High Probability Swing Trading Strategies Pdf

The proliferation of readily available resources promising instant riches through swing trading is raising concerns among financial regulators and experienced traders. A particular document, a PDF outlining "High Probability Swing Trading Strategies," is under scrutiny for potentially misleading and unrealistic claims.

This article delves into the controversies surrounding these types of readily available resources, their potential dangers, and provides warnings for those considering relying on them.

The Allure of "High Probability" Strategies

The promise of quick profits is a powerful lure, especially for newcomers to the stock market. PDFs and online courses claiming to reveal "high probability" swing trading strategies exploit this desire. These resources often oversimplify complex market dynamics.

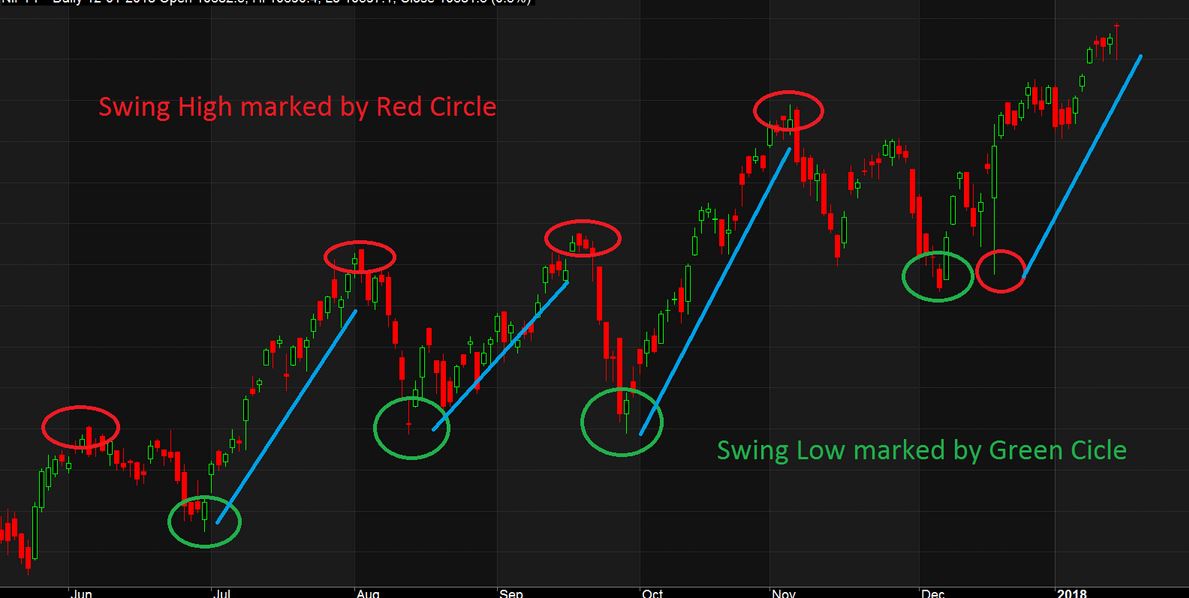

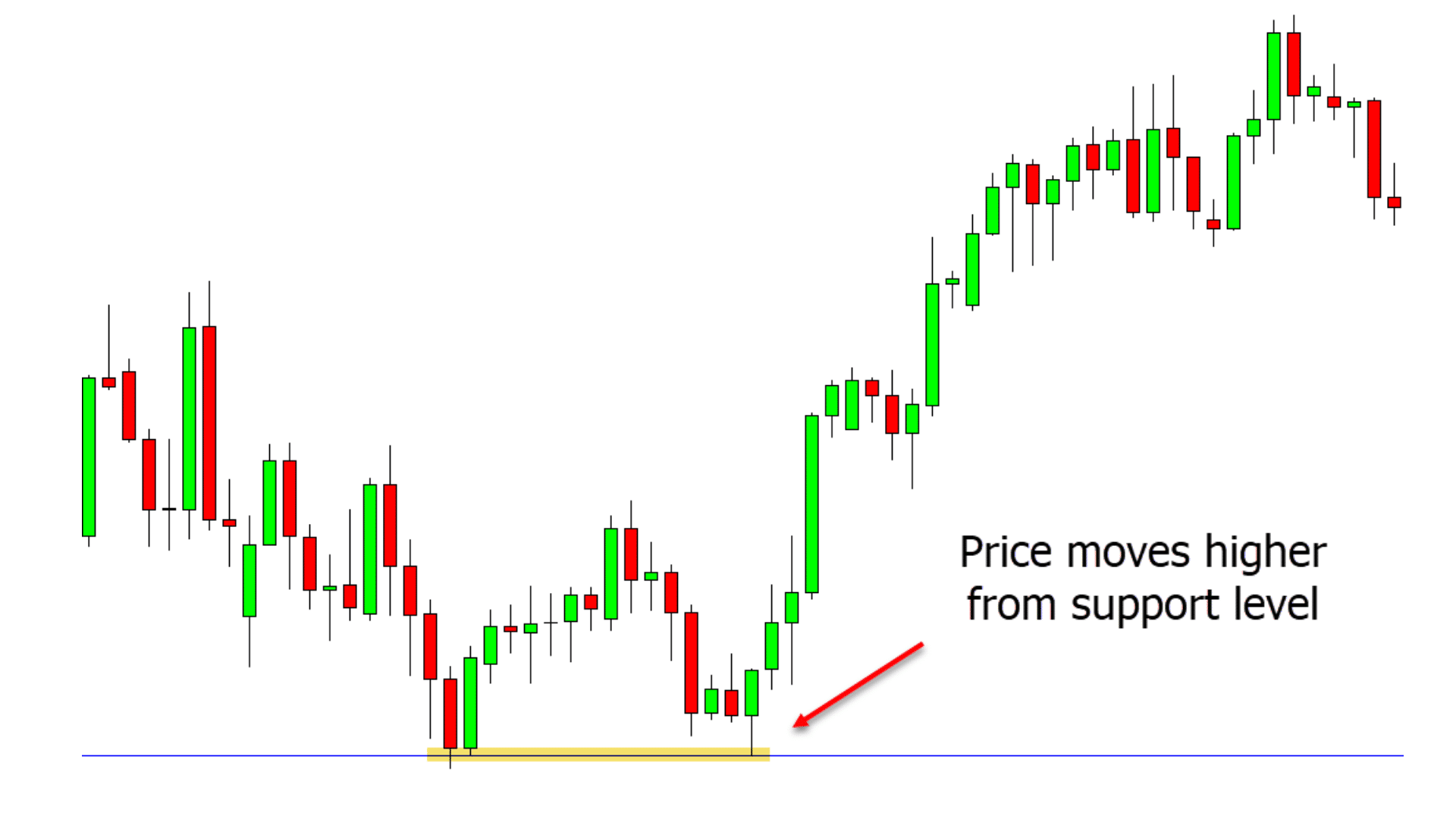

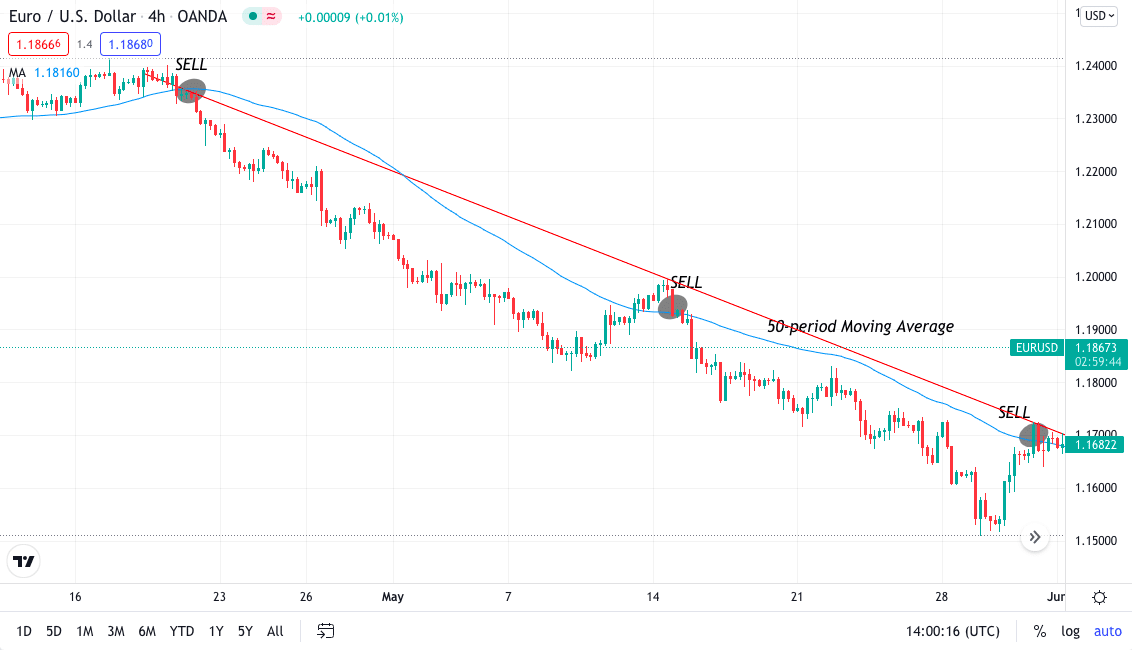

They suggest that specific chart patterns or indicators can guarantee successful trades. The reality of trading is far more nuanced, and no strategy can offer a foolproof path to profits. Market volatility and unforeseen events always play a significant role.

Concerns About Misleading Information

Many of these "high probability" strategy guides are authored by individuals with questionable credentials. Some lack verifiable trading experience. Others have a vested interest in promoting specific brokers or trading platforms.

Their primary goal might not be to educate traders but to generate affiliate revenue or collect user data. Financial regulators warn against blindly trusting such sources. Independent verification of claims is critical.

The Dangers of Over-Simplification

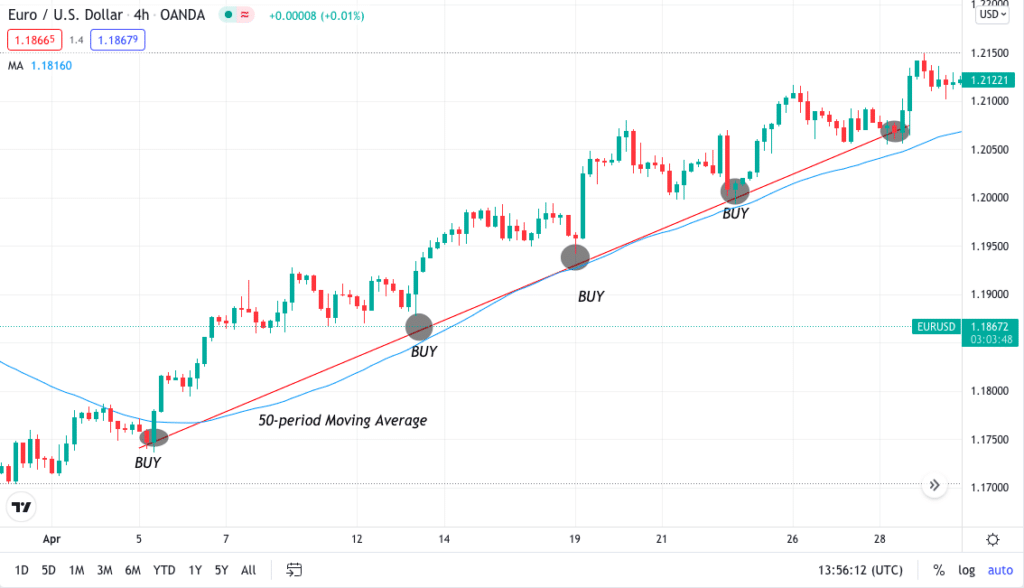

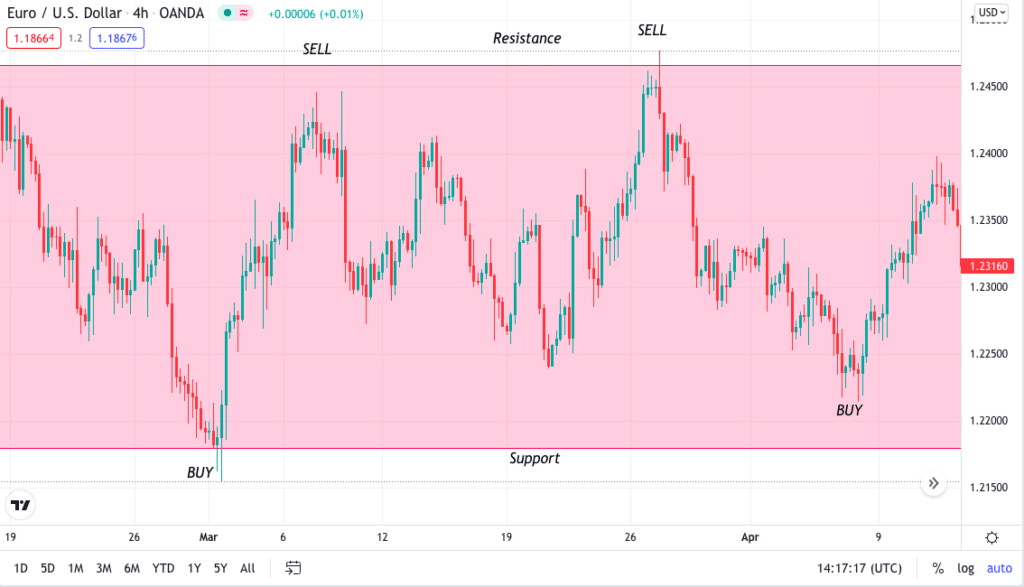

Swing trading involves holding positions for a few days or weeks, aiming to profit from short-term price fluctuations. These strategies require a solid understanding of technical analysis, risk management, and market psychology.

PDFs that condense these complex concepts into simplistic rules can be dangerous. Traders who rely solely on these guidelines may make poorly informed decisions. Significant financial losses are a possible outcome.

Real-World Examples and Case Studies

Reports are surfacing of novice traders losing substantial capital after applying strategies found in such PDFs. In one instance, a trader invested heavily in a penny stock based on a pattern described as "guaranteed to surge." The stock plummeted, resulting in a complete loss of investment.

Another case involved a trader who consistently used a specific indicator combination promoted in a PDF. While initially successful, the strategy failed during a period of increased market volatility. The trader, lacking a proper risk management plan, incurred heavy losses.

Expert Opinions and Regulatory Warnings

Experienced traders and financial analysts are vocal about the dangers of relying on unverified trading strategies. "There's no holy grail in trading," says John Carter, a seasoned trader and author. He further stated that "Any resource promising guaranteed profits should be approached with extreme caution."

The Securities and Exchange Commission (SEC) has issued warnings about online trading schemes and the importance of conducting thorough due diligence. They encourage investors to verify the credentials of anyone offering financial advice.

Key Elements Missing From These PDFs

Most of these guides gloss over crucial aspects of successful swing trading. Risk management is often inadequately addressed. Proper position sizing and stop-loss orders are critical for protecting capital.

Trading psychology, the emotional discipline required to stick to a strategy, is also frequently ignored. The ability to manage fear and greed is essential for long-term success in the market.

Protecting Yourself From Misleading Information

Educate yourself from reputable sources, such as established financial institutions and accredited educational programs. Seek guidance from licensed financial advisors.

Independently verify any trading strategy before implementing it with real money. Start with a demo account or paper trading to test the strategy's effectiveness and your own understanding of the market.

Next Steps and Ongoing Developments

Regulatory bodies are increasing their scrutiny of online trading resources and marketing materials. The focus is on identifying and shutting down deceptive schemes.

Traders should remain vigilant and report any suspected fraudulent activity to the appropriate authorities. Continuous education and a healthy dose of skepticism are your best defenses against misleading information.