Historically Par Value Was Considered To Be

Imagine a bustling stock exchange floor, decades ago, a cacophony of shouts and frantic hand gestures. Paper certificates, symbols of ownership, changed hands at a dizzying pace. These certificates bore a simple, yet powerful inscription: par value. This seemingly insignificant number held a weight far beyond its numerical representation, shaping the perception of a company's worth and influencing investor behavior in ways we can barely fathom today.

At its heart, par value, historically speaking, was the nominal value assigned to a share of stock when it was first issued by a company. While its modern relevance is often debated, understanding its historical context is crucial for grasping the evolution of corporate finance and the changing relationship between companies and their shareholders. It offers a unique lens through which to view the financial landscape of the past.

The Genesis of Par Value: A Symbol of Stability

The concept of par value emerged during a time when corporate structures were still relatively nascent. It served as a fundamental building block in the then-developing world of finance.

In the early days of corporations, par value was often seen as a representation of the company's initial capital investment. It represented the minimum amount that shareholders would contribute for each share.

Think of it as a promise: a company stating that at least this much money has been put into the business to start. This gave investors a sense of security, a feeling that their investment was backed by tangible assets and a commitment from the company.

Par Value as a Safeguard

One of the primary intentions behind par value was to protect creditors. It acted as a buffer, preventing companies from distributing assets to shareholders if doing so would impair the stated capital (the total par value of all outstanding shares).

The idea was to ensure that the company had a minimum amount of capital available to meet its obligations. This was especially important during periods of economic uncertainty.

This protection, however, often proved more theoretical than practical. The actual value of a company's assets and its ability to generate profits were often far more important than the par value stated on its shares.

The Shifting Sands: Limitations and Misconceptions

Over time, the limitations of par value became increasingly apparent. The number often bore little to no relation to the actual market value of the shares.

A share with a par value of $1 might trade for $50, $100, or even more, depending on market sentiment and the company's performance. This disconnect led to widespread confusion.

Investors frequently misinterpreted par value as an indicator of the stock's true worth. This misunderstanding could lead to poor investment decisions and a false sense of security.

The Rise of No-Par Value Stock

Recognizing these issues, many jurisdictions began to allow companies to issue stock without a stated par value, often referred to as "no-par value stock." This change represented a significant shift in corporate finance.

The introduction of no-par value stock gave companies greater flexibility in how they accounted for their capital. It also reduced the potential for investor confusion.

Delaware, a leading jurisdiction for corporate law in the United States, was an early adopter of no-par value stock, further solidifying its prominence in corporate governance.

Modern Relevance and Lasting Legacy

While par value may seem like a relic of the past in many modern contexts, it still exists in some jurisdictions and can have practical implications. Understanding it is important.

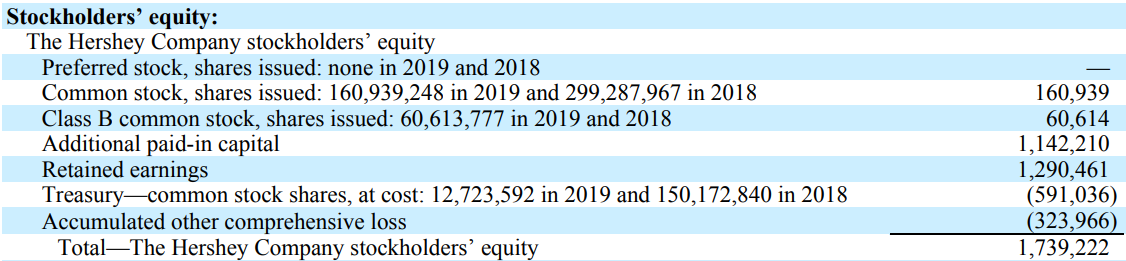

Even where no-par value stock is prevalent, the concept of stated capital, derived from par value, can still influence accounting practices and corporate distributions.

For example, some jurisdictions may restrict the payment of dividends if it would reduce the company's capital below the level of its stated capital. This acts as a kind of creditor protection.

A Lesson in Financial History

The story of par value is a reminder that financial concepts are not static. They evolve to reflect changes in the economy, legal landscape, and investor understanding.

It teaches us the importance of critical thinking and the need to look beyond simple numbers when assessing the value of an investment. It encourages informed investment decisions.

"Understanding the historical context of financial instruments is crucial for navigating the complexities of the modern market," notes Professor Emily Carter, a finance historian at the University of Chicago.

Looking Ahead: A New Era of Transparency

In today's interconnected and data-driven world, investors have access to a wealth of information that was unimaginable in the era of par value's prominence. Companies are now pushed to provide transparency.

Sophisticated analytical tools and readily available financial data allow for a much deeper understanding of a company's true worth. This represents a shift away from the simplistic reliance on nominal values.

The focus has shifted to key performance indicators (KPIs), future earnings projections, and sustainable growth strategies. This information helps reveal true market value and reduce reliance on face values.

"The information age demands a new approach to valuation, one that prioritizes transparency, data-driven analysis, and a comprehensive understanding of a company's business model," argues David Miller, a leading investment analyst at Goldman Sachs.

In conclusion, while par value may no longer hold the same sway it once did, its historical significance remains undeniable. It serves as a valuable lesson in the evolution of corporate finance and the ongoing quest for more accurate and transparent measures of value.

The legacy of par value reminds us to approach financial information with a critical eye and to always seek a deeper understanding of the underlying factors that drive value. It is a constant reminder of finance's long past.

:max_bytes(150000):strip_icc()/Parvalue-Final-1a535f4a987248bd8c09f75551c7a011.jpg)