Global Lending Services Minimum Credit Score

The path to vehicle ownership, a cornerstone of modern life, often winds through the complex landscape of credit scores and loan approvals. For many, particularly those with less-than-perfect credit, securing an auto loan can feel like navigating a maze. Global Lending Services (GLS), a major player in the subprime auto lending market, has become a focal point of ongoing discussion regarding accessibility and the minimum credit score requirements for obtaining financing.

This article delves into the often-opaque world of GLS's lending practices, examining the minimum credit score typically required for loan approval, the factors that influence these decisions, and the broader implications for consumers seeking vehicle financing. The discussion will encompass perspectives from industry analysts, consumer advocacy groups, and GLS itself, aiming to provide a balanced and comprehensive understanding of this critical aspect of the auto lending ecosystem.

Understanding Global Lending Services (GLS)

GLS is a prominent indirect auto lender, partnering with dealerships across the United States. They specialize in providing financing to consumers with credit scores that fall outside the range typically served by traditional banks and credit unions. This positions them as a critical, albeit controversial, source of financing for a significant segment of the population.

Subprime lending, by its very nature, carries increased risk. This risk is reflected in the higher interest rates and fees often associated with these loans, a point of contention frequently raised by consumer advocates.

The Minimum Credit Score Threshold

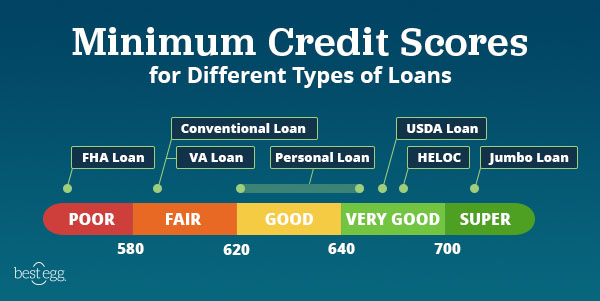

Pinpointing an exact minimum credit score for GLS loan approval is challenging due to the multifaceted nature of their underwriting process. While GLS doesn't publicly advertise a specific minimum score, industry reports and anecdotal evidence suggest a general range. This range typically hovers around the 500 FICO score mark, though approvals below this threshold are not entirely unheard of.

However, a credit score is not the sole determinant. GLS, like other lenders, considers a variety of factors beyond the raw credit score.

Factors Beyond the Credit Score

Income stability plays a crucial role. A consistent and verifiable income stream provides GLS with assurance regarding the borrower's ability to repay the loan.

The loan-to-value (LTV) ratio is another significant factor. A lower LTV, meaning a larger down payment, reduces the lender's risk and increases the likelihood of approval.

Debt-to-income (DTI) ratio, employment history, and the vehicle being financed also contribute to the final decision. These factors are all assessed holistically to determine creditworthiness.

Perspectives on GLS's Lending Practices

GLS maintains that its lending practices are responsible and provide a valuable service to underserved communities. They argue that they offer a pathway to vehicle ownership for individuals who might otherwise be excluded from the market.

Consumer advocacy groups, however, express concerns about the potential for predatory lending practices. They highlight the high interest rates and fees associated with subprime auto loans, warning that these loans can trap borrowers in cycles of debt.

"While we recognize the need for alternative financing options, we urge consumers to carefully consider the terms and conditions of subprime auto loans," states a representative from the National Consumer Law Center. "These loans often come with exorbitant interest rates and fees, which can quickly become unsustainable."

The Role of Regulation

The subprime auto lending market is subject to a complex web of regulations at both the state and federal levels. These regulations aim to protect consumers from unfair or deceptive lending practices.

The Consumer Financial Protection Bureau (CFPB) plays a key role in overseeing this market. The CFPB has the authority to investigate and take action against lenders who violate consumer protection laws.

Ongoing debates surrounding the appropriate level of regulation continue to shape the industry. Some argue for stricter regulations to curb potentially predatory practices, while others contend that excessive regulation could stifle access to credit for those who need it most.

Navigating the Subprime Auto Loan Landscape

For consumers considering a subprime auto loan, careful research and due diligence are paramount. Obtaining quotes from multiple lenders is essential to compare interest rates, fees, and loan terms.

It's crucial to thoroughly understand the terms and conditions of the loan before signing any agreements. Consumers should pay close attention to the annual percentage rate (APR), the total cost of the loan, and any potential penalties for late payments.

Improving one's credit score is always a worthwhile endeavor. This can be achieved by paying bills on time, reducing debt, and monitoring credit reports for errors.

The Future of Subprime Auto Lending

The future of subprime auto lending is uncertain, influenced by economic conditions, regulatory changes, and evolving consumer preferences. A potential economic downturn could lead to increased defaults and tighter lending standards.

Technological advancements, such as AI-powered underwriting, may also play a role in shaping the industry. These technologies could potentially improve risk assessment and personalize loan offers.

Ultimately, the success of subprime auto lending hinges on striking a balance between providing access to credit and protecting consumers from predatory practices. Continuous monitoring, responsible lending practices, and robust consumer education are essential to ensure a fair and sustainable market.