Which Statements Below Define A Liability

Imagine you're running a small bakery, the sweet aroma of cinnamon rolls filling the air. You've promised Mrs. Gable a custom cake for her anniversary next week, and she's already paid a deposit. The ingredients are prepped, the design is sketched, but what happens if a crucial piece of equipment breaks down? What obligations do you truly have? This scenario, though simple, cuts to the core of understanding liabilities in the business world.

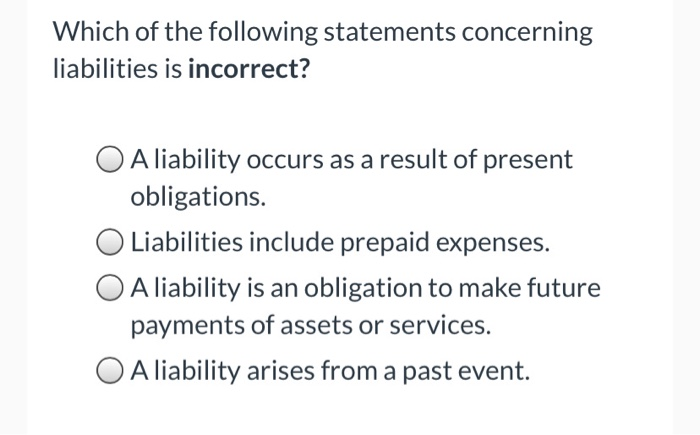

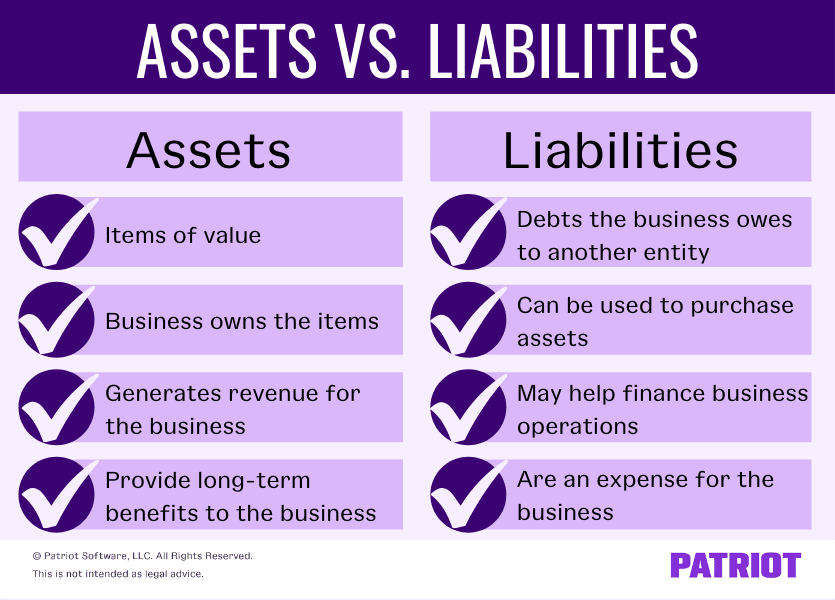

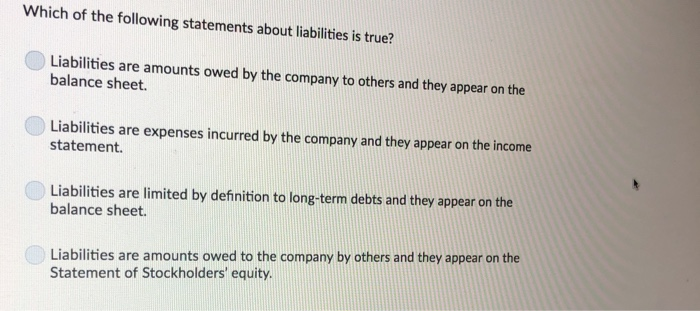

At its heart, a liability is a present obligation of an entity to transfer an economic resource as a result of past events. In simpler terms, it's something you owe to someone else, and that "owing" stems from something that's already happened. Dissecting this definition and its nuances is crucial for anyone involved in business, finance, or even personal financial planning.

Decoding Liabilities: What Qualifies as a Debt?

The definition of a liability might seem straightforward, but identifying what truly constitutes one requires careful consideration. Let's break down the key elements.

The Obligation Factor

The most crucial element is the existence of a present obligation. This means that the entity has a duty or responsibility to act. This duty can arise from legal contracts, constructive obligations (created by past practice), or equitable obligations (moral duties).

Consider, for instance, unpaid invoices to suppliers. They represent a clear obligation arising from a purchase you made. The supplier provided goods or services, and you now have a duty to pay them the agreed-upon amount.

Transfer of Economic Resources

A true liability involves the transfer of an economic resource. This usually means paying cash, but it can also involve transferring other assets, providing services, or issuing equity.

Imagine a warranty offered on a product you sell. If the product malfunctions, you're obligated to repair or replace it, representing a transfer of your resources to the customer.

The Significance of Past Events

The obligation must be a result of past events. You can't simply *think* you owe something; it has to stem from a transaction or occurrence that has already taken place.

A planned future expansion, for example, doesn't create a liability. While you might anticipate borrowing money, no obligation exists until you actually sign the loan agreement.

Common Examples of Liabilities

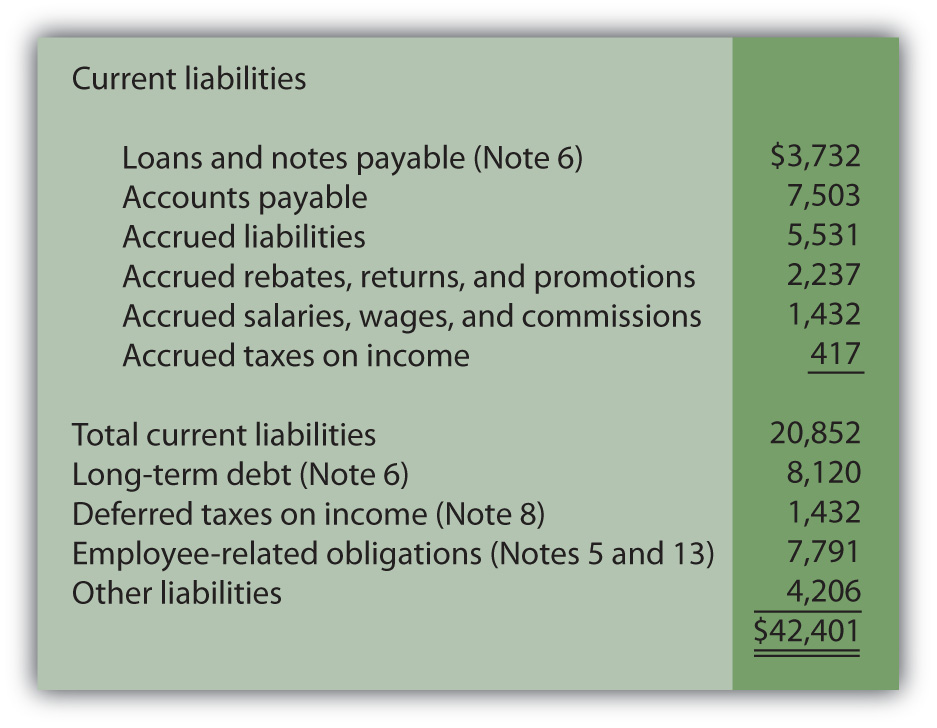

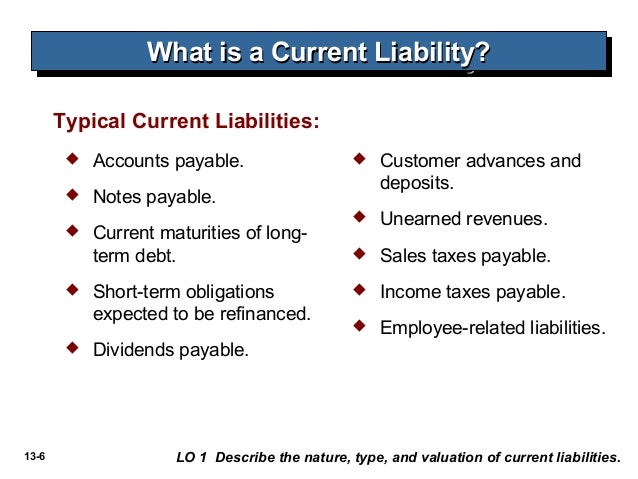

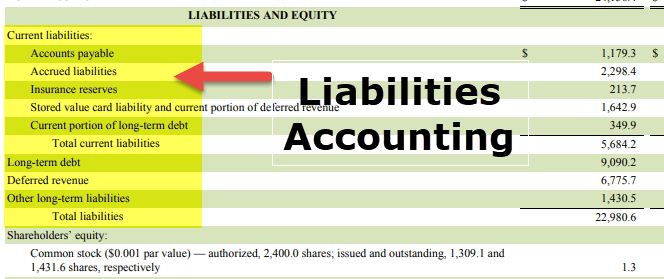

Liabilities take many forms, ranging from everyday bills to complex financial instruments. Understanding these different types can improve financial literacy.

Accounts Payable

This is one of the most common types of liabilities. Accounts payable represents short-term obligations to suppliers for goods or services purchased on credit. These are typically due within a short period, often 30 to 90 days.

Loans and Mortgages

Loans, whether from banks or other lenders, are clear liabilities. They represent a contractual obligation to repay borrowed funds, usually with interest, over a specified period. Mortgages are simply loans secured by real estate.

Salaries and Wages Payable

If employees have worked but haven't been paid yet, the unpaid wages represent a liability. This liability arises the moment the employee renders their services.

Deferred Revenue

Deferred revenue occurs when a company receives payment for goods or services that haven't yet been delivered or provided. This creates an obligation to fulfill the commitment. Imagine a magazine subscription; the company owes you the magazines you've paid for.

Warranty Obligations

As mentioned earlier, warranties create a liability. Companies must estimate the potential costs of repairing or replacing defective products and recognize this as a liability on their balance sheet.

Statements that Define a Liability: Case Studies

Let's examine some specific statements to determine if they define a liability.

Scenario 1: "We anticipate needing to replace our delivery van within the next year." This statement doesn't represent a liability. It's a future plan, not a present obligation arising from a past event.

Scenario 2: "We have signed a contract to purchase raw materials next month." The key question is, have you received the raw materials? If not, it may not be a liability (it could be a contract obligation to be fulfilled), but if the materials have arrived but you haven't paid, then it's accounts payable, a definite liability.

Scenario 3: "A customer has filed a lawsuit against us for alleged product defects." This *could* be a liability. The company needs to assess the likelihood of losing the lawsuit and the potential financial impact. If it's probable and can be reasonably estimated, a liability should be recorded.

The Importance of Accurate Liability Reporting

Accurate liability reporting is essential for a business's financial health and transparency. It provides stakeholders—investors, lenders, and others—with a clear picture of the company's financial obligations.

Overstating liabilities can make a company appear weaker than it is, potentially deterring investors. Understating them, on the other hand, can mislead stakeholders about the company's true financial position and risk profile.

According to the Financial Accounting Standards Board (FASB), proper recognition and measurement of liabilities are fundamental to providing relevant and reliable financial information. This information is crucial for making informed economic decisions.

Liabilities in Personal Finance

The concept of liabilities extends beyond the business world. Understanding liabilities is equally important in managing personal finances. Your mortgage, car loan, credit card balances, and other debts are all personal liabilities.

Tracking these liabilities, and understanding their impact on your net worth, is crucial for sound financial planning. Overwhelming debt can hinder your ability to save, invest, and achieve your financial goals.

Conclusion: Embracing the Responsibility

Liabilities are not inherently bad. In fact, they're often a necessary part of doing business and achieving financial goals. Businesses use loans to expand, and individuals use mortgages to buy homes.

The key is to understand your obligations, manage them responsibly, and accurately reflect them in your financial records. By doing so, you can ensure financial stability and make informed decisions for a brighter future.

:max_bytes(150000):strip_icc()/liability_finalv2-ce102fb03b734ee1ad4674125a87a2a1.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)