Hdfc Regalia Credit Card Forex Charges

Imagine strolling through a bustling marketplace in Marrakech, the scent of spices filling the air, vibrant colors swirling around you. You reach for your wallet, ready to haggle for a beautiful handcrafted rug, and confidently pull out your HDFC Regalia Credit Card. But a tiny, nagging thought crosses your mind: "What are those pesky foreign transaction fees going to be?"

This question is top of mind for many Indian travelers and international shoppers who rely on the HDFC Regalia Credit Card for its rewards and convenience. Let’s delve into the intricacies of its forex charges, understanding how they impact your spending abroad and what strategies you can employ to minimize them, ensuring your travel experiences remain as smooth and financially savvy as possible.

Understanding Forex Charges on Your HDFC Regalia Card

The HDFC Regalia Credit Card, known for its reward points and travel benefits, does come with foreign transaction fees. These charges, usually a percentage of the transaction amount, apply when you use your card for purchases made in a foreign currency, whether you're physically abroad or shopping online from an international retailer.

According to HDFC Bank's official website, the standard forex markup fee is typically around 3.5% on each international transaction. This percentage can quickly add up, especially if you're making numerous purchases or dealing with larger sums of money.

The Breakdown: Why These Charges Exist

Forex charges aren't arbitrary; they cover the costs incurred by banks and payment networks for converting currencies and processing international transactions. These costs include currency exchange fees, operational expenses, and risk management charges.

It's important to note that these fees are standard practice across most credit cards in India, albeit with varying rates. The 3.5% charged by HDFC is fairly typical within the Indian credit card landscape.

Minimizing the Impact: Strategies for Savvy Travelers

While unavoidable, there are several strategies you can use to mitigate the impact of these forex charges. One simple approach is to use a credit card with lower or zero forex fees. Some premium cards specifically cater to international travelers and offer this benefit.

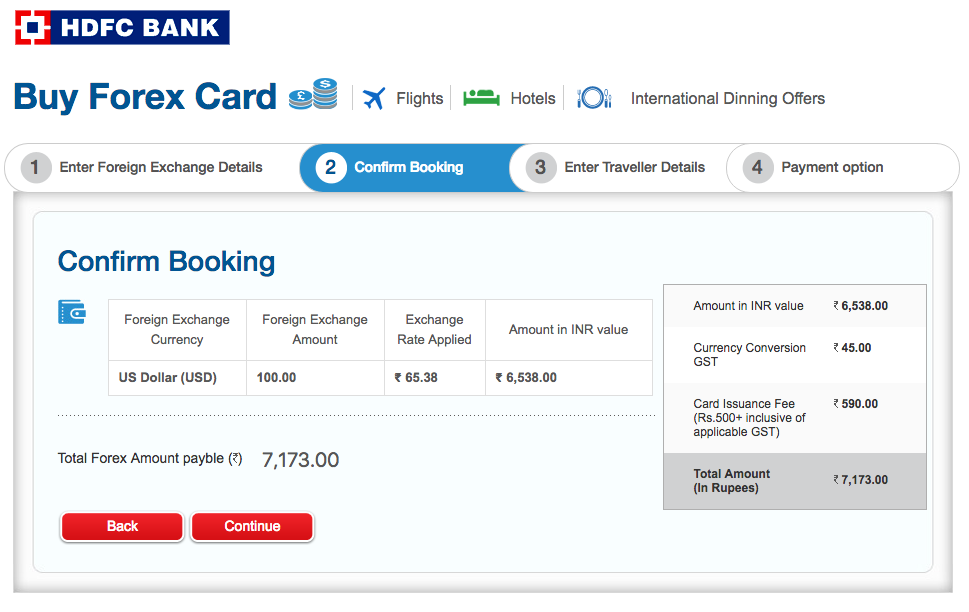

Consider using alternative payment methods, like forex cards, which can offer more favorable exchange rates and lower fees. Forex cards allow you to load a specific amount in a foreign currency beforehand, shielding you from fluctuating exchange rates and high transaction fees.

Another helpful tip is to always pay in the local currency when you're given the option. Opting to pay in Indian Rupees (INR) when abroad might seem convenient, but it often results in the merchant applying a less favorable exchange rate, potentially costing you more in the long run.

HDFC Regalia Card: Weighing the Benefits Against the Costs

The HDFC Regalia Credit Card offers a robust rewards program and travel benefits, making it an attractive option for many. However, it's crucial to weigh these advantages against the 3.5% forex charges, especially if you frequently travel abroad or shop internationally.

Evaluate your spending habits and travel patterns to determine if the rewards outweigh the accumulated forex fees. If you find that the fees significantly diminish your savings, exploring alternative card options might be worthwhile.

A Future of Lower Fees?

The credit card industry is constantly evolving, and there's increasing pressure on banks to offer more competitive forex rates. Keep an eye out for potential changes in HDFC Bank's policies or the emergence of new card products with lower or zero forex fees.

"Staying informed about the latest developments in forex charges and payment solutions is key to making financially sound decisions when traveling or shopping internationally," says financial analyst, Ritu Sharma.

This awareness empowers you to choose the most cost-effective methods and maximize your savings.

Conclusion

The HDFC Regalia Credit Card, with its blend of rewards and convenience, remains a popular choice. Understanding its forex charges and proactively employing strategies to minimize them can significantly enhance your international spending experience.

By staying informed and making smart choices, you can enjoy your travels and purchases without the worry of excessive fees eating into your budget. Remember, a little planning can go a long way in making your global adventures truly rewarding.