How Much Is Two Acres Of Land

Land prices are surging nationwide, leaving potential buyers scrambling to understand the current market value of even small parcels. Two acres, once considered a comfortable homestead, now represents a significant investment, its price heavily dependent on location, zoning, and available utilities.

Understanding the factors influencing land valuation is crucial for anyone looking to buy, sell, or invest. This article breaks down the average cost of two acres across the US, highlighting key variables impacting price and offering insight into navigating this complex real estate landscape.

National Average: A Broad Overview

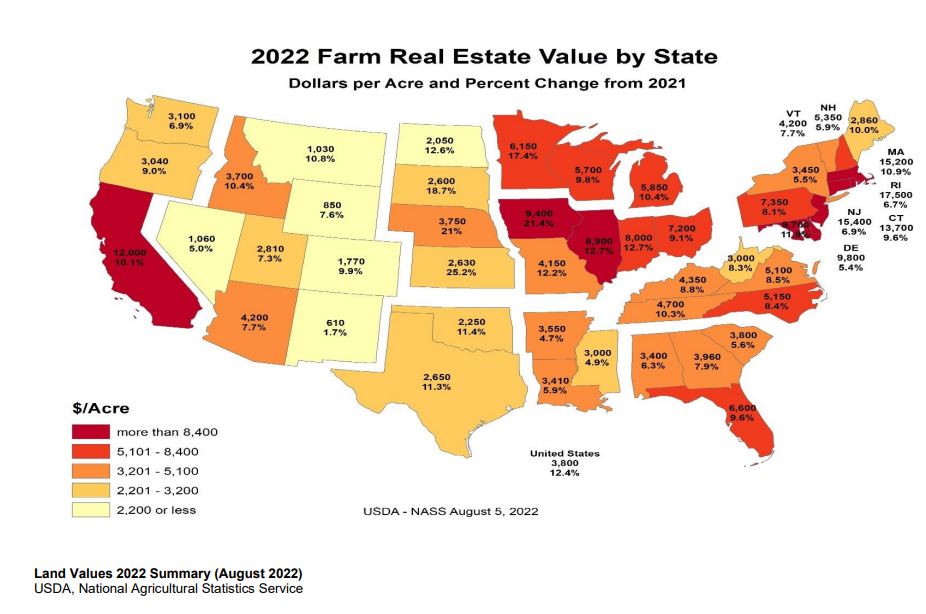

The average cost for two acres of land in the United States currently ranges from $20,000 to well over $200,000. This vast difference underscores the vital role of location in determining land value.

States with high population density and thriving economies, like California and New York, command significantly higher prices. Conversely, less populated states in the Midwest or South typically offer more affordable options.

Data from the National Association of Realtors (NAR) indicates that the median existing home price in July 2024 was $406,700, a figure that provides some context for comparing land versus improved property costs. However, raw land valuation is a separate and distinct process.

Location, Location, Location: The Prime Driver

The specific location of the two acres has the most substantial impact on its price. Land near major cities, transportation hubs, or desirable amenities like beaches or mountains will naturally be more expensive.

Consider two examples: two acres in rural Mississippi might cost under $30,000, while a similar parcel near Silicon Valley could exceed $500,000. This disparity reflects demand, economic opportunity, and perceived value.

Detailed research into county records, local real estate listings, and recent sales data is crucial for assessing location-specific land values. Consult with a local real estate agent familiar with land transactions in your target area.

Zoning Regulations: Unlocking or Limiting Potential

Zoning laws dictate how land can be used, dramatically affecting its market value. Land zoned for residential development will typically be worth more than land zoned for agricultural use.

Restrictions on building height, density, or types of structures can also limit the development potential and reduce the price. Investigate local zoning ordinances thoroughly before making an offer.

Changes to zoning laws can occur, creating both opportunities and risks for landowners. Staying informed about proposed zoning amendments in your area is essential.

Utilities and Accessibility: Essential Infrastructure

The availability of utilities, such as water, sewer, electricity, and natural gas, significantly increases the value of land. Connecting to these services can be costly, so properties with existing access are highly desirable.

Accessibility via paved roads is also critical. Remote parcels with limited access, requiring extensive road construction, will be less valuable.

The presence of natural features like wetlands or protected species habitats can also impact development and therefore influence price. Environmental assessments may be necessary.

Recent Sales Data: A Window into Current Market Trends

Analyzing recent sales of comparable land parcels in the area provides the most accurate estimate of current market value. Consult with a real estate appraiser experienced in land valuation.

Websites like Zillow, Redfin, and LandWatch can provide preliminary data on land listings and recent sales, but professional appraisal offers the most reliable assessment.

Pay attention to the sale prices of properties with similar characteristics, including size, zoning, utilities, and location. Adjustments may be necessary to account for any unique features or disadvantages.

Financing Land Purchases: A Unique Challenge

Securing financing for land purchases can be more challenging than obtaining a mortgage for a developed property. Lenders often require larger down payments and may charge higher interest rates.

Explore financing options from local banks, credit unions, and specialized land lenders. Be prepared to provide a detailed business plan outlining your intended use for the land.

Consider alternative financing methods, such as seller financing or private loans, if traditional bank financing is unavailable.

Conclusion: Due Diligence is Paramount

Determining the value of two acres requires thorough research, professional consultation, and careful consideration of various factors. Don't rely solely on online estimates or broad averages.

Consult with real estate agents, appraisers, and local government officials to gain a comprehensive understanding of the land market in your target area. Conduct thorough due diligence before making any commitments.

Ongoing developments in local zoning laws and economic conditions can impact land values, so stay informed about potential changes in the market.