How To Lower Apr On Credit Card Chase

Imagine opening your monthly credit card statement. The numbers swim before your eyes – purchases you vaguely remember, and then, that looming interest charge. It feels like a dark cloud over your finances, especially when you know a lower rate could make all the difference. But navigating the world of credit card APRs can feel daunting.

This article provides actionable strategies to potentially lower your APR on a Chase credit card, helping you save money and manage your debt more effectively. It explores the art of negotiation, balance transfers, and other practical methods to lighten the financial burden of high interest rates.

Understanding APR and Its Impact

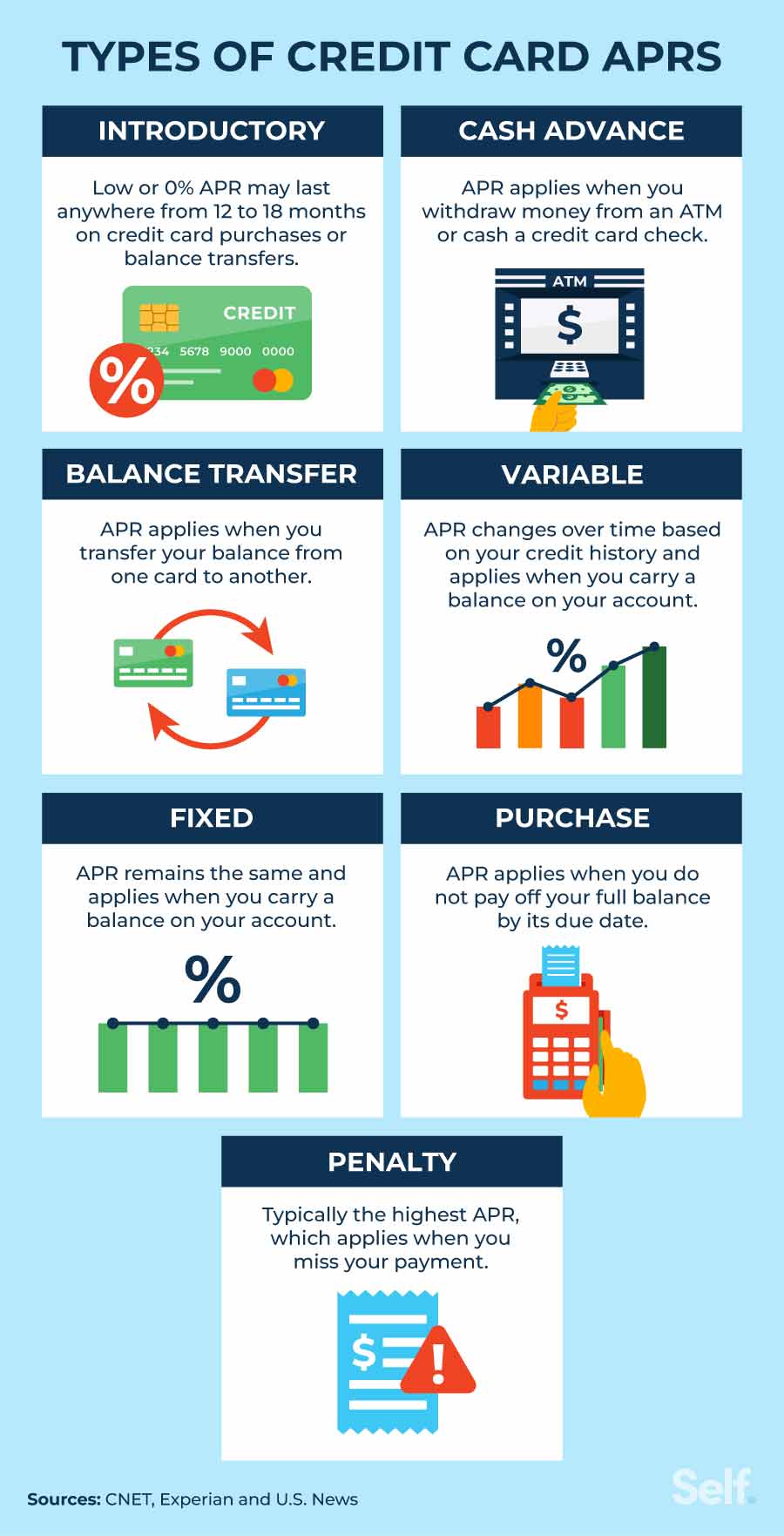

APR, or Annual Percentage Rate, represents the yearly cost of borrowing money on your credit card. It includes the interest rate and any associated fees. A high APR means a larger portion of your payments goes towards interest, not the principal balance, making it harder to pay down your debt.

Chase, as a major credit card issuer, offers a range of cards with varying APRs. The rate you initially receive depends on your creditworthiness at the time of application. However, your initial APR isn't necessarily set in stone.

Tactics for Lowering Your Chase APR

Negotiation: The Art of Asking

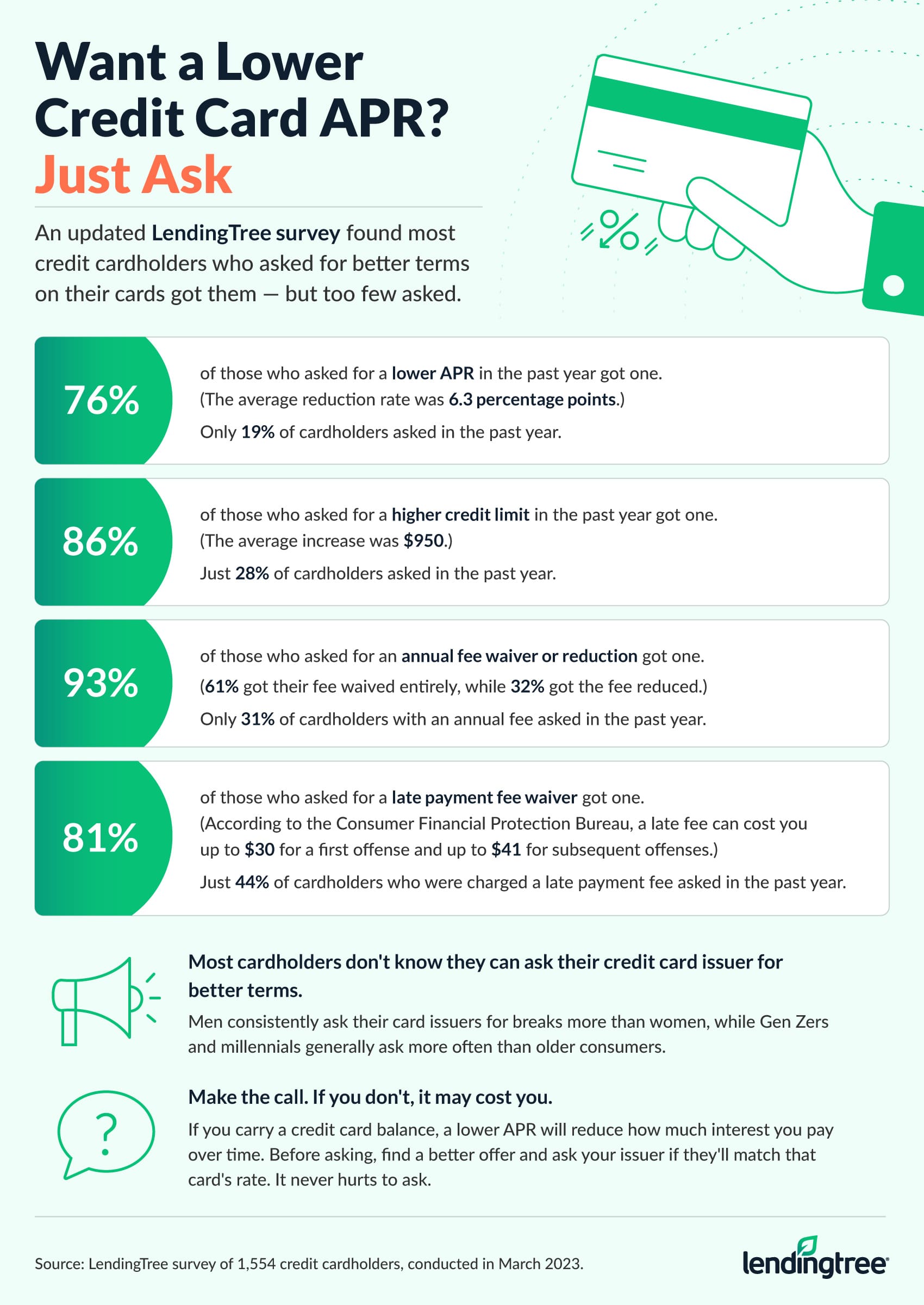

One of the most direct approaches is simply to ask Chase for a lower APR. Prepare your case beforehand. Gather information about your credit score, payment history, and any offers you've received from other credit card companies.

Call the customer service number on the back of your card. Politely explain that you've been a loyal customer with a good payment record and are seeking a lower rate. Mentioning competitor offers can add leverage.

Be prepared for the possibility of a 'no'. Don't be discouraged. You can try again later, perhaps after improving your credit score further, or speaking to a different representative.

Balance Transfers: Shifting the Debt

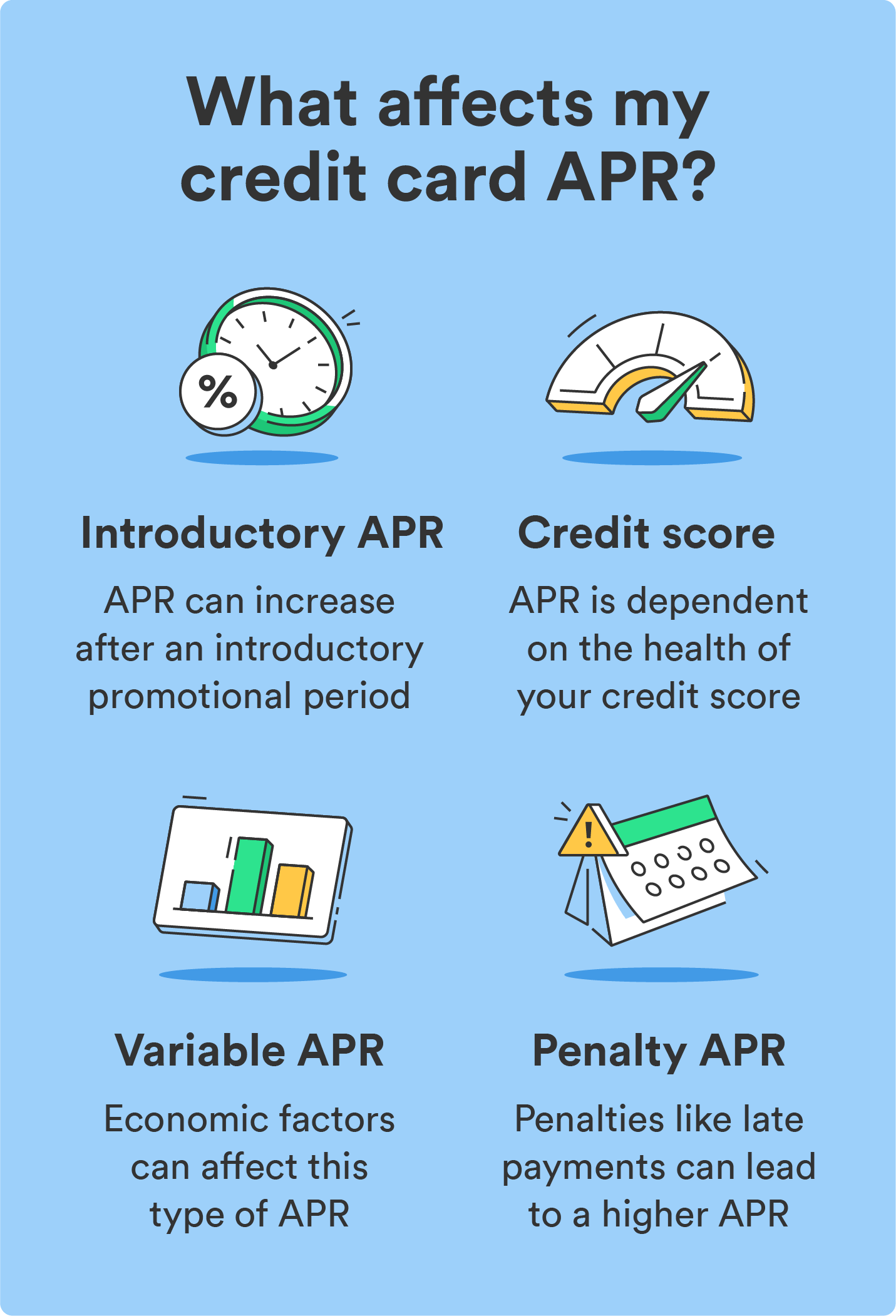

A balance transfer involves moving your existing credit card debt from one card to another, often to take advantage of a lower introductory APR. Chase frequently offers balance transfer promotions on some of their cards.

Before initiating a balance transfer, carefully consider the fees involved. Balance transfer fees typically range from 3% to 5% of the transferred amount. Calculate whether the potential savings from the lower APR outweigh the fee.

Ensure you can pay off the balance within the promotional period. Otherwise, the APR may jump back up, negating the benefits.

Improving Your Credit Score: A Long-Term Strategy

Your credit score is a primary factor in determining your APR. A higher credit score signals lower risk to lenders, making you eligible for better rates.

Focus on responsible credit behavior: Pay your bills on time, keep your credit utilization low (ideally below 30%), and avoid opening too many new accounts at once.

Monitor your credit report regularly for any errors. Dispute any inaccuracies to improve your score.

Consider a Different Chase Card

Chase offers a variety of credit cards, each with different features and APR ranges. It might be worthwhile to explore whether you qualify for another Chase card with a lower standard APR.

This could involve applying for a new card and transferring your balance. Be mindful of the potential impact on your credit score from opening a new account.

Carefully compare the terms and conditions of different cards before applying. Focus on APR, fees, and rewards programs.

The Takeaway

Lowering your credit card APR requires a proactive approach and a clear understanding of your financial situation. While there's no guarantee of success, these strategies can significantly improve your chances of securing a better rate and saving money on interest charges.

Remember that patience and persistence are key. Consistent responsible credit management is the most reliable path to long-term financial well-being.