How Do I Make A Diminished Value Claim

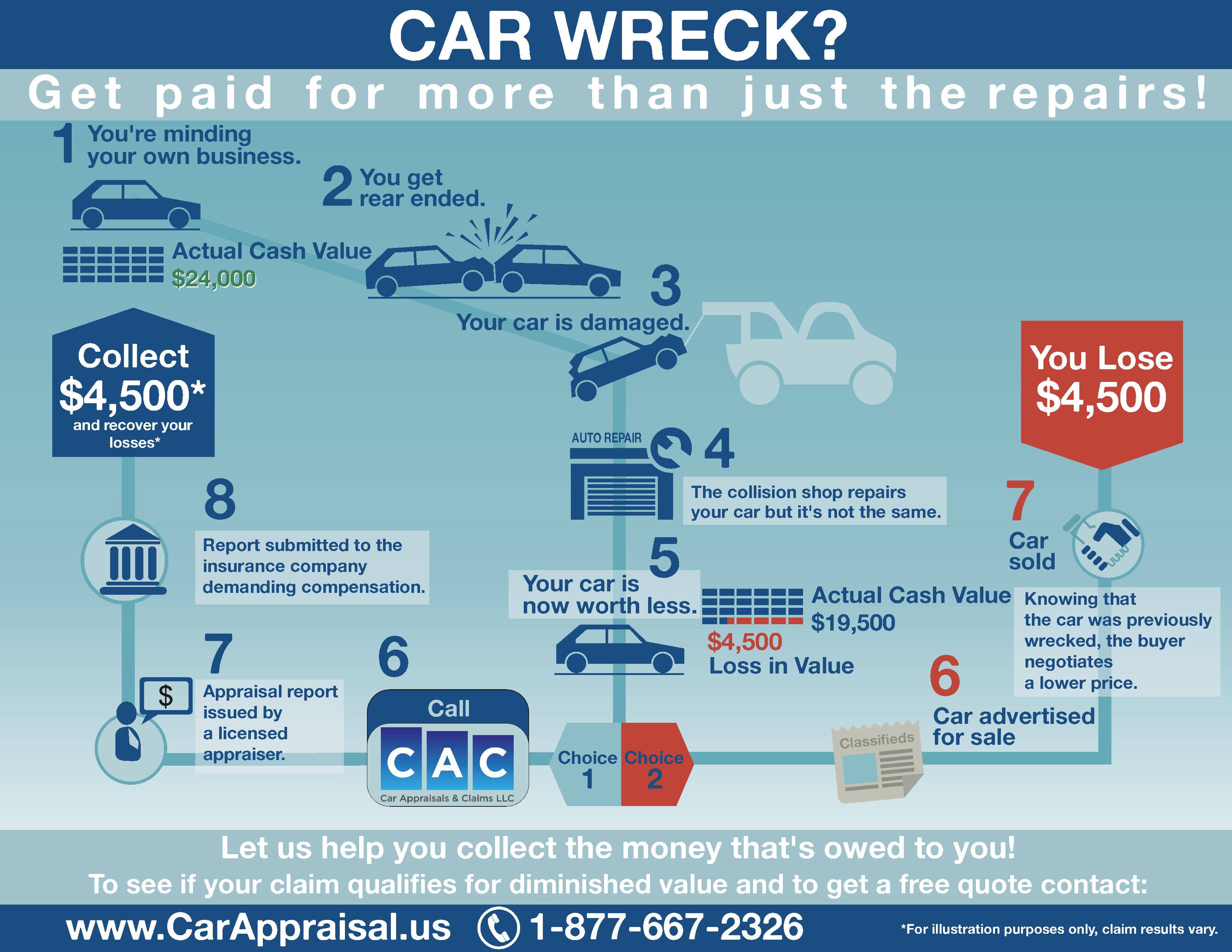

Accidents happen, and even with repairs, a vehicle's market value can decrease after a collision. This loss, known as diminished value, can be claimed to recoup some of the financial impact. Navigating the claims process, however, requires understanding the steps involved and the documentation needed.

This article provides a guide on how to make a diminished value claim, outlining the necessary steps, documentation, and potential challenges. Understanding this process can help vehicle owners potentially recover lost value after an accident.

Understanding Diminished Value

Diminished value is the reduction in a vehicle's market value after it has been repaired from accident damage. Even with high-quality repairs, a vehicle's history of damage can make it less appealing to potential buyers.

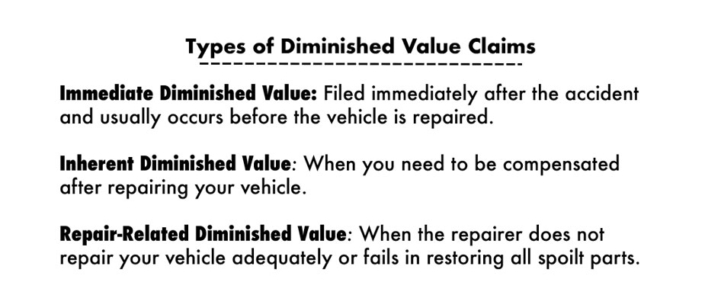

There are generally three types of diminished value: immediate, inherent, and repair-related. Immediate diminished value is the loss of value simply due to the accident itself. Inherent diminished value is the reduction in value that exists even after perfect repairs. Repair-related diminished value occurs when repairs are substandard.

Steps to Filing a Diminished Value Claim

The process of filing a diminished value claim involves several key steps.

1. Determine Eligibility

Not all accidents qualify for a diminished value claim. Typically, the claimant must not be at fault for the accident.

Furthermore, the vehicle must have been repaired to a high standard. Some states also have limitations on the age or mileage of the vehicle.

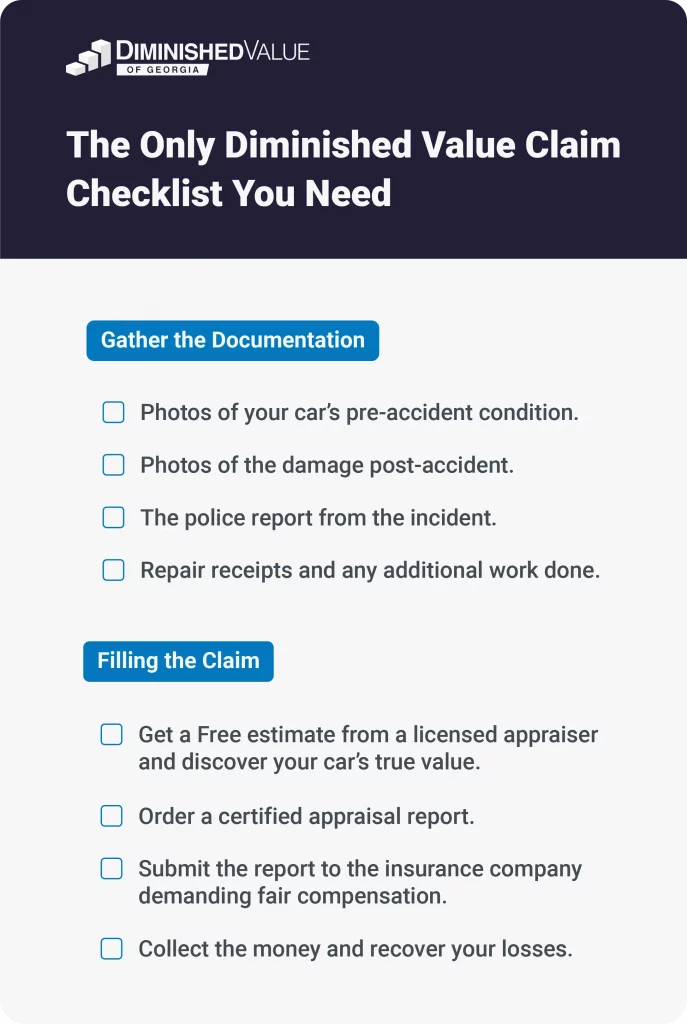

2. Gather Documentation

Collecting thorough documentation is crucial for a successful claim. This includes the police report, photos of the damage, and repair estimates.

Also important are the repair bills, and the vehicle's pre-accident value as determined by sources like the Kelly Blue Book or NADA Guides.

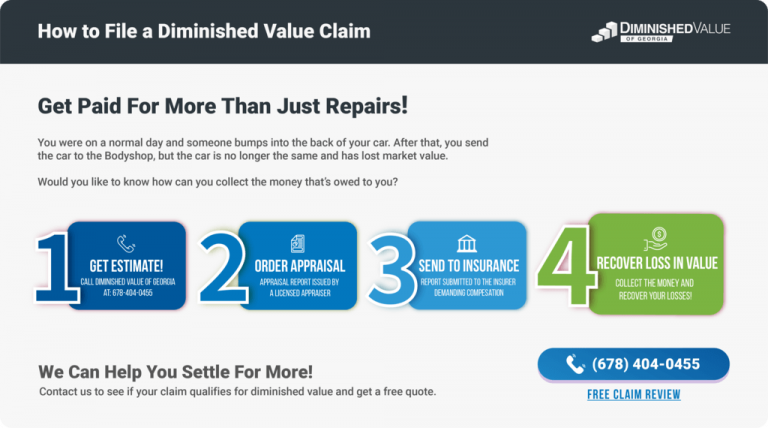

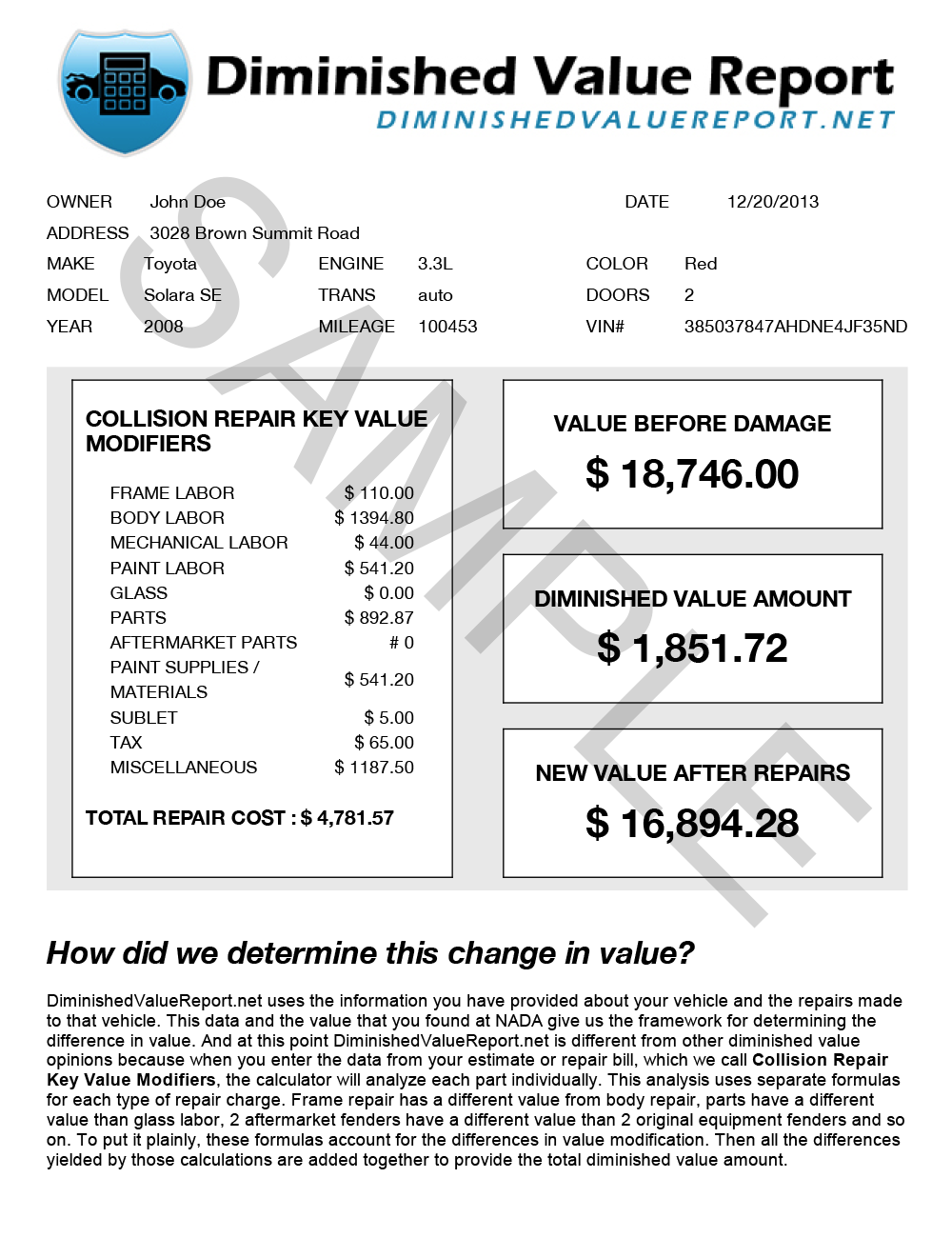

3. Obtain a Diminished Value Appraisal

A diminished value appraisal from a qualified appraiser is essential. The appraiser will assess the vehicle's condition and history to determine the amount of value lost.

These appraisals typically cost between $300 and $600, but can vary based on location and the complexity of the case. Choose an appraiser with experience in diminished value claims.

4. Submit the Claim

Once you have gathered all necessary documentation and the appraisal, submit the claim to the at-fault driver's insurance company. The claim should include a demand letter outlining the basis for the claim and the amount of compensation sought.

Keep copies of all documents submitted. Be prepared to negotiate with the insurance adjuster.

5. Negotiation and Potential Legal Action

Insurance companies may try to minimize or deny diminished value claims. Be prepared to negotiate and present your case effectively.

If negotiations fail, consider consulting with an attorney specializing in diminished value claims. Legal action may be necessary to recover the full amount of your loss.

Potential Challenges and Considerations

Successfully pursuing a diminished value claim can be challenging.

Insurance companies often dispute the amount of diminished value or argue that the repairs restored the vehicle to its pre-accident condition. Be ready to provide compelling evidence to support your claim.

Some states have laws that limit or prohibit diminished value claims. Research the laws in your state before pursuing a claim.

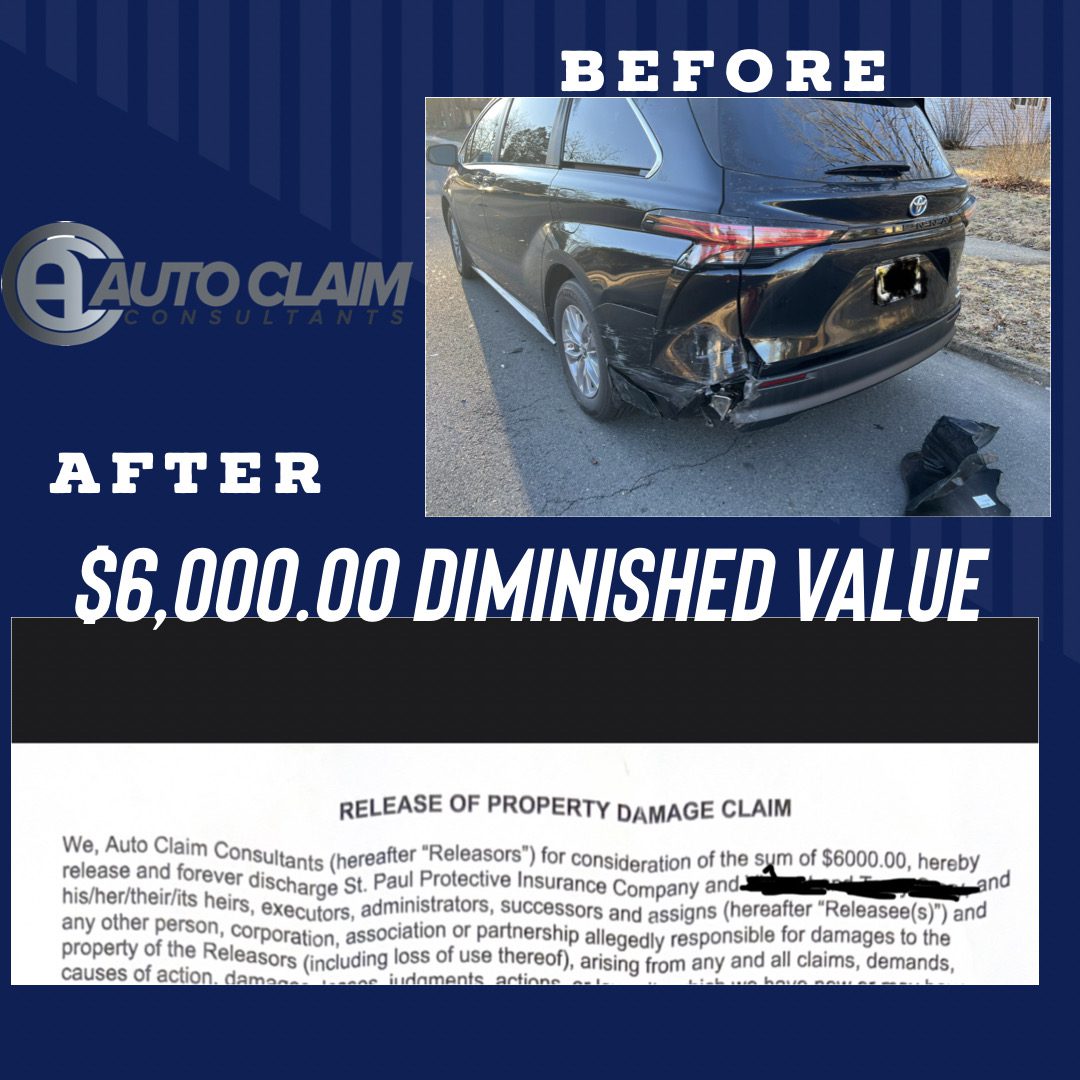

Impact on Vehicle Owners

Filing a diminished value claim can help vehicle owners recover some of the financial loss resulting from an accident. It provides a means to be compensated for the reduced resale value of their vehicle, even after repairs.

Understanding the process and gathering the necessary documentation are crucial for a successful outcome. Seek professional advice when needed to navigate the complexities of the claims process.

By taking proactive steps and being well-prepared, vehicle owners can increase their chances of a successful diminished value claim and fair compensation. The Insurance Information Institute recommends keeping detailed records of all communications with the insurance company.