How Does Accrued Market Discount Affect Gain Or Loss

Navigating the complexities of bond investments requires understanding various factors that can influence profitability. One often overlooked aspect is the accrued market discount, which significantly impacts how gains or losses are calculated when a bond is sold or matures. This article delves into the intricacies of accrued market discount, its calculation, and its implications for investors.

The concept of accrued market discount might seem complex, but it's crucial for investors to grasp. Failing to understand it can lead to inaccurate estimations of investment returns and potentially unforeseen tax liabilities.

What is Accrued Market Discount?

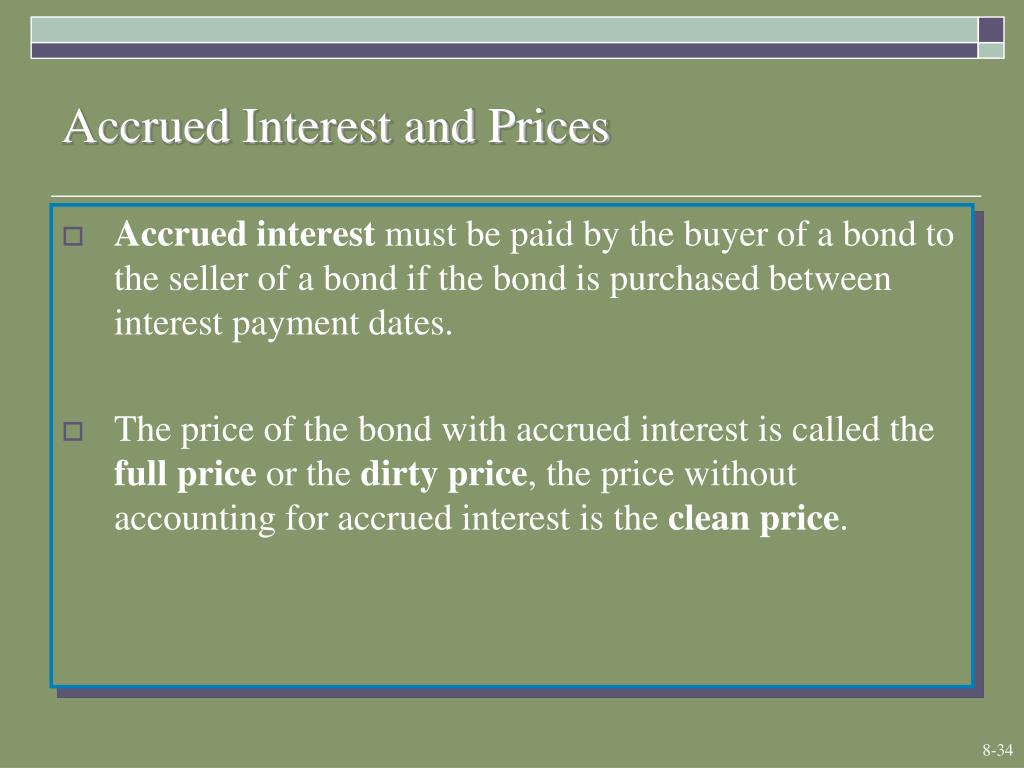

A market discount occurs when a bond is purchased for less than its face value in the secondary market. This can happen for several reasons, including rising interest rates, which make older bonds with lower coupon rates less attractive. The accrued market discount is the portion of the market discount that has economically accrued since the bond was purchased.

It is essentially the increase in value that the bond has experienced over time as it approaches its maturity date and gets closer to its face value. This accrual is not necessarily realized in cash until the bond is sold or matures.

How is Accrued Market Discount Calculated?

Calculating the accrued market discount involves several steps. First, you need to determine the total market discount, which is the difference between the bond's face value and the purchase price.

The method for calculating the accrued portion depends on whether the discount is considered de minimis. De minimis market discount is a small discount determined by IRS guidelines. If the discount is not de minimis, the investor must use the constant yield method to determine the accrued amount.

The constant yield method is more complex, requiring the calculation of the bond's yield to maturity (YTM) and applying that yield over time to determine the accrual. While precise calculations often require financial calculators or software, the basic principle is to allocate the discount proportionally over the remaining life of the bond based on its yield.

Impact on Gain or Loss

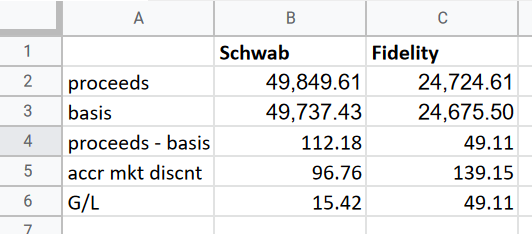

The accrued market discount plays a crucial role in determining the capital gain or loss when a bond is sold. When a bond subject to market discount is sold, the portion of the gain attributable to the accrued market discount is generally treated as ordinary income, rather than a capital gain.

This distinction is significant because ordinary income is typically taxed at a higher rate than capital gains. Therefore, understanding the accrued market discount can help investors anticipate their tax obligations more accurately.

For instance, if an investor buys a bond at a discount of $100 and sells it for $50 more than their purchase price, and $30 of that $50 gain is attributed to accrued market discount, that $30 will be taxed as ordinary income. The remaining $20 would be treated as a capital gain.

Election to Include Accrued Market Discount Currently

Investors have the option to elect to include the accrued market discount in their taxable income each year, rather than deferring it until the bond is sold or matures. This election can be beneficial in certain situations, such as when an investor anticipates being in a higher tax bracket in the future.

By including the accrued market discount currently, the investor spreads out the tax liability over time. This can potentially result in lower overall taxes paid, depending on their individual circumstances.

Reporting Accrued Market Discount

Proper reporting of accrued market discount is essential for tax compliance. Investors must accurately track the amount of accrued market discount each year and report it on their tax returns. This typically involves using IRS Form 1099-OID, which brokers are required to provide to investors.

It is imperative to maintain detailed records of bond purchases, sales, and any associated market discount calculations to support the information reported on tax forms. Consulting with a tax professional is often advisable to ensure accurate reporting and compliance with tax regulations.

Significance for Investors

The significance of accrued market discount lies in its ability to impact the after-tax return on bond investments. By understanding how it is calculated and taxed, investors can make more informed decisions about bond selection and portfolio management.

Failure to account for the accrued market discount can lead to an overestimation of investment returns and potentially unexpected tax liabilities. Therefore, investors should carefully consider this factor when evaluating bond investments.

Furthermore, comprehending the tax implications of accrued market discount is crucial for effective tax planning. Investors can strategize to minimize their tax burden by timing bond sales appropriately and considering the election to include accrued market discount currently.

Conclusion

The accrued market discount is a critical element in the landscape of bond investing. It affects the calculation of gains and losses, and impacts tax liabilities.

Investors who take the time to understand its nuances can improve their investment decision-making and achieve better financial outcomes. Seeking professional advice from financial advisors and tax professionals is always a prudent step to ensure proper understanding and implementation of these concepts.