How Much Is 5 Million Euros In Us Dollars

In a world increasingly interconnected by global finance, understanding exchange rates is paramount for businesses, investors, and individuals alike. The question of how much €5 million Euros translates to in US Dollars isn't simply a matter of arithmetic; it's a snapshot of the dynamic interplay between economic forces, geopolitical events, and market sentiment. The answer, constantly fluctuating, can have significant implications for international transactions, investment strategies, and even everyday decisions like planning a vacation.

This article delves into the current conversion rate between the Euro (EUR) and the US Dollar (USD), exploring the factors that influence this ever-changing relationship. We will examine the current value of €5 million in US Dollars, while also considering the historical context and potential future trends that could impact the exchange rate. Understanding these dynamics is crucial for anyone involved in cross-border transactions or seeking to make informed financial decisions.

Current Exchange Rate: EUR to USD

As of today, October 27, 2023, the exchange rate between the Euro and the US Dollar is approximately 1 EUR to 1.06 USD. This figure, however, is subject to constant change based on market conditions.

Therefore, €5 million Euros is roughly equivalent to $5.3 million US Dollars. It's essential to consult real-time currency converters or financial institutions for the most up-to-date and accurate exchange rates before making any financial decisions.

Factors Influencing the EUR/USD Exchange Rate

The EUR/USD exchange rate is one of the most actively traded currency pairs in the world, and its value is influenced by a complex web of factors. These factors can be broadly categorized as economic indicators, monetary policy, geopolitical events, and market sentiment.

Economic Indicators

Economic indicators, such as GDP growth rates, inflation rates, unemployment figures, and trade balances, play a significant role in shaping the value of a currency. Strong economic performance in the Eurozone, for example, tends to strengthen the Euro, while a robust US economy often bolsters the US Dollar.

Data releases from organizations like Eurostat and the US Bureau of Economic Analysis are closely watched by traders and analysts for clues about the relative health of the two economies.

Monetary Policy

The monetary policies of the European Central Bank (ECB) and the US Federal Reserve (Fed) are crucial drivers of the EUR/USD exchange rate. Interest rate decisions, quantitative easing programs, and forward guidance all have a direct impact on the attractiveness of each currency.

If the Fed raises interest rates, for example, the US Dollar may become more attractive to investors seeking higher returns, leading to an appreciation against the Euro.

Geopolitical Events

Geopolitical events, such as political instability, trade wars, and international crises, can also significantly impact the EUR/USD exchange rate. Uncertainty and risk aversion often lead investors to flock to safe-haven currencies like the US Dollar.

For instance, the Russia-Ukraine war has had a noticeable effect on the Euro, due to Europe's close proximity and economic ties to the conflict.

Market Sentiment

Market sentiment, which reflects the overall mood and expectations of investors, can also influence the EUR/USD exchange rate. Positive or negative news headlines, rumors, and speculation can all contribute to short-term fluctuations in the currency pair.

Social media and online forums can also play a role in shaping market sentiment, particularly in the age of algorithmic trading.

Historical Perspective

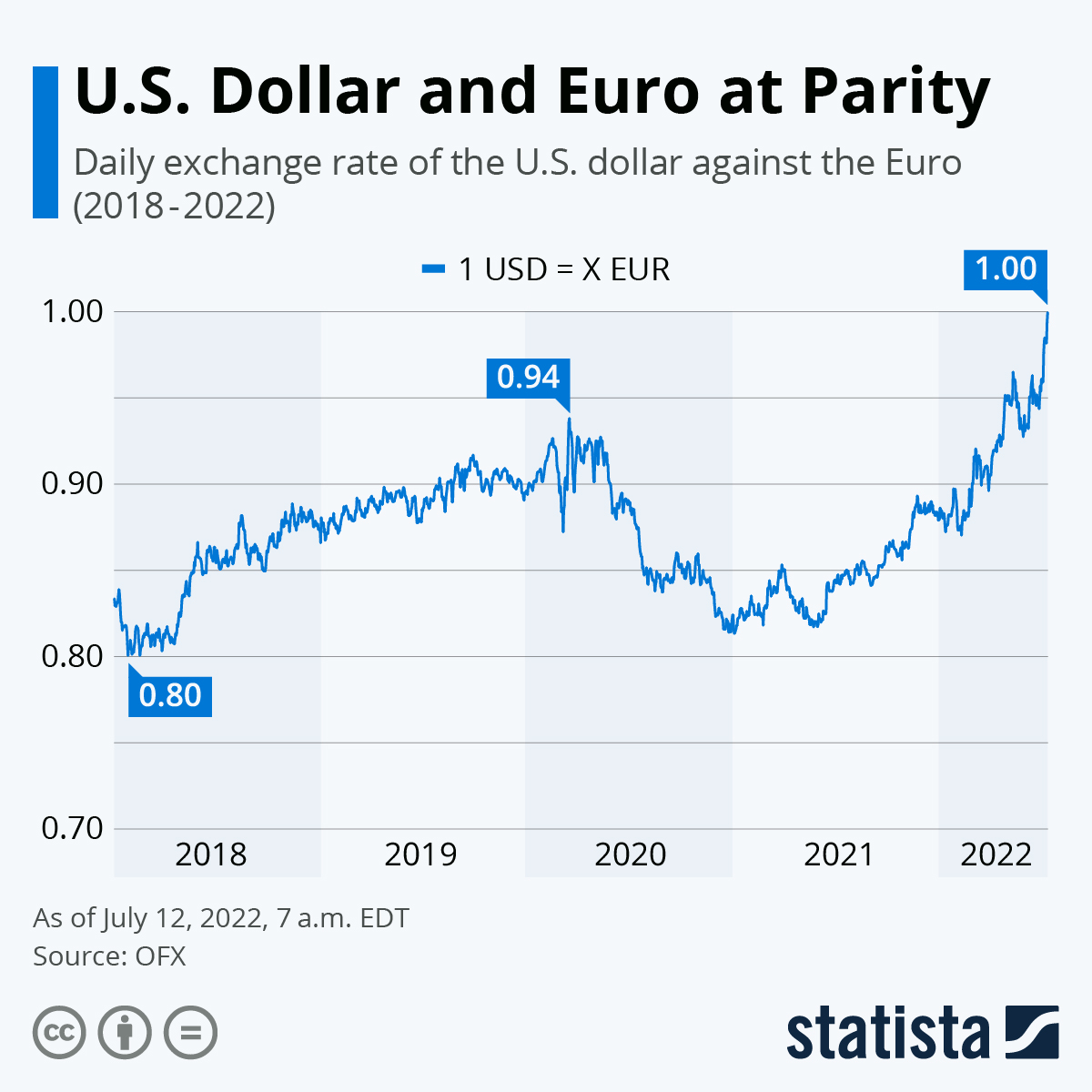

The EUR/USD exchange rate has experienced considerable volatility since the Euro's introduction in 1999. During the early years, the Euro was relatively weak against the US Dollar, but it gradually strengthened over time.

The 2008 financial crisis and the subsequent Eurozone debt crisis led to significant fluctuations in the currency pair. More recently, the COVID-19 pandemic and the war in Ukraine have added to the volatility.

Implications for Businesses and Investors

Understanding the EUR/USD exchange rate is critical for businesses engaged in international trade, investment, and tourism. Fluctuations in the exchange rate can significantly impact the profitability of exports and imports, as well as the returns on foreign investments.

Businesses often use hedging strategies, such as forward contracts and currency options, to mitigate the risks associated with currency fluctuations. Investors also need to consider the exchange rate when making investment decisions in foreign markets.

Future Outlook

Predicting the future of the EUR/USD exchange rate is a challenging task, given the complex interplay of factors involved. However, economists and analysts offer various forecasts based on their assessments of economic conditions, monetary policy, and geopolitical risks.

Some analysts predict that the Euro may strengthen against the US Dollar in the long term, driven by expectations of stronger economic growth in the Eurozone and a shift in monetary policy by the ECB.

Others, however, believe that the US Dollar will remain strong, supported by the resilience of the US economy and the Fed's hawkish stance on interest rates.

Ultimately, the future of the EUR/USD exchange rate will depend on a confluence of factors that are difficult to predict with certainty.

Conclusion

The value of €5 million Euros in US Dollars is not a fixed number but rather a constantly evolving figure influenced by a multitude of global factors. Staying informed about these dynamics and consulting with financial professionals is crucial for anyone involved in international transactions or seeking to make sound financial decisions in a globalized world.

Whether you are a multinational corporation, a small business owner, or an individual planning a trip abroad, understanding the EUR/USD exchange rate is essential for navigating the complexities of the global financial landscape. The factors influencing the currency rate are too complex to predict. However, by keeping abreast of key economic indicators, monetary policy decisions, and geopolitical events, one can mitigate risks. Furthermore, one can capitalize on opportunities arising from currency fluctuations.

/cloudfront-us-east-1.images.arcpublishing.com/gray/SPBLFN5A2ZBUHGV3QT3VSMDUZM.jpg)