Gamestop Gross Profit New Video Game Hardware Fiscal Year 2015

GameStop's 2015 fiscal year gross profit margins are under the microscope as new video game hardware sales figures are released. The numbers paint a picture of shifting market dynamics and highlight challenges facing the retail giant.

This article dissects GameStop's 2015 financial performance, focusing on gross profit and the impact of next-generation console sales.

Fiscal Year 2015: Key Performance Indicators

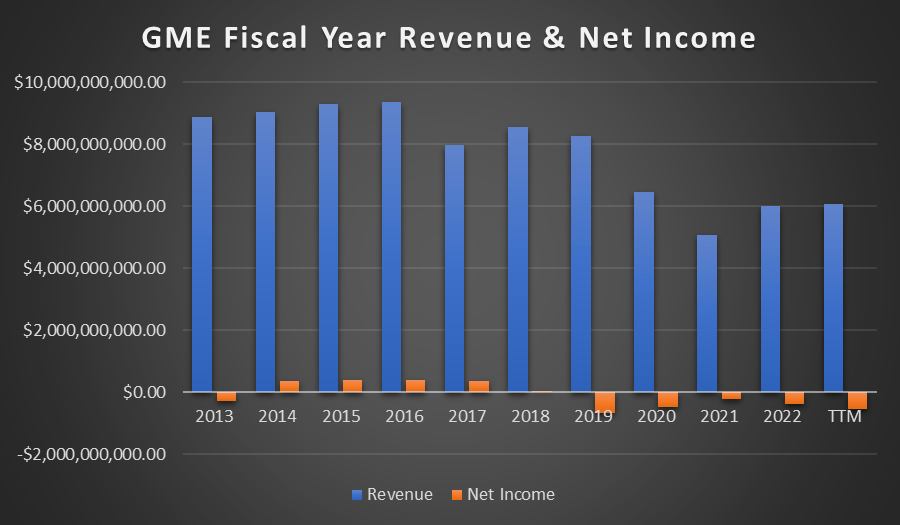

GameStop reported total global sales of $9.36 billion for fiscal year 2015, a 4.7% increase compared to the previous year. However, gross profit figures reveal a more nuanced story.

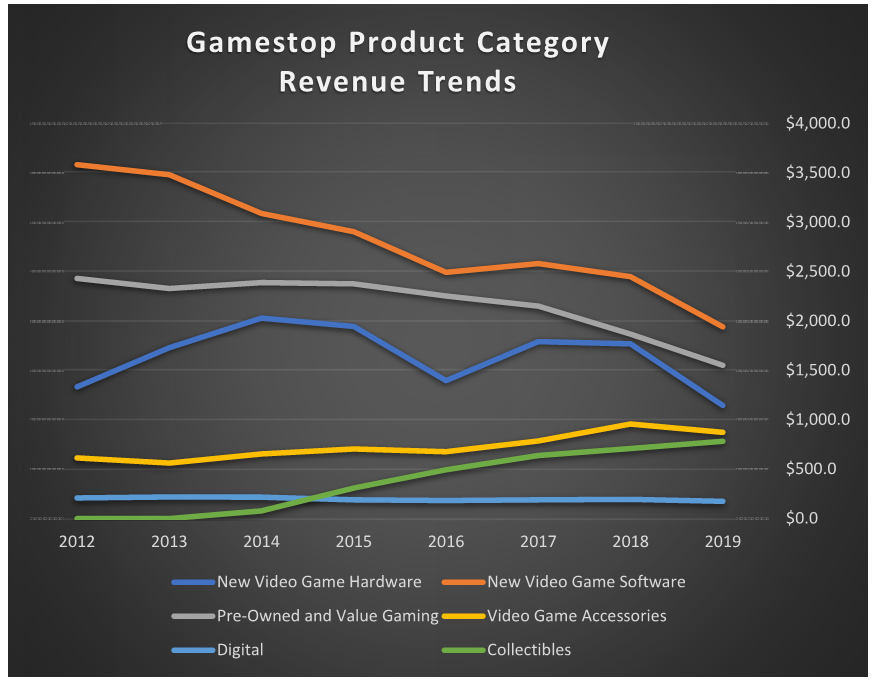

The company's gross profit margin decreased slightly to 30.7% from 31.1% in fiscal year 2014. This decline is partially attributed to the sales mix, with a greater proportion of revenue coming from lower-margin hardware sales.

New hardware sales, driven by the PlayStation 4 and Xbox One, increased significantly. But this growth didn't translate directly into proportionally higher gross profits.

New Video Game Hardware Performance

Next-generation consoles were a major driver of revenue for GameStop in 2015. Sales of new hardware jumped by 25.4% year-over-year.

This surge was fueled by strong consumer demand for the PlayStation 4 and Xbox One. Despite the high volume, hardware typically carries lower profit margins than software or accessories.

GameStop actively promoted trade-in programs to drive console sales. These programs, while boosting hardware revenue, can impact gross profit margins due to the cost of refurbishment and resale of pre-owned consoles.

Software and Pre-Owned Market

New software sales saw modest growth. However, the pre-owned market, a key profit center for GameStop, experienced a slight decline.

The shift towards digital distribution continues to pose a challenge to the pre-owned games market. GameStop is actively seeking strategies to mitigate this impact.

The company's digital sales grew, but represented a relatively small percentage of overall revenue. This indicates the ongoing challenge of competing with direct digital downloads.

Impact on Gross Profit

The increase in hardware sales, coupled with the slight decline in the pre-owned market, impacted GameStop's overall gross profit margin. Lower margins on hardware sales put pressure on overall profitability.

GameStop executives addressed these challenges during investor calls. They outlined strategies to improve margins, including focusing on higher-margin categories like collectibles and accessories.

Cost optimization efforts were also implemented to offset the impact of lower gross profit margins. These measures aimed to improve operational efficiency and reduce expenses.

Strategic Responses and Future Outlook

GameStop is diversifying its business model to address the changing landscape of the gaming industry. This includes expanding its offerings beyond traditional video game retail.

The company is investing in collectibles, technology brands, and other related businesses. These initiatives aim to create new revenue streams and improve overall profitability.

GameStop's management is closely monitoring industry trends and consumer behavior. Adaptations to its business strategy are expected as the gaming market evolves.

Financial Data and Analysis

Detailed financial data, including segment-specific performance, can be found in GameStop's official SEC filings. These reports provide a comprehensive overview of the company's financial health.

Analyst reports offer further insights into GameStop's performance. These reports often provide projections and recommendations based on market trends and company strategy.

Investors and stakeholders are closely watching GameStop's actions. The company's ability to adapt to the changing market will be crucial for its long-term success.

Conclusion: Navigating the Changing Landscape

GameStop's fiscal year 2015 performance highlights the challenges and opportunities facing the company. Shifting consumer preferences and the rise of digital distribution are key factors shaping the market.

GameStop must continue to adapt its business model to remain competitive. This includes focusing on higher-margin categories and optimizing its cost structure.

The company's next earnings report will provide further insights into its progress. Investors will be closely watching for signs of improvement in gross profit margins and overall profitability.

![Gamestop Gross Profit New Video Game Hardware Fiscal Year 2015 [100+] Gamestop Wallpapers | Wallpapers.com](https://wallpapers.com/images/hd/gamestop-logo-signage-t2ryls87cvoqz12i.jpg)