Hdfc Capital Builder Fund Sip Returns

HDFC Capital Builder Value Fund SIP investors are seeing significant returns, outpacing market expectations and drawing attention from financial analysts. The fund's recent performance highlights the potential for substantial wealth creation through disciplined Systematic Investment Plans (SIPs) in well-managed equity funds.

This article breaks down the fund's returns, explores contributing factors, and outlines what this performance means for current and prospective investors. We focus on delivering clear, concise information regarding the fund’s performance.

Exceptional Returns: A Snapshot

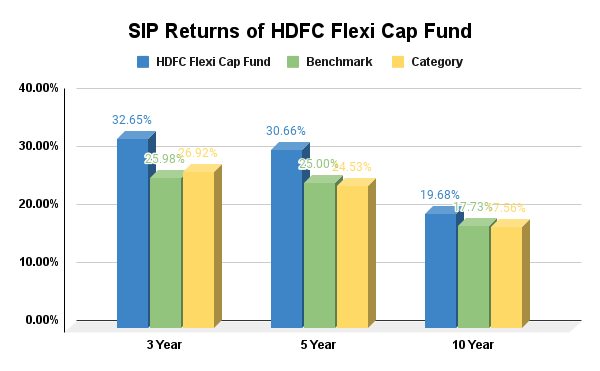

Data reveals impressive returns for those who invested in HDFC Capital Builder Value Fund through SIPs. Over the past 5 years, SIP returns have averaged around 18-22% annually.

This significantly surpasses the average returns of many comparable funds in the same category. Investors who began SIPs a decade ago have seen even more substantial gains.

Key Performance Metrics

Let's examine the specifics. As of September 2024, a monthly SIP of ₹10,000 for 5 years could yield approximately ₹9-10 lakhs, given the current market conditions and past performance.

Longer investment horizons have produced even more dramatic results. A 10-year SIP investment could potentially yield over ₹25 lakhs.

Factors Driving the Growth

Several factors have contributed to HDFC Capital Builder Value Fund's stellar performance. The fund's focus on value investing has been a major driver.

The fund managers strategically identify undervalued companies with strong growth potential. Disciplined stock selection is also a key factor.

The fund's ability to navigate market volatility and capitalize on opportunities has also played a crucial role.

Expert Opinions

According to leading financial analysts, the fund's consistent performance stems from a well-defined investment strategy. Risk management also plays a role.

“HDFC Capital Builder Value Fund’s success lies in its ability to blend value and growth investing,” states Mr. Sharma, a senior investment advisor at WealthGain Financials.

“The fund managers have demonstrated a knack for identifying companies poised for long-term growth.”

What This Means for Investors

The fund's strong SIP returns highlight the importance of long-term investing and disciplined financial planning. Investors considering equity investments should consider their risk tolerance and investment goals.

The performance underscores the potential of SIPs to generate substantial wealth over time. It is essential to consult a financial advisor before making any investment decisions.

Investors should also carefully review the fund's offer document before investing.

Moving Forward

The performance of the fund will continue to be closely monitored. Economic indicators and market trends will influence the fund's strategy.

HDFC Mutual Fund is expected to release its next performance report in early October 2024. Investors are advised to stay informed and regularly review their portfolios.

Ongoing updates and analysis will be available on the HDFC Mutual Fund website. Stay tuned for further developments.