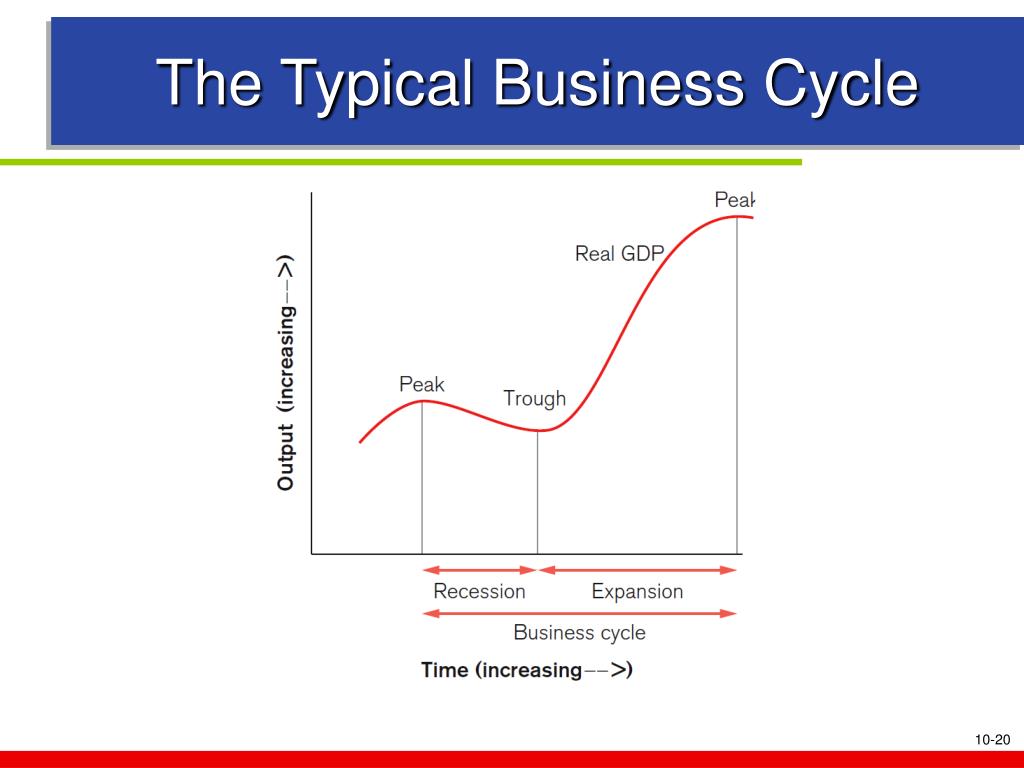

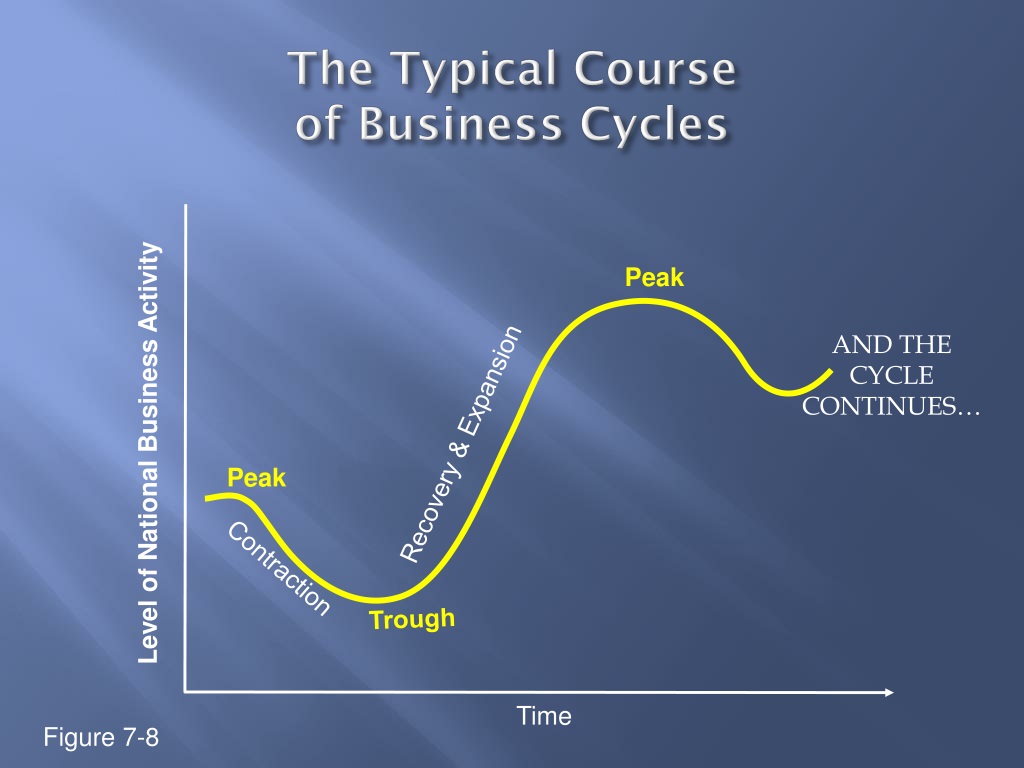

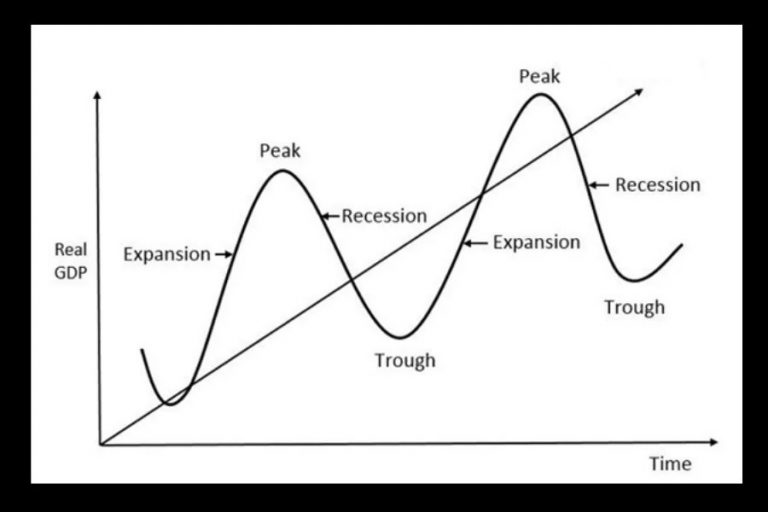

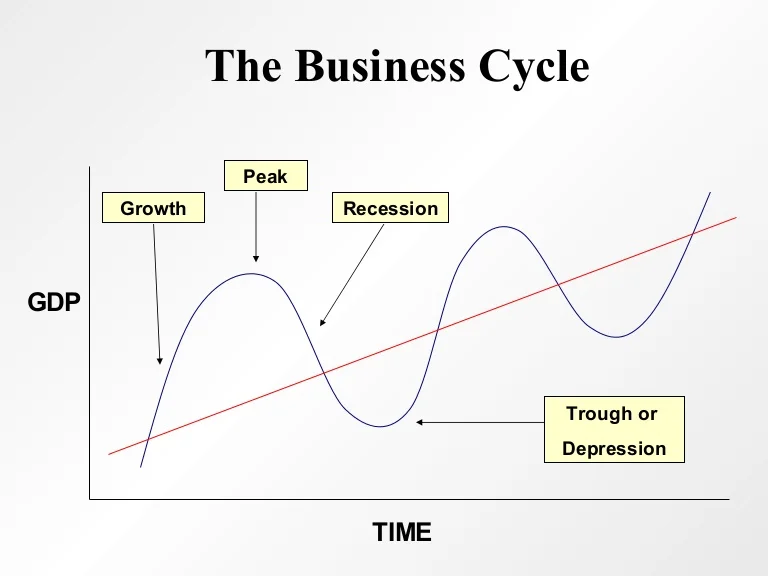

What Are The Four Phases In The Typical Business Cycle

Economic storm clouds are gathering, and understanding the business cycle is now crucial for businesses and individuals alike. Ignoring these phases can spell disaster; knowing them is your shield.

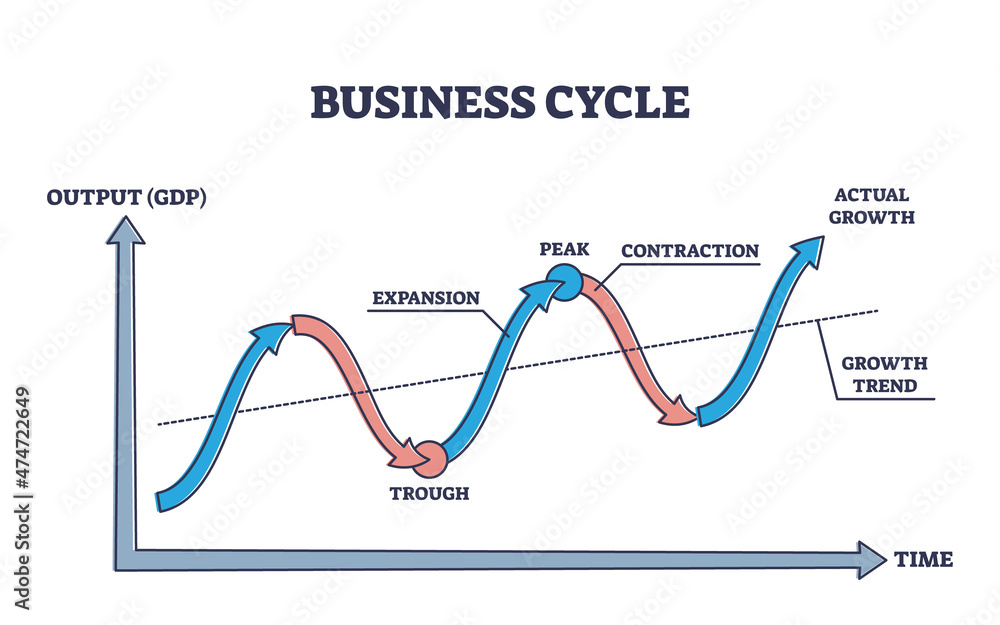

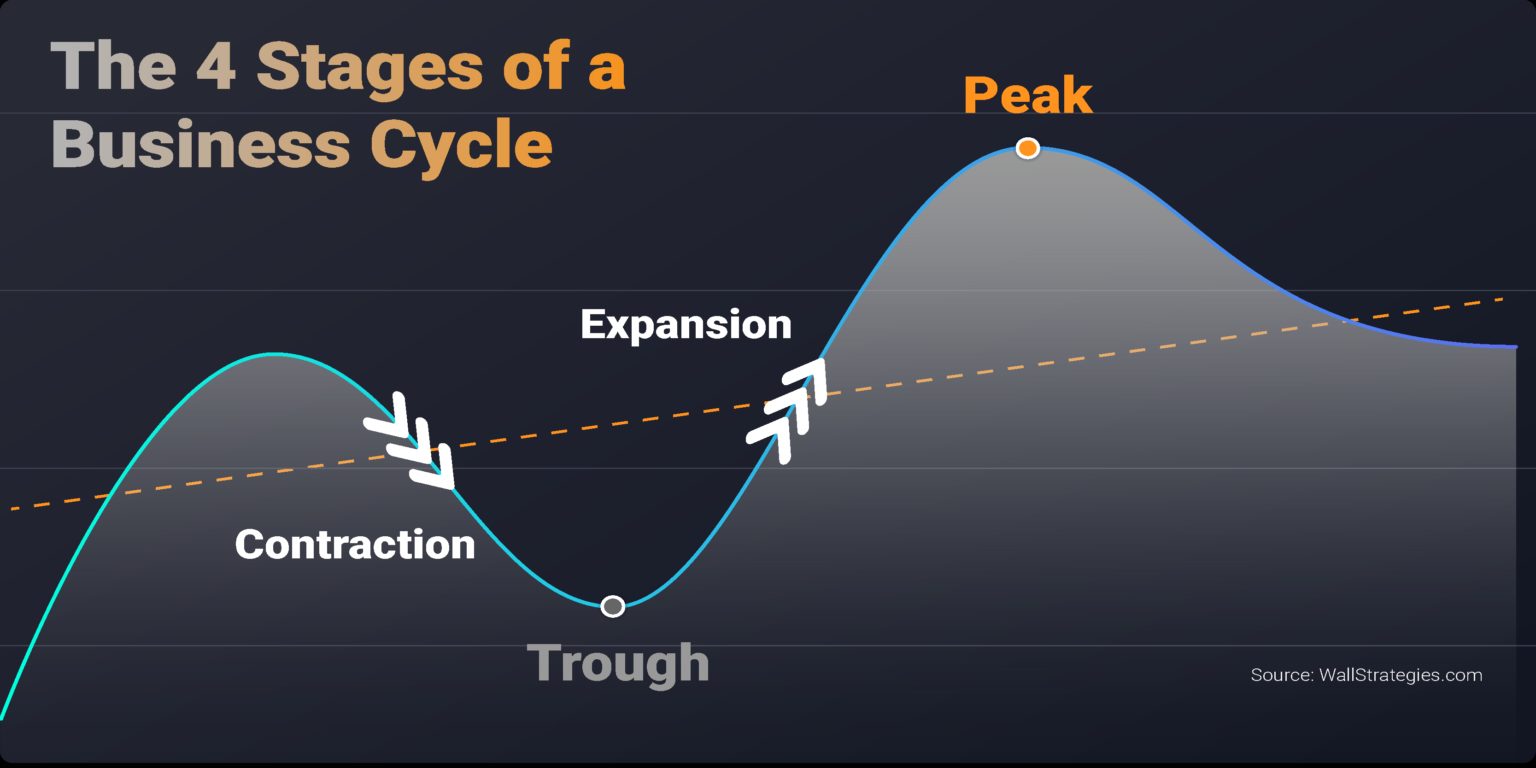

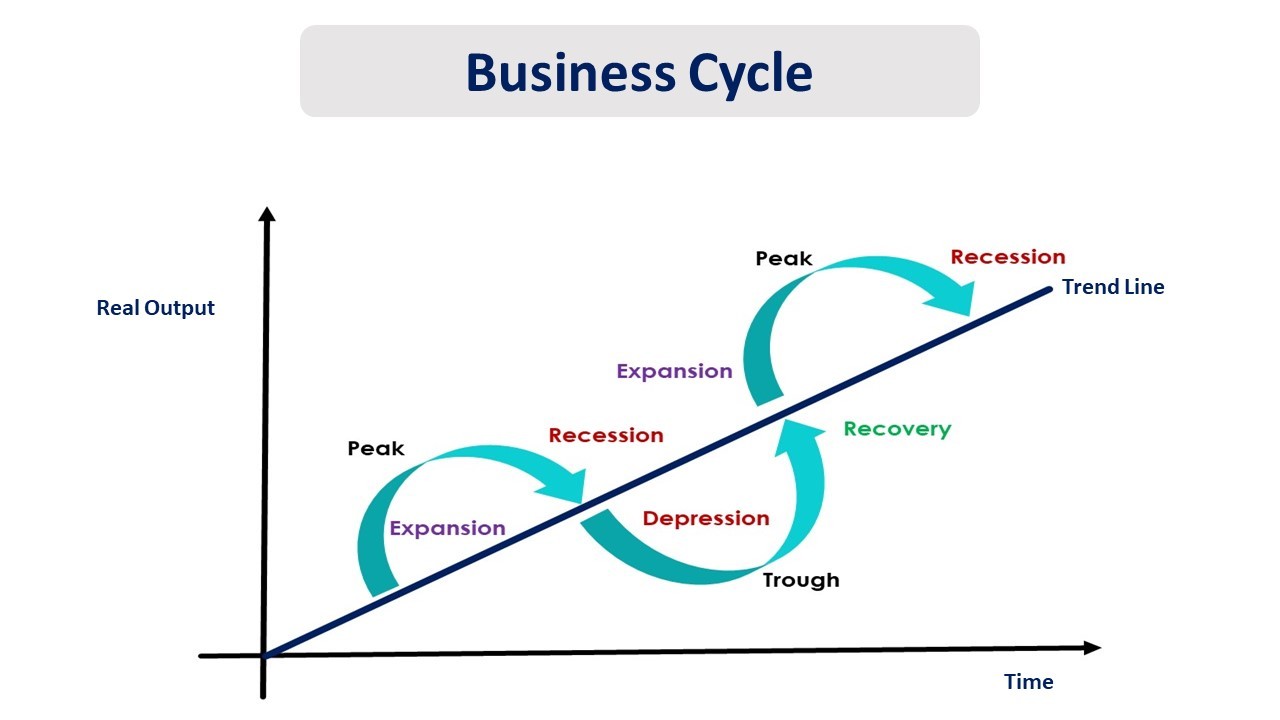

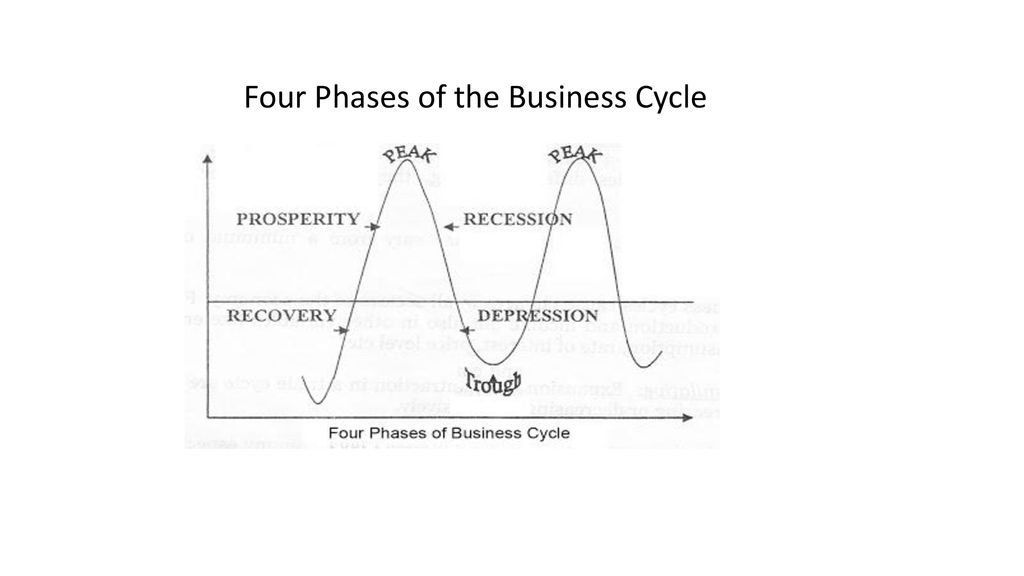

This article breaks down the four critical phases of the business cycle – Expansion, Peak, Contraction, and Trough – providing a concise guide to navigating the turbulent economic waters ahead.

Understanding the Four Phases

Phase 1: Expansion

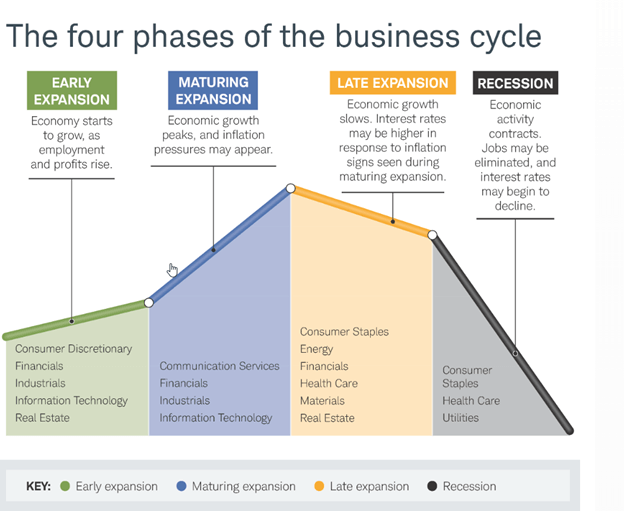

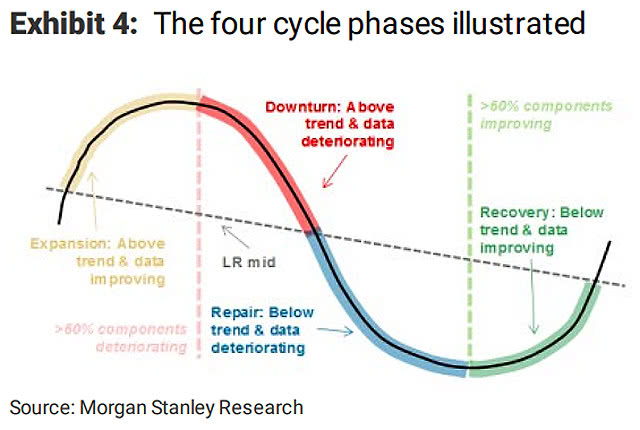

The Expansion phase is characterized by economic growth. GDP is increasing, unemployment is falling, and consumer confidence is high. Businesses are investing and expanding their operations.

Interest rates are typically low, encouraging borrowing and spending. According to the National Bureau of Economic Research (NBER), the average expansion phase since 1945 has lasted about 58 months.

Phase 2: Peak

The Peak represents the upper turning point of the business cycle. Economic growth slows down or stops. This phase indicates a potential overheating of the economy.

Inflation often rises during the peak due to increased demand. Businesses may start to see a decline in profits. The *peak* phase is usually short-lived.

Phase 3: Contraction

The Contraction phase, also known as a recession, is marked by economic decline. GDP decreases, unemployment rises, and consumer spending falls.

Businesses may reduce production and lay off employees. This phase can be triggered by various factors, including interest rate hikes or a decrease in consumer confidence. Contractions are officially declared by the *NBER*.

During a *contraction*, strategic financial planning is essential to survive economic stagnation.

Phase 4: Trough

The Trough represents the lower turning point of the business cycle. Economic activity is at its lowest point. This phase indicates the end of the recession and sets the stage for the next expansion.

Unemployment is typically high, and consumer confidence is low. However, this phase also presents opportunities for investment and recovery.

Government intervention through fiscal or monetary policies may stimulate the economy. For example, decrease interest rates to encourage spending.

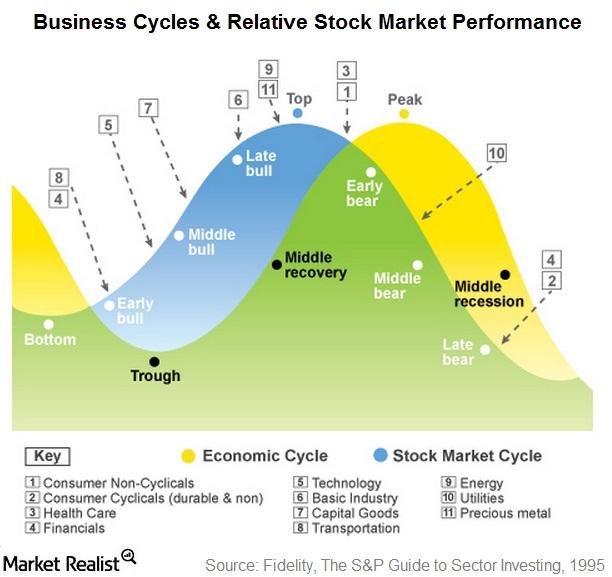

Key Indicators and Their Significance

Understanding these four phases requires careful analysis of multiple economic indicators.

GDP growth is a primary indicator, reflecting the overall health of the economy.

Unemployment rates signal labor market conditions; rising unemployment typically marks a *contraction*. Consumer Price Index (*CPI*) reflects inflation trends, influencing consumer behavior and monetary policy.

Interest rates affect borrowing costs and investment decisions, often adjusted by the Federal Reserve to stabilize the economy.

What’s Next?

Monitoring key economic indicators is vital. Staying informed about the latest economic data and expert analyses will allow for proactive strategies.

Businesses should consider diversifying revenue streams and building financial reserves. Individuals should focus on securing stable employment and managing debt prudently. The economy is like the ocean, always in motion.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

.png)