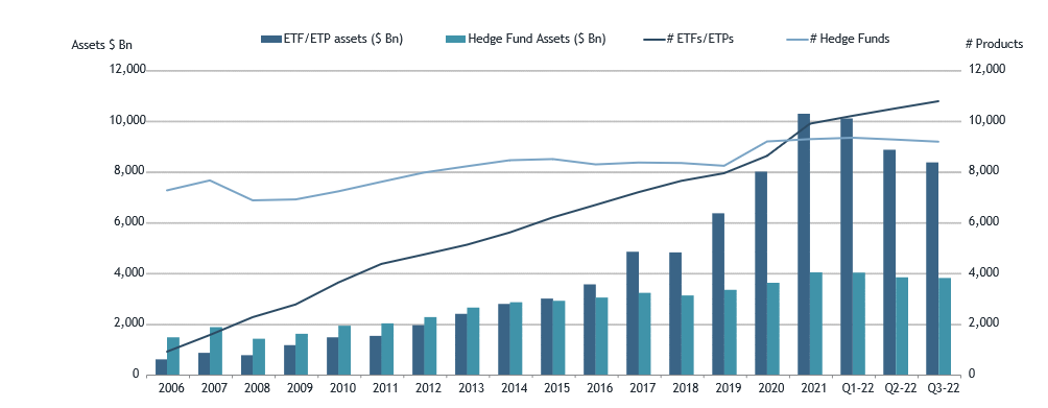

Hedge Fund Industry Assets Under Management

Imagine a bustling marketplace, but instead of fruits and vegetables, the wares on offer are intricate financial strategies, promising lucrative returns. The air hums with the low murmur of complex calculations and the quiet confidence of those who believe they hold the key to unlocking wealth. This is a snapshot of the hedge fund industry, a world often shrouded in mystery, yet wielding immense influence over global financial landscapes.

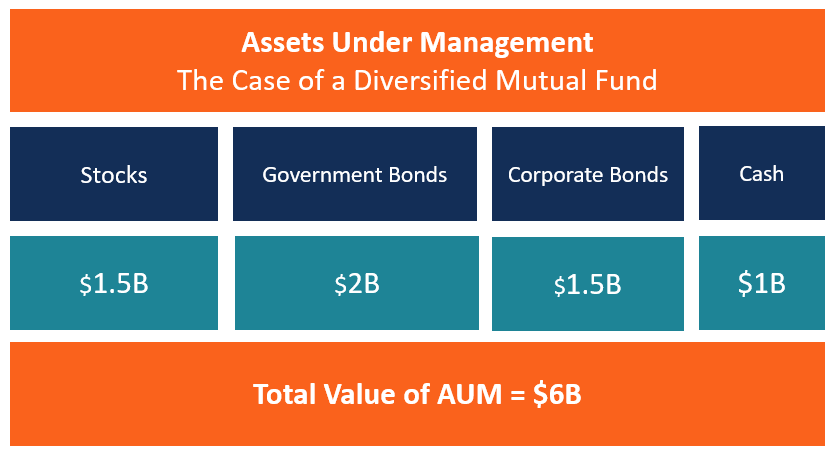

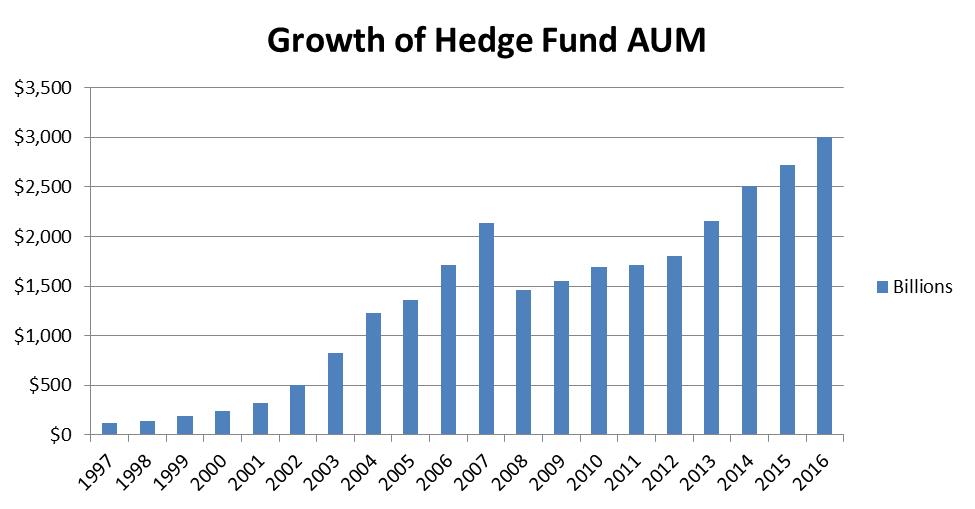

The assets under management (AUM) of the hedge fund industry represents a crucial barometer of investor confidence, market performance, and the overall health of the financial ecosystem. This article delves into the current state of hedge fund AUM, exploring its recent trends, underlying factors, and what these figures suggest about the future of this dynamic sector. Examining these trends offers valuable insights into investor sentiment and broader economic forces.

A History of Hedge Funds

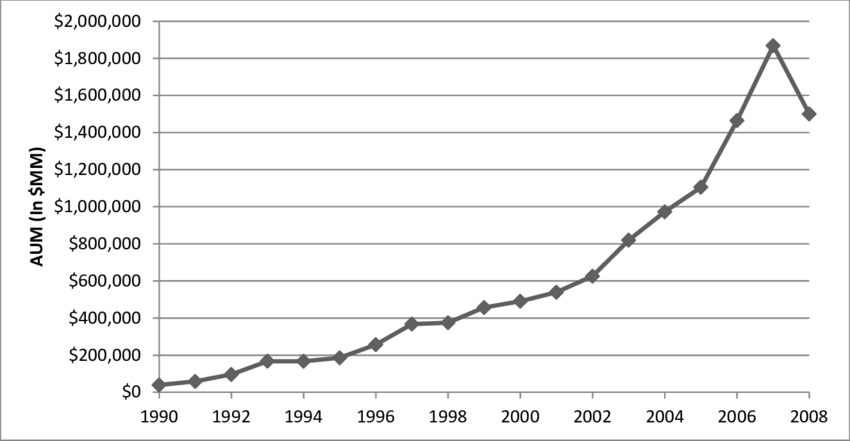

The story of hedge funds began in 1949 with Alfred Winslow Jones, who sought to mitigate market risk through a strategy of hedging. He combined long and short positions, aiming for consistent returns regardless of market direction. This innovative approach laid the foundation for what would become a multi-trillion-dollar industry.

In their early days, hedge funds were relatively small and catered to a niche clientele. They were known for their flexibility and use of sophisticated investment techniques. This differentiated them from traditional investment vehicles.

Over the decades, the industry experienced significant growth and diversification. More sophisticated strategies emerged, alongside a broadening investor base. The growth has been driven by institutional investors seeking higher returns than traditional assets.

Recent Trends in AUM

The hedge fund industry's AUM has experienced fluctuations in recent years, mirroring the volatility of global markets. Data from Preqin and other reputable sources provide a detailed picture of these trends. Overall, the industry maintains a substantial foothold within the broader financial landscape.

According to recent reports, the industry saw both inflows and outflows of capital, depending on the period examined. Market performance, investor appetite for risk, and broader macroeconomic conditions have all played a role. Performance is a crucial factor affecting investor decisions about allocating capital to hedge funds.

For example, a period of strong market gains may attract greater investment into hedge funds, while periods of economic uncertainty may lead to some investors pulling back. Understanding these dynamics is essential for interpreting AUM figures.

Factors Influencing AUM

Several key factors influence the AUM of the hedge fund industry. These include market performance, investor sentiment, and regulatory changes. Furthermore, the competitive landscape and the availability of alternative investment options also play a significant role.

Strong market performance typically leads to increased AUM, as existing investments grow in value and attract new capital. Conversely, market downturns can result in declines in AUM. Ultimately, hedge funds’ ability to navigate market volatility is a vital element in their success.

Investor sentiment is another critical driver. Confidence in the economy and the belief that hedge funds can deliver superior returns encourage investment. Changes in sentiment can rapidly impact capital flows.

Regulatory Landscape

Regulatory changes can also impact AUM. Increased scrutiny and stricter compliance requirements may deter some investors, while enhanced transparency could attract others. Hedge funds navigate a complex regulatory environment.

The Dodd-Frank Act, for example, brought about significant changes in the regulation of hedge funds in the United States. This increased transparency and oversight.

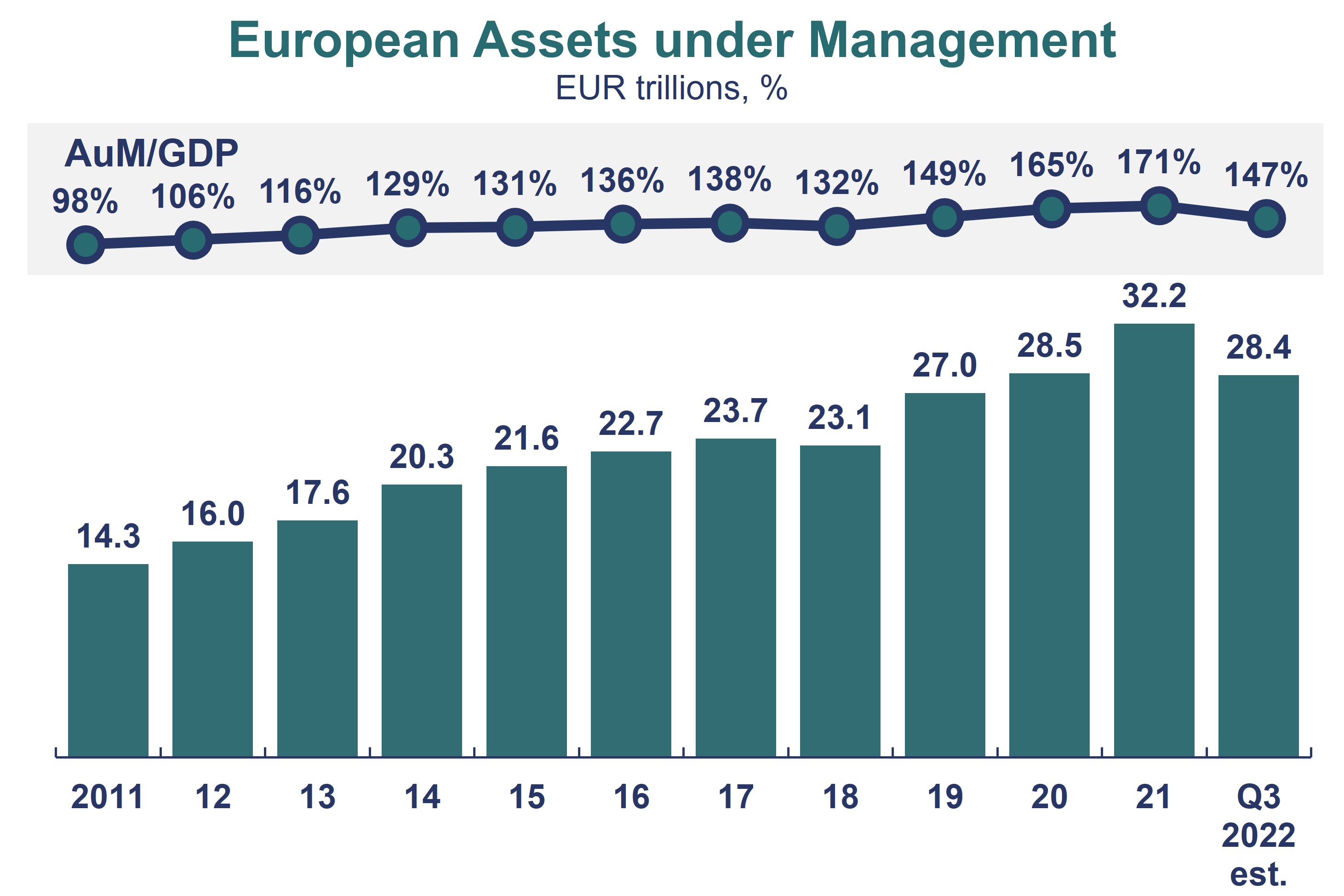

European regulations, such as the Alternative Investment Fund Managers Directive (AIFMD), similarly have a considerable impact on the industry. These measures are meant to reduce systemic risk and improve investor protection.

The Significance of AUM Figures

The AUM figures of the hedge fund industry carry significant implications for the broader financial markets. They reflect the collective investment decisions of a substantial pool of capital. They can also provide insights into the perception of risk and the search for yield among institutional investors.

High AUM suggests that institutional investors maintain a positive outlook on the potential returns offered by hedge funds. This can influence investment strategies and market dynamics across various asset classes. These trends indicate confidence in the investment approaches employed by hedge funds.

Conversely, a decline in AUM might signal concerns about market stability or the ability of hedge funds to consistently deliver on their promises. It is important to consider multiple indicators rather than relying on AUM alone.

Looking Ahead

The future of hedge fund AUM is subject to various forces. These forces range from macroeconomic trends to technological advancements. The industry will continue to evolve. Success will depend on adaptability and innovation.

As interest rates rise and inflation persists, hedge funds are expected to play an increasingly vital role in generating returns in a challenging environment. Investors may turn to hedge funds for their ability to navigate market volatility. These strategies could be crucial for preserving capital.

Furthermore, the rise of alternative data and artificial intelligence is transforming the way hedge funds operate. These technologies offer new opportunities for identifying investment opportunities and managing risk. They also pose new challenges for talent acquisition and ethical considerations.

"The hedge fund industry remains a dynamic and important part of the global financial system," states a recent report by PwC. "Its ability to adapt to changing market conditions and leverage new technologies will be crucial for future success."

Conclusion

The AUM of the hedge fund industry provides a valuable window into the complex world of finance. It reflects investor sentiment, market conditions, and the ongoing evolution of investment strategies. While not a singular indicator of success or failure, it offers an important perspective.

As the industry continues to navigate changing landscapes, understanding the factors that influence AUM remains essential for investors, regulators, and anyone interested in the future of global finance. The constant evolution of strategies and regulations keeps the hedge fund industry at the forefront of investment innovation.

Ultimately, the story of hedge fund AUM is a narrative of risk, reward, and the ongoing quest to understand and navigate the ever-changing currents of the global economy. It's a story worth watching closely, as it holds valuable clues about the direction of our financial future.

![Hedge Fund Industry Assets Under Management Hedge Fund Industry Assets Under Management by Strategy Type [OC] : r](https://i.redd.it/w0oxe9ld3pvy.jpg)