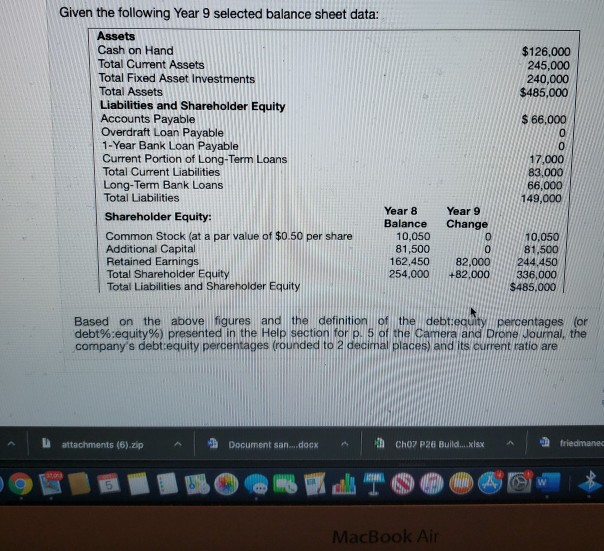

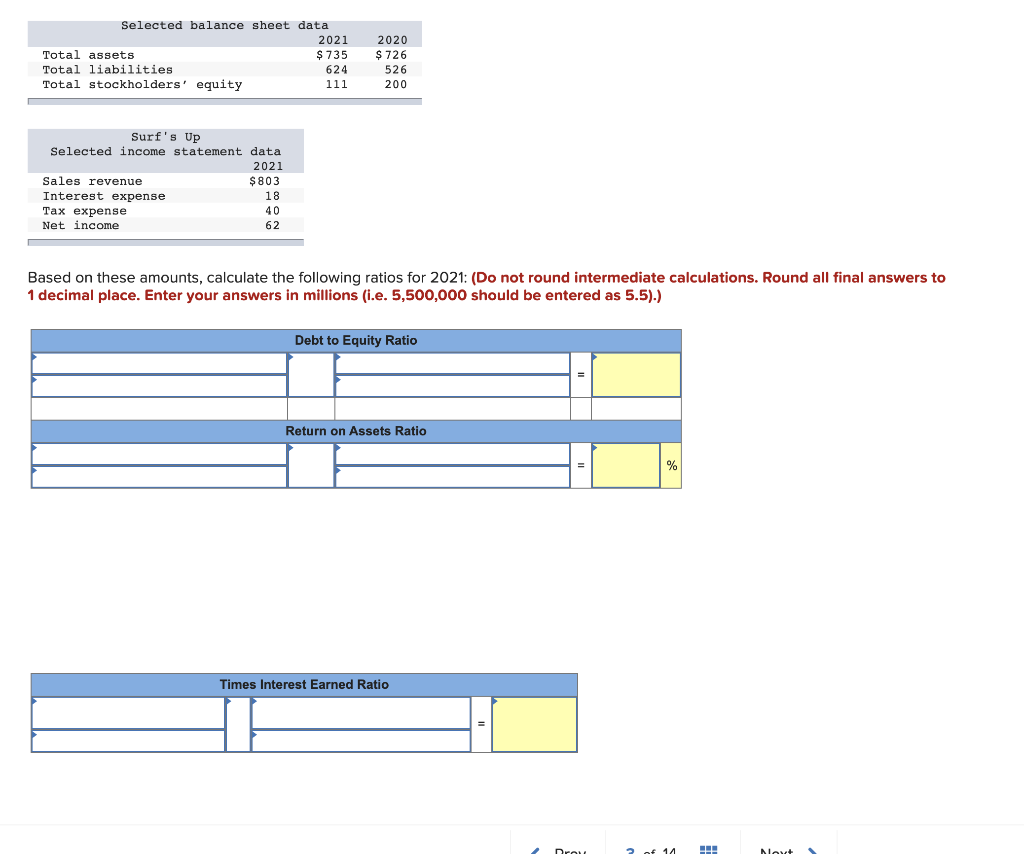

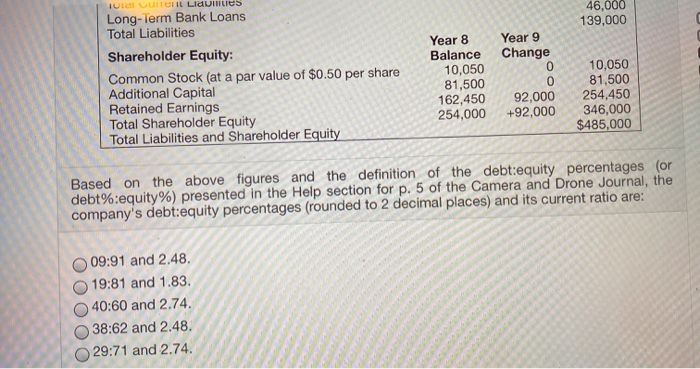

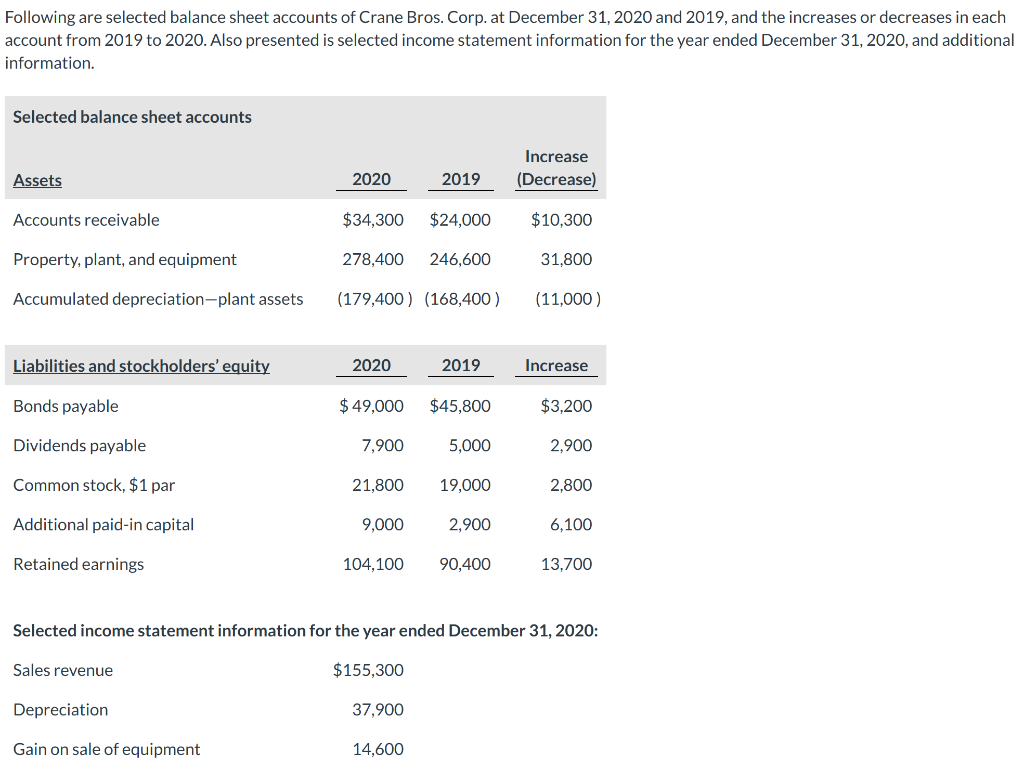

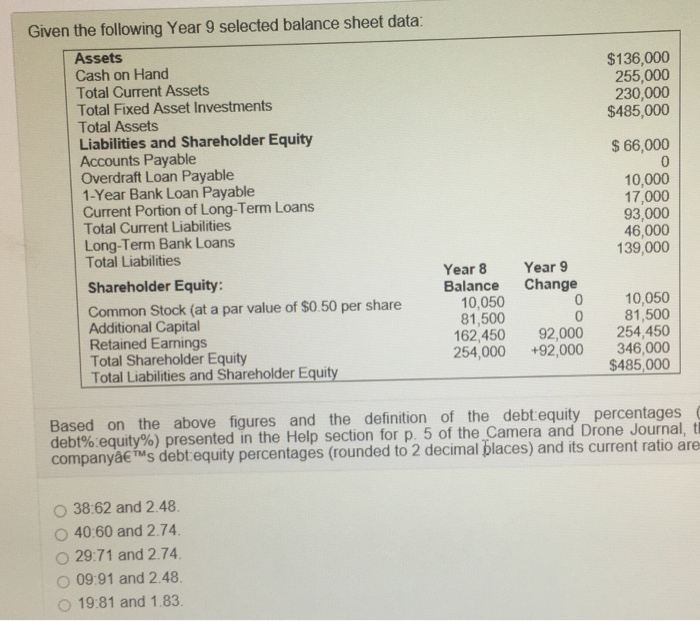

Given The Following Year 9 Selected Balance Sheet Data

Imagine a classroom filled with bright-eyed Year 9 students, their faces illuminated not by the glow of screens, but by the focused concentration of understanding their first balance sheet. The numbers swim before them, assets and liabilities dancing a delicate dance of fiscal responsibility. These aren't just figures; they represent the foundational building blocks of financial literacy for a generation poised to shape the economic landscape of tomorrow.

This article explores the fascinating world of Year 9 balance sheets, revealing what seemingly simple data can tell us about the financial acumen of young students and the potential impact of early financial education. By analyzing selected balance sheet data from a cohort of Year 9 students, we can gain insights into their understanding of basic accounting principles and the challenges they face in managing their finances.

A Glimpse into Young Financial Minds

The selected balance sheet data from Year 9 students presents a unique opportunity to assess their grasp of core financial concepts. Analyzing assets like savings, allowances, and perhaps even small investments alongside liabilities such as outstanding loans from family or friends offers a window into their financial world.

This exercise isn't merely academic; it's a practical application of mathematical and analytical skills that prepares them for real-world financial decisions.

The Building Blocks: Understanding Assets

Assets, in their simplest form, are what a student owns. For a Year 9 student, these might include savings accounts, cash on hand, or even items of value they could sell, like a video game console. The presence of savings, even in small amounts, indicates a degree of financial planning and deferred gratification.

It suggests an understanding of the importance of setting aside resources for future needs or wants.

Consider a student who diligently saves a portion of their allowance each week. This demonstrates not only financial discipline but also an awareness of the power of compound interest, even if they don't explicitly understand the formula.

The Other Side of the Coin: Liabilities and Debt

Liabilities represent what a student owes to others. This could take the form of a loan from a parent or a friend, perhaps to purchase a much-desired item. Understanding liabilities is crucial for developing responsible borrowing habits.

It teaches students the importance of considering the consequences of taking on debt and the obligation to repay it.

Imagine a scenario where a student borrows money to buy the latest smartphone. The balance sheet would reflect this liability, prompting the student to think about the repayment schedule and the impact on their available funds.

The Importance of Early Financial Literacy

Financial literacy is not just about understanding balance sheets; it's about empowering young people to make informed decisions throughout their lives. Starting financial education early, like in Year 9, can lay the foundation for sound financial habits and a more secure future.

Research from organizations like the OECD (Organisation for Economic Co-operation and Development) consistently highlights the link between financial literacy and positive financial outcomes.

Studies have shown that individuals with higher levels of financial literacy are more likely to save for retirement, manage debt effectively, and avoid financial scams.

Bridging the Gap: Educational Initiatives

Schools and educational institutions play a vital role in promoting financial literacy among young people. Integrating practical financial concepts into the curriculum can help students develop the skills they need to succeed in the real world. This could involve simulating real-world scenarios, like creating and managing a budget or understanding the basics of investing.

Community organizations and financial institutions also offer valuable resources and programs to support financial education. Workshops, seminars, and online tools can provide students with the knowledge and skills they need to make informed financial decisions.

The Jump$tart Coalition for Personal Financial Literacy is a prime example, providing resources and advocacy for financial education in schools.

Challenges and Opportunities

While the selected balance sheet data provides valuable insights, it's important to acknowledge the challenges students may face in managing their finances. Limited income, lack of access to financial resources, and peer pressure can all impact their financial decisions.

Providing students with the tools and support they need to overcome these challenges is essential for fostering financial well-being. This includes teaching them how to budget, save, and avoid debt, as well as providing access to financial counseling and support services.

Consider the influence of social media on spending habits, where students might feel pressured to keep up with the latest trends. Financial education can equip them with the critical thinking skills to resist these pressures and make informed choices.

Beyond the Numbers: A Holistic Approach

Financial literacy is not just about numbers and spreadsheets; it's about developing a holistic understanding of money and its role in our lives. This includes exploring topics like ethical spending, social responsibility, and the impact of financial decisions on the environment. Encouraging students to think critically about the values and beliefs that shape their financial decisions can help them develop a more responsible and sustainable approach to money management.

For example, discussions about fair trade practices and the impact of consumerism on developing countries can broaden their understanding of the ethical dimensions of finance. By fostering a sense of social responsibility, we can empower young people to use their financial resources to make a positive impact on the world.

Conclusion: Investing in the Future

The selected Year 9 balance sheet data offers a glimpse into the financial lives of young students and highlights the importance of early financial education. By equipping them with the knowledge and skills they need to manage their finances effectively, we can empower them to build a more secure and prosperous future. It's more than just balancing numbers; it's about building a foundation for a generation of financially responsible citizens.

As we reflect on these young minds grappling with assets and liabilities, it becomes clear that investing in their financial literacy is an investment in the future of our communities and our world. By providing them with the tools and support they need to succeed, we can help them navigate the complexities of the financial landscape and build a brighter tomorrow.