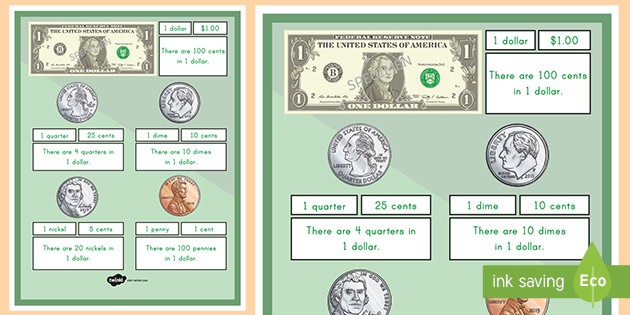

25 Cents On The Dollar Meaning

Distress signals are flashing across the financial landscape as investors grapple with the stark reality: "25 cents on the dollar" – a phrase now synonymous with significant loss and potential collapse.

This term signifies receiving only a quarter of the originally invested or owed amount, typically in scenarios like bankruptcy, distressed asset sales, or debt restructuring. The immediate implications for stakeholders are severe, demanding swift action and careful navigation.

Understanding the Dire Meaning

The phrase "25 cents on the dollar" starkly illustrates the magnitude of financial distress.

It means that for every dollar invested or loaned, creditors and investors will only recover 25 cents.

This represents a 75% loss, highlighting the severity of the financial situation.

Bankruptcy Proceedings

Bankruptcy is often the backdrop for this unfavorable return.

When a company or individual declares bankruptcy, assets are liquidated to repay debts.

Secured creditors are usually paid first, leaving unsecured creditors and equity holders to fight over the remaining scraps, often resulting in minimal recovery.

For instance, in a hypothetical bankruptcy case, unsecured creditors might only receive 25 cents on the dollar due to the limited assets available.

Distressed Asset Sales

Distressed asset sales are another common scenario.

Companies facing financial difficulties may sell assets at significantly reduced prices to raise immediate capital.

Buyers are only willing to pay a fraction of the asset's original value, reflecting the urgent need for the seller to offload the asset.

Example: A real estate developer facing insolvency might sell properties for 25 cents on the dollar to avoid foreclosure, accepting a massive loss to secure immediate cash flow.

Debt Restructuring

Debt restructuring involves renegotiating the terms of a loan to make it more manageable for the borrower.

In extreme cases, creditors may agree to accept significantly less than the full amount owed to avoid a complete default.

This often manifests as creditors agreeing to receive 25 cents on the dollar, a painful but necessary concession.

According to a 2023 report by S&P Global, distressed exchanges, where creditors receive less than the original value of their debt, have become increasingly common.

In some instances, creditors have accepted settlements that translate to a recovery rate of approximately 25 cents on the dollar, indicating widespread financial stress.

Recent Examples and Implications

While specific recent cases may be subject to non-disclosure agreements, the implications of such low recovery rates are universal.

Investors experience significant losses, potentially impacting portfolios and retirement savings.

Creditors face reduced profitability and increased risk assessments for future lending.

The ripple effects extend to the broader economy, potentially leading to reduced investment and slower growth.

Companies facing similar financial challenges may be hesitant to invest or expand, fearing the same fate.

This creates a climate of uncertainty and caution.

Navigating the Fallout

For investors facing this situation, diversification is crucial.

Spreading investments across different asset classes can mitigate the impact of losses from any single investment.

Seeking professional financial advice is also highly recommended to navigate complex bankruptcy or restructuring proceedings.

Creditors must carefully assess the risk profiles of borrowers and implement robust due diligence procedures.

Negotiating favorable terms and securing collateral can help minimize potential losses in the event of financial distress.

Early intervention and proactive communication with borrowers are also essential.

Next Steps and Ongoing Developments

The evolving economic landscape necessitates continuous monitoring of financial markets and risk factors.

Regulatory bodies are likely to scrutinize bankruptcy and restructuring processes to ensure fairness and transparency.

Ongoing developments in legislation and financial regulations may impact recovery rates and investor protections.

As the economic climate shifts, stakeholders must remain vigilant and proactive in managing their financial risks.

The phrase "25 cents on the dollar" serves as a stark reminder of the potential for significant losses and the importance of sound financial planning and risk management.

The situation demands immediate attention to mitigate further damage and prepare for potential long-term repercussions.