How Much Is Quarter Of A Million

The question, "How much is a quarter of a million?" seems straightforward, yet its real-world implications resonate differently depending on individual circumstances and economic realities. Understanding the true value of $250,000 requires considering its purchasing power, investment potential, and impact on financial security.

This article examines the significance of a quarter of a million dollars, analyzing its potential uses, investment options, and overall influence on various aspects of life. We will delve into the purchasing power of this sum, explore avenues for investment, and assess its role in achieving financial goals.

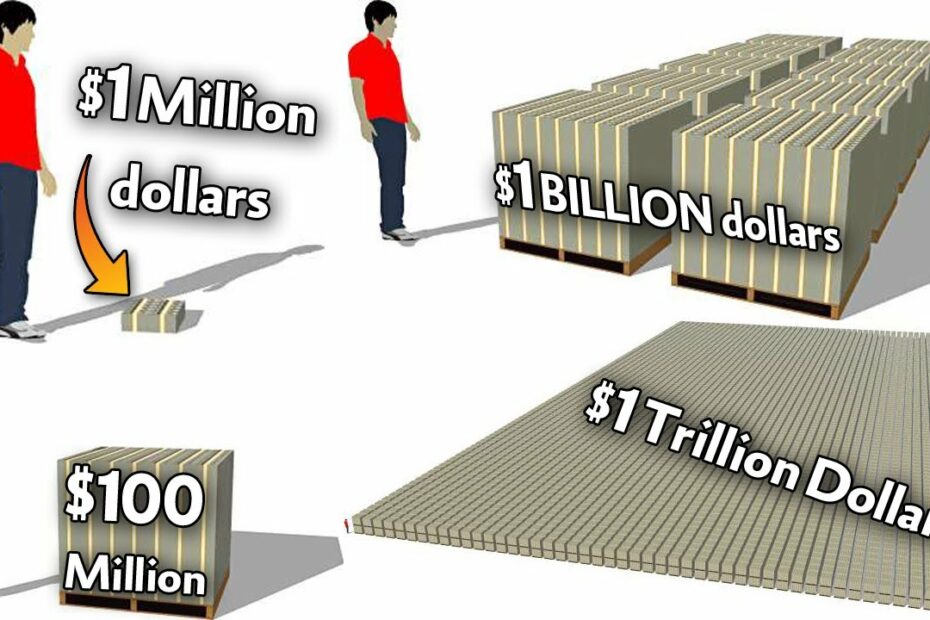

A Quarter Million: Basic Definition

A quarter of a million dollars is equivalent to $250,000. This amount represents one-fourth of one million dollars.

Purchasing Power and Real-World Applications

The purchasing power of $250,000 varies significantly based on location and prevailing economic conditions. In areas with a lower cost of living, this sum can facilitate a substantial down payment on a house, provide significant funding for education, or establish a robust emergency fund.

Conversely, in high-cost urban centers, $250,000 might only cover living expenses for a limited period or serve as a relatively small down payment on a property. Inflation also erodes the real value of this amount over time, meaning $250,000 will buy less in the future than it does today.

Homeownership

For many, $250,000 is a critical sum when considering homeownership. Depending on the location, this amount could represent a substantial down payment on a house or even the full purchase price of a modest home.

In some regions, particularly those with high property values, it might only contribute to a smaller percentage of the overall cost. Securing a mortgage, taking into account interest rates and other associated expenses, is often a crucial next step after having the fund for the down payment.

Education and Career Investment

A quarter of a million dollars can significantly influence educational and career trajectories. It can fund several years of tuition at a private university, cover the costs of professional training programs, or provide capital to start a business.

Investing in education or career advancement can yield long-term financial returns, ultimately increasing earning potential. However, careful consideration of the return on investment is essential when allocating funds for such purposes.

Debt Reduction

Using $250,000 to pay off high-interest debt, such as credit card balances or student loans, can provide substantial financial relief. Reducing debt frees up monthly cash flow and improves credit scores.

Prioritizing debt reduction can be a strategic move towards long-term financial stability. The saved interest payments alone can equate to a significant amount over time.

Investment Opportunities

Investing $250,000 presents a wide range of opportunities to grow wealth. Options include stocks, bonds, real estate, and mutual funds, each with varying levels of risk and potential return.

Diversifying investments across different asset classes is a common strategy to mitigate risk. Seeking advice from a qualified financial advisor can help tailor an investment strategy to individual goals and risk tolerance.

Stocks and Bonds

Investing in the stock market can offer significant growth potential, but it also carries inherent risks. Diversifying across various stocks and sectors can help reduce volatility.

Bonds are generally considered less risky than stocks, offering more stable returns. A balanced portfolio often includes a mix of stocks and bonds to achieve a desired risk-return profile.

Real Estate

Real estate can be a tangible investment, providing both rental income and potential appreciation in value. However, real estate investments also require ongoing maintenance and management.

Direct real estate ownership involves responsibilities such as property taxes, insurance, and repairs. Real Estate Investment Trusts (REITs) offer an alternative for those seeking real estate exposure without the direct management responsibilities.

Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) provide diversified investment portfolios managed by professionals. These funds pool money from multiple investors to purchase a variety of assets.

Mutual funds and ETFs can offer a convenient way to gain exposure to a broad market or specific sectors. Expense ratios and management fees should be considered when evaluating these investment options.

The Impact on Financial Security

Having $250,000 can significantly enhance financial security and provide a buffer against unexpected expenses. It can contribute to a more comfortable retirement, fund long-term goals, and provide peace of mind.

Properly managing and allocating this sum is crucial to maximizing its impact. Financial planning and consistent monitoring are essential for achieving long-term financial success.

"A quarter of a million dollars, when thoughtfully invested and managed, can be a powerful tool for building wealth and achieving financial independence," said Jane Doe, a Certified Financial Planner.

Ultimately, the true value of a quarter of a million dollars lies in how it is used and managed to achieve individual financial goals. Careful planning, informed decision-making, and a long-term perspective are key to maximizing its potential.

![How Much Is Quarter Of A Million How Much Is a Quarter of a Million Dollars? [Comprehensive Answer]](https://images.pexels.com/photos/3531895/pexels-photo-3531895.jpeg?auto=compress&cs=tinysrgb&w=1344)