How Much Should Owner Pay Themselves

The question of owner compensation remains a persistent challenge for small business owners and entrepreneurs, navigating the precarious balance between personal financial security and reinvestment in their ventures. Striking the right chord is crucial, not only for immediate financial stability but also for long-term business sustainability and growth. Underpay yourself, and you risk personal financial strain; overpay, and you jeopardize your company's capital reserves.

At the heart of this complex issue is the need to determine a fair and sustainable salary that reflects the owner’s contributions, the business’s financial health, and future growth prospects. This article delves into the intricate factors that business owners must consider when deciding how much to pay themselves, drawing from expert opinions and industry data to offer a comprehensive guide.

Understanding the Factors Involved

Several key elements influence the optimal owner's compensation strategy. These considerations span from industry benchmarks and financial performance to legal structures and tax implications.

Industry Benchmarks and Market Rates

Researching industry standards for similar roles is a crucial starting point. Associations like the Small Business Administration (SBA) and resources like Salary.com can provide valuable insights into typical salaries for positions comparable to the owner's responsibilities within the same sector and geographical location.

However, context is key. A CEO of a tech startup in Silicon Valley will naturally command a different compensation package than the owner of a local bakery in a rural town.

Business Financial Performance

Profitability and cash flow are paramount. It's imperative to assess what the business can realistically afford without hindering its operational capabilities and future investments.

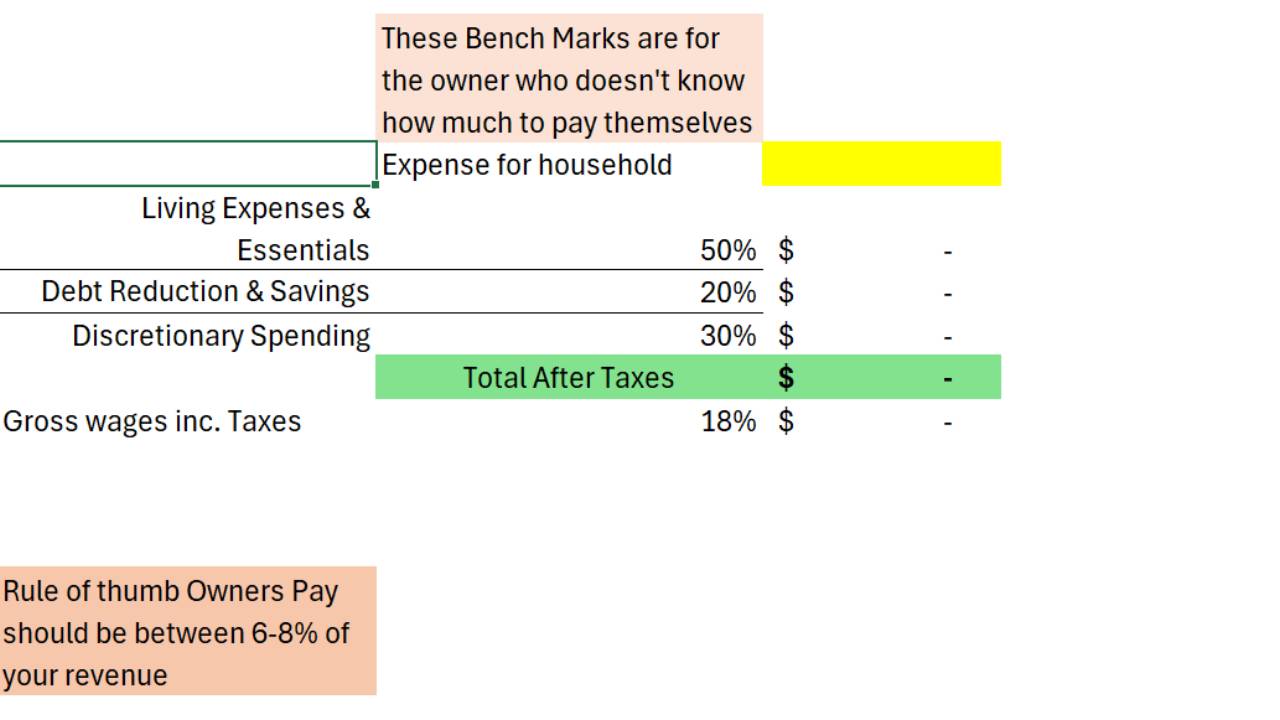

According to data from accounting firms, a common rule of thumb suggests that owner's draw should not exceed a certain percentage of the company's net profit – a figure that varies based on industry and stage of growth.

Legal Structure and Tax Implications

The business's legal structure (sole proprietorship, partnership, LLC, S-corp, or C-corp) significantly impacts how owners can compensate themselves and the associated tax consequences.

For instance, owners of S-corporations often take a salary (subject to employment taxes) and then distributions (potentially subject to lower tax rates). Understanding these nuances is critical for optimizing tax efficiency.

Owner's Role and Responsibilities

Consider the actual work performed by the owner. Are they actively involved in daily operations, or are they primarily focused on strategic oversight?

An owner who dedicates significant time and effort to revenue-generating activities deserves a higher compensation than someone who takes a more hands-off approach.

Different Compensation Strategies

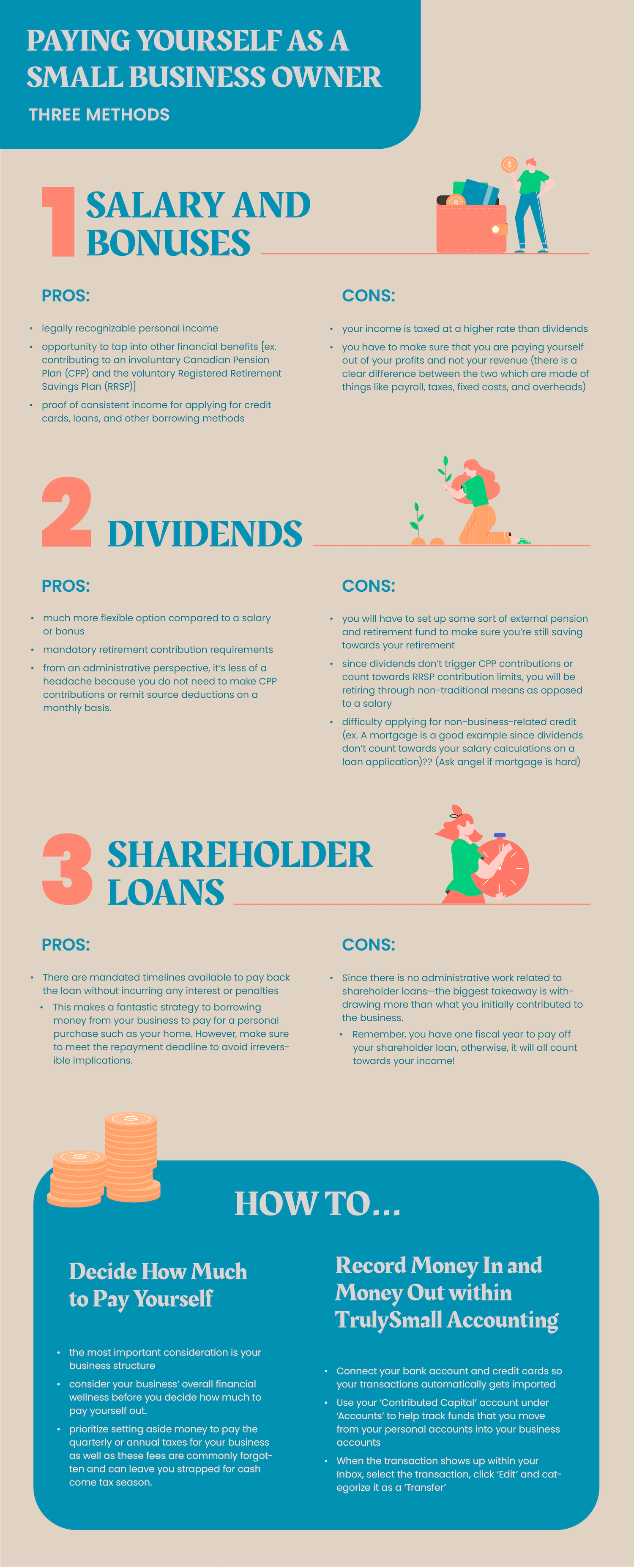

There's no one-size-fits-all approach to owner compensation. Several strategies can be employed, each with its advantages and disadvantages.

Salary Plus Bonus

A fixed salary provides predictable income, while a bonus structure ties compensation to the company's performance. This motivates owners to drive growth and profitability.

The bonus amount can be determined by pre-defined metrics, such as revenue targets or profit margins.

Owner's Draw

Common for sole proprietorships and partnerships, an owner's draw allows the owner to withdraw funds from the business as needed. However, it can be less structured and potentially lead to overspending if not managed carefully.

It’s important to maintain accurate records of all withdrawals for tax purposes.

Profit Sharing

In this model, a percentage of the company's profits is distributed to the owner (and potentially other employees) based on a pre-determined formula. This aligns the owner's interests with the company's overall success.

Profit sharing can also be an effective way to attract and retain talent.

Expert Perspectives

Financial advisors emphasize the importance of creating a budget that separates personal and business finances. This helps to avoid the temptation of dipping into business funds for personal expenses and ensures that the business has sufficient capital for growth.

Business consultants often recommend establishing clear financial goals and developing a compensation plan that aligns with those goals. They also stress the need for regular financial reviews to assess the effectiveness of the compensation strategy and make adjustments as needed.

Looking Ahead

Determining the right owner’s compensation is an ongoing process that requires careful consideration of various factors and a willingness to adapt to changing circumstances.

As the business evolves, the owner's role may change, the financial landscape may shift, and new opportunities may arise.

By regularly reviewing and adjusting the compensation strategy, owners can ensure that they are fairly compensated for their contributions while also positioning their businesses for long-term success. Consulting with financial professionals and staying informed about industry trends are vital for making informed decisions and navigating the complexities of owner compensation.

![How Much Should Owner Pay Themselves How Much Do Startup Founders Pay Themselves? [2024]](https://d1pnnwteuly8z3.cloudfront.net/images/177302d9-3657-45b7-ac9d-acf801d83a74/9b074d94-5da5-400d-b8bf-ecb9519b5338.png)