How Do I Dissolve A Business Partnership

Untangling a business partnership can feel like navigating a legal minefield. Knowing the proper steps and potential pitfalls is crucial for a smooth and equitable dissolution.

This article provides a comprehensive overview of how to dissolve a business partnership, covering key legal considerations and practical advice to help business owners navigate this complex process.

Understanding the Partnership Agreement

The foundation of any partnership dissolution lies in the partnership agreement. This document, ideally created at the outset of the business, outlines the procedures for dissolving the partnership.

It typically specifies how assets will be distributed, liabilities handled, and disputes resolved.

If a partnership agreement exists, following its terms is paramount to avoid legal complications.

What if there is No Partnership Agreement?

In the absence of a formal agreement, state laws govern the dissolution process. These laws, often based on the Uniform Partnership Act (UPA), provide default rules for winding up the business.

Generally, dissolving a partnership without an agreement requires the consent of all partners. Disagreements can lead to protracted legal battles.

Steps to Dissolve a Business Partnership

The dissolution process generally involves several key steps. First, a formal notice of intent to dissolve must be provided to all partners.

This notice should clearly state the intention to dissolve the partnership and the proposed date of dissolution.

The partners then need to conduct an accounting of all partnership assets and liabilities.

Asset Valuation and Distribution

Determining the fair market value of assets is crucial for equitable distribution. This may involve engaging independent appraisers to assess the value of tangible and intangible assets.

The partnership agreement, or state law in its absence, dictates how assets are to be distributed.

Common methods include distributing assets in proportion to each partner's capital contributions or according to a predetermined formula.

Liability Allocation

Partners are typically jointly and severally liable for the debts of the partnership. This means that creditors can pursue any partner for the full amount of the debt.

The dissolution agreement should clearly specify how existing liabilities will be handled.

This may involve assigning responsibility for specific debts to individual partners or establishing a fund to cover outstanding obligations.

Legal and Tax Considerations

Dissolving a partnership involves significant legal and tax implications. Partners should consult with legal and financial professionals to ensure compliance with all applicable laws and regulations.

Properly documenting the dissolution process is crucial for avoiding future disputes.

Tax Implications

The dissolution of a partnership can trigger various tax consequences, including capital gains taxes. The specific tax implications depend on the structure of the partnership and the distribution of assets.

The Internal Revenue Service (IRS) provides guidance on the tax treatment of partnership dissolutions.

Seeking professional tax advice is essential to minimize potential tax liabilities.

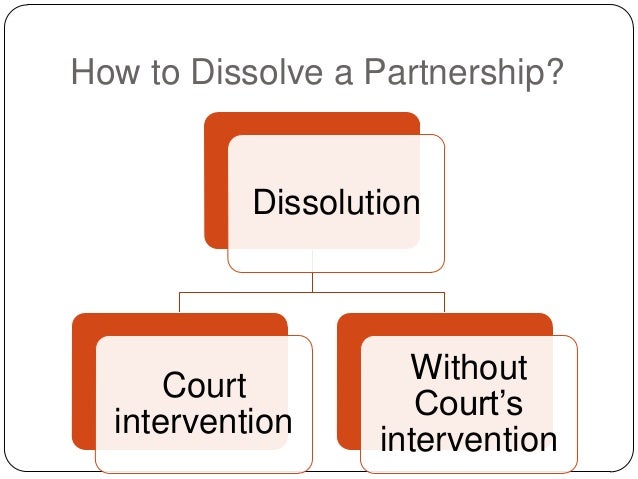

Potential Challenges and Dispute Resolution

Disagreements among partners are common during the dissolution process. Differences in opinion regarding asset valuation, liability allocation, or other matters can lead to conflicts.

Mediation or arbitration can be effective methods for resolving disputes amicably.

These alternative dispute resolution processes offer a less adversarial and more cost-effective alternative to litigation.

"Dissolving a partnership is often a stressful process, but with careful planning and professional guidance, it can be managed effectively," said Jane Doe, a business attorney specializing in partnership law.

A well-documented and legally sound dissolution agreement protects the interests of all parties involved.

Ultimately, the success of a partnership dissolution depends on clear communication, mutual respect, and a commitment to reaching a fair and equitable resolution.