How Does A 401k Affect Your Yearly Taxes

The allure of a comfortable retirement often hinges on strategic planning, and for many Americans, the 401(k) is a cornerstone of that strategy. But beyond the accumulation of wealth, understanding how this powerful retirement tool interacts with your annual tax obligations is crucial.

This article delves into the intricate relationship between 401(k) contributions and your yearly taxes. We explore how contributing to a 401(k) can impact your tax liability, the different types of 401(k) plans and their tax implications, and strategies to maximize tax benefits while planning for the future. Navigating these complexities can unlock significant savings and enhance your overall financial well-being.

The Immediate Tax Benefit: Deferring Income

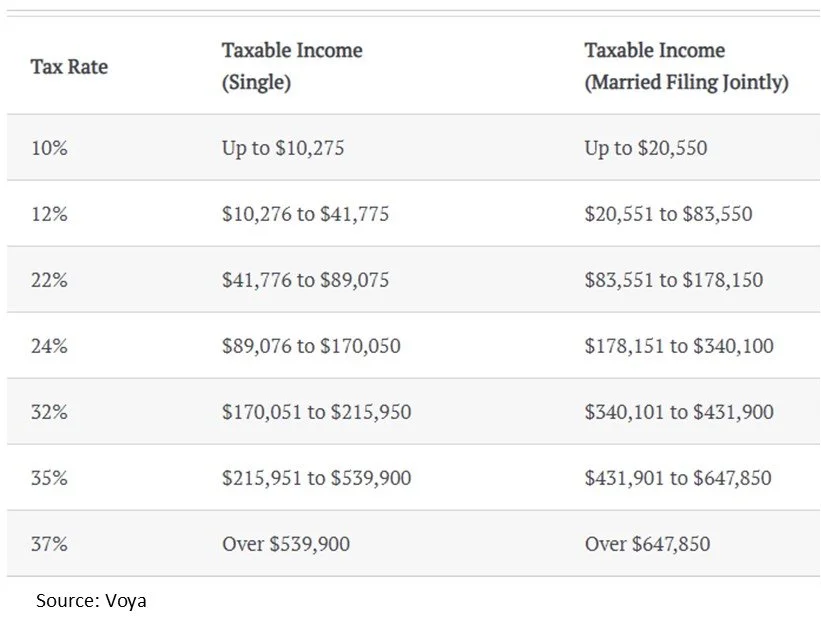

A primary advantage of traditional 401(k) plans lies in their ability to defer income taxes. When you contribute to a traditional 401(k), the amount you contribute is deducted from your taxable income for that year. This means you pay less in taxes in the short term.

For example, if you earn $60,000 annually and contribute $6,000 to a traditional 401(k), your taxable income is reduced to $54,000. This reduction can potentially lower your tax bracket, resulting in further savings.

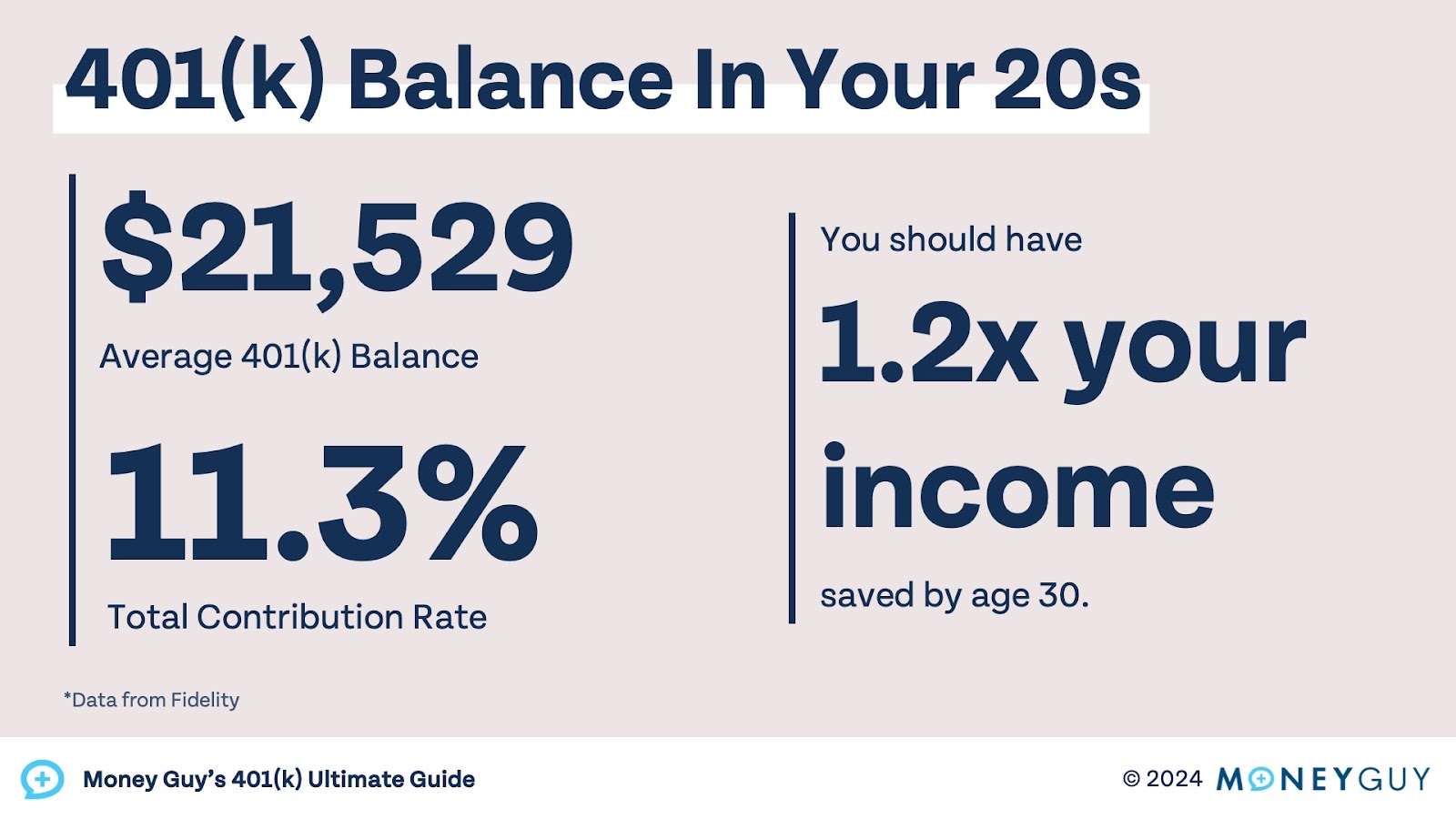

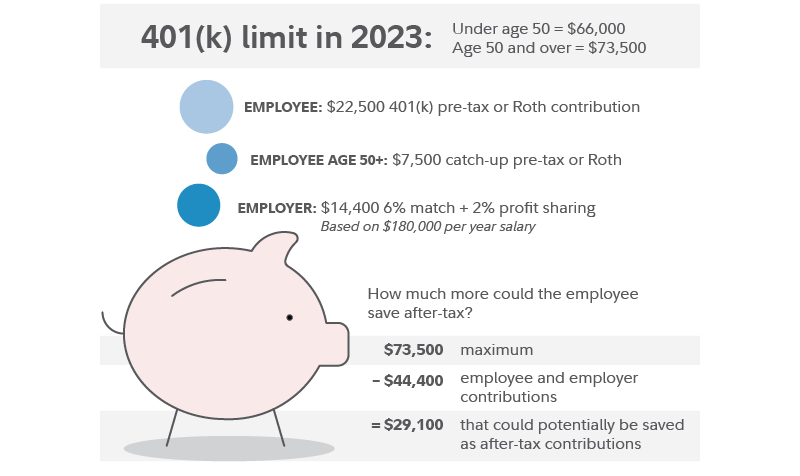

According to the IRS, the contribution limits for 401(k) plans can change annually. For 2024, the contribution limit for employees is $23,000, with an additional $7,500 catch-up contribution for those age 50 or older.

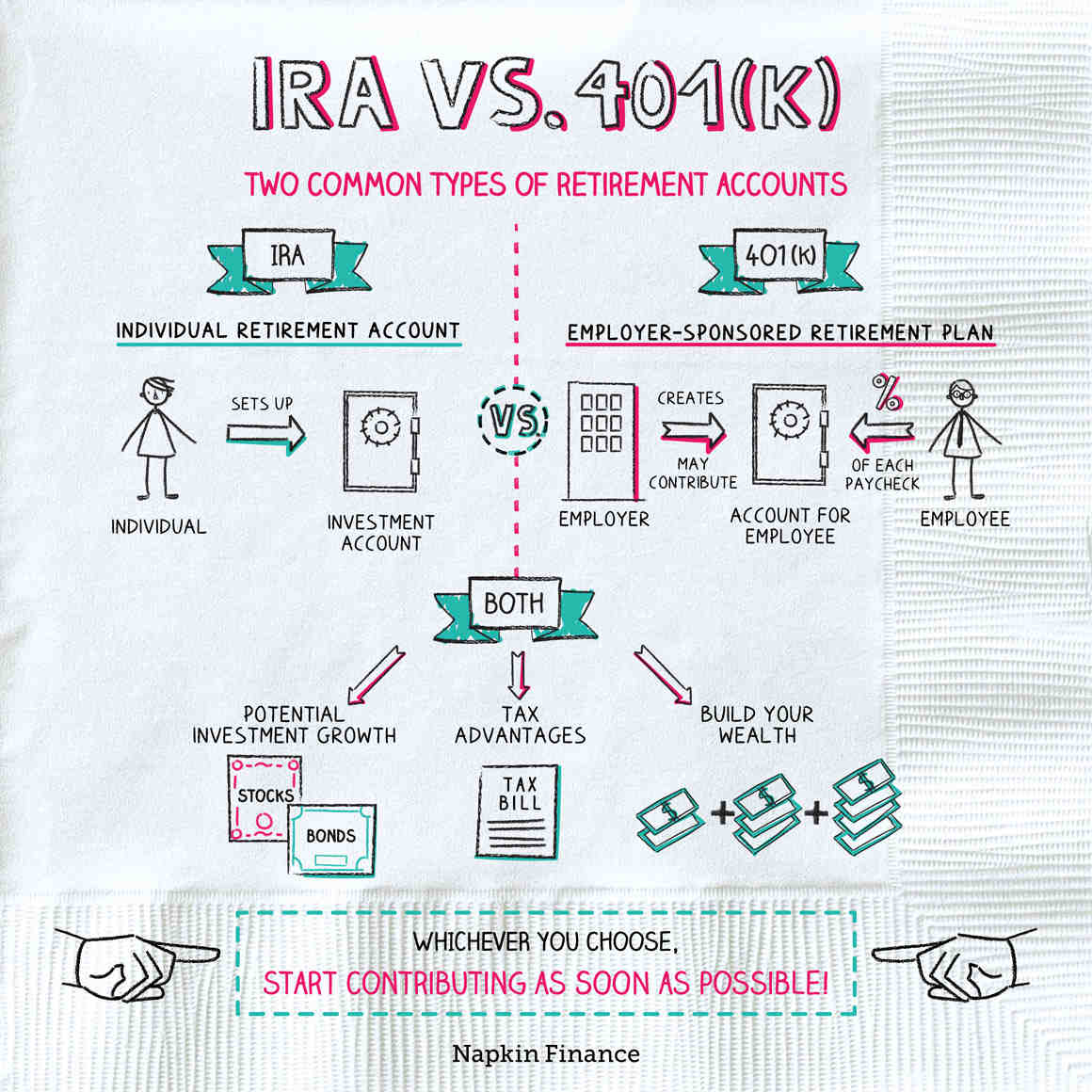

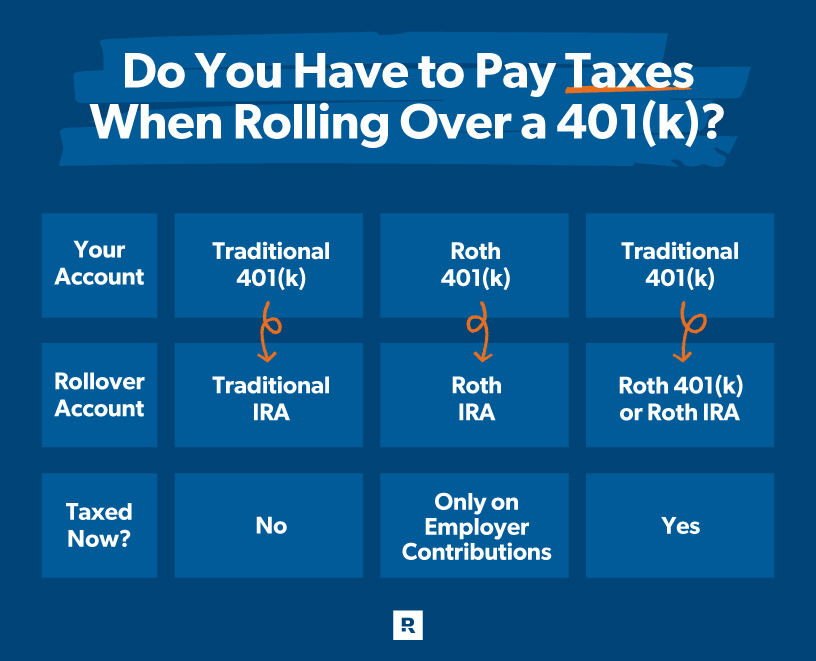

Traditional vs. Roth 401(k): A Taxing Choice

While traditional 401(k) plans offer immediate tax relief, Roth 401(k)s operate differently. With a Roth 401(k), you contribute after-tax dollars. This means you don't receive an immediate tax deduction.

However, the significant advantage of a Roth 401(k) is that your qualified withdrawals in retirement are entirely tax-free. This can be particularly beneficial if you anticipate being in a higher tax bracket during retirement.

The choice between a traditional and Roth 401(k) depends on your individual circumstances and financial outlook. Factors to consider include your current income, expected future income, and risk tolerance.

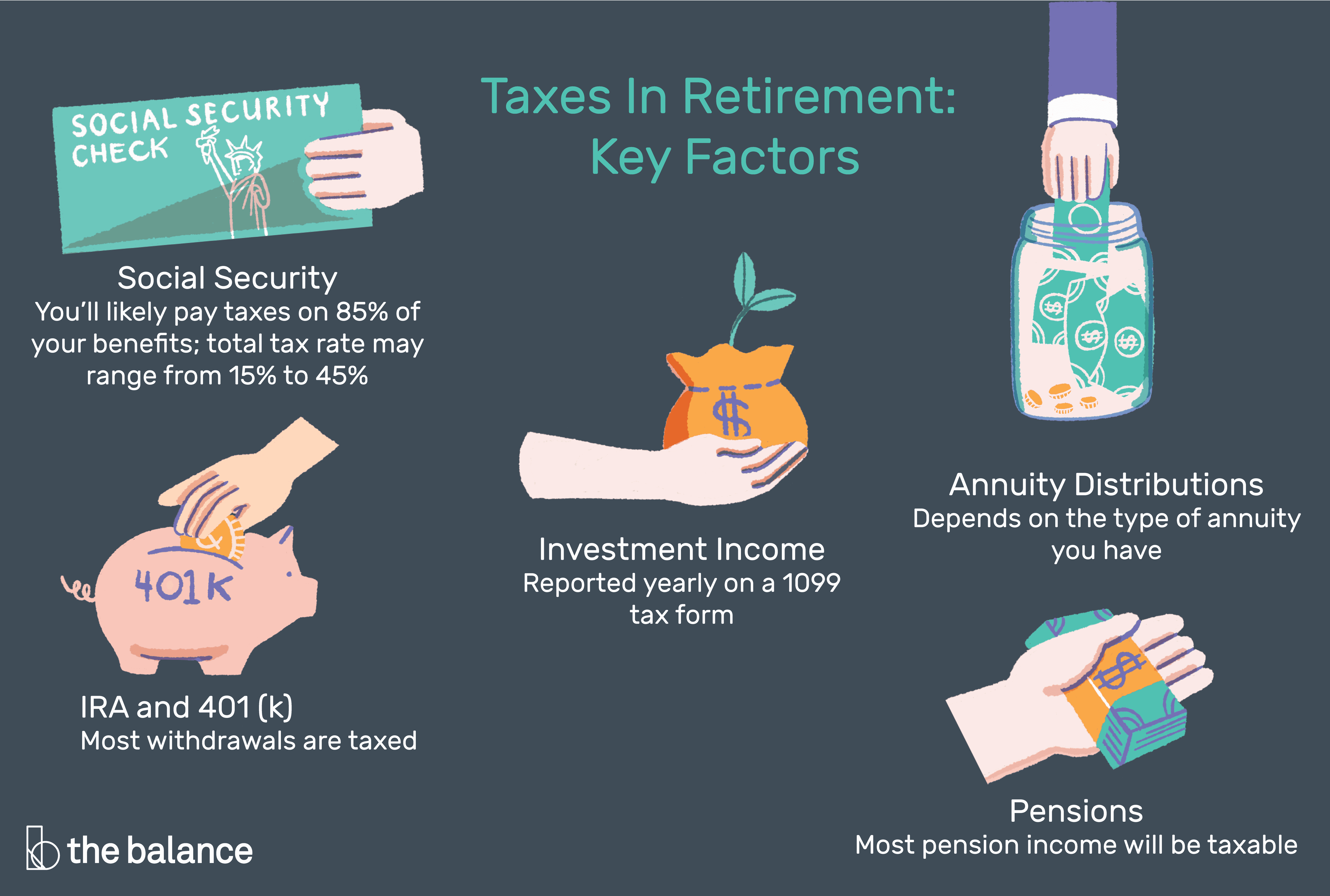

Distributions in Retirement: The Taxman Cometh (Eventually)

While traditional 401(k) plans defer taxes on contributions, those taxes eventually come due during retirement. When you withdraw money from a traditional 401(k), the distributions are taxed as ordinary income.

This means the amount you withdraw will be added to your other sources of income in retirement, and you'll pay taxes at your prevailing tax rate. Careful planning is essential to avoid unexpected tax burdens during this stage of life.

Roth 401(k) distributions, on the other hand, are generally tax-free, provided certain conditions are met. This is a major advantage for those seeking predictable retirement income.

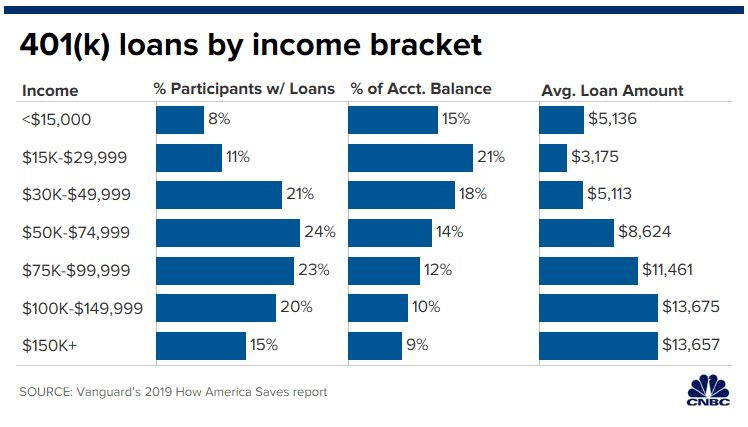

Potential Penalties: Early Withdrawals and Missed Opportunities

Withdrawing funds from a 401(k) before age 59 1/2 typically triggers a 10% penalty, in addition to regular income taxes. While exceptions exist (such as certain hardship cases), early withdrawals should generally be avoided.

The Department of Labor emphasizes the importance of understanding the rules and restrictions surrounding 401(k) plans. Early withdrawals can significantly deplete your retirement savings and result in hefty tax liabilities.

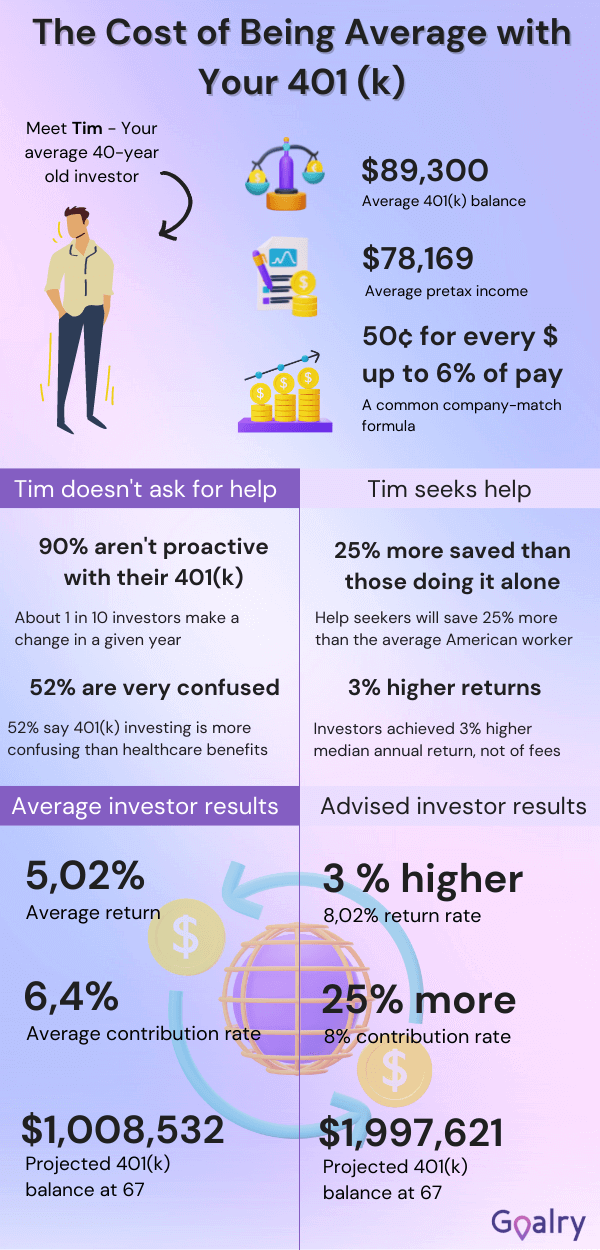

Furthermore, failing to contribute enough to your 401(k) to receive the full employer match is a missed opportunity. The employer match is essentially free money and can significantly boost your retirement savings.

Maximizing Tax Benefits: Strategies for Success

To maximize the tax benefits of your 401(k), consider increasing your contribution rate, especially if you're not yet contributing enough to receive the full employer match. Also, carefully evaluate whether a traditional or Roth 401(k) aligns better with your financial goals.

Consulting with a qualified financial advisor can provide personalized guidance based on your unique situation. A financial advisor can help you develop a comprehensive retirement plan that considers tax implications, investment strategies, and your overall financial well-being.

Staying informed about changes to tax laws and 401(k) regulations is also crucial. Regularly review your retirement plan and make adjustments as needed to optimize your tax benefits.

The Road Ahead: Planning for a Tax-Efficient Retirement

Understanding how your 401(k) affects your yearly taxes is essential for building a secure and tax-efficient retirement. By carefully considering your options, maximizing contributions, and seeking professional advice, you can navigate the complexities of the tax system and achieve your long-term financial goals.

The future of retirement planning will likely involve even greater emphasis on tax optimization. As tax laws evolve, staying proactive and informed will be key to maximizing the benefits of your 401(k) and ensuring a comfortable retirement.

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Comparison.jpg?width=1500&height=845&name=Pre-Tax vs. Roth Contributions to 401(k) Comparison.jpg)