Highest Interest Rate On Fixed Deposit In Bank Of Baroda

Bank of Baroda (BoB) has recently announced an attractive interest rate on select fixed deposit (FD) schemes, positioning itself as a competitive player in the retail banking sector. This move comes at a time when depositors are actively seeking higher returns on their investments amidst fluctuating market conditions.

The announcement is significant because it offers an avenue for risk-averse investors to potentially earn higher returns than traditional savings accounts or other low-yield investment options. The heightened interest rate is expected to draw considerable attention from both existing and prospective customers.

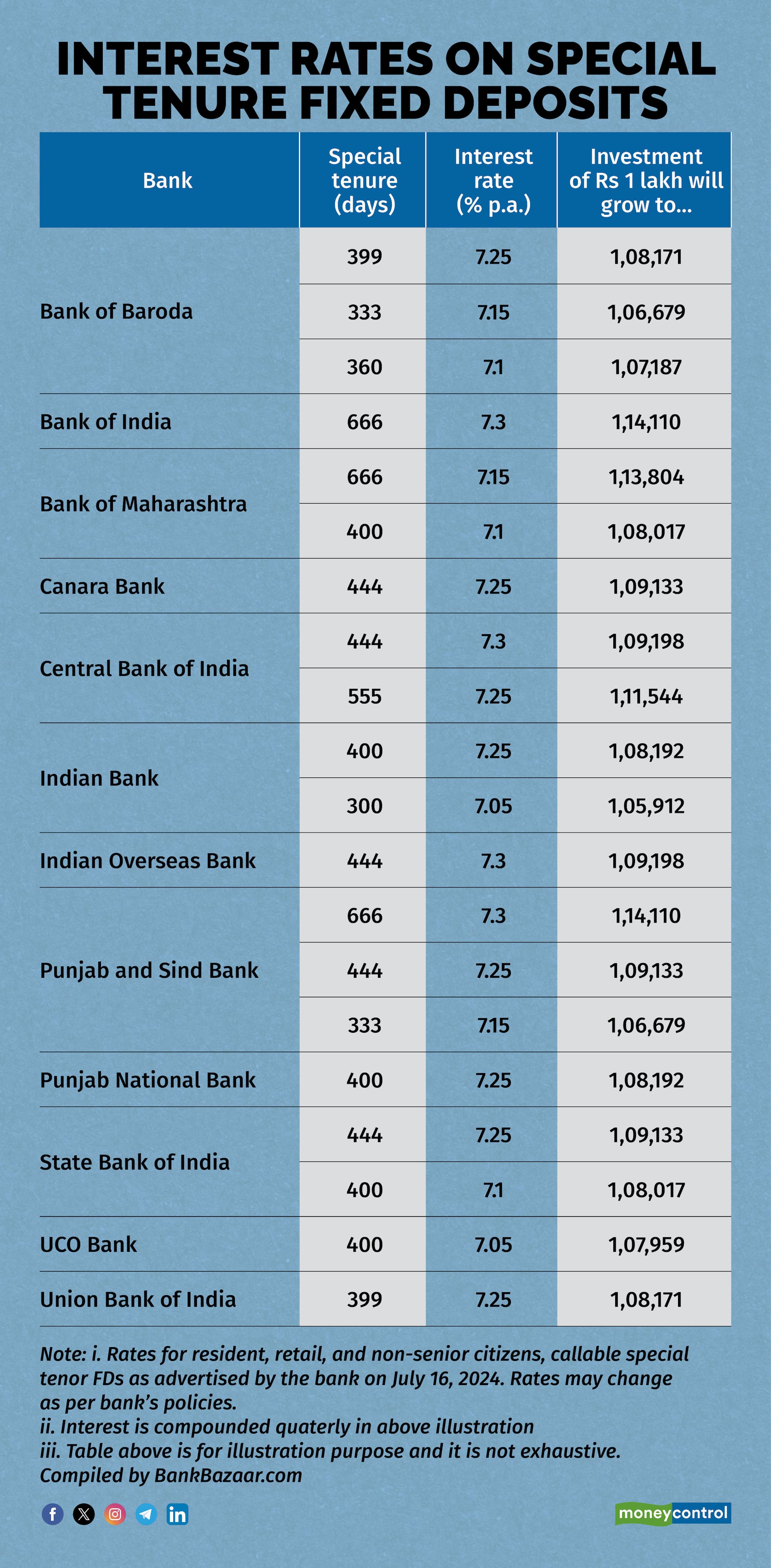

Details of the Enhanced Interest Rates

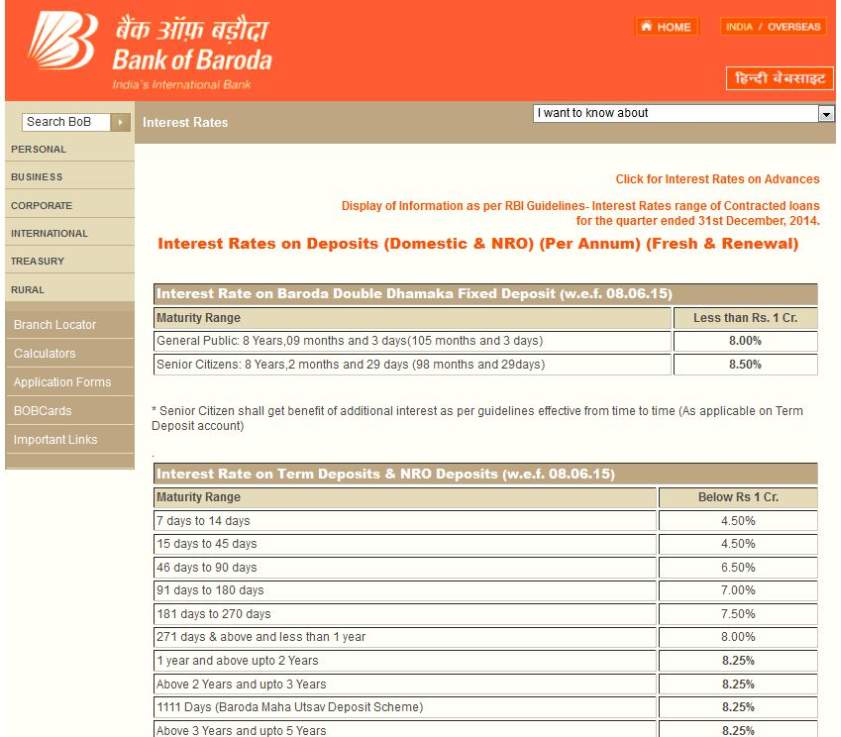

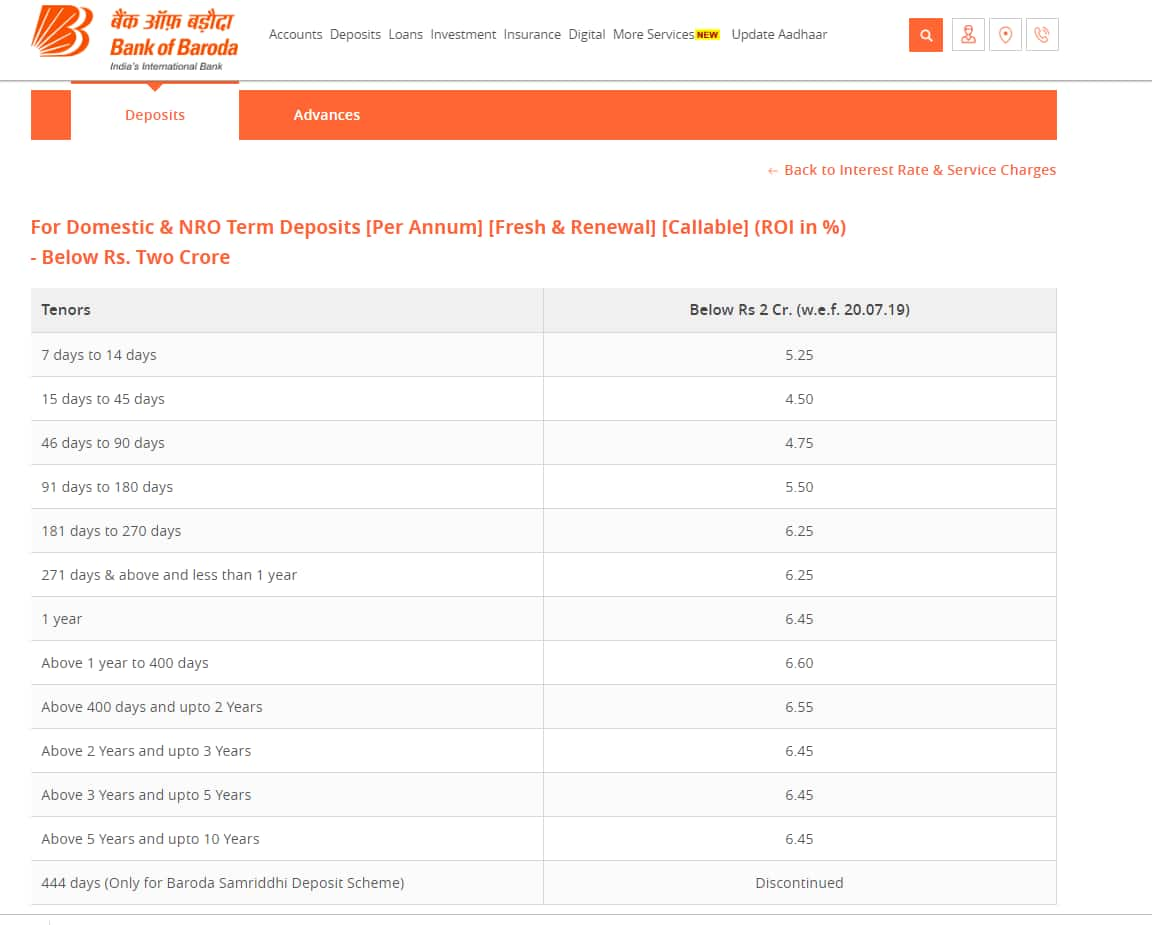

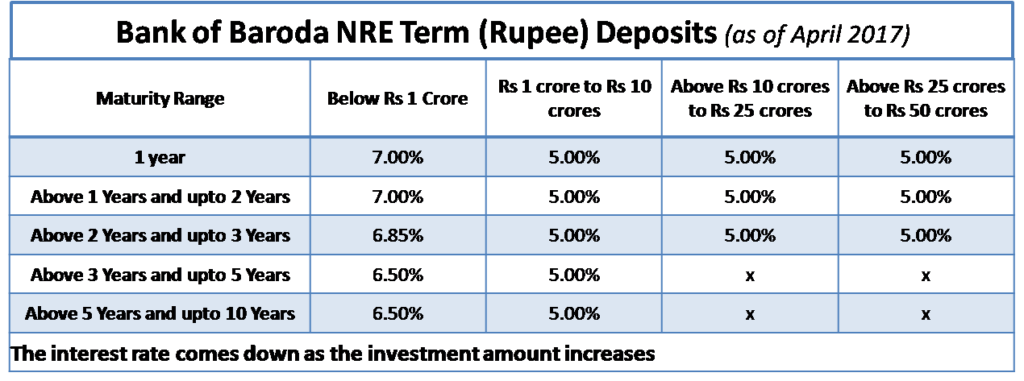

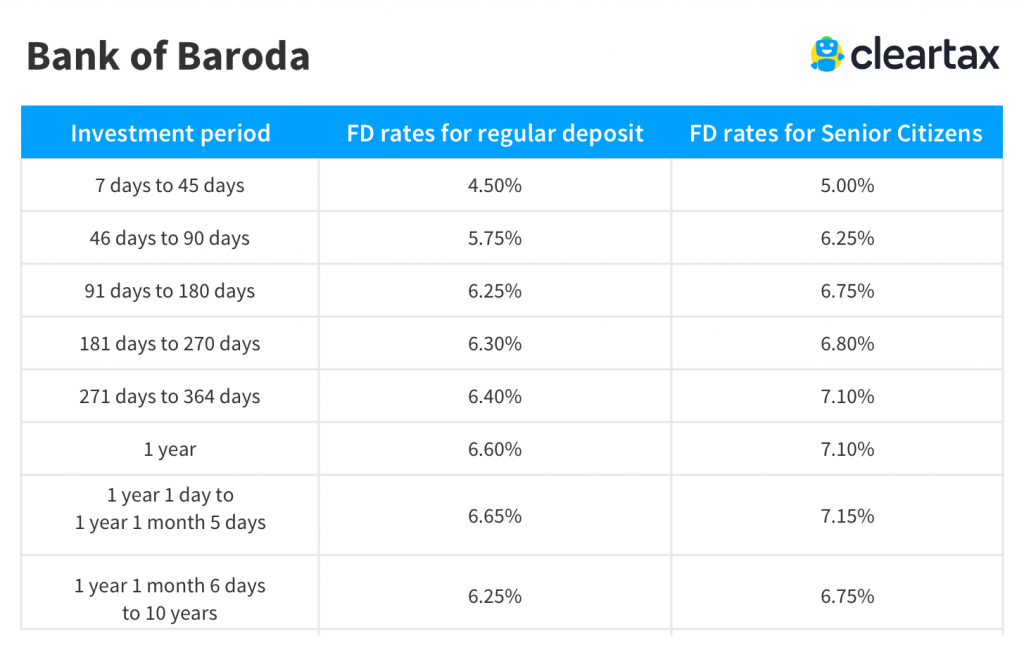

The Bank of Baroda has introduced enhanced interest rates on specific tenures of fixed deposits. This applies to deposits below ₹2 crore. While the exact percentage varies based on the duration of the deposit, the highest rate being offered is for a specific term period.

According to official statements released by Bank of Baroda, the revised rates are effective immediately from [Insert Date Here]. The specific tenure offering the maximum rate is for [Insert Tenure Here], providing depositors with a lucrative short-to-medium term investment opportunity.

Understanding the Specific Rates

The peak interest rate is reportedly [Insert Percentage Here] for the aforementioned tenure. This is a notable increase compared to the previously offered rates. This increase puts Bank of Baroda among the top banks offering competitive FD rates in this specific maturity bracket.

Other tenures also see revisions, though with varying degrees of increase. Investors are advised to consult the bank's official website or visit their nearest branch for a complete breakdown of the revised interest rate structure.

"We are committed to providing our customers with the best possible returns on their investments," said [Insert Name and Designation of Bank Official Here], in a press release. "These enhanced interest rates reflect our commitment to customer-centric banking and our confidence in the Indian economy."

Impact on Depositors and the Market

The move is anticipated to have a positive impact on depositors, particularly senior citizens and those seeking stable investment options. Higher FD rates offer a secure way to grow savings, especially during times of economic uncertainty.

This initiative from Bank of Baroda might also prompt other banks to re-evaluate their own FD rates. Such competition can ultimately benefit depositors by pushing interest rates upward across the banking sector. This could influence saving habits and investment strategies among the general public.

Expert Opinions

Financial analysts believe that this decision aligns with the current market trends. Many banks are looking to attract and retain deposits. It is being driven by the increased demand for credit and the need to bolster their liquidity positions.

"In the current scenario, fixed deposits are becoming an attractive investment avenue again," says [Insert Name of Financial Analyst Here], a market expert at [Insert Firm/Organization Here]. "The enhanced rates offered by banks like Bank of Baroda can provide a relatively safe and predictable return compared to more volatile investment options."

Considerations for Investors

While the higher interest rates are appealing, potential investors should carefully consider their individual financial goals and risk tolerance. It's crucial to assess whether the specific tenure aligns with their investment horizon.

Furthermore, investors should be aware of the tax implications of fixed deposits. Interest earned on FDs is taxable according to the individual's income tax slab. They should factor this into their overall investment planning.

Ultimately, Bank of Baroda's enhanced interest rates on fixed deposits present a compelling opportunity for investors seeking stable returns. By understanding the details of the scheme and carefully assessing their own financial circumstances, individuals can make informed decisions that align with their investment objectives.