How To Pay Yourself Llc Sole Proprietorship

Navigating the financial landscape as a small business owner can feel like traversing a minefield, especially when it comes to understanding the seemingly simple task of paying yourself. For those operating under an LLC (Limited Liability Company) or as a sole proprietorship, the process isn't as straightforward as receiving a traditional paycheck. Confused bookkeeping, incorrect tax filings, and potential legal ramifications await those who mismanage their owner's draw.

This article aims to dissect the nuances of compensating yourself as an owner of an LLC or sole proprietorship. It will clarify the approved methods for taking owner's draws, meticulously explaining record-keeping best practices, and navigating the crucial considerations surrounding self-employment taxes.

Understanding Owner's Draws

An owner's draw is essentially the method by which owners of LLCs and sole proprietorships compensate themselves for their work and investment in the business. Unlike employees who receive a salary or wages subject to payroll taxes, owners are not considered employees of their own companies.

Therefore, they cannot be paid through a traditional payroll system. Instead, they take "draws" from the company's profits.

LLC vs. Sole Proprietorship

The fundamental difference between an LLC and a sole proprietorship lies in their legal structure and liability protection. A sole proprietorship is the simplest business structure, directly linking the business to the individual owner, meaning personal assets are at risk. An LLC, on the other hand, provides a level of separation between the owner's personal assets and the business's liabilities.

Despite this difference, the process for taking owner's draws is generally similar for both structures. Owners withdraw money from the business based on its profitability and their personal needs.

How to Pay Yourself: The Process

The core principle of paying yourself as an LLC or sole proprietorship owner revolves around tracking profits and taking draws against those profits. Here's a breakdown of the standard procedure:

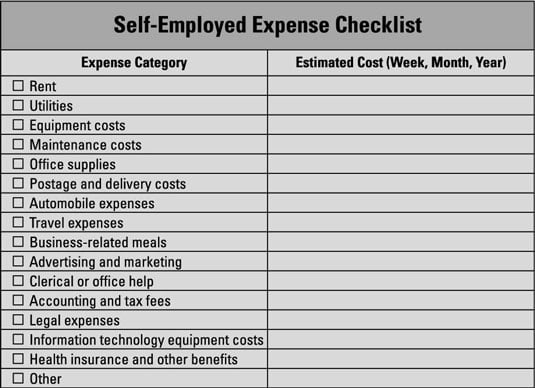

First, carefully track all income and expenses of your business. Accurate bookkeeping is essential for determining profitability and calculating the amount available for owner's draws.

Second, determine the amount of money the business can afford to distribute to the owner. Consider business needs, upcoming expenses, and any reinvestment strategies.

Third, withdraw the funds from the business account and transfer them to your personal account. Label this transaction clearly as an "owner's draw" for accurate record-keeping.

Fourth, maintain meticulous records of all owner's draws, including the date, amount, and purpose of the withdrawal. This documentation is vital for tax purposes.

Record-Keeping Best Practices

Maintaining accurate and comprehensive records of all financial transactions, particularly owner's draws, is non-negotiable. Failure to do so can lead to significant problems during tax season and potential audits from the IRS.

Use accounting software like QuickBooks, Xero, or FreshBooks to track income, expenses, and owner's draws. These tools streamline the process and minimize the risk of errors.

Clearly label all transactions related to owner's draws with specific descriptions. Avoid generic terms like "transfer" or "withdrawal;" instead, use "owner's draw - [Date]" or "distribution to owner."

Regularly reconcile bank statements with your accounting records. This practice helps identify any discrepancies or errors early on.

"Good record-keeping isn't just about compliance; it's about having a clear understanding of your business's financial health," emphasizes Susan Jones, a CPA specializing in small business taxation.

Navigating Self-Employment Taxes

One of the most crucial aspects of paying yourself as an LLC or sole proprietorship owner is understanding and managing self-employment taxes. Unlike employees who have taxes withheld from their paychecks, self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

Self-employment taxes typically amount to 15.3% of your net earnings. It's essential to factor this into your financial planning and set aside funds specifically for tax payments.

You can often deduct one-half of your self-employment taxes from your gross income. This deduction helps reduce your overall tax burden.

Making estimated tax payments quarterly is usually mandatory for self-employed individuals. Failure to do so can result in penalties from the IRS.

LLC Tax Structures and Impact on Owner Pay

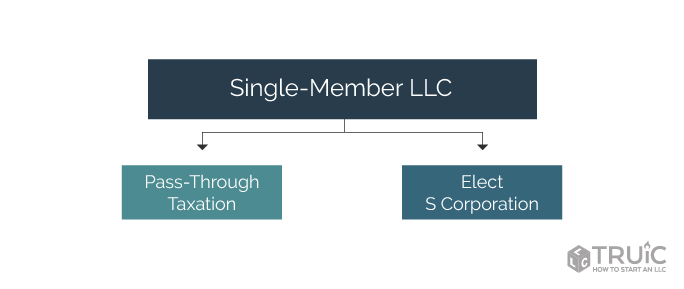

While the general principle of owner's draws remains consistent, the tax implications can vary depending on how the LLC is structured for tax purposes.

An LLC can be taxed as a sole proprietorship (for single-member LLCs), a partnership (for multi-member LLCs), or as a corporation (S-Corp or C-Corp).

When an LLC elects to be taxed as an S-Corp, the owner can be both an employee and an owner. This allows the owner to receive a reasonable salary subject to payroll taxes, along with owner's distributions.

Taxed as an S-Corp, only the salary portion is subject to self-employment taxes. Distributions are not, which can lead to potential tax savings.

Future Trends and Considerations

The increasing complexity of the tax code and the growing popularity of LLCs and sole proprietorships are driving the need for more robust financial management tools and resources for small business owners. Expect to see further development in accounting software and online platforms designed to simplify bookkeeping, tax preparation, and compliance.

Consult with a qualified accountant or tax advisor to determine the most appropriate tax structure for your LLC and to develop a personalized strategy for managing owner's draws and self-employment taxes.

Staying informed about tax law changes and best practices is crucial for ensuring compliance and maximizing your financial benefits as a small business owner.