France Syringes Needles And Urinary Catheters Market

France faces a critical juncture in its medical supplies market as demand for syringes, needles, and urinary catheters surges amidst evolving healthcare needs. Market players are scrambling to adapt to shifting regulations and increased competition, raising concerns about supply chain stability and pricing pressures.

This article examines the current state of the French market for syringes, needles, and urinary catheters, outlining key trends, major players, and emerging challenges shaping its trajectory. It provides a concise overview of the factors influencing market dynamics and potential future developments.

Market Overview: Key Trends and Drivers

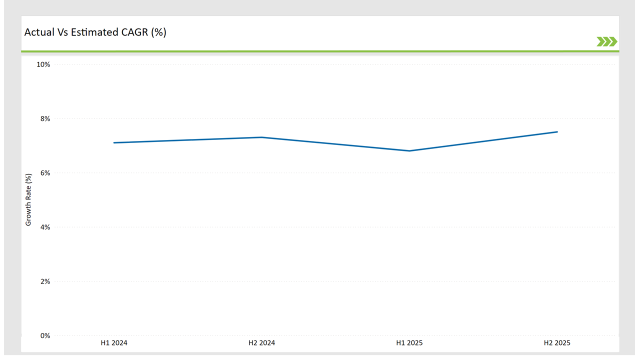

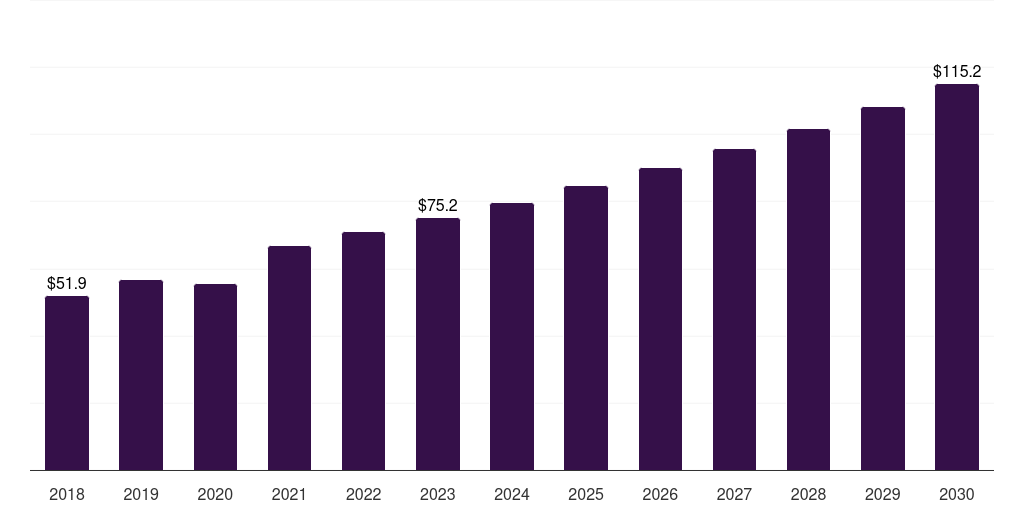

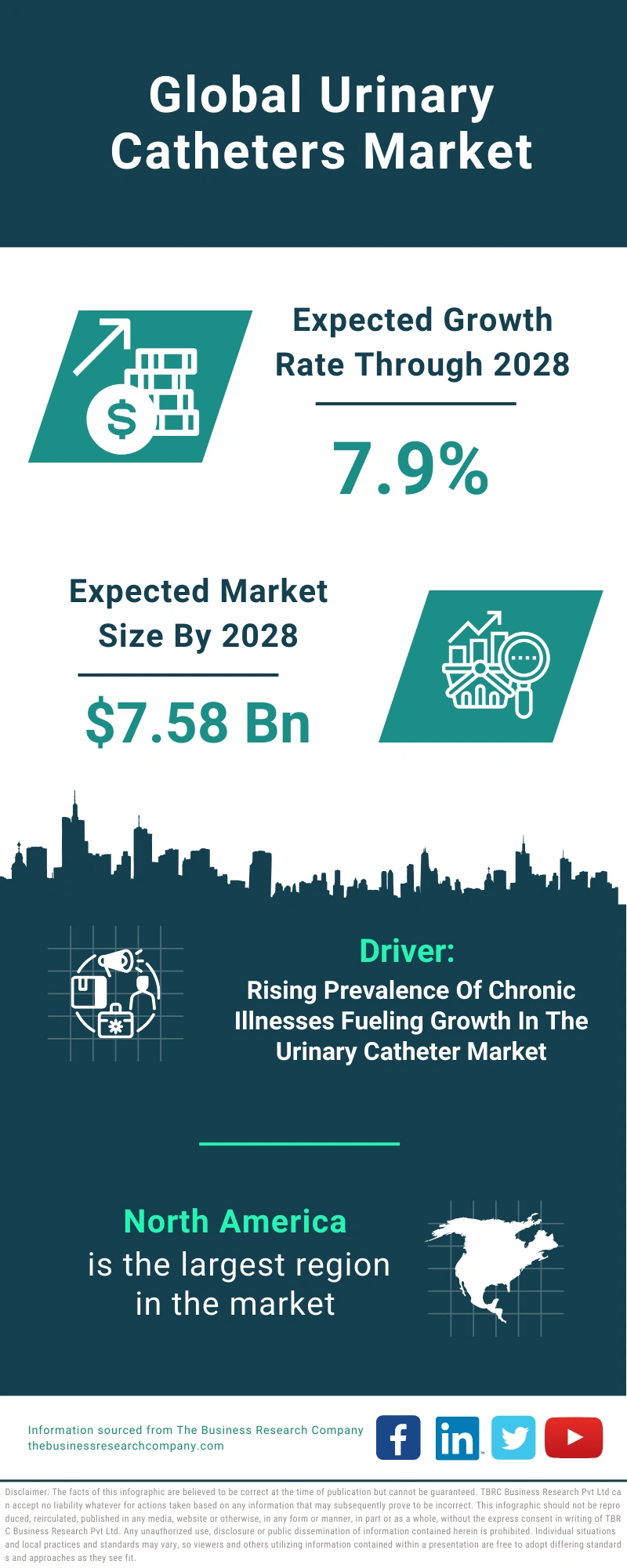

The French market for syringes, needles, and urinary catheters is experiencing steady growth, driven by an aging population, increasing prevalence of chronic diseases like diabetes, and expanding use of injectable medications. Demand is also fueled by rising awareness of infection prevention and the need for safe and effective medical devices.

Government initiatives to improve healthcare access and promote home healthcare are further contributing to market expansion. Increased investment in healthcare infrastructure and favorable reimbursement policies are also playing a crucial role.

However, stringent regulations, price controls, and increasing competition from international manufacturers pose significant challenges to market players. The implementation of the European Medical Device Regulation (MDR) is adding complexity to the regulatory landscape.

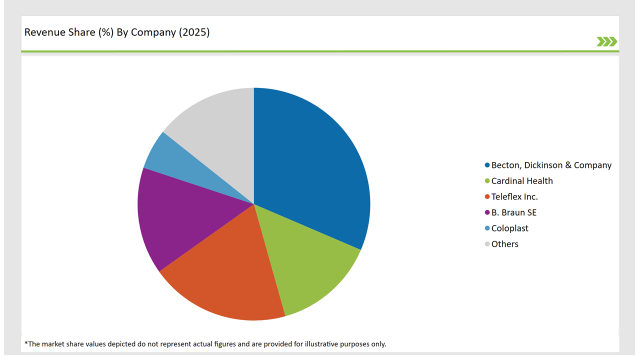

Major Market Players and Competitive Landscape

The French market is characterized by the presence of both domestic and international manufacturers. Key players include Becton Dickinson, B. Braun Melsungen, Terumo Corporation, and Medtronic.

These companies offer a wide range of products, including standard syringes and needles, safety syringes, insulin syringes, and various types of urinary catheters. Competition is intense, with companies focusing on product innovation, quality, and cost-effectiveness to gain market share.

Smaller, specialized players also operate in niche segments of the market, focusing on specific types of catheters or innovative syringe designs. Mergers and acquisitions are increasingly common as companies seek to consolidate their position and expand their product portfolio.

Syringes and Needles Segment

The syringes and needles segment holds the largest share of the overall market. Safety syringes, designed to prevent needlestick injuries, are experiencing particularly strong growth.

The increasing use of injectable drugs for chronic disease management is driving demand for insulin syringes and prefilled syringes. Advancements in needle technology, such as ultra-fine needles and coated needles, are improving patient comfort and adherence to treatment.

However, concerns about proper disposal of used syringes and needles remain a key challenge, requiring effective waste management strategies.

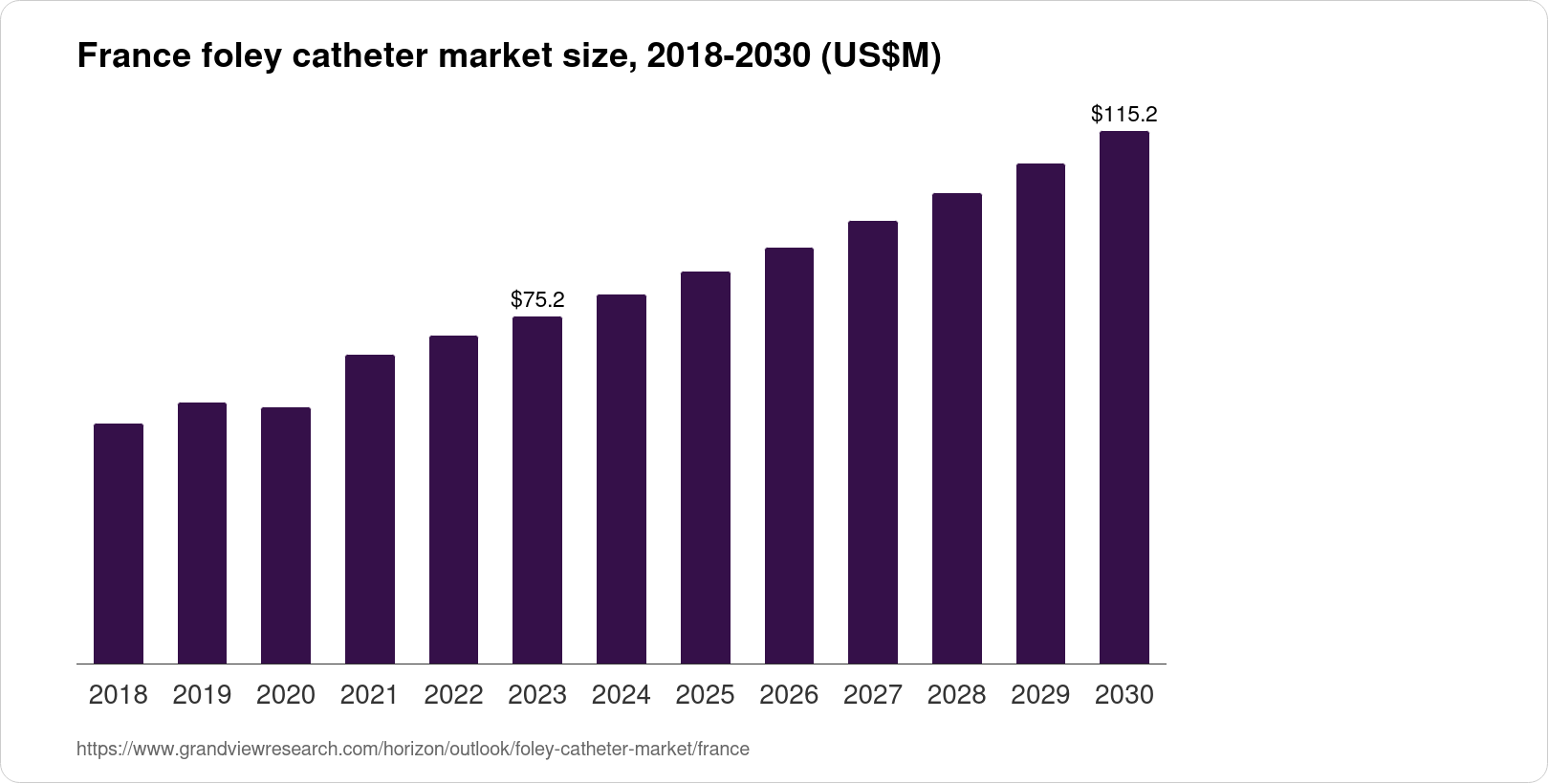

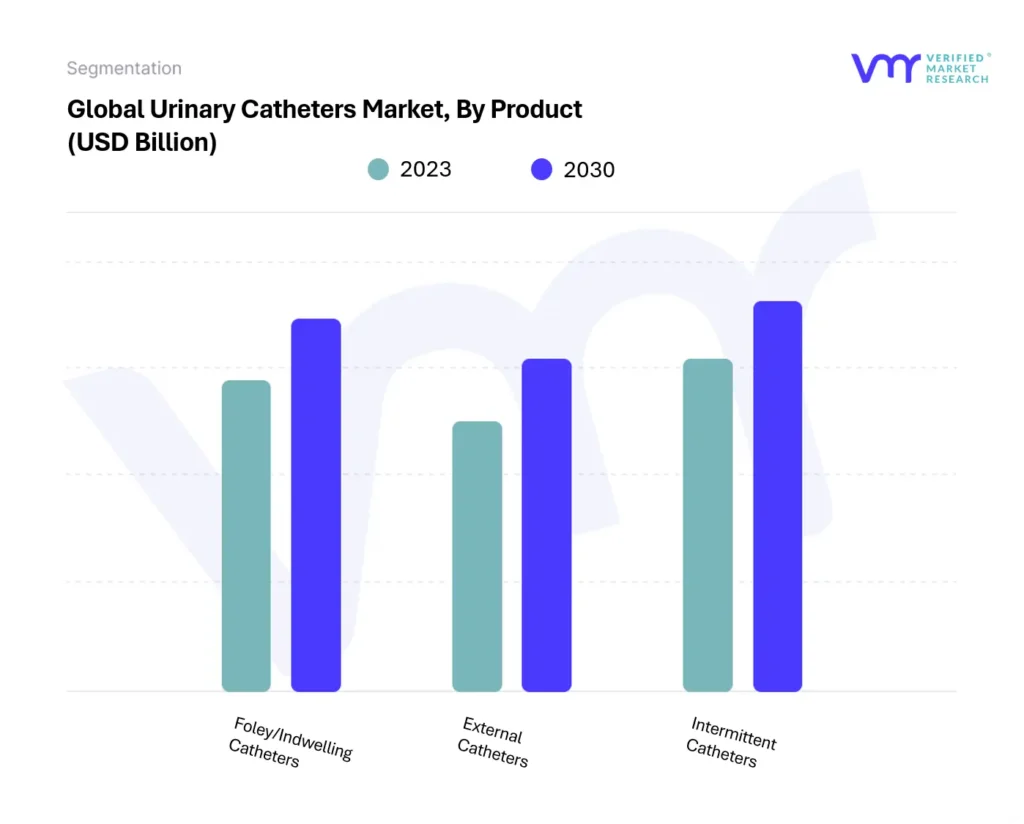

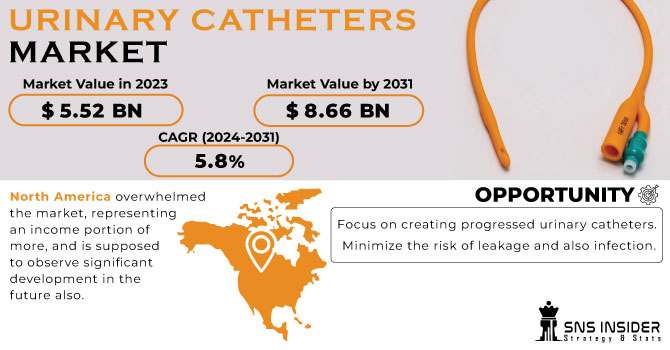

Urinary Catheters Segment

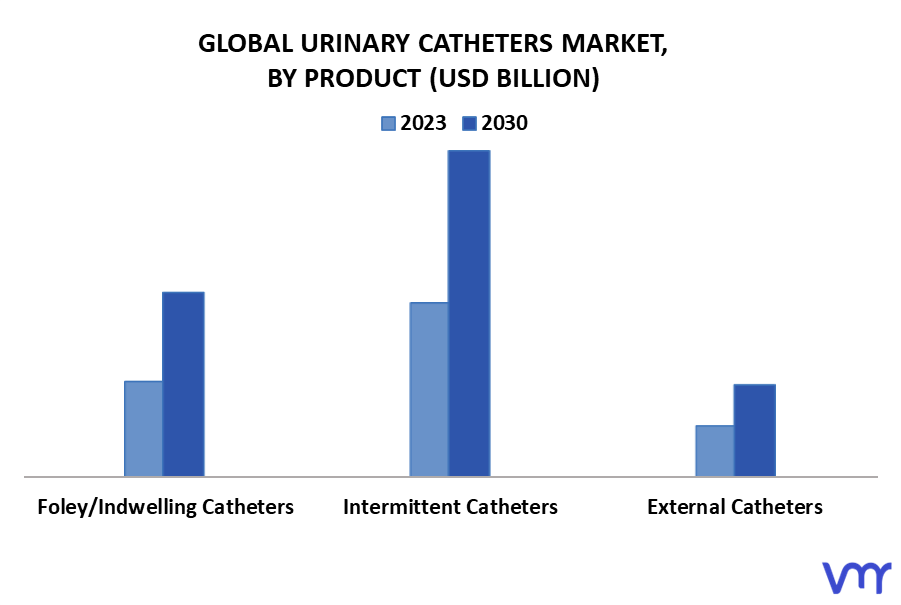

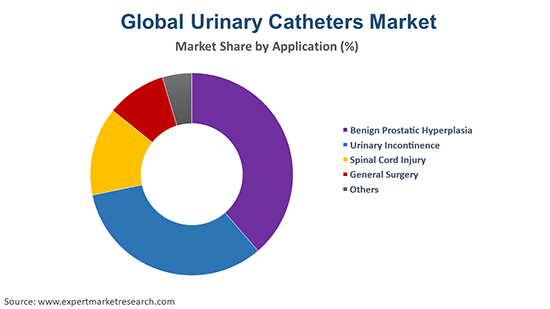

The urinary catheters segment is also experiencing growth, driven by the increasing prevalence of urinary incontinence and urinary retention. Demand is high for both indwelling catheters and intermittent catheters.

Developments in catheter materials, such as silicone and hydrophilic coatings, are improving patient comfort and reducing the risk of catheter-associated urinary tract infections (CAUTIs). CAUTIs are a major concern in healthcare settings, driving demand for antimicrobial catheters.

The growing trend towards home healthcare is increasing the use of intermittent self-catheterization, leading to demand for user-friendly and discreet catheter designs.

Regulatory Environment and Compliance

The French market is subject to stringent regulations regarding the safety and performance of medical devices. The European Medical Device Regulation (MDR) has significantly increased the requirements for manufacturers, including stricter clinical evaluation and post-market surveillance.

Compliance with the MDR requires significant investment in regulatory affairs and quality management systems. Market players must ensure that their products meet the highest safety standards to maintain market access.

The French National Agency for Medicines and Health Products Safety (ANSM) plays a crucial role in enforcing regulations and monitoring the safety of medical devices. Regular audits and inspections are conducted to ensure compliance.

Challenges and Opportunities

The French market faces several challenges, including price controls, increasing competition, and the rising cost of raw materials. The implementation of the MDR is adding complexity to the regulatory landscape and increasing compliance costs.

However, the market also presents significant opportunities for companies that can innovate and offer high-quality, cost-effective products. The aging population and increasing prevalence of chronic diseases are driving demand for advanced medical devices.

Growing awareness of infection prevention and the need for safe and effective medical devices is also creating opportunities for innovative product solutions. Companies that can adapt to the evolving regulatory landscape and meet the changing needs of healthcare providers and patients are well-positioned for success.

Future Outlook

The French market for syringes, needles, and urinary catheters is expected to continue to grow in the coming years. Technological advancements, such as smart catheters and drug-eluting syringes, are expected to drive innovation and improve patient outcomes.

Increased investment in healthcare infrastructure and favorable reimbursement policies are likely to further support market expansion. However, price pressures and regulatory challenges will continue to be significant factors influencing market dynamics.

Market players need to focus on product innovation, cost-effectiveness, and compliance with evolving regulations to maintain a competitive edge. Monitoring ongoing developments in regulatory policies and technological advancements will be crucial for navigating the complexities of the French medical device market. Further updates are expected from ANSM regarding post-market surveillance and enforcement of MDR guidelines.