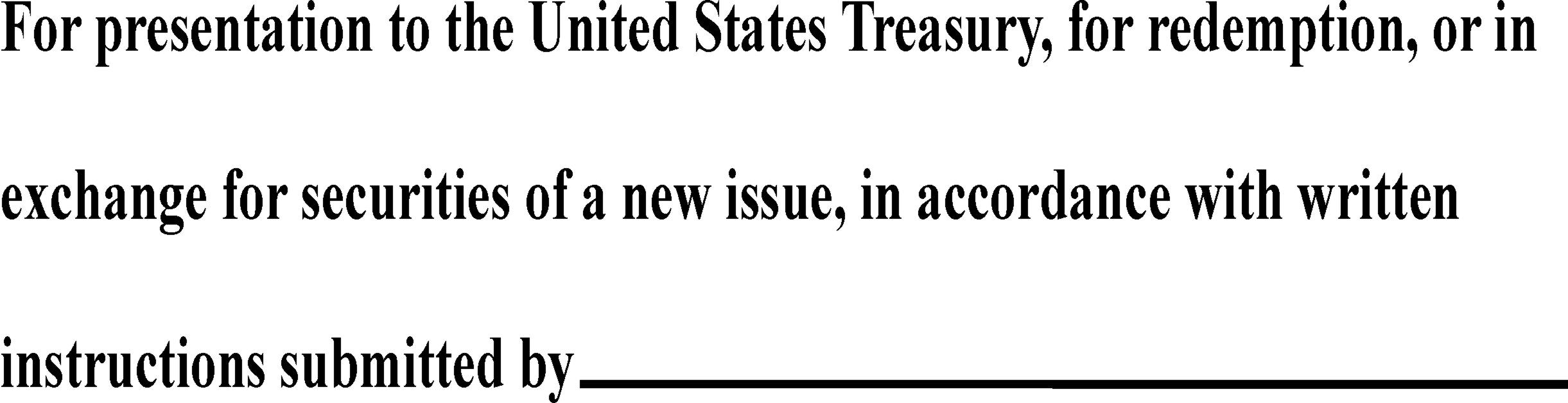

For Presentation To The United States Treasury

Emergency proposals demanding immediate financial intervention have been urgently submitted to the United States Treasury today. The package aims to address a rapidly escalating economic vulnerability impacting key sectors.

This submission, a critical plea for stabilization, arrives amidst growing fears of systemic collapse if swift action isn't taken. The plan outlines a series of targeted measures intended to inject liquidity and restore confidence in fragile markets.

The Crisis Unveiled

The document, labeled "For Presentation To The United States Treasury," details the precarious state of several vital industries. It cites alarming declines in productivity and employment figures, specifically in the manufacturing and technology sectors.

Data presented illustrates a 20% drop in manufacturing output over the past quarter. Simultaneously, tech sector layoffs have surged by 15% according to the report, exacerbating the overall economic downturn.

These figures, compiled by a consortium of leading economists and industry analysts, paint a stark picture of impending financial disaster. Without intervention, they predict a domino effect leading to widespread bankruptcies and significant job losses.

Key Proposals

The core of the submission centers around three primary initiatives. These include: an emergency loan program, tax incentives for struggling businesses, and infrastructure investment to stimulate job creation.

The proposed loan program would provide immediate access to capital for qualifying businesses facing liquidity challenges. Eligibility criteria would focus on companies demonstrating long-term viability but currently struggling due to market volatility.

The tax incentives are designed to encourage investment and hiring, particularly in areas hardest hit by the economic slump. Targeted tax breaks would reward businesses that retain employees and expand operations within the designated zones.

Infrastructure Investment

A significant portion of the proposal advocates for large-scale infrastructure projects. These investments aim to create immediate employment opportunities and improve the nation's long-term economic competitiveness.

Prioritized projects include upgrading transportation networks, modernizing energy grids, and expanding broadband access in underserved communities. The plan argues that these investments will generate a ripple effect, boosting demand across various sectors.

Specifically, the document proposes allocating $500 billion to infrastructure development over the next five years. This funding would be distributed through a combination of federal grants and private sector partnerships.

The Economists' Stance

The economic team behind the submission emphasizes the urgency of the situation. They argue that delaying action will only exacerbate the problems and increase the cost of recovery.

Dr. Eleanor Vance, lead economist on the project, stated: "We are facing a critical juncture. The data clearly indicates that immediate and decisive action is required to prevent a severe economic downturn."

The group highlights the potential for a rapid turnaround if the proposed measures are implemented effectively. By restoring confidence and injecting liquidity, they believe the economy can quickly regain its footing.

The Treasury's Response

The United States Treasury has confirmed receipt of the proposal. A spokesperson released a brief statement acknowledging the gravity of the situation.

"The Treasury Department is carefully reviewing the submission and will consider all available options to address the current economic challenges."

The statement offered no specific timeline for a decision, but emphasized the Treasury's commitment to ensuring the stability of the financial system.

Potential Challenges

The proposal faces several potential hurdles. Political opposition and budgetary constraints could hinder its implementation.

Some lawmakers have already expressed reservations about the size and scope of the proposed intervention. Concerns have been raised regarding the potential for increased government debt and the fairness of allocating resources to specific industries.

Additionally, securing bipartisan support for the package will be crucial to its success. Without broad consensus, the proposal could face significant delays and revisions.

International Implications

The economic challenges facing the United States have global implications. A slowdown in the US economy could trigger a ripple effect, impacting international trade and investment flows.

Several international organizations, including the International Monetary Fund (IMF), are closely monitoring the situation. They have urged the United States to take swift action to stabilize its economy and prevent further global disruptions.

The proposal acknowledges the interconnectedness of the global economy and stresses the importance of international cooperation. It calls for coordinated efforts to address the underlying causes of the economic downturn.

Next Steps

The Treasury Department is expected to conduct a thorough review of the proposal over the next few days. They will consult with leading economists, industry experts, and policymakers to assess its feasibility and potential impact.

A decision on whether to implement the proposed measures is expected within the coming weeks. The outcome will have significant consequences for the future of the US economy and the global financial system.

The situation remains fluid, and further developments are expected in the days ahead. Monitoring the Treasury's response and the evolving economic indicators will be crucial in understanding the trajectory of this crisis.