How Can I See All Of My Subscriptions

In today's increasingly digital world, managing subscriptions has become a common challenge. From streaming services to software licenses, many consumers find themselves juggling numerous recurring payments. Learning how to effectively track and control these subscriptions can save money and prevent unwanted charges.

This article will explore various methods for consolidating and viewing all your subscriptions in one place. It will provide practical steps and resources for taking control of your recurring expenses. This information will empower you to make informed decisions about your digital spending.

Subscription Management Tools and Services

Several apps and websites are designed specifically to help manage subscriptions. Services like Truebill (now Rocket Money) and Trim automatically identify recurring charges by linking to your bank and credit card accounts.

They offer a centralized dashboard where you can view all your subscriptions. Some also offer features such as cancellation assistance and negotiation of lower rates.

How They Work

These tools typically work by analyzing your transaction history. They then identify recurring payments based on the merchant and frequency of charges.

Once identified, the subscriptions are categorized and displayed in a user-friendly interface. Alerts are often provided for upcoming renewals or price increases.

Privacy Considerations

It's crucial to consider privacy implications when using these services. Ensure the app or website has strong security measures to protect your financial data.

Review their privacy policy carefully to understand how your data will be used and shared. Look for encryption and two-factor authentication features.

Manual Methods for Tracking Subscriptions

For those who prefer a more hands-on approach, manual methods can be effective. Creating a spreadsheet or using a note-taking app can help you stay organized.

List each subscription, the monthly or annual cost, the renewal date, and the platform where you subscribed. Regularly review this list to identify subscriptions you no longer need.

Leveraging Bank and Credit Card Statements

Your bank and credit card statements are valuable resources for identifying subscriptions. Review your statements each month, paying close attention to recurring charges.

Flag any unfamiliar or unwanted subscriptions. Contact the merchant directly to cancel the subscription and request a refund if necessary. You can also contact your bank or credit card company to dispute unauthorized charges.

Using Password Managers

Password managers like LastPass and 1Password can also aid in subscription management. These tools often store subscription details along with your login information.

They provide a convenient way to track where you have active accounts. You can also add notes about billing cycles and cancellation policies.

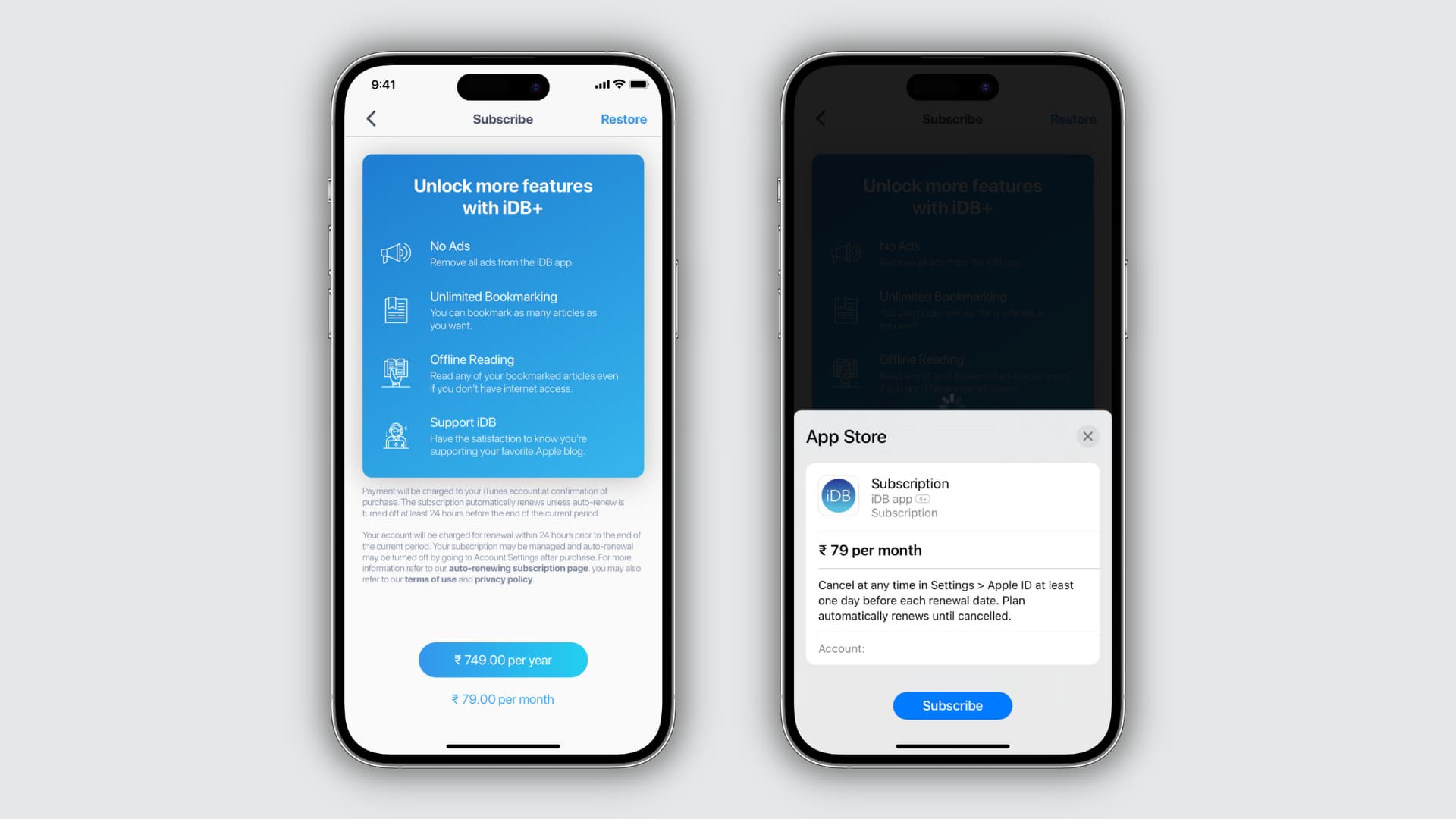

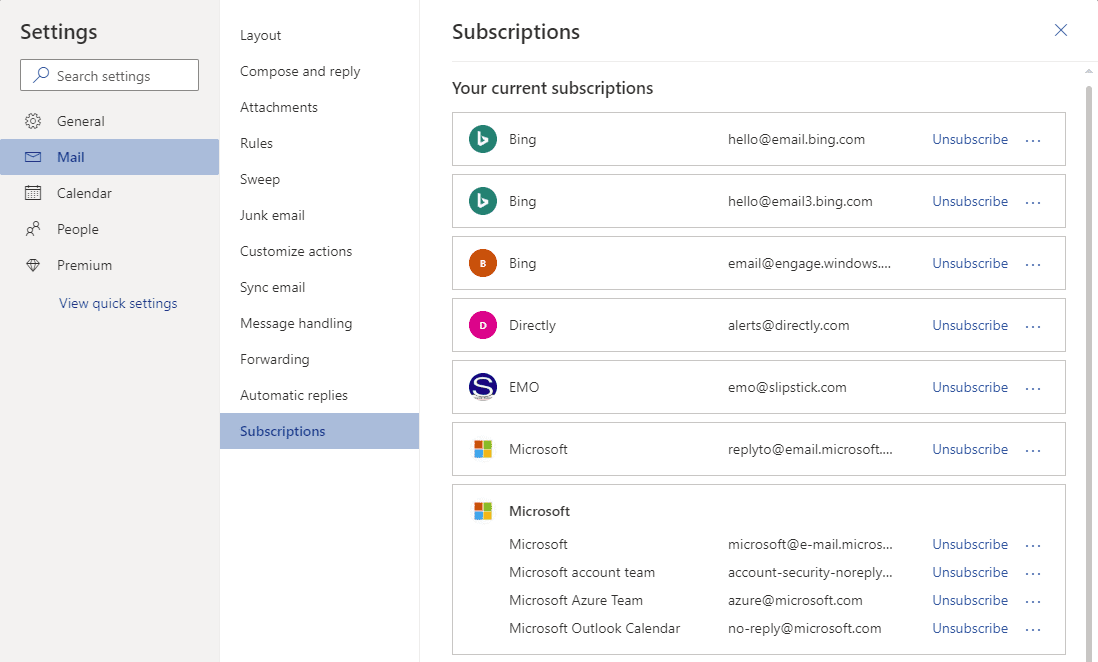

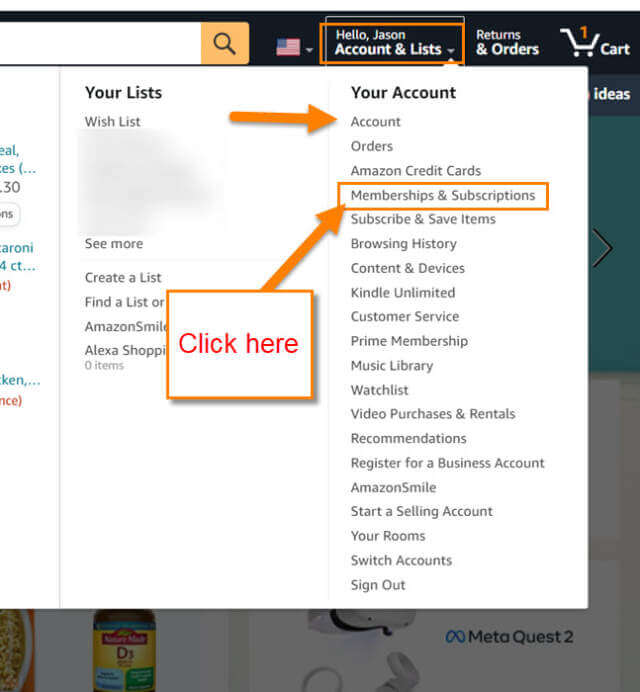

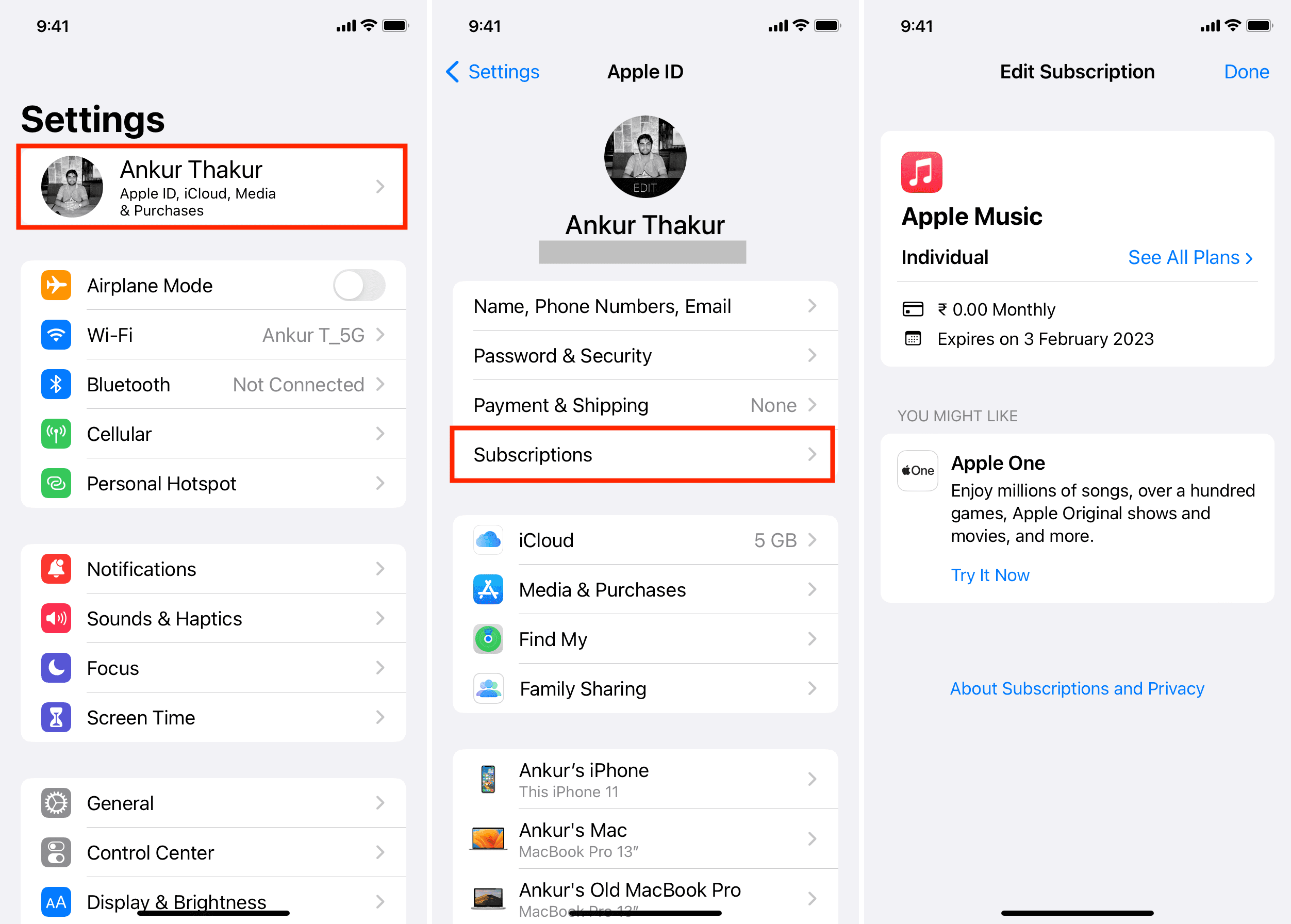

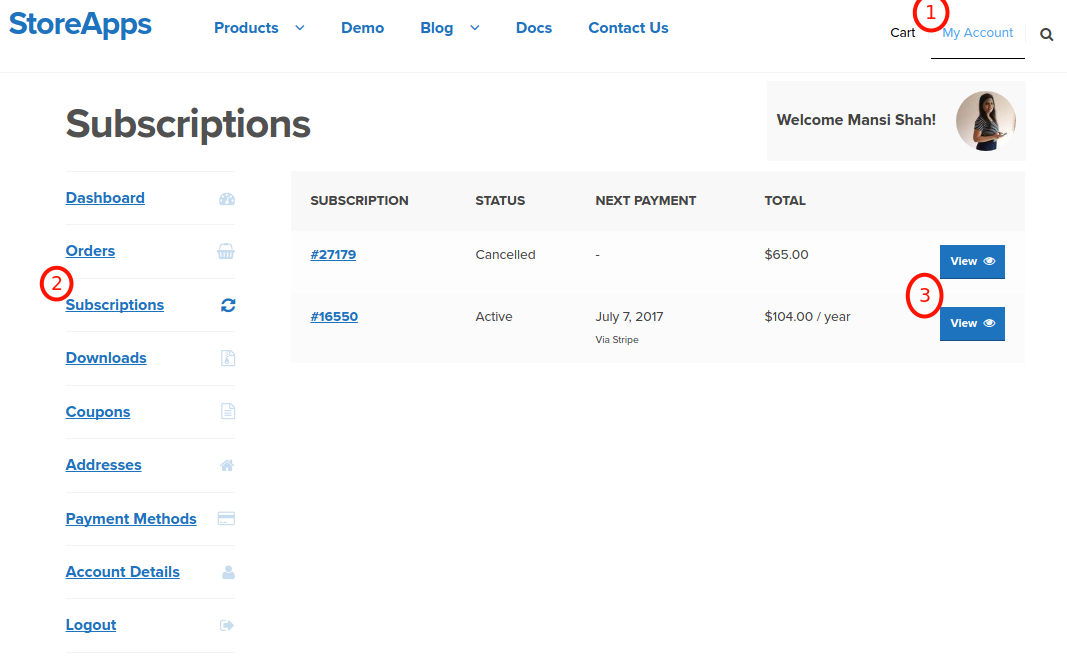

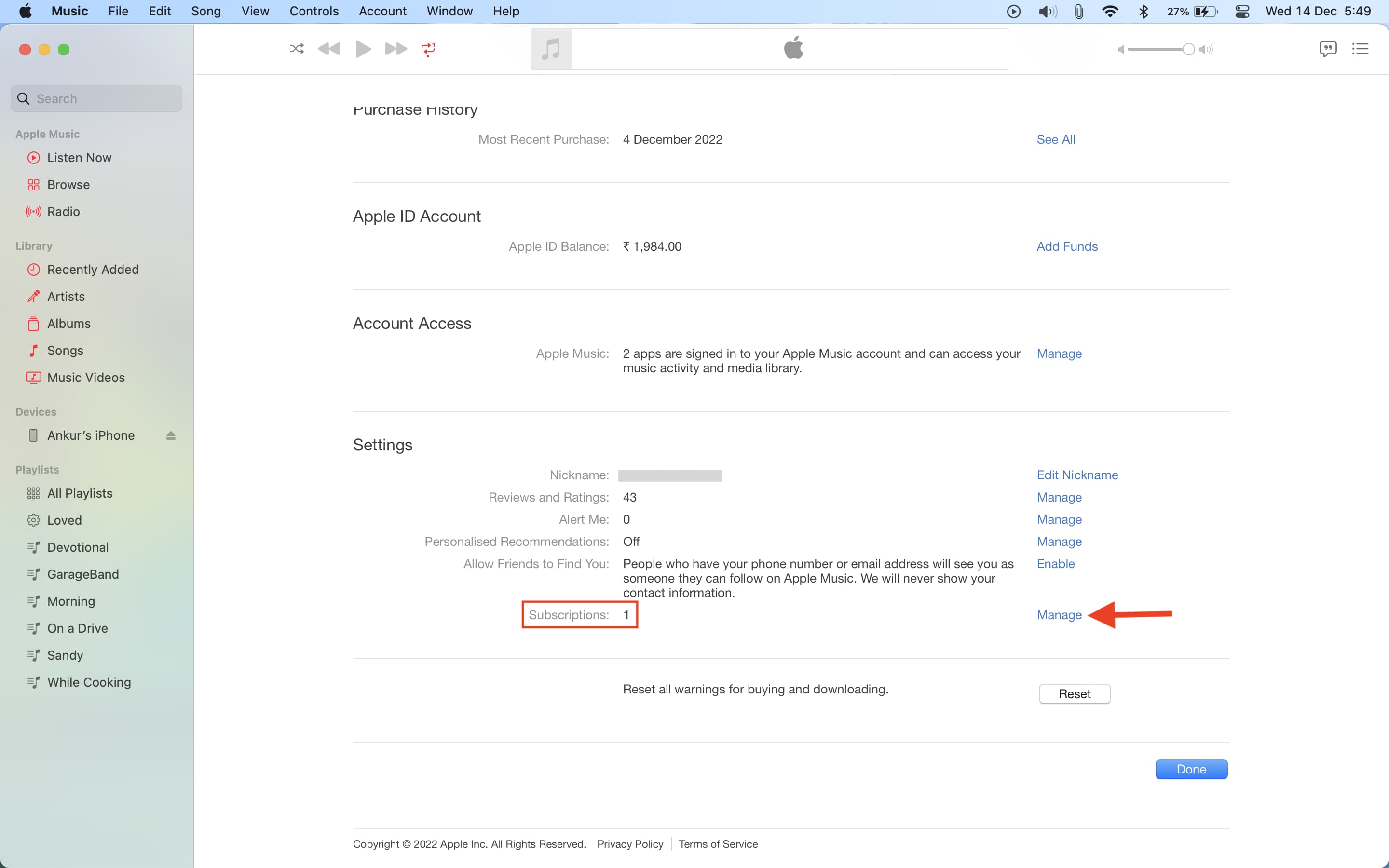

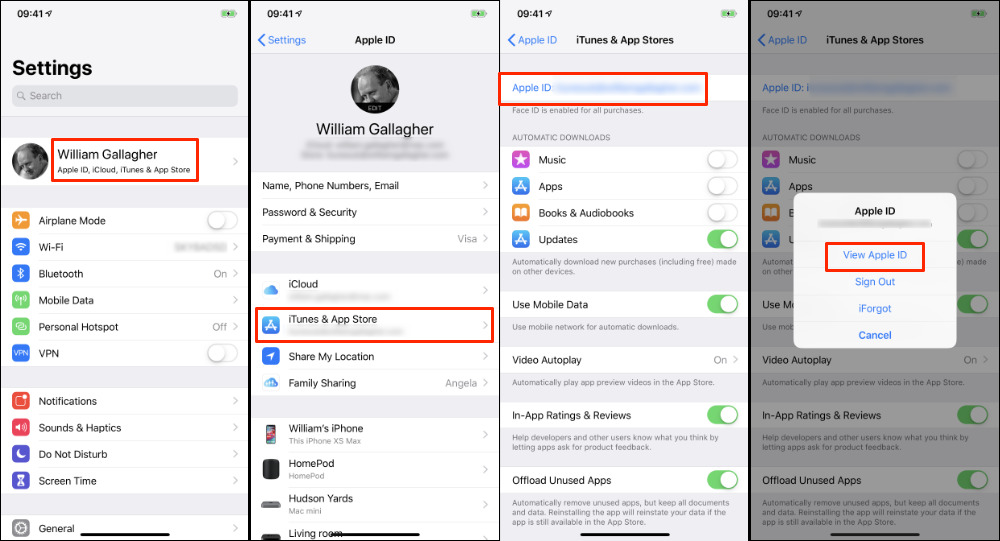

Direct Platform Management

Many subscriptions are managed directly through the platforms where you signed up. This includes services like Netflix, Spotify, and Amazon Prime.

Log in to each platform and navigate to your account settings. You will usually find a "Subscription" or "Billing" section where you can view and manage your subscriptions.

This is often the most direct way to cancel a subscription. It is a great way to update your payment information.

The Importance of Regular Review

Regardless of the method you choose, regularly reviewing your subscriptions is essential. Set a reminder to audit your recurring expenses at least once a month.

This will help you identify and cancel subscriptions you no longer use or need. This will free up budget for other financial goals.

By taking a proactive approach to subscription management, you can save money and gain greater control over your finances. It is important to keep track of your spending!

:max_bytes(150000):strip_icc()/iOSSubscriptions01-97b8e9ce685c441fbb6ea6223be11698.jpg)