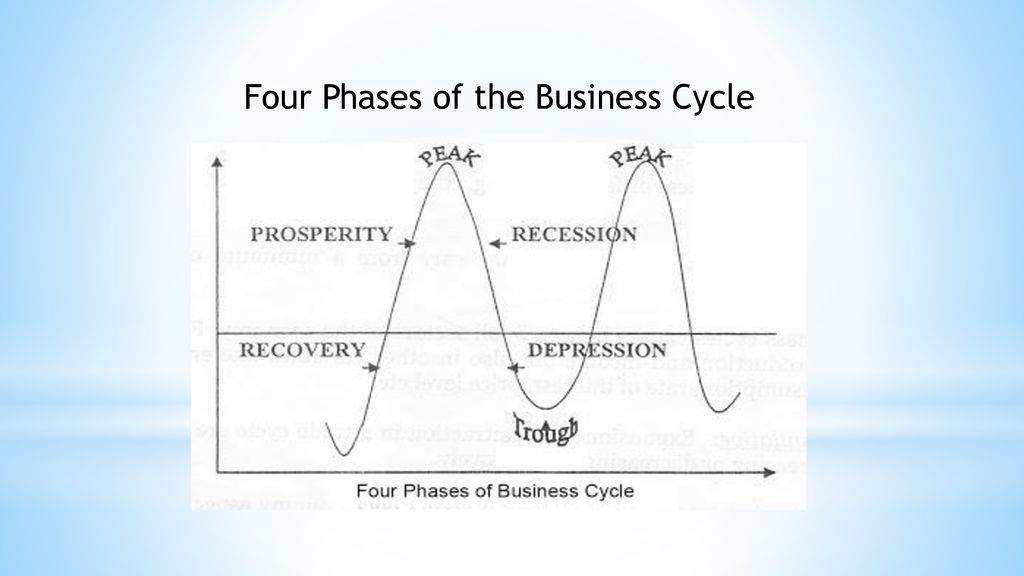

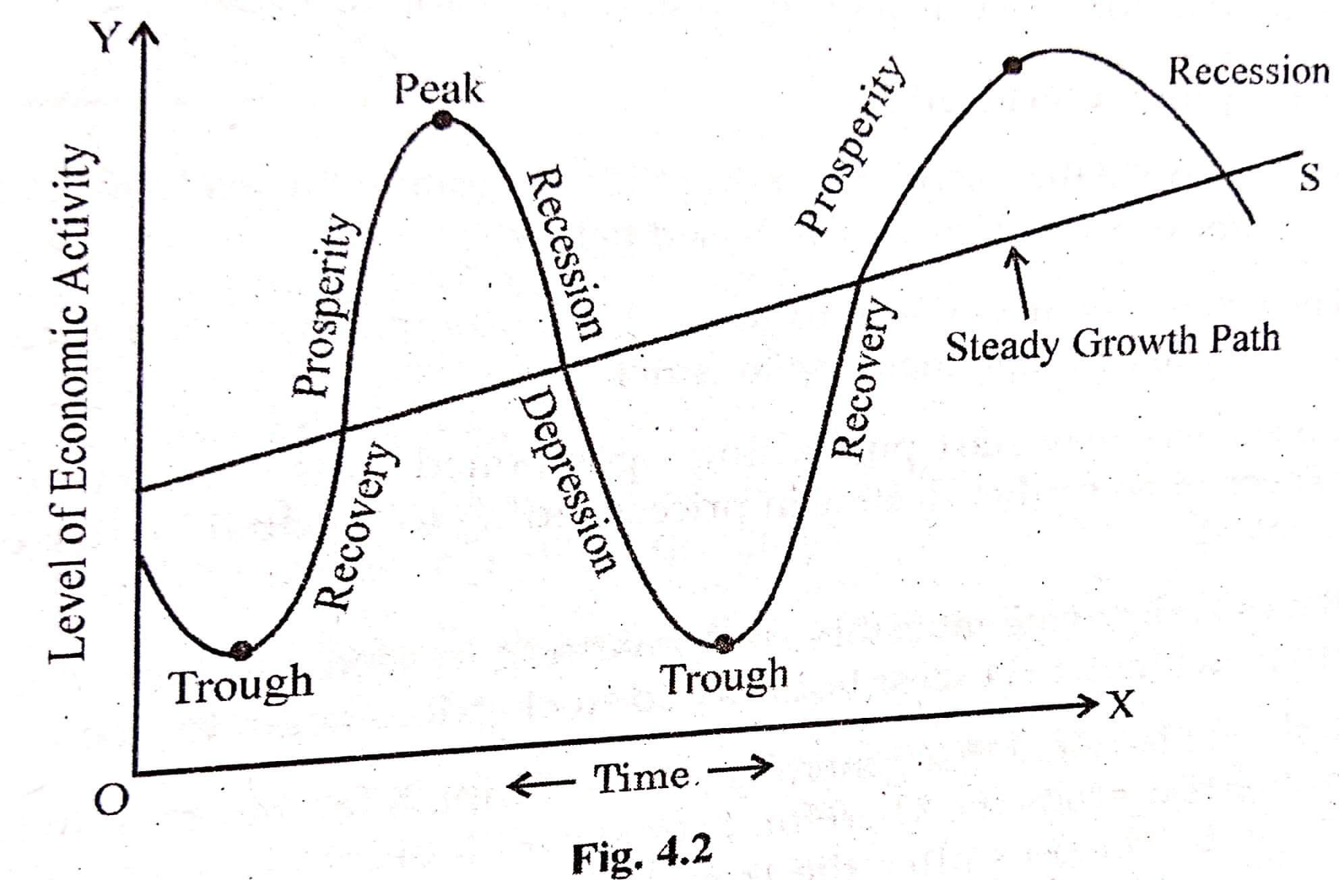

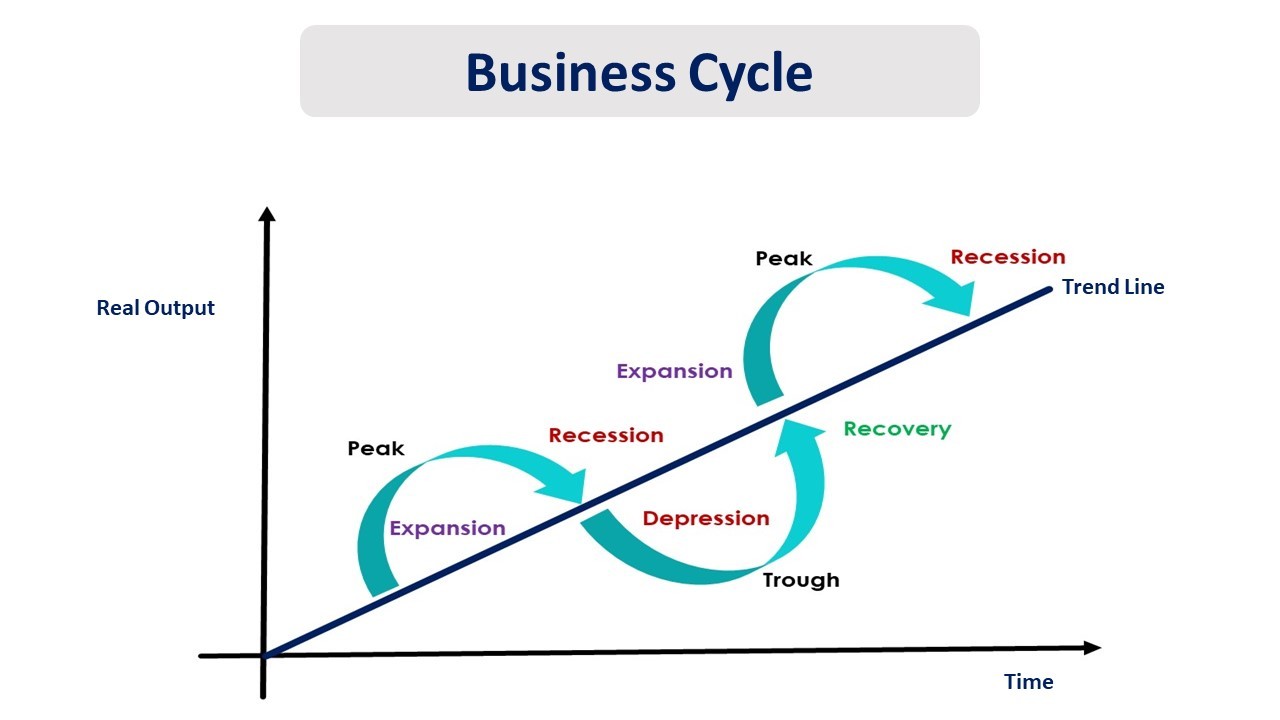

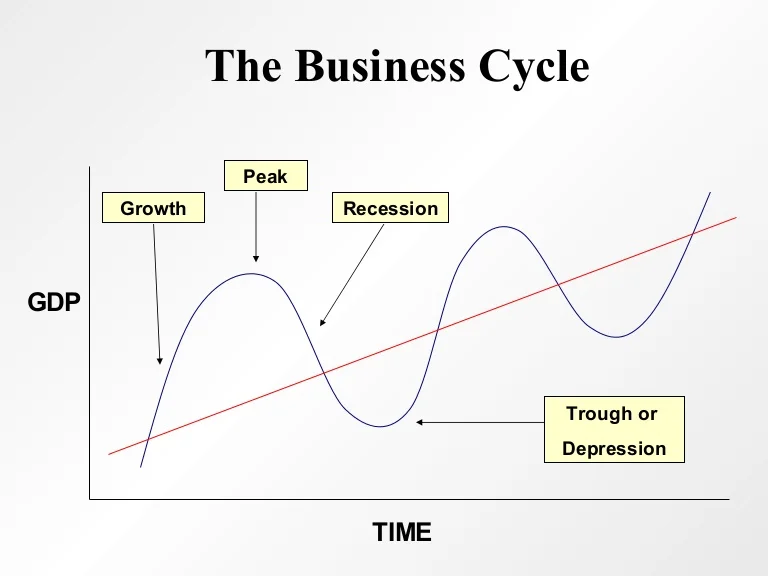

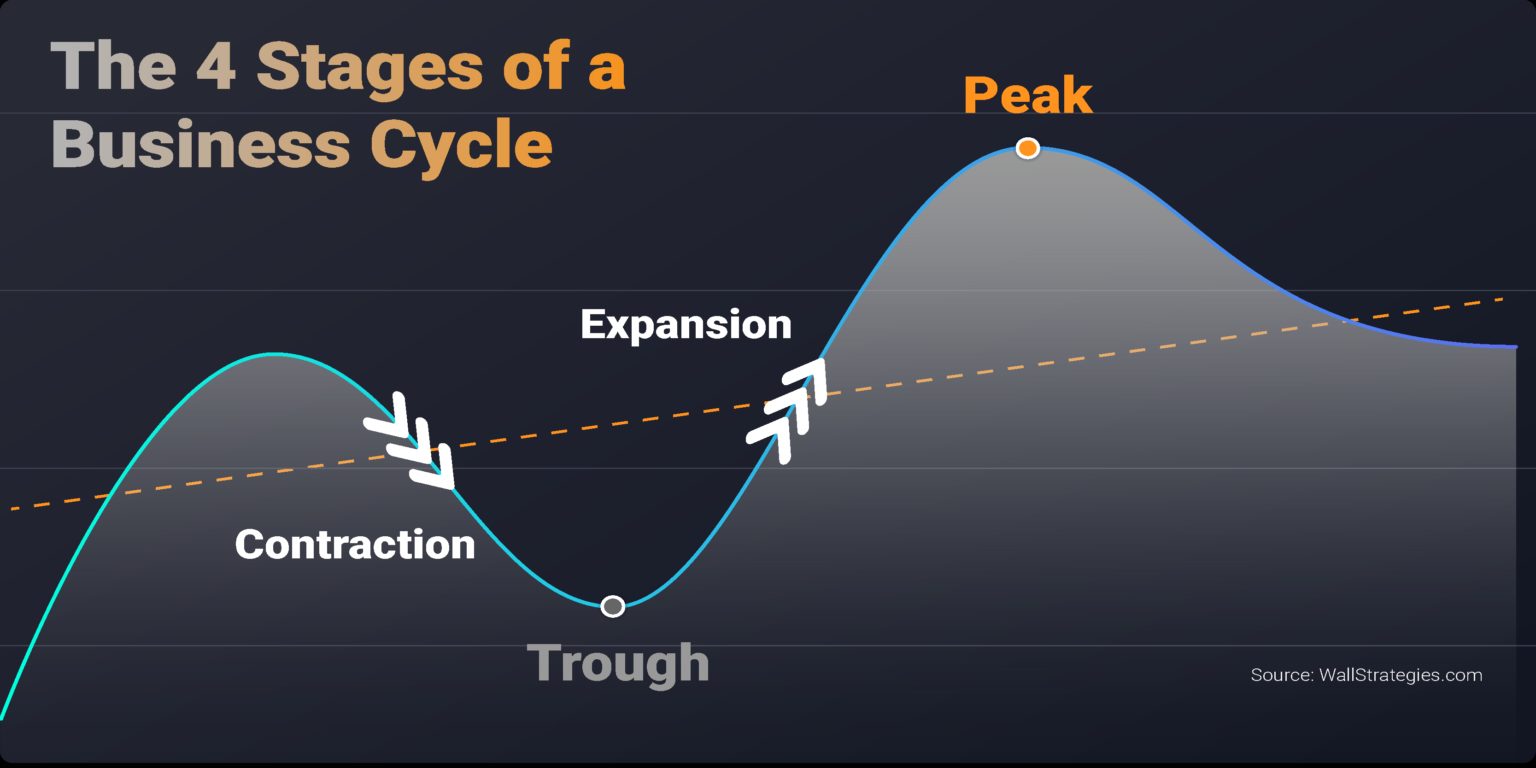

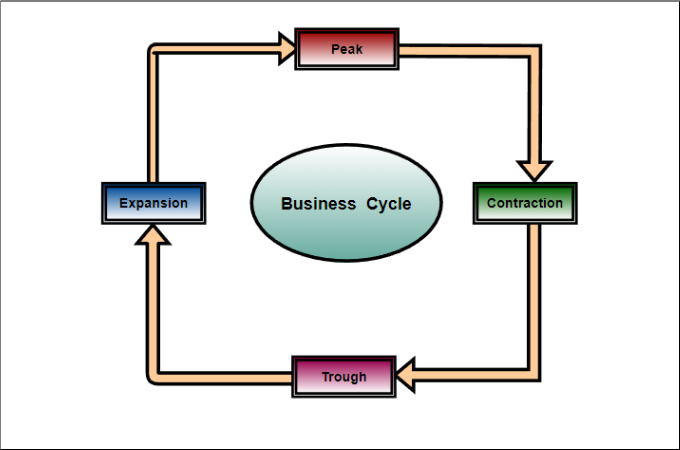

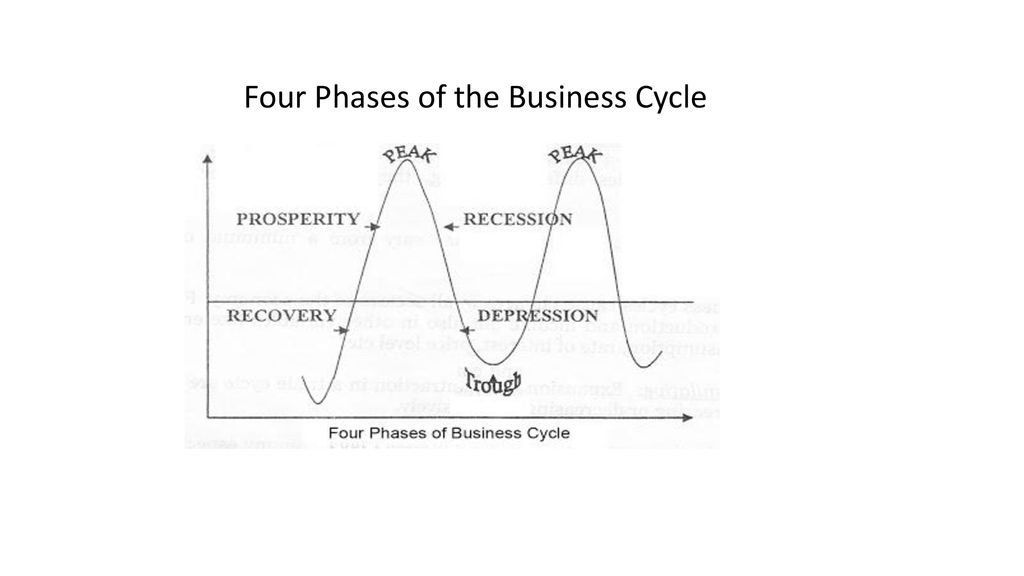

This article breaks down the core phases of the business cycle – expansion, peak, contraction, and trough – providing a clear roadmap for understanding economic shifts and preparing for what's next.

The Four Phases: A Quick Breakdown

Expansion: Growth and Optimism

The expansion phase marks a period of economic growth.

GDP is rising, unemployment is falling, and consumer confidence is generally high.

Businesses are investing, hiring, and expanding their operations, leading to increased production and overall prosperity.

Peak: The Crest of the Wave

The peak represents the highest point of economic activity in the business cycle.

Demand may outstrip supply, leading to inflation and potential bubbles in asset prices, such as real estate or stocks.

Economic indicators begin to show signs of slowing down or reaching their limits.

Contraction: The Downturn Begins

Also known as a recession, the contraction phase is a period of economic decline.

GDP falls for two consecutive quarters, unemployment rises, and consumer spending decreases.

Businesses may reduce investments, lay off workers, and scale back production in response to declining demand, creating a vicious cycle.

Trough: Rock Bottom

The trough marks the lowest point of economic activity during the business cycle.

Unemployment is typically high, and consumer confidence is low.

However, the trough also represents the turning point where the economy begins to stabilize and prepare for the next expansion phase.

Key Economic Indicators

Monitoring key economic indicators is essential for tracking the business cycle.

These indicators include GDP growth, unemployment rate, inflation rate, consumer confidence, and interest rates.

Changes in these indicators provide valuable signals about the current phase and potential future direction of the economy.

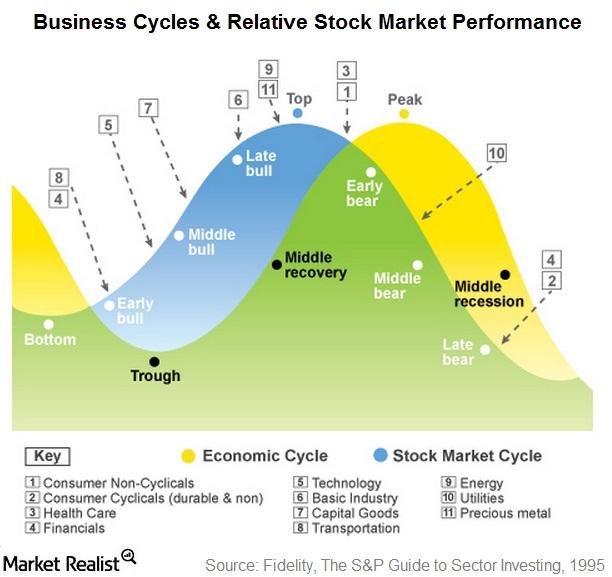

Navigating the Cycle

Understanding the business cycle empowers individuals and businesses to make informed decisions.

During expansion, it may be wise to invest and expand.

During contraction, it's crucial to conserve capital and prepare for potential downturns.

What's Next?

The global economy is currently facing significant challenges, including inflation, rising interest rates, and geopolitical uncertainties.

Economists are closely monitoring these factors to assess the likelihood and severity of a potential recession in 2024.

Stay informed about economic developments and consult with financial advisors to make informed decisions for your financial future.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)