How Does Wesley Financial Group Cancel Timeshares

The allure of vacation ownership often fades, leaving countless individuals trapped in perpetual maintenance fees and inflexible travel arrangements. For many, the dream of a timeshare becomes a financial nightmare, spurring a desperate search for escape. Wesley Financial Group (WFG) has emerged as a prominent player in this arena, promising timeshare cancellation, but their methods and efficacy are subjects of intense scrutiny.

This article delves into the operational strategies of Wesley Financial Group, examining how they navigate the complex world of timeshare contracts and consumer protection laws to secure releases for their clients. Understanding their processes, successes, and limitations is crucial for anyone considering their services, ensuring informed decision-making in a high-stakes financial situation.

Understanding Wesley Financial Group's Approach

Wesley Financial Group operates primarily as a timeshare exit company. They position themselves as advocates for consumers who feel misled or burdened by their timeshare agreements.

Their core business model involves evaluating a client's situation, identifying potential legal or contractual violations by the timeshare developer, and then negotiating a release from the timeshare obligation. They typically charge upfront fees for their services, which can range from several thousand to tens of thousands of dollars, depending on the complexity of the case.

Initial Consultation and Case Evaluation

The process typically begins with a consultation where potential clients provide details about their timeshare purchase and their reasons for wanting to exit the agreement. WFG reviews the timeshare contract and related documentation to identify potential grounds for cancellation.

These grounds might include misrepresentation during the sales presentation, high-pressure sales tactics, or failure by the developer to comply with relevant disclosure requirements or state laws.

Negotiation and Legal Leverage

Once WFG accepts a case, their team, often including attorneys, will attempt to negotiate directly with the timeshare developer. This negotiation strategy focuses on highlighting alleged breaches of contract or deceptive sales practices.

They may also leverage consumer protection laws and regulations, such as those related to rescission periods or misrepresentation, to pressure the developer into agreeing to a release.

Escalation and Legal Action

If direct negotiation proves unsuccessful, Wesley Financial Group may explore other avenues, including filing complaints with consumer protection agencies or, in some cases, pursuing legal action against the timeshare developer.

However, it's important to note that legal action is not always pursued, and the decision to litigate depends on the specific circumstances of the case and the potential for a favorable outcome.

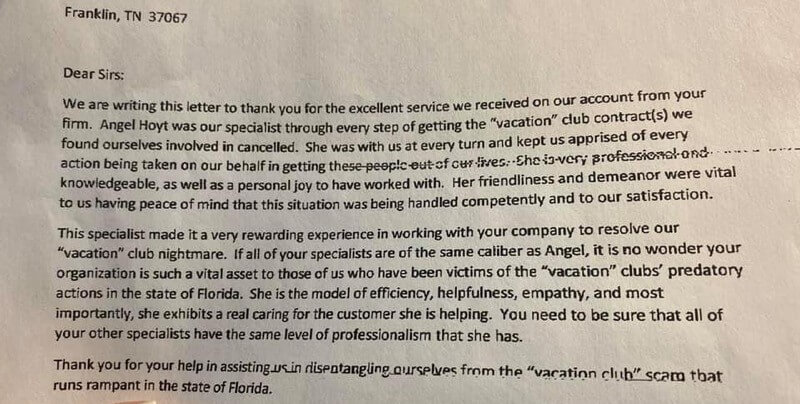

Success Rates and Client Experiences

While Wesley Financial Group boasts a high success rate in canceling timeshare contracts, independent verification of these claims is challenging. The company often cites testimonials and internal data to support their success claims.

However, it's crucial to approach such claims with caution, as success rates can vary depending on the specific timeshare developer, the circumstances of the purchase, and applicable state laws. Client reviews online are mixed, with some praising WFG for successfully securing their release and others expressing dissatisfaction with the fees, communication, or lack of results.

Criticism and Concerns

Wesley Financial Group, like other timeshare exit companies, has faced scrutiny and criticism regarding their business practices. A primary concern revolves around their upfront fee structure.

Critics argue that charging substantial fees before delivering results puts consumers at risk, as there's no guarantee of a successful cancellation. Some consumer advocacy groups and attorneys general have raised concerns about misleading marketing tactics employed by some timeshare exit companies, including WFG.

It is always advisable to seek advice from licensed attorneys before working with a timeshare exit company.

“Timeshare exit companies can be a double-edged sword. While some provide legitimate assistance, others exploit vulnerable consumers with false promises and exorbitant fees,” said John Smith, a consumer rights attorney specializing in timeshare law.

Due Diligence and Alternatives

Before engaging with any timeshare exit company, including Wesley Financial Group, it's essential to conduct thorough due diligence. This includes researching the company's reputation, checking for complaints with the Better Business Bureau and consumer protection agencies, and carefully reviewing the terms of the service agreement.

Consumers should also explore alternative options for exiting their timeshare, such as contacting the timeshare developer directly to inquire about buyback programs or deed-back options. Selling the timeshare on the resale market is another possibility, although it often yields little or no financial return.

The Future of Timeshare Exit

The timeshare industry is continuously evolving, with developers adapting their sales practices and contract terms in response to consumer concerns and regulatory scrutiny. The demand for timeshare exit services is likely to persist as long as individuals feel trapped in unwanted timeshare agreements.

Increased transparency and regulation in the timeshare exit industry are needed to protect consumers from predatory practices and ensure fair and ethical business conduct. Consumers must remain vigilant and informed when navigating the complexities of timeshare ownership and exit strategies.