How Can I Deposit Money To Someone Else Bank Account

In today's interconnected world, the need to transfer funds to another person's bank account arises frequently, whether for personal or professional reasons. While seemingly straightforward, understanding the various methods and their associated considerations is crucial to ensure a smooth and secure transaction.

This article provides a comprehensive guide on how to deposit money into someone else's bank account, outlining the available options, their respective processes, security measures, and potential fees. Navigating these options effectively requires a clear understanding of the processes, security protocols, and potential costs associated with each method.

Understanding Your Options

Several methods exist for depositing money into someone else's bank account, each with its own set of advantages and disadvantages. These include direct deposits at the bank, online transfers, mobile banking apps, third-party payment platforms, and wire transfers.

Direct Deposit at the Bank

One of the most traditional methods involves physically visiting the recipient's bank branch. You will typically need the recipient's full name, bank name, and account number.

Some banks may also require your identification and may have limits on the amount you can deposit. It's always a good idea to verify the recipient's information with them beforehand to avoid errors.

Online Transfers

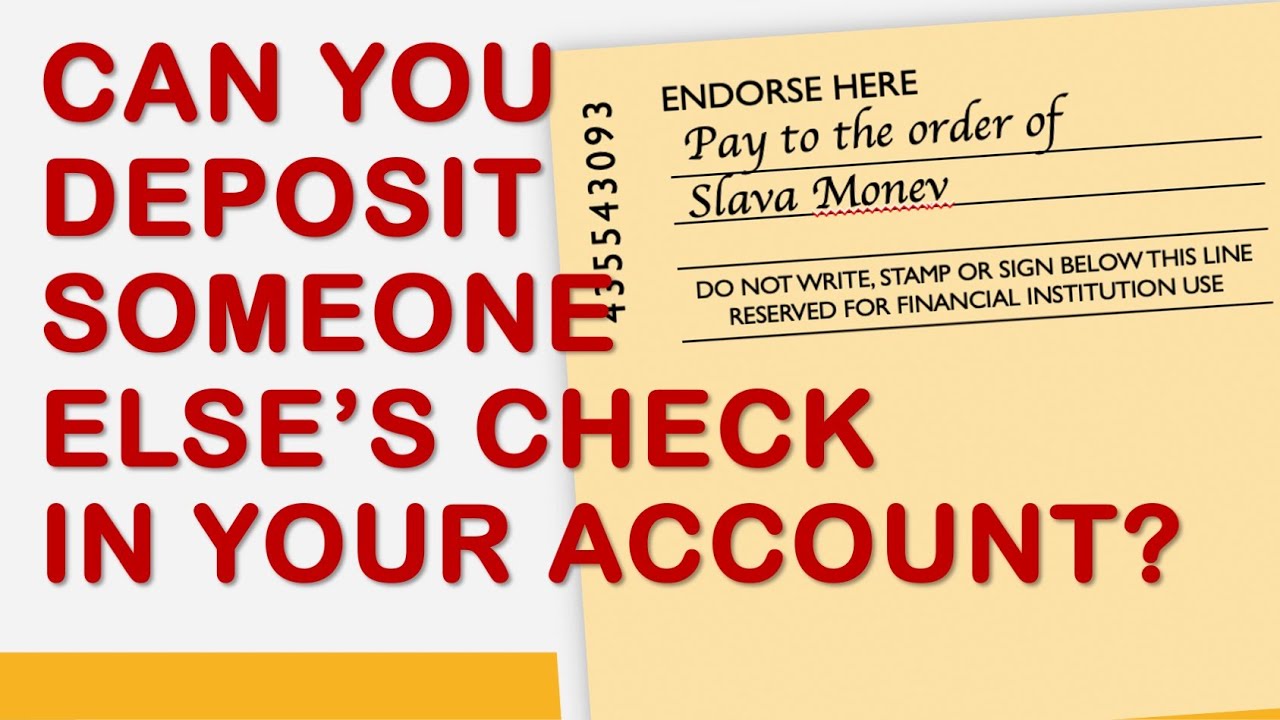

Many banks offer online transfer services that allow you to send money to other accounts, even those at different banks. This usually requires adding the recipient as a payee in your online banking portal.

You'll need the recipient's full name, bank name, account number, and possibly the bank's routing number. Online transfers are generally convenient and secure, but they may have daily or transaction limits.

Mobile Banking Apps

Mobile banking apps provide a convenient way to transfer funds directly from your smartphone or tablet. The process is similar to online transfers, requiring you to add the recipient's account details.

Mobile banking apps often utilize enhanced security features like biometric authentication to protect your transactions. Limits and processing times may vary depending on the bank.

Third-Party Payment Platforms

Platforms like PayPal, Venmo, and Zelle offer a streamlined way to send money electronically. These services typically require both parties to have an account and are often linked to a bank account or debit card.

While convenient, these platforms may charge fees for certain transactions or have limits on the amount you can send. Security is paramount, so always double-check the recipient's information before sending money.

Wire Transfers

Wire transfers are a reliable option for sending larger sums of money domestically or internationally. These transfers are typically processed through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network for international transactions.

Wire transfers require more detailed information, including the recipient's bank name, account number, SWIFT code (for international transfers), and routing number. Wire transfers are generally more expensive than other methods, with fees charged by both the sending and receiving banks.

Security Considerations

When transferring money to someone else's account, prioritizing security is essential to protect against fraud and errors. Always double-check the recipient's information to ensure accuracy.

Be wary of phishing scams or suspicious requests for money. Use strong passwords and enable two-factor authentication whenever possible.

Navigating Fees and Limits

Most transfer methods come with associated fees and transaction limits. Direct bank deposits may have minimal or no fees, but online transfers, mobile banking apps, and third-party payment platforms often have tiered fee structures.

Wire transfers typically have the highest fees, particularly for international transactions. Understanding these costs beforehand can help you choose the most cost-effective option.

The Future of Fund Transfers

The landscape of fund transfers is constantly evolving with advancements in technology. Real-time payment systems are becoming increasingly popular, offering faster and more efficient ways to send money.

Blockchain technology and cryptocurrencies are also emerging as potential alternatives for international money transfers. As these technologies mature, they may offer even more convenient and secure options for transferring funds in the future.

In conclusion, depositing money into someone else's bank account involves navigating a range of options, each with its own set of benefits and considerations. By understanding the available methods, security protocols, and potential costs, individuals can make informed decisions that ensure a smooth and secure transaction.