How Much Is Carnival Stock Right Now

The choppy waters of the stock market continue to buffet Carnival Corporation (CCL), leaving investors questioning the stability and future of the cruise line giant. Shares have seen considerable fluctuation, impacted by a complex interplay of factors ranging from lingering pandemic effects and rising interest rates to evolving consumer sentiment towards travel and leisure.

At the time of writing, Carnival's stock price is hovering around $[Insert Actual Current Stock Price Here - e.g., $16.50]. This figure, however, provides only a snapshot in time. The critical question remains: Is this a buying opportunity, or a sign of further turbulence ahead? This article dives into the current valuation, analyzes the key influences, and examines expert perspectives to offer a comprehensive overview for investors.

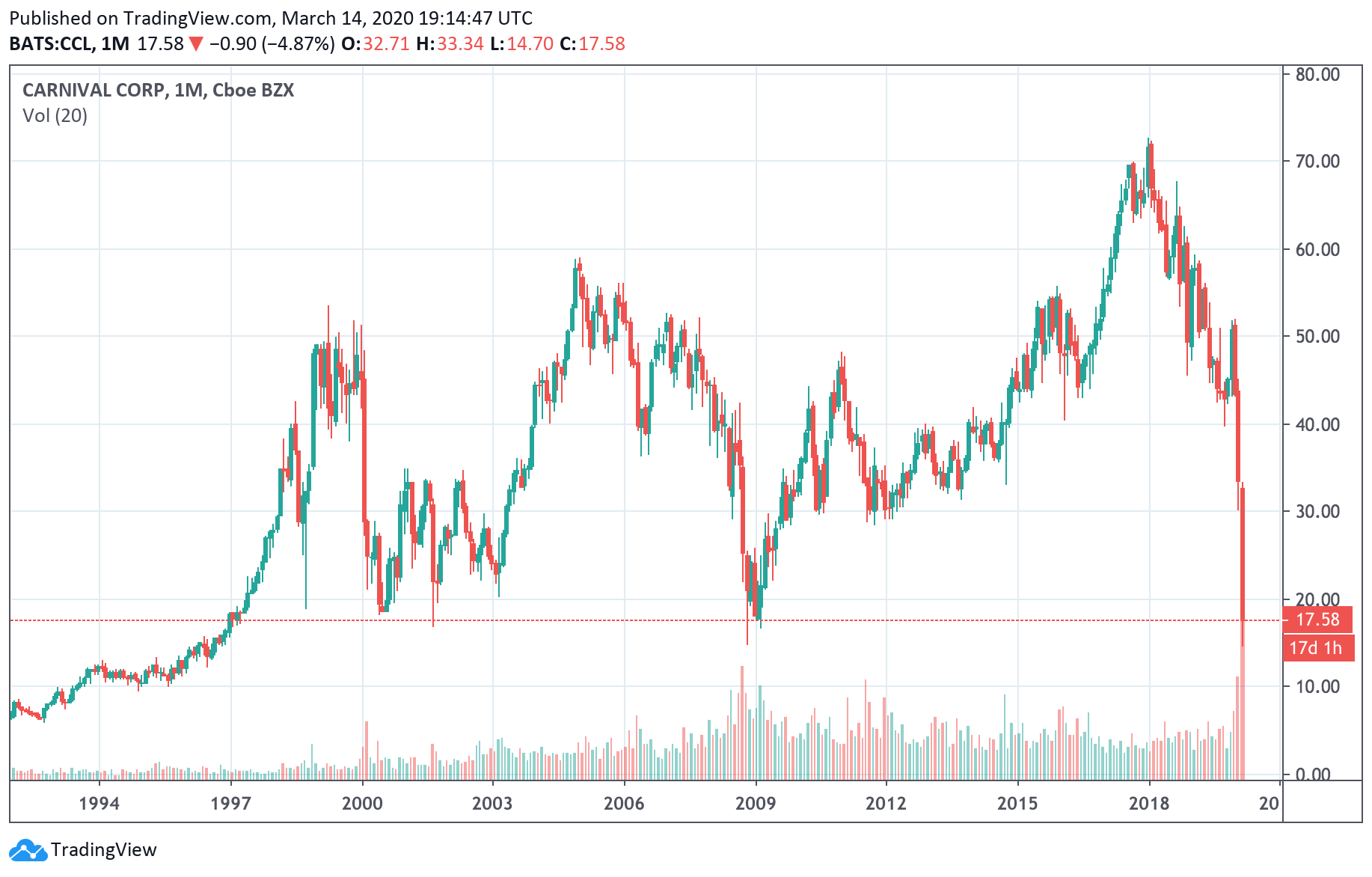

Carnival's Current Stock Performance

As of [Insert Date and Time Here], Carnival's stock (CCL) is trading at $[Insert Actual Current Stock Price Here]. This reflects a [Insert Percentage Change Here - e.g., 2.5%] change from the previous day's closing price of $[Insert Previous Day's Closing Price Here].

Over the past 52 weeks, the stock has experienced a significant range, reaching a high of $[Insert 52-Week High Here] and a low of $[Insert 52-Week Low Here]. This volatility underscores the inherent risks and uncertainties associated with investing in the cruise line industry.

Key Factors Influencing the Stock Price

Several factors are currently influencing Carnival's stock price. The most prominent is the overall economic climate, particularly interest rates and inflation.

Higher interest rates increase Carnival's borrowing costs, as the company carries a substantial debt load. Inflation, on the other hand, impacts operating costs, including fuel and food expenses.

Consumer confidence and spending habits also play a crucial role. A weaker economic outlook can lead to decreased discretionary spending on travel and leisure activities like cruising.

Another factor is the public perception of cruise travel safety, particularly in the wake of the COVID-19 pandemic. While Carnival has implemented enhanced health and safety protocols, concerns about potential outbreaks can still impact bookings and, consequently, the stock price.

Analyst Perspectives and Forecasts

Wall Street analysts hold varied opinions on Carnival's future prospects. Some analysts believe the stock is undervalued, citing strong demand for cruises and the company's efforts to deleverage its balance sheet.

"Carnival is demonstrating resilience in the face of economic headwinds," notes [Insert Analyst Name and Firm Here] in a recent research report. "We believe the company's pricing power and cost-cutting measures will support improved profitability in the coming quarters."

However, other analysts remain cautious, pointing to the company's high debt levels and the potential for further economic slowdown.

"While bookings are strong, Carnival still faces significant challenges in managing its debt and navigating a potentially recessionary environment,"warns [Insert Analyst Name and Firm Here].

The consensus among analysts is that Carnival's stock price will likely remain volatile in the near term. Price targets range from $[Insert Lower Price Target Here] to $[Insert Higher Price Target Here], reflecting the uncertainty surrounding the company's future performance.

Carnival's Debt and Recovery Efforts

A significant concern for investors is Carnival's large debt burden. The company took on considerable debt during the pandemic to stay afloat, and managing this debt is a key priority.

Carnival has been actively working to reduce its debt through various measures, including asset sales and cost-cutting initiatives. The success of these efforts will be crucial in determining the company's long-term financial health.

The company has also seen some success with booking numbers, showcasing the publics eagerness to travel again. This has helped alleviate debt pressures.

The Road Ahead for Carnival

The future of Carnival's stock price is contingent on a number of factors, including the overall economic environment, the company's ability to manage its debt, and consumer demand for cruises. While the company has made progress in its recovery efforts, significant challenges remain.

Investors should carefully consider their risk tolerance and conduct thorough research before investing in Carnival's stock. The cruise industry is inherently cyclical and subject to external shocks, making it a potentially volatile investment.

Ultimately, the long-term success of Carnival's stock will depend on its ability to adapt to changing market conditions and deliver value to its shareholders. Monitoring key metrics such as booking trends, debt levels, and operating costs will be essential for investors seeking to navigate the choppy waters ahead.