Financial Management For Small Business

Imagine a cozy bakery, sunlight streaming through the window, the aroma of freshly baked bread filling the air. Flour dusts the apron of the owner, Sarah, who greets each customer with a warm smile. But behind the scenes, Sarah faces a challenge many small business owners know well: managing the finances to keep her sweet dream alive.

Sound financial management is the lifeblood of any small business. It's not just about making a profit; it's about understanding cash flow, planning for the future, and making informed decisions that ensure long-term sustainability. Neglecting this vital aspect can lead to serious problems, even closure, regardless of how brilliant the business idea is.

The Foundation: Understanding Your Numbers

Many small business owners start with a passion, be it baking, crafting, or providing a specialized service. However, passion alone doesn't pay the bills. A clear understanding of your business's financial health is crucial.

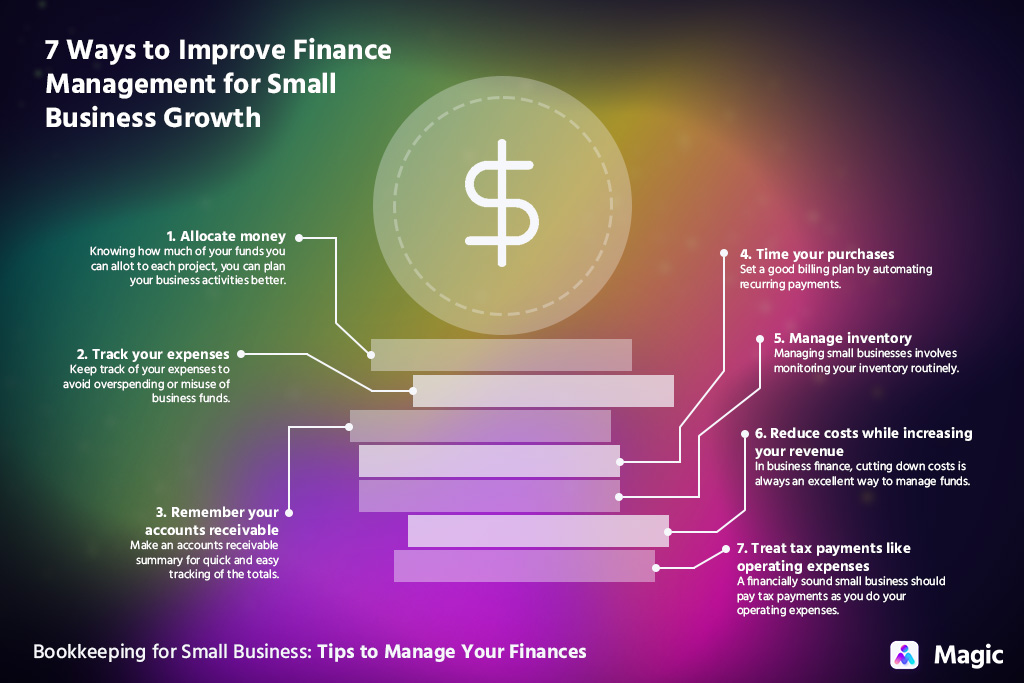

This begins with meticulous record-keeping. Tracking income and expenses diligently allows you to see where your money is coming from and where it's going. Tools like accounting software (QuickBooks, Xero) can significantly simplify this process, providing real-time insights into your financial performance.

Creating a budget is the next vital step. It's a roadmap that outlines your expected income and expenses over a specific period. Regularly comparing your actual performance against your budget allows you to identify potential problems early on and make necessary adjustments.

Cash Flow is King (or Queen!)

Cash flow management is arguably the most important aspect of financial management for small businesses. Even profitable businesses can fail if they run out of cash. Maintaining a healthy cash flow means ensuring that you have enough money coming in to cover your expenses.

Consider Sarah, the bakery owner. She might sell a lot of bread, but if her customers pay on credit and her suppliers demand immediate payment, she could face a cash flow crunch. Strategies to manage cash flow include offering early payment discounts to customers, negotiating longer payment terms with suppliers, and carefully managing inventory.

According to the Small Business Administration (SBA), a significant number of small business failures are attributed to poor cash flow management. Planning and accurate forecasting is key to ensuring enough reserves.

Planning for the Future: Investing and Growth

Sound financial management isn't just about surviving; it's about thriving. Planning for the future involves making strategic investments and setting financial goals. These goals might include expanding your business, hiring more employees, or developing new products or services.

Consider the importance of setting up a realistic financial plan. For example, allocating funds for marketing and advertising, researching new technologies, or investing in employee training can all contribute to long-term growth and profitability. Reinvesting profits back into the business is a sign of financial health and smart management.

Accessing funding for growth is another important consideration. This could involve applying for a small business loan, seeking investment from venture capitalists, or exploring government grants. The SBA offers resources and programs to help small businesses access capital.

Seeking Expert Advice

Managing finances can be complex, especially for those without a financial background. Don't hesitate to seek professional help. A qualified accountant or financial advisor can provide invaluable guidance and support.

They can help you with everything from setting up your accounting system to developing a financial plan to navigating tax laws.

"It's important to have someone who understands the numbers and can provide objective advice,"says John Smith, a certified financial planner specializing in small business finance.

Remember Sarah, the bakery owner? She initially struggled to manage her finances on her own. But after consulting with a small business accountant, she gained a clearer understanding of her cash flow, developed a budget, and started planning for the future. Her business is now thriving.

Conclusion: A Foundation for Success

Financial management isn't just about numbers; it's about empowerment. By understanding your finances, you gain control over your business's destiny. It empowers you to make informed decisions, weather economic storms, and achieve your long-term goals.

The journey of a small business owner is often challenging, but with a solid foundation of financial literacy, you can turn your dream into a sustainable and successful reality. Just like Sarah, you can bake up a recipe for success that lasts.