How To Find Total Liabilities And Stockholders Equity

In the intricate world of corporate finance, deciphering a company's financial health requires understanding key components of its balance sheet. Two critical sections are total liabilities and stockholders' equity, which provide insights into a company’s obligations and ownership structure, respectively. Accurately calculating and interpreting these figures is essential for investors, creditors, and company management alike.

This article provides a comprehensive guide on how to find total liabilities and stockholders' equity. It details the process of navigating the balance sheet, identifying relevant accounts, and performing the necessary calculations. By understanding these fundamental concepts, stakeholders can gain a clearer picture of a company's financial standing and make informed decisions.

Understanding the Balance Sheet Equation

The foundation for calculating total liabilities and stockholders’ equity lies in the basic accounting equation: Assets = Liabilities + Stockholders’ Equity. This equation highlights that a company's assets are financed by either debt (liabilities) or equity (ownership). Understanding this equation is critical for interpreting the information presented on the balance sheet.

What are Assets?

Assets represent what a company owns. These include cash, accounts receivable, inventory, property, plant, and equipment (PP&E), and intangible assets.

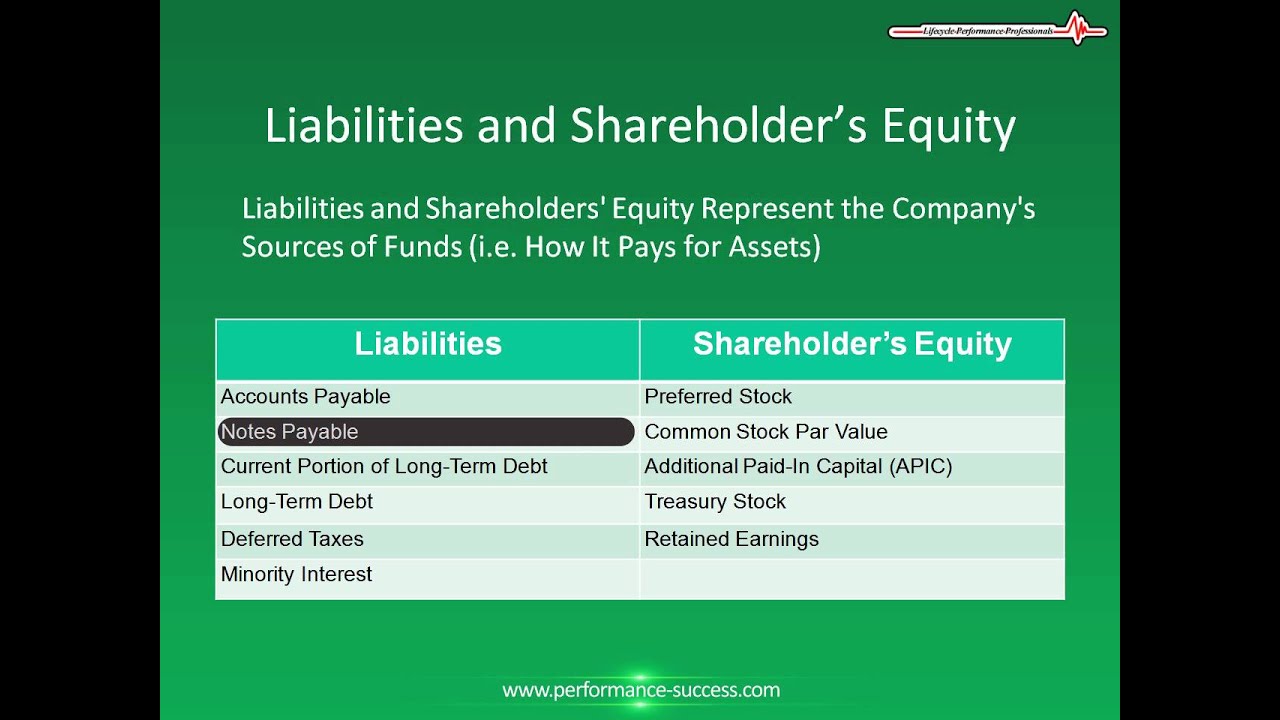

What are Liabilities?

Liabilities are a company's obligations to external parties. They represent what a company owes to creditors, suppliers, and other entities.

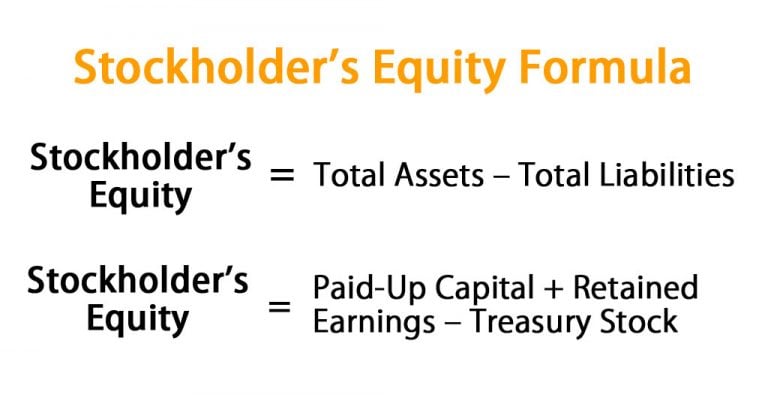

What is Stockholders' Equity?

Stockholders' equity, also known as shareholders' equity or net worth, represents the owners' stake in the company. It is the residual interest in the assets of an entity after deducting liabilities.

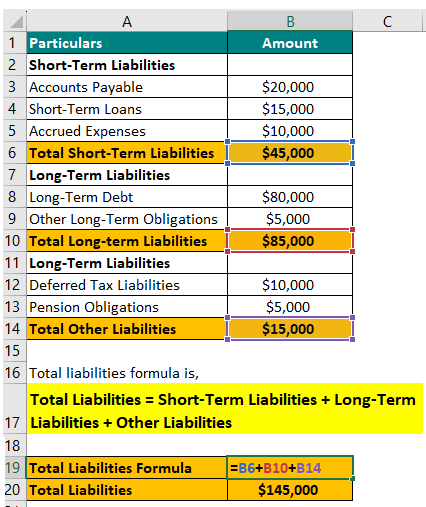

Locating Total Liabilities

Total liabilities represent the sum of all obligations a company owes to outside parties. These obligations are typically categorized as either current liabilities or non-current liabilities.

Current Liabilities

Current liabilities are obligations due within one year or within the company's operating cycle, whichever is longer. Common examples include accounts payable, salaries payable, short-term debt, and the current portion of long-term debt.

To find total current liabilities, sum all the individual current liability accounts listed on the balance sheet. This figure provides insight into a company's short-term liquidity and ability to meet its immediate financial obligations.

Non-Current Liabilities

Non-current liabilities, also known as long-term liabilities, are obligations due beyond one year. These include long-term debt, deferred tax liabilities, and pension obligations.

Similar to current liabilities, total non-current liabilities are calculated by adding all the individual non-current liability accounts. This figure reflects a company's long-term debt burden and its ability to manage its long-term financial commitments.

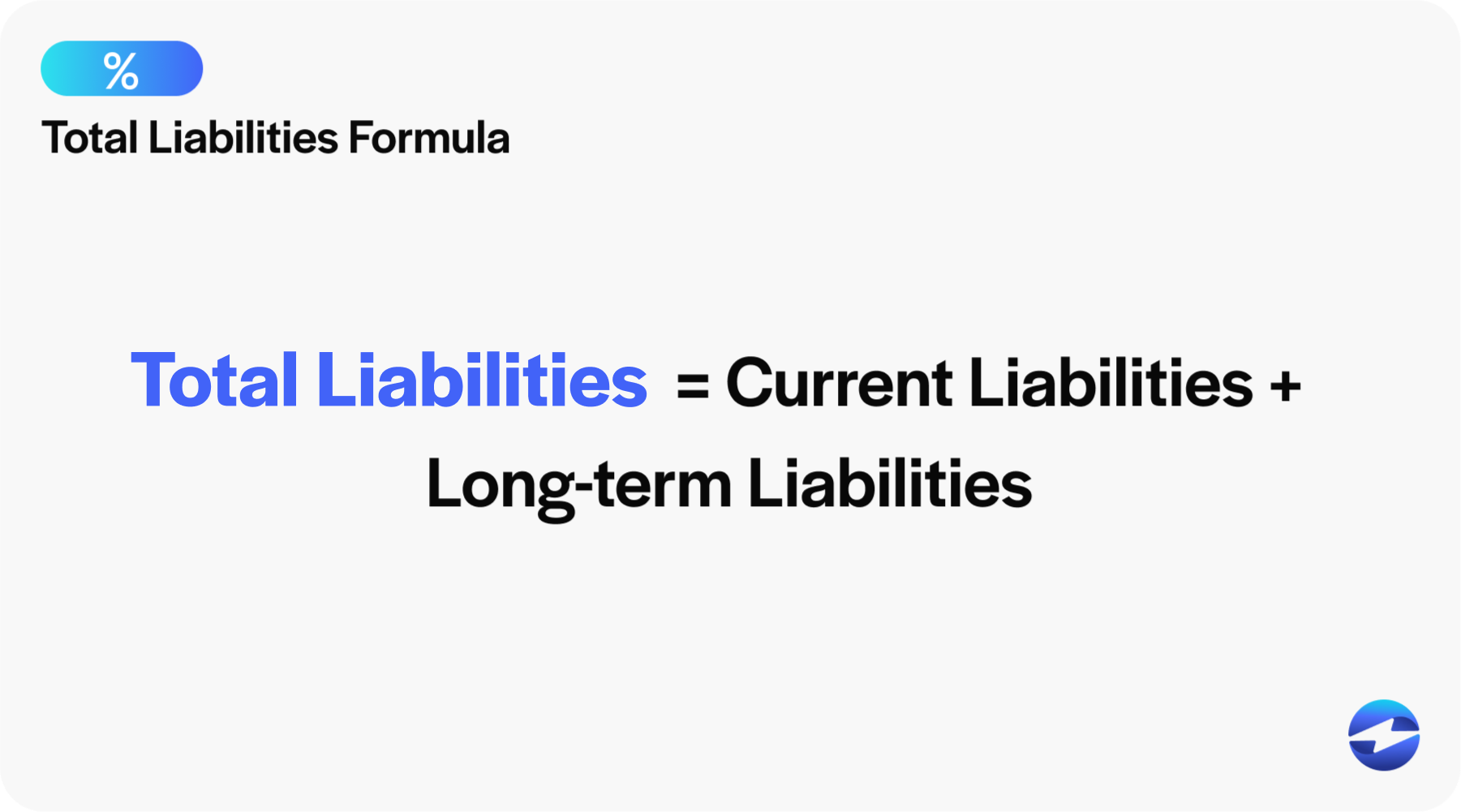

Calculating Total Liabilities

Once both current and non-current liabilities are determined, total liabilities are simply the sum of these two figures. The formula is: Total Liabilities = Total Current Liabilities + Total Non-Current Liabilities.

This total provides a comprehensive view of the company's overall debt obligations. This is a crucial metric for assessing a company's solvency and financial risk.

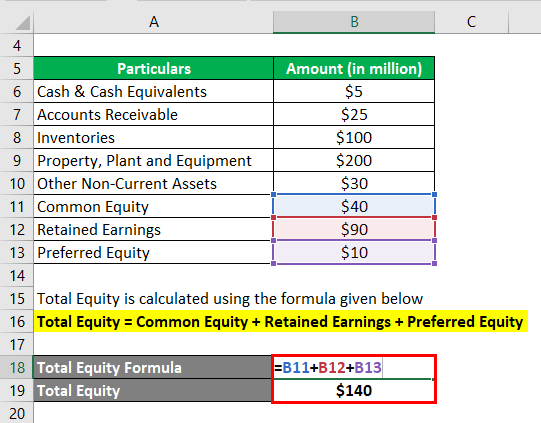

Understanding Stockholders' Equity

Stockholders' equity represents the owners' stake in the company. It comprises several components, including common stock, preferred stock, retained earnings, and accumulated other comprehensive income.

Common Stock

Common stock represents the basic ownership in a corporation. Common stockholders typically have voting rights and are entitled to a share of the company's profits.

Preferred Stock

Preferred stock is a class of stock that typically has preference over common stock in terms of dividends and liquidation proceeds. However, preferred stockholders often do not have voting rights.

Retained Earnings

Retained earnings represent the accumulated profits of the company that have not been distributed to shareholders as dividends. This is a crucial component of stockholders' equity, reflecting the company's ability to generate profits over time.

Accumulated Other Comprehensive Income (AOCI)

AOCI includes items such as unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and pension adjustments. These items are not included in net income but are reported as a component of stockholders' equity.

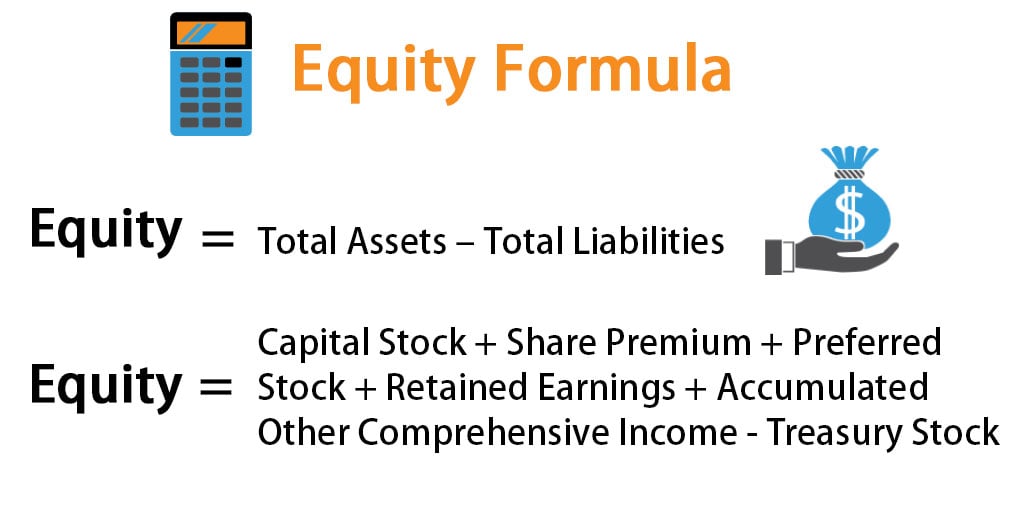

Calculating Total Stockholders' Equity

Total stockholders' equity is calculated by summing all the individual components of equity. The formula is: Total Stockholders' Equity = Common Stock + Preferred Stock + Retained Earnings + Accumulated Other Comprehensive Income.

This figure reflects the total value of the owners' stake in the company. It's a key indicator of a company's financial strength and ability to grow.

Analyzing Liabilities and Stockholders' Equity

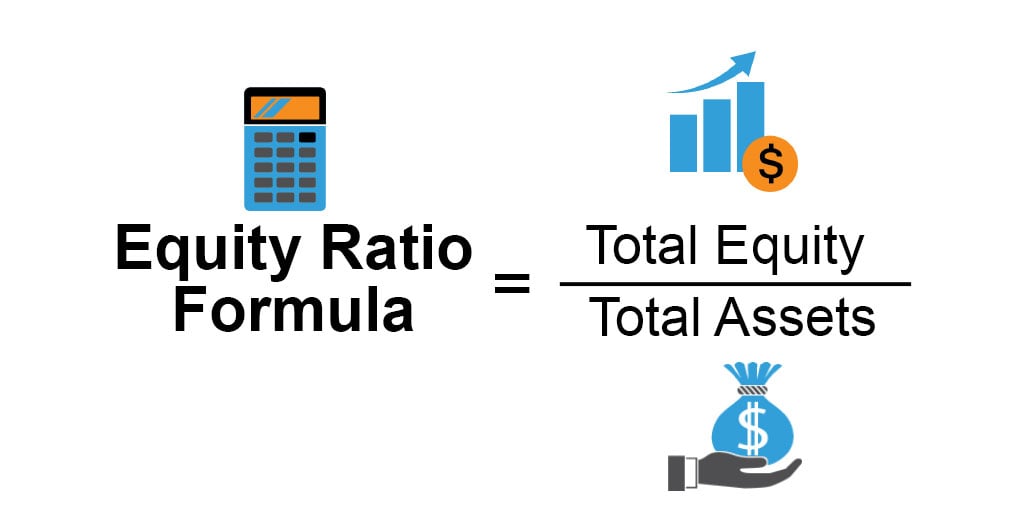

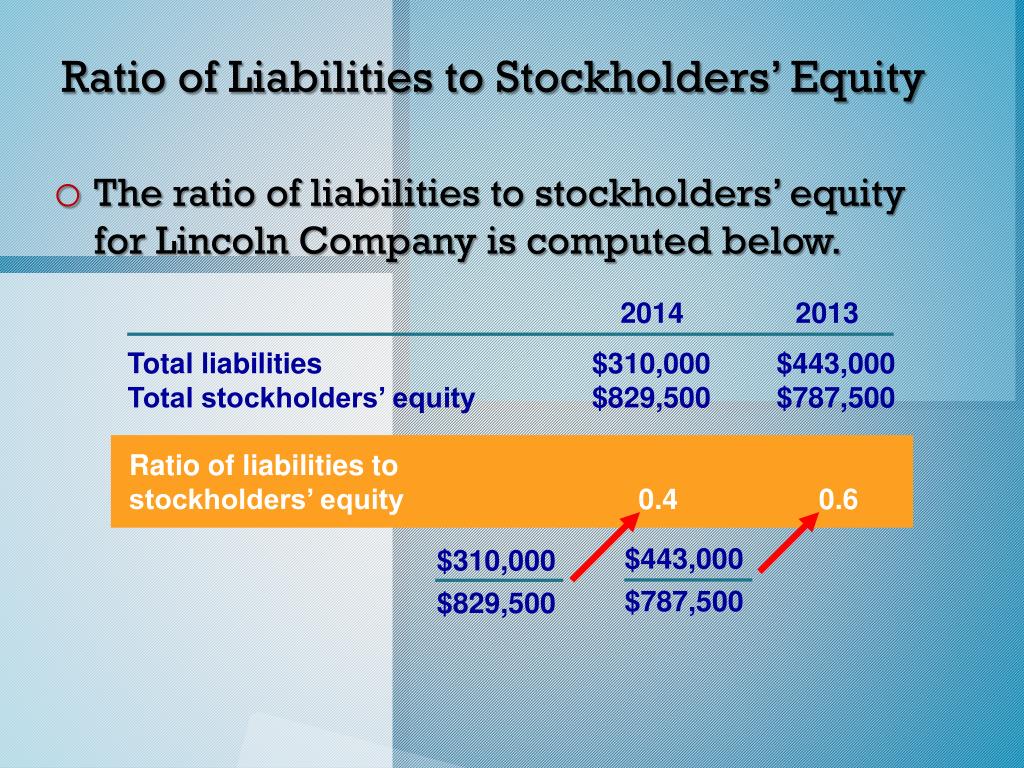

Simply calculating total liabilities and stockholders' equity is not enough. Investors and analysts must also analyze these figures in relation to other financial metrics to gain a complete understanding of a company's financial health.

For example, the debt-to-equity ratio, calculated by dividing total liabilities by total stockholders' equity, indicates the extent to which a company is using debt to finance its operations. A high debt-to-equity ratio may indicate a higher level of financial risk.

Similarly, the level of retained earnings provides insights into a company's profitability and dividend policy. A company with consistently increasing retained earnings is generally considered to be financially healthy.

Looking Ahead

Understanding how to find total liabilities and stockholders' equity is crucial for anyone involved in financial analysis or investment decisions. As accounting standards evolve and new financial instruments emerge, it's essential to stay updated on the latest guidelines and best practices for interpreting the balance sheet.

By mastering these fundamental concepts, stakeholders can gain a deeper understanding of a company's financial position and make more informed decisions. This ultimately contributes to more efficient capital allocation and a more robust financial market.