Financial Center Credit Union Customer Service

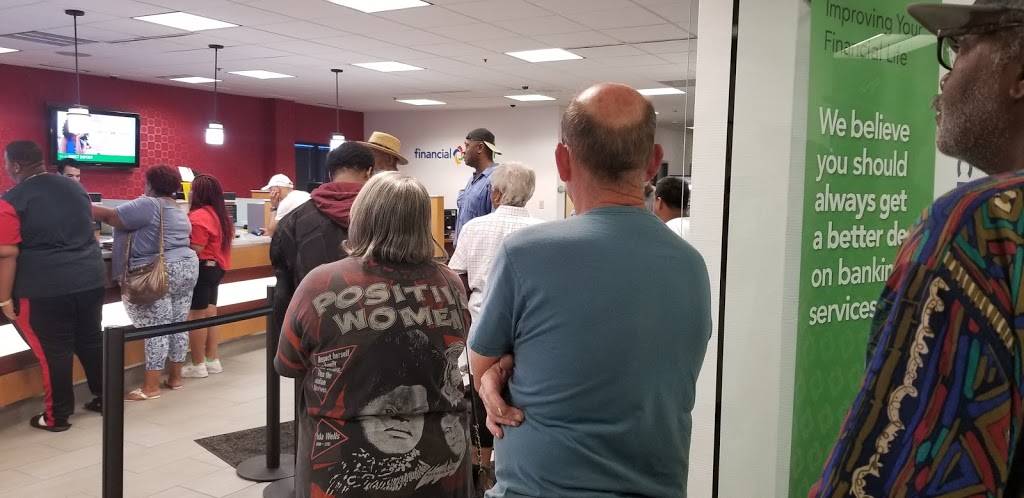

The scent of freshly brewed coffee hangs in the air, mingling with the quiet hum of conversations. Sunlight streams through the large windows of Financial Center Credit Union (FCCU), illuminating the warm, inviting atmosphere. Here, nestled in the heart of Indiana, members aren't just account numbers; they're neighbors, friends, and the very lifeblood of a community credit union built on a foundation of exceptional service.

At its core, Financial Center Credit Union distinguishes itself through an unwavering commitment to providing customer service that goes above and beyond. This dedication isn't just a marketing slogan; it's a deeply ingrained philosophy that permeates every interaction, shaping the member experience and driving the credit union's continued success.

A Legacy of Service Excellence

Founded in 1952, FCCU began as a financial cooperative serving the employees of International Harvester. Over the years, it has grown to serve a much broader community, expanding its membership to include anyone who lives, works, worships, or attends school in specific Indiana counties.

However, despite its growth, FCCU has remained steadfast in its commitment to its founding principles: putting members first and providing personalized, attentive service. This philosophy is not just a historical footnote; it's actively cultivated and reinforced through employee training, internal policies, and ongoing member feedback.

One key element of FCCU's success is its emphasis on employee empowerment. Team members are given the autonomy to resolve issues, make decisions, and truly advocate for the member. This fosters a sense of ownership and responsibility, resulting in more efficient and effective service.

The Human Touch in a Digital World

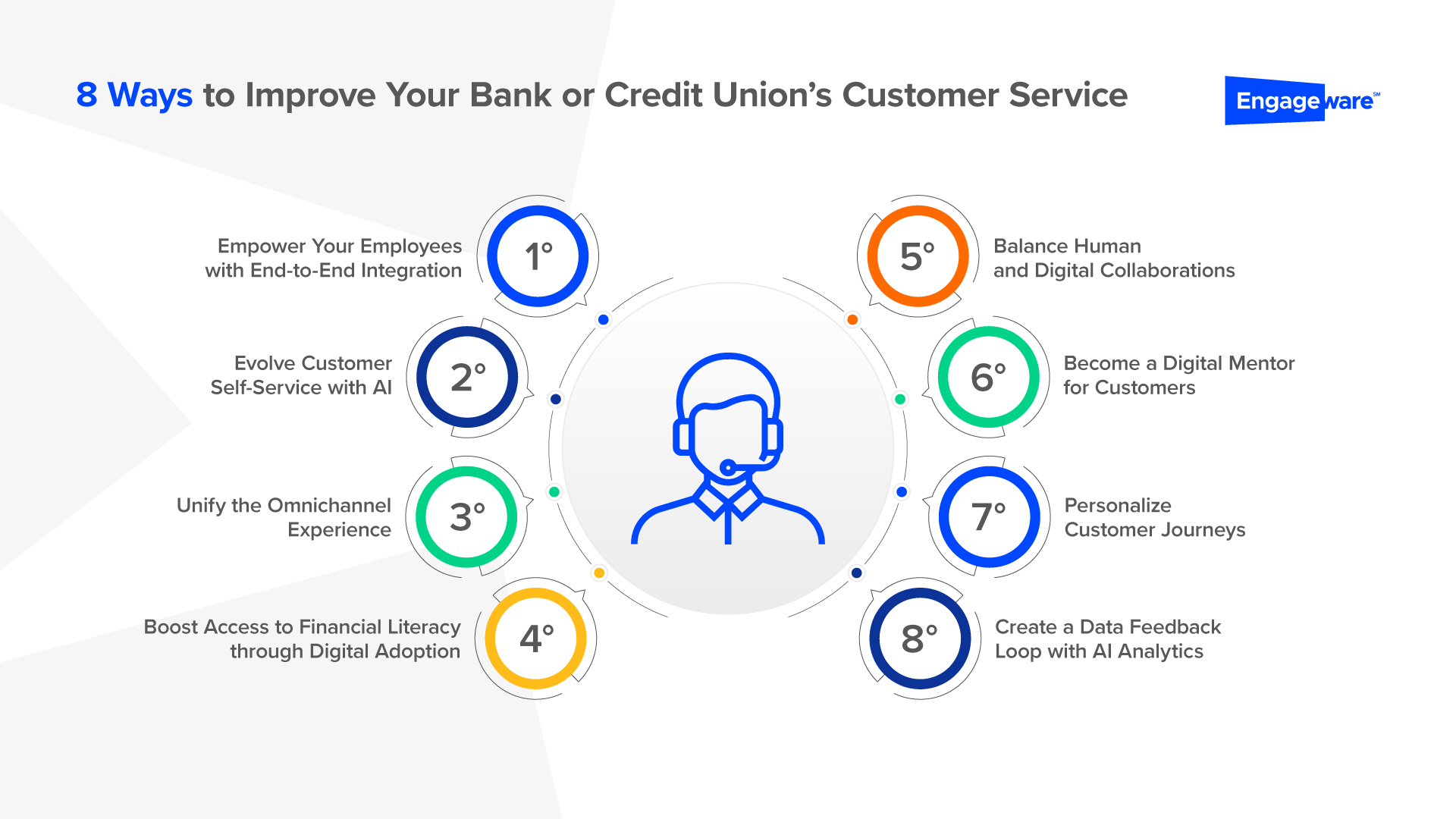

In an increasingly digital world, FCCU understands the importance of striking a balance between technological innovation and the personal touch that defines its brand. While offering convenient online and mobile banking options, the credit union also prioritizes maintaining accessible and responsive in-person support.

According to FCCU's official statements, they are committed to provide multiple channels for its member. The credit union also invests in training and development programs that equip its employees with the skills and knowledge necessary to navigate complex financial situations and provide tailored guidance to each member.

"We believe in building relationships, not just processing transactions," explains Dustin Fuller, Vice President of Marketing at Financial Center First Credit Union. "Our goal is to be a trusted financial partner for our members, helping them achieve their goals and dreams."

Beyond Transactions: Building Relationships

The concept of relationship banking is central to FCCU's service model. Employees are encouraged to take the time to get to know their members, understand their individual needs, and offer solutions that are tailored to their specific circumstances. This goes beyond simply answering questions; it involves proactive outreach, financial education, and personalized support.

For instance, FCCU offers free financial literacy workshops and seminars to help members improve their financial knowledge and make informed decisions. They also provide one-on-one financial counseling to assist members with budgeting, debt management, and retirement planning. This demonstrates FCCU's investment in the long-term financial well-being of its members.

"We measure our success not just by the number of accounts we open, but by the positive impact we have on our members' lives," says Kevin Ryan, President and CEO of Financial Center First Credit Union. "We want to be more than just a financial institution; we want to be a vital part of the community."

This commitment is reflected in FCCU's active involvement in local community initiatives, including sponsoring local events, supporting charitable organizations, and providing scholarships to deserving students. This strengthens the credit union's ties to the community and reinforces its commitment to social responsibility.

Listening and Adapting to Member Needs

FCCU recognizes that member needs and expectations are constantly evolving. To stay ahead of the curve, the credit union actively seeks feedback from its members through surveys, focus groups, and online reviews. This feedback is then used to identify areas for improvement and to develop new products and services that better meet the needs of its members.

The credit union employs a robust system for tracking and resolving member complaints, ensuring that every concern is addressed promptly and effectively. This proactive approach to problem-solving helps to maintain member satisfaction and build trust.

One example of FCCU's responsiveness to member feedback is the recent launch of a new mobile banking app, which features a more user-friendly interface and enhanced security features. This demonstrates the credit union's commitment to investing in technology that enhances the member experience.

The Proof is in the Pudding: Member Testimonials

The true measure of FCCU's customer service is the feedback it receives from its members. Countless testimonials and online reviews attest to the credit union's exceptional service and commitment to member satisfaction.

Members frequently praise FCCU's friendly and knowledgeable staff, its convenient branch locations, and its commitment to providing personalized service. Many also express appreciation for the credit union's financial education programs and its support for the local community. This collective feedback paints a clear picture of a credit union that genuinely cares about its members.

One member, Sarah Miller, shares her experience: "I've been a member of Financial Center for over 10 years, and I've always been impressed with their customer service. The staff is always friendly and helpful, and they go above and beyond to meet my needs. I wouldn't bank anywhere else!"

Looking Ahead: Continuing the Legacy

As Financial Center Credit Union looks to the future, it remains committed to its core values of member service, community involvement, and financial stability. The credit union plans to continue investing in technology, training, and employee development to ensure that it can continue to provide exceptional service in an ever-changing financial landscape.

FCCU recognizes that its success is directly linked to the success of its members and the communities it serves. By staying true to its founding principles and continuing to adapt to the needs of its members, Financial Center Credit Union is well-positioned to continue its legacy of service excellence for years to come.

The warmth and genuine care that define FCCU's approach to member service are palpable. It's more than just a credit union; it's a financial partner, a community advocate, and a place where members truly feel valued. The scent of coffee may fade, but the feeling of being genuinely cared for lingers long after you leave.