Onemain Pretax Net Income Share Repurchase

OneMain Financial, a prominent lender focused on nonprime consumers, is making headlines with a recently announced share repurchase program coinciding with reported fluctuations in its pretax net income. The move has sparked debate among financial analysts and investors, raising questions about the company's capital allocation strategy amidst a changing economic landscape and evolving consumer credit market.

This article delves into the intricacies of OneMain's financial performance, analyzes the implications of the share repurchase program, and examines the perspectives of various stakeholders. The analysis includes an overview of recent financial data, a detailed look at the share repurchase authorization, and an assessment of the broader market factors influencing OneMain's strategic decisions. The goal is to provide a comprehensive understanding of the current situation and its potential impact on the company and its investors.

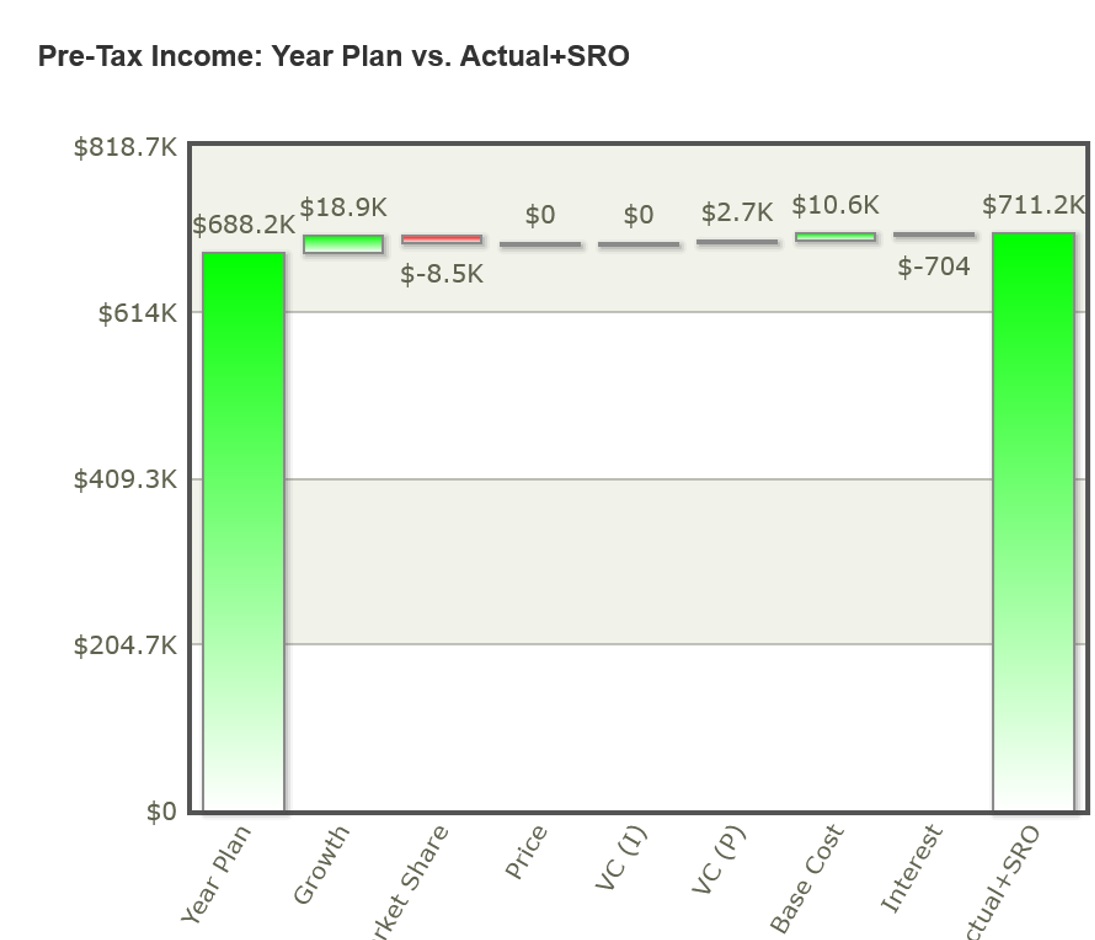

OneMain's Pretax Net Income: A Closer Look

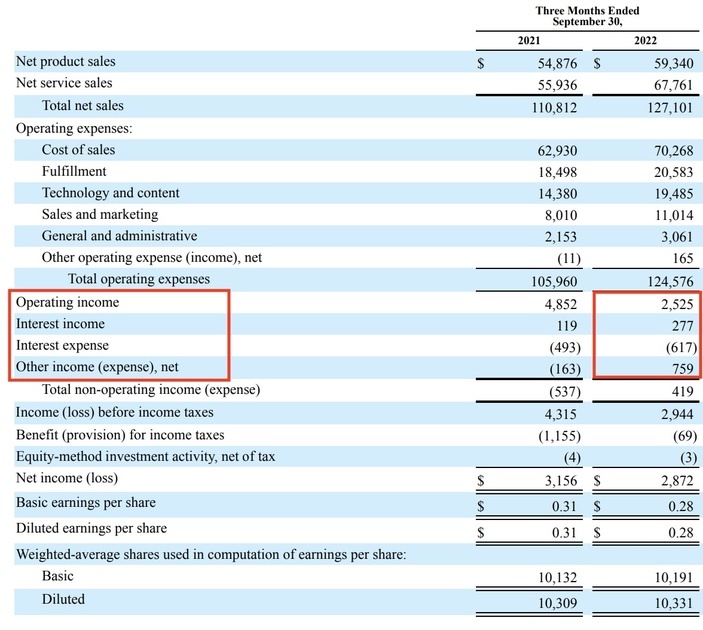

OneMain Financial has demonstrated a complex financial performance picture in recent periods. The company's pretax net income has experienced shifts, influenced by factors such as loan origination volume, credit losses, and operating expenses. Understanding these fluctuations is key to interpreting the company's overall financial health and strategic direction.

Recent earnings reports indicate a dynamic interplay of positive and negative forces affecting OneMain's bottom line. While the demand for personal loans remains strong, concerns about credit quality and the potential for economic slowdowns are contributing to uncertainty. These are key variables impacting their profitability.

Factors Influencing Earnings

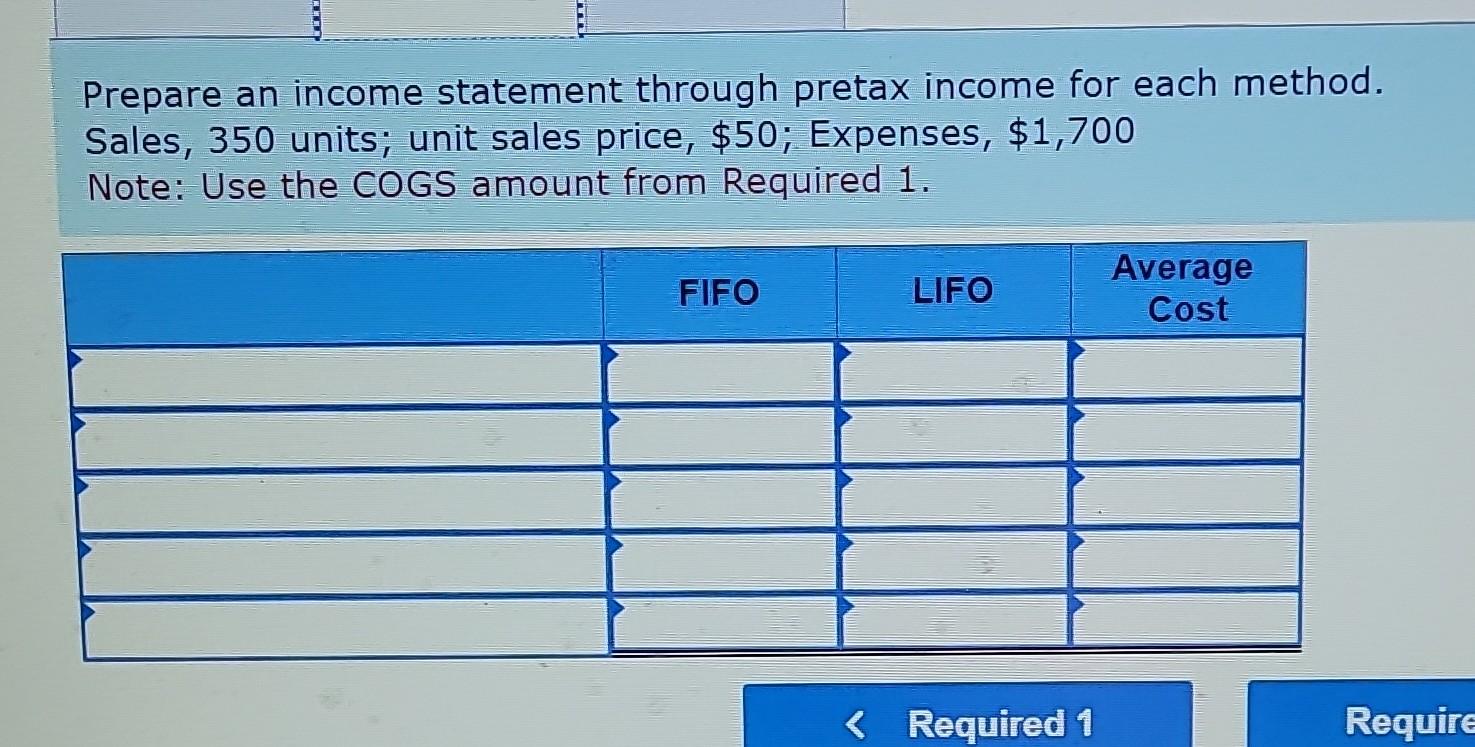

Several factors play a role in shaping OneMain's pretax net income. Loan volume, driven by consumer demand and marketing efforts, directly impacts revenue. Credit losses, a measure of loans that are not repaid, significantly affects profitability, especially during economic downturns.

Operating expenses, including salaries, technology investments, and regulatory compliance costs, also contribute to the overall financial picture. The balance between these factors determines the final pretax net income figure, a crucial metric for investors and analysts.

The Share Repurchase Program: Details and Rationale

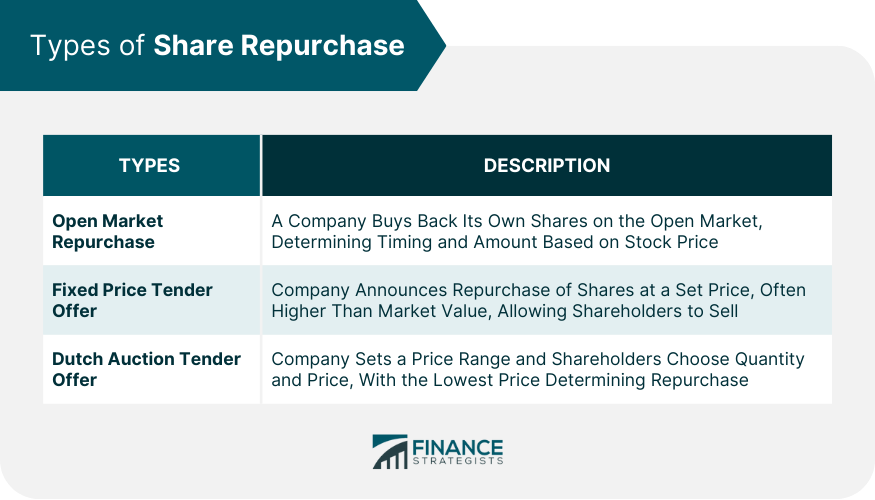

OneMain's announcement of a share repurchase program has attracted significant attention. A share repurchase program, or buyback, allows a company to purchase its own outstanding shares in the open market. This can reduce the number of shares outstanding, potentially increasing earnings per share and boosting the stock price.

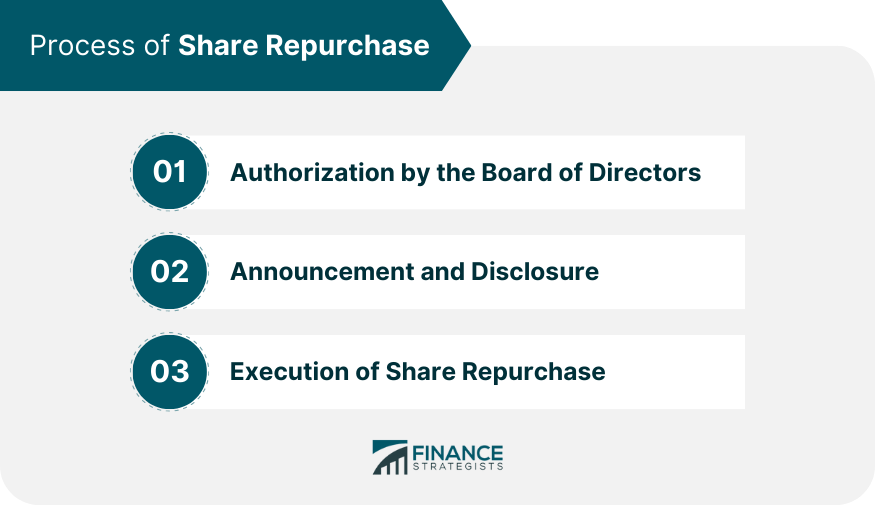

The company's stated rationale for the repurchase program typically includes a belief that its shares are undervalued and a desire to return capital to shareholders. The program's details, including the authorized amount and the timeframe for execution, are closely scrutinized by investors.

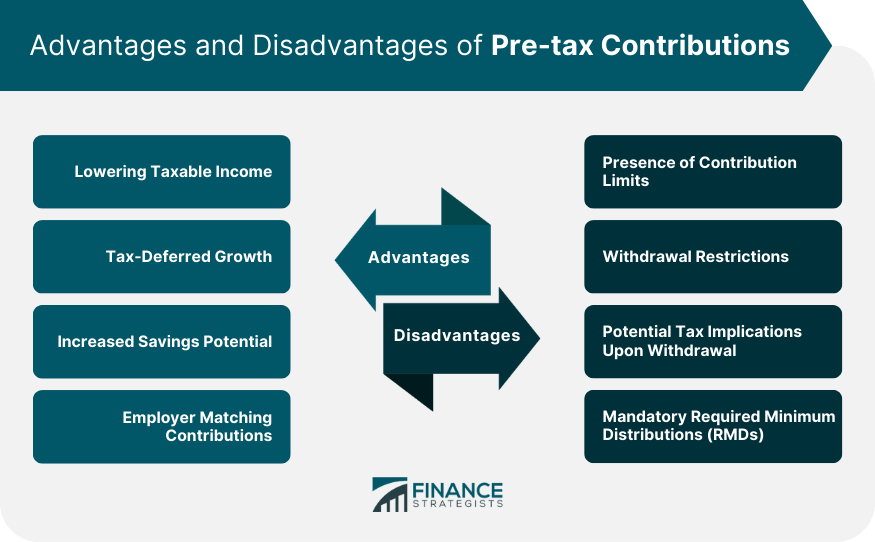

Potential Benefits and Drawbacks

Share repurchases can offer several potential benefits to a company and its shareholders. Reducing the number of outstanding shares can increase earnings per share, making the company more attractive to investors. It can also signal management's confidence in the company's future prospects, potentially boosting the stock price.

However, share repurchases also have potential drawbacks. They can divert capital away from other potentially value-creating investments, such as research and development, acquisitions, or debt reduction. Critics argue that buybacks can be used to artificially inflate earnings per share, masking underlying business problems.

Analyzing the Timing and Context

The timing of the share repurchase program, coinciding with reported fluctuations in pretax net income, raises questions about the company's priorities. Some analysts argue that the company should focus on strengthening its balance sheet and investing in future growth initiatives rather than returning capital to shareholders through buybacks.

Others contend that the buyback is a prudent use of capital, given the company's strong cash flow and the perceived undervaluation of its shares. The broader economic context, including interest rate trends and the health of the consumer credit market, is crucial in assessing the appropriateness of the buyback.

Stakeholder Perspectives

Various stakeholders have different perspectives on the share repurchase program. Shareholders may welcome the potential for increased earnings per share and a higher stock price. Bondholders, on the other hand, may be concerned that the buyback reduces the company's financial flexibility and increases its leverage.

Analysts offer independent assessments of the buyback's merits and risks, considering factors such as the company's financial performance, market conditions, and alternative uses of capital. The opinions of these groups directly affect the market valuation of the company.

Looking Ahead: Implications and Future Outlook

The share repurchase program will likely continue to be a subject of debate and scrutiny. The effectiveness of the program in achieving its stated goals will depend on a variety of factors, including the company's ability to execute the buyback efficiently and the overall market environment.

OneMain's future performance will be influenced by trends in the consumer credit market, interest rate fluctuations, and the company's ability to manage credit risk. Investors will closely monitor the company's financial results and strategic decisions in the coming quarters.

Ultimately, the success of OneMain's share repurchase program will depend on its ability to balance short-term shareholder returns with long-term value creation. This requires careful consideration of the company's financial position, market opportunities, and the interests of all stakeholders.