Mobile Home Title Loan Fast And Easy Today

The promise of quick cash can be alluring, especially when financial pressures mount. A growing industry offers a seemingly straightforward solution: mobile home title loans. However, the ease and speed advertised mask a complex web of risks that can leave borrowers in a far worse financial situation than they started.

This article delves into the burgeoning market of mobile home title loans, examining its purported benefits, the inherent dangers lurking beneath the surface, and the regulatory landscape attempting to keep pace. We will explore the perspectives of both lenders and borrowers, analyzing the fine print and the potential long-term consequences of securing a loan against one's home.

Understanding Mobile Home Title Loans

Mobile home title loans are short-term, high-interest loans secured by the title of a manufactured home. Unlike traditional mortgages, these loans often bypass rigorous credit checks, appealing to individuals with limited or poor credit histories. The application process is typically streamlined, with lenders advertising "fast and easy" approvals and funding within hours.

The appeal is understandable. Borrowers facing unexpected expenses, medical bills, or job loss may see a mobile home title loan as a lifeline. The quick access to cash offers immediate relief, seemingly solving immediate problems.

How They Work

To obtain a mobile home title loan, a borrower must own the mobile home outright and possess a clear title. The lender assesses the value of the home, often offering a loan amount significantly lower than the actual market value. This discrepancy creates an immediate disadvantage for the borrower.

Interest rates on these loans are notoriously high, often exceeding 300% APR (Annual Percentage Rate). These rates are significantly higher than those associated with traditional bank loans or credit cards. Fees and charges can also be substantial, further inflating the overall cost of borrowing.

The loan terms are typically short, ranging from 30 days to several months. Borrowers are expected to repay the loan in full within this timeframe. Failure to do so can result in repossession of the mobile home.

The Risks Involved

The primary risk associated with mobile home title loans is the potential for repossession. If a borrower cannot repay the loan, the lender can seize the mobile home, leaving the borrower homeless and without their primary asset. This is a devastating consequence, particularly for low-income individuals and families.

The high interest rates and fees create a debt trap. Borrowers often find themselves unable to repay the loan on time, leading to rollovers or renewals. These rollovers add even more fees and interest to the outstanding balance, making it increasingly difficult to escape the debt cycle.

Predatory lending practices are a significant concern. Some lenders may not fully disclose the terms and conditions of the loan, including the high interest rates and potential for repossession. This lack of transparency can leave borrowers unaware of the true cost of borrowing until it is too late.

The Borrower's Perspective

Many borrowers turn to mobile home title loans out of desperation. They may have exhausted other options, such as bank loans or credit cards. The promise of quick cash is often too tempting to resist, even with the knowledge of the high interest rates.

Some borrowers report feeling pressured or misled by lenders. They may not fully understand the terms of the loan or the potential consequences of default. This vulnerability is often exploited by unscrupulous lenders.

"I needed the money for my mother's medical bills," shared a borrower who wished to remain anonymous. "I didn't realize how high the interest was until it was too late. Now I'm facing foreclosure." This highlights the real-life impact of these loans on vulnerable individuals.

The Lender's Perspective

Lenders argue that they provide a valuable service to individuals who are unable to obtain credit elsewhere. They claim that the high interest rates are justified by the high risk of lending to borrowers with poor credit histories.

They also emphasize the convenience and speed of the loan process. Borrowers can access cash quickly and easily, without the need for extensive paperwork or credit checks. This is a significant advantage for those who need immediate financial assistance.

However, critics argue that lenders profit from the vulnerability of borrowers. The high interest rates and fees are seen as exploitative, particularly when borrowers are unable to repay the loan.

Regulatory Landscape

Regulation of mobile home title loans varies by state. Some states have strict laws that limit interest rates and fees. Others have little or no regulation, allowing lenders to operate with minimal oversight. This patchwork of regulations creates opportunities for predatory lenders to target vulnerable borrowers in states with weaker consumer protections.

The Consumer Financial Protection Bureau (CFPB) has taken steps to address predatory lending practices, including those related to mobile home title loans. However, the CFPB's authority has been challenged, and the future of consumer protection regulations remains uncertain.

Advocates are calling for stronger federal and state regulations to protect borrowers from predatory lending practices. These regulations could include limits on interest rates, mandatory disclosures, and stronger enforcement mechanisms.

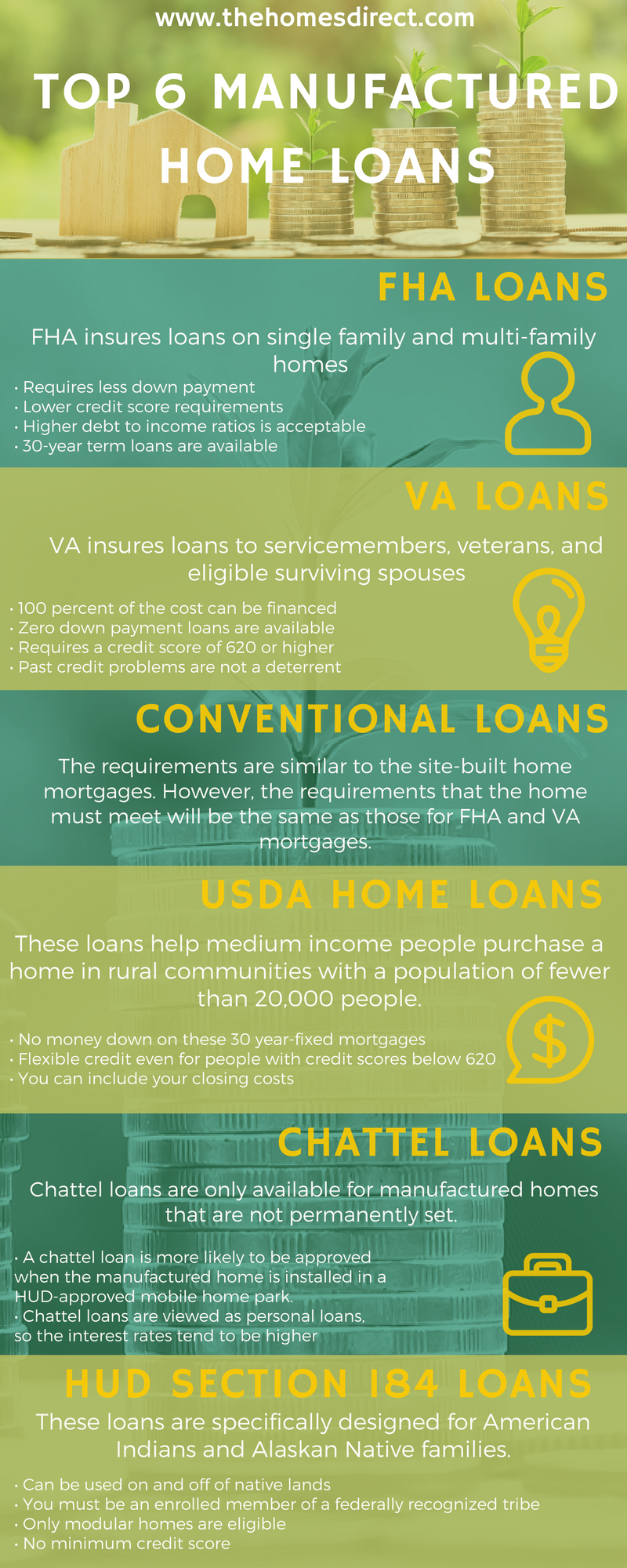

Alternatives to Mobile Home Title Loans

Before considering a mobile home title loan, borrowers should explore alternative options. These options may include:

- Seeking assistance from local charities or social service organizations.

- Negotiating payment plans with creditors.

- Applying for a personal loan from a bank or credit union.

- Exploring government assistance programs.

These alternatives may not provide immediate relief, but they are less likely to lead to repossession and financial ruin. It is crucial to carefully weigh all options before taking out a mobile home title loan.

Conclusion

Mobile home title loans offer a tempting solution to immediate financial problems, but the risks are substantial. The high interest rates and potential for repossession can trap borrowers in a cycle of debt and lead to devastating consequences. While lenders may frame these loans as a service, they often prey on the vulnerable, profiting from their desperation.

Stronger regulations are needed to protect borrowers from predatory lending practices. In the meantime, individuals should exercise extreme caution when considering a mobile home title loan. Exploring alternative options and seeking financial counseling can help avoid the pitfalls of this dangerous financial product. The promise of "fast and easy" cash should be viewed with skepticism and a thorough understanding of the potential long-term costs.

:max_bytes(150000):strip_icc()/Primary_Image-9a594df1aee842efbdee160a56512fe3.jpg)

![Mobile Home Title Loan Fast And Easy Today The 6 Best Lenders For Manufactured Home Loans [2023]](https://timothyplivingston.com/wp-content/uploads/2021/12/manufactured-home-loans-1068x601.png)