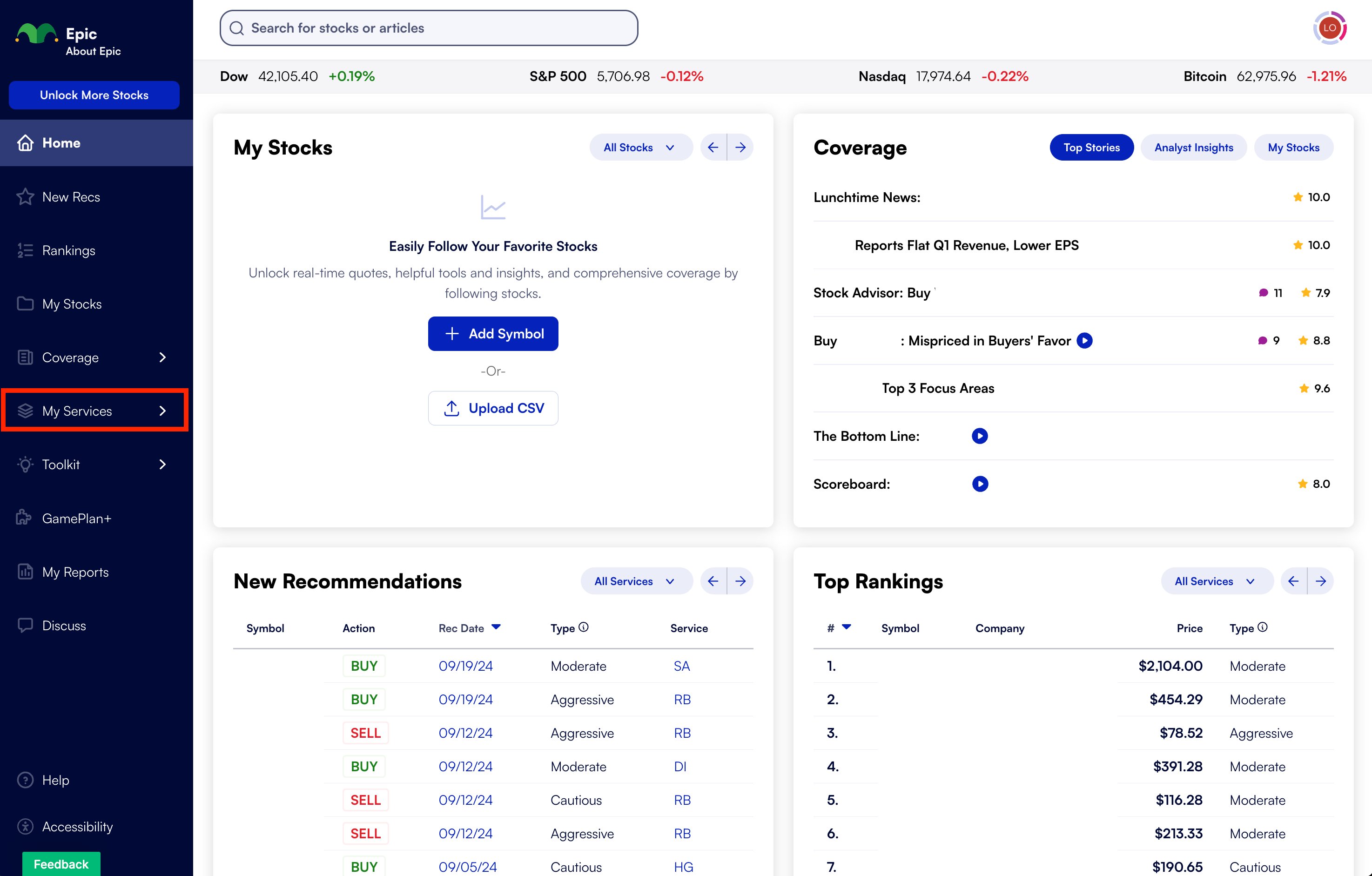

Motley Fool Premium Services Review

For investors navigating the complexities of the stock market, subscription-based investment services have become increasingly popular. Among the leading players in this space is The Motley Fool, offering a suite of Premium Services designed to cater to a wide range of investment styles and experience levels.

This article provides an objective review of Motley Fool Premium Services, examining their offerings, costs, performance, and potential benefits, and drawbacks. It aims to equip readers with the information needed to determine whether these services align with their individual investment goals and risk tolerance. Understanding the nuances of these services is crucial for making informed decisions in a volatile market.

What are Motley Fool Premium Services?

The Motley Fool offers several Premium Services, each with a specific focus. These include Stock Advisor, Rule Breakers, and specialized services like Everlasting Stocks and various options-focused subscriptions.

Stock Advisor, perhaps their most well-known service, provides two stock picks each month, focusing on long-term growth potential. Rule Breakers targets high-growth companies that are disrupting established industries.

Key Features and Benefits

A central feature of Motley Fool Premium Services is the access to expert stock recommendations and analysis. Subscribers receive regular updates on recommended stocks, including buy/sell guidance and commentary on company performance.

Many services offer access to a members-only online community. This feature allows subscribers to engage with other investors and share insights and perspectives.

Educational resources are often included, providing subscribers with tools to enhance their investment knowledge. These resources may include articles, webinars, and model portfolios.

Cost and Subscription Details

The cost of Motley Fool Premium Services varies widely, depending on the specific subscription. Annual fees can range from a few hundred to several thousand dollars.

Stock Advisor and Rule Breakers typically fall on the lower end of the price spectrum, while specialized services command higher fees. Promotional offers and discounts are frequently available, particularly for new subscribers.

Subscribers should carefully review the terms of service, including cancellation policies and refund options, before committing to a subscription.

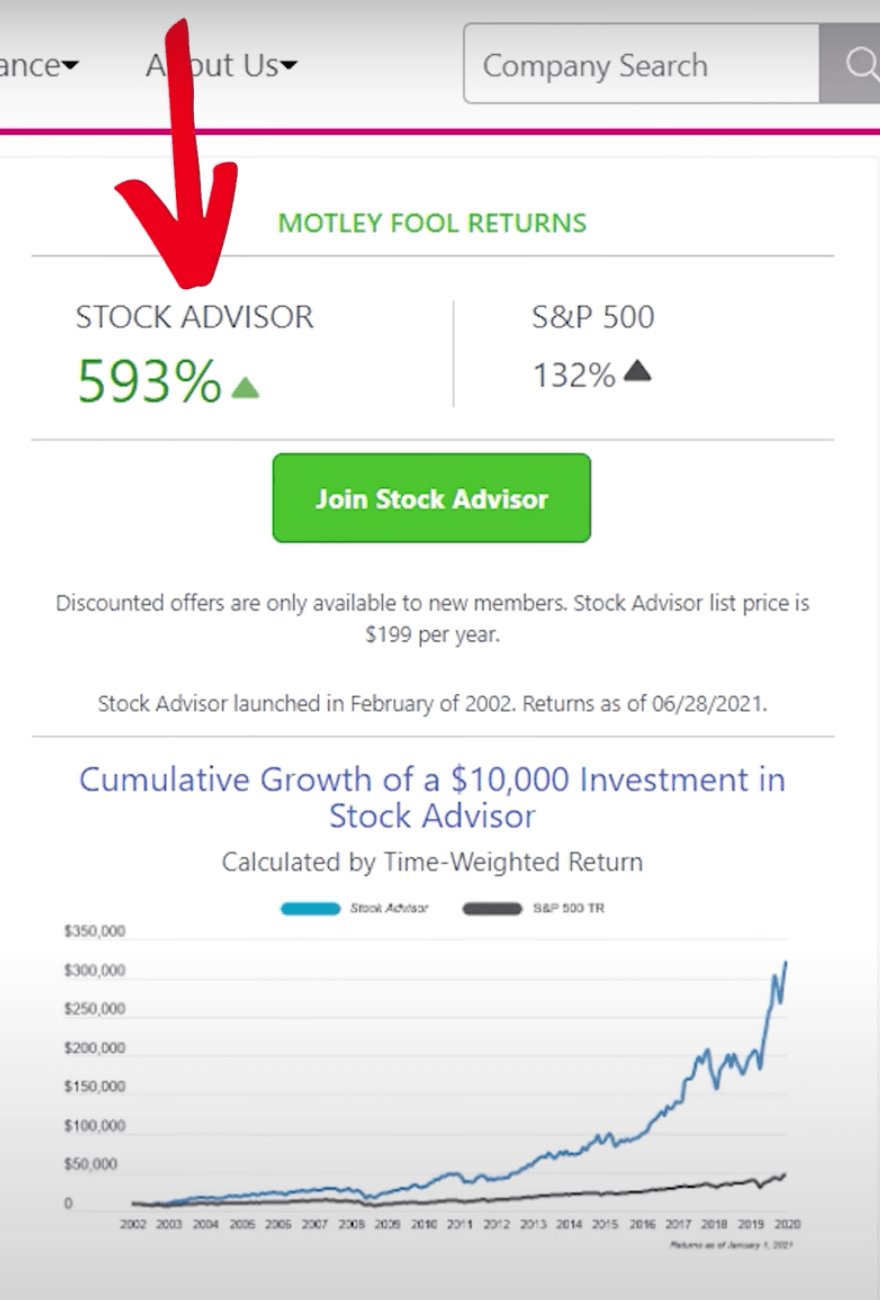

Performance and Track Record

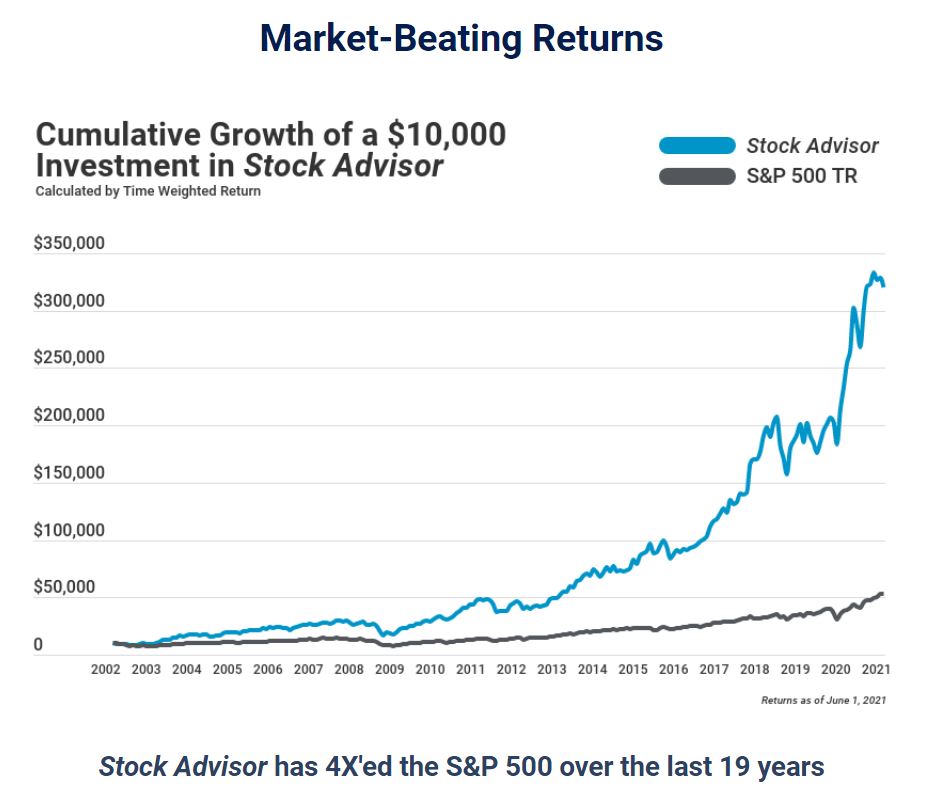

The Motley Fool often promotes the historical performance of its stock picks. While past performance is not indicative of future results, examining historical data can provide insights into the service's investment strategy.

Independent sources and investment websites track the performance of Motley Fool recommendations. However, interpreting these results requires caution, as different methodologies can yield varying conclusions.

It's essential to understand that all investments carry risk, and Motley Fool Premium Services are not a guarantee of profit.

Potential Drawbacks and Considerations

The cost of Premium Services can be a significant barrier for some investors. It is important to assess whether the potential benefits outweigh the subscription fees.

The volume of recommendations can be overwhelming for some subscribers. Implementing a systematic approach to evaluating and selecting stocks is crucial.

Relying solely on Motley Fool recommendations without conducting independent research is not advisable. Subscribers should use the service as a tool to supplement their own due diligence.

Impact on Investors

Motley Fool Premium Services can be a valuable resource for investors seeking expert stock recommendations and analysis. The educational resources and community features can also enhance investment knowledge and decision-making.

However, it's crucial to approach these services with realistic expectations and a solid understanding of investment risk. Investors should carefully consider their individual financial situation and investment goals before subscribing.

A Word of Caution

No investment advisory service can guarantee profits or eliminate risk. Thoroughly research any investment recommendation and understand your own risk tolerance. Remember that investment success depends on many factors, including market conditions and personal financial discipline.