How Much Should You Initially Invest In Stocks

For those venturing into the stock market, one of the first and most pressing questions is: How much capital should I initially invest? There's no one-size-fits-all answer. It hinges on individual financial circumstances, risk tolerance, and investment goals.

Determining the appropriate initial investment amount is crucial for building a diversified portfolio and achieving long-term financial success. Experts generally advise careful consideration before committing any funds to the market. Investing should align with one's overall financial plan.

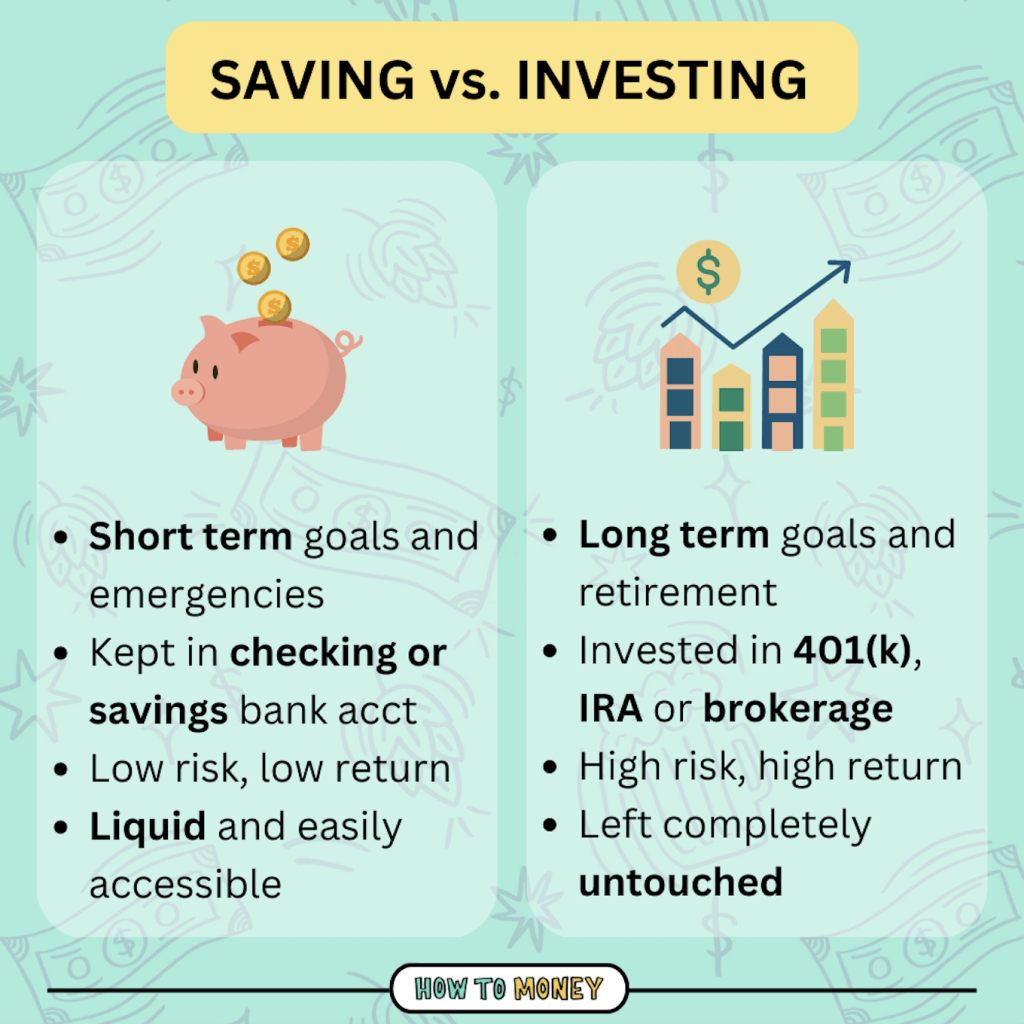

Assessing Your Financial Situation

Before investing in stocks, it is important to realistically evaluate your current financial landscape. Consider your income, expenses, debts, and existing savings. The Securities and Exchange Commission (SEC) emphasizes the importance of having a solid financial foundation.

Ensure you have an emergency fund to cover at least three to six months of living expenses. This will prevent you from having to sell investments during a financial hardship. Paying off high-interest debt, such as credit card balances, should also take precedence over investing.

Risk Tolerance and Investment Goals

Your risk tolerance plays a significant role in determining your initial investment amount. Investors with a higher risk tolerance may be comfortable allocating a larger percentage of their capital to stocks. Conversely, those with a lower risk tolerance may prefer to start with a smaller amount and gradually increase their exposure over time.

Clearly define your investment goals, such as saving for retirement, a down payment on a house, or education expenses. The timeline for achieving these goals will also influence your investment strategy. Shorter timelines often require a more conservative approach.

Dollar-Cost Averaging

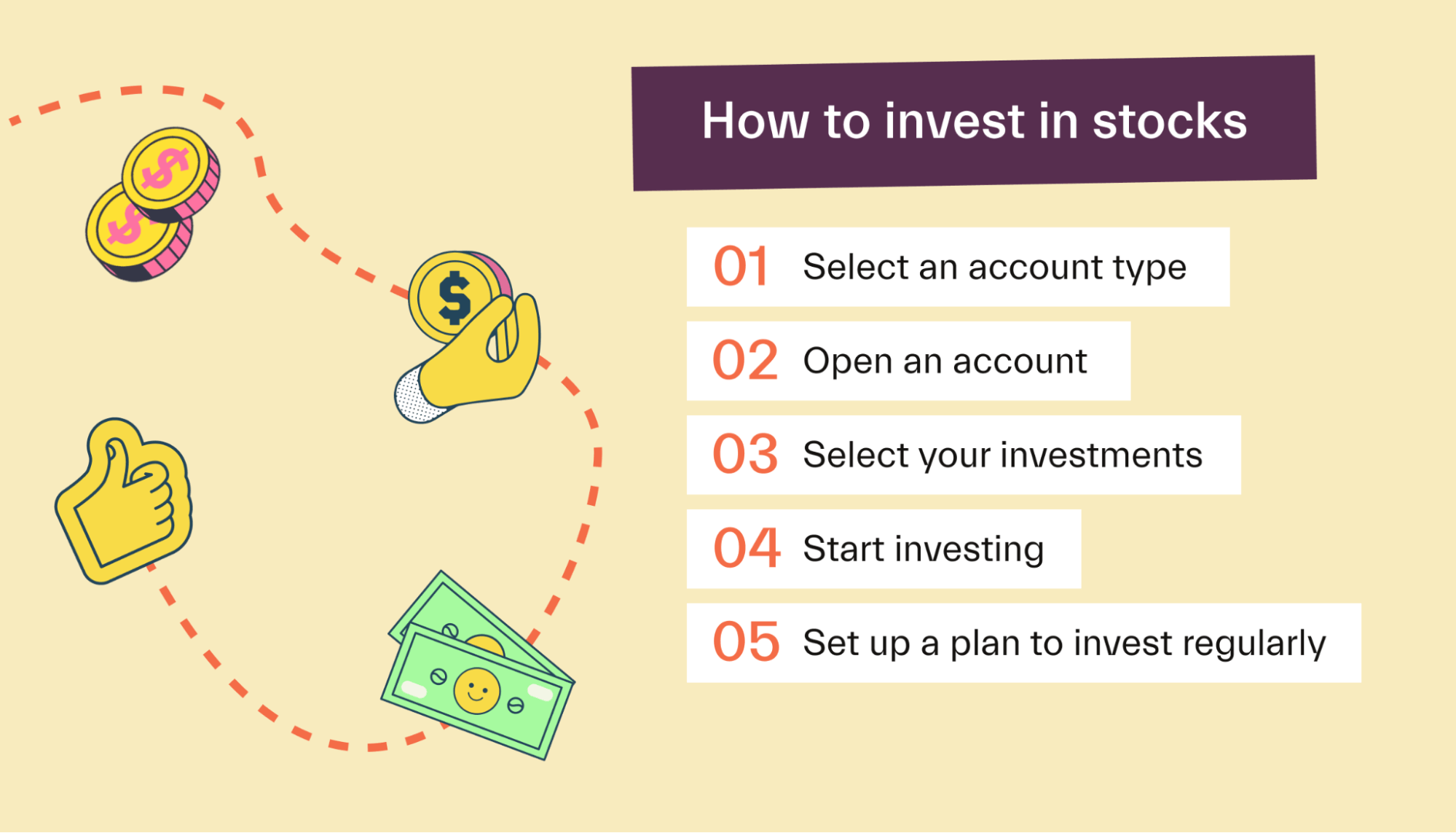

One popular strategy for new investors is dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the stock price. This can help mitigate the risk of investing a large sum right before a market downturn.

For example, instead of investing $6,000 at once, you could invest $500 each month for a year. This approach allows you to buy more shares when prices are low and fewer shares when prices are high. Vanguard, a leading investment management company, highlights the potential benefits of this method.

Starting Small

There's no minimum amount required to start investing in the stock market. With the rise of online brokerages and fractional shares, it's possible to begin with as little as $5 or $10. This accessibility allows individuals to learn the ropes of investing without risking a substantial amount of money.

Starting small can be particularly beneficial for beginners who are unsure about their risk tolerance. It provides an opportunity to gain experience and confidence before committing more capital. Many brokers, like Fidelity, offer resources for new investors, including educational materials and investment tools.

Diversification is Key

Regardless of the initial investment amount, diversification is essential. Spreading your investments across different stocks, bonds, and asset classes can help reduce risk. Exchange-Traded Funds (ETFs) and mutual funds offer a convenient way to diversify your portfolio.

These investment vehicles typically hold a basket of securities, providing instant diversification. Index funds, which track a specific market index like the S&P 500, are a popular choice for beginners. Remember to research any investments thoroughly before investing.

Seeking Professional Advice

If you're unsure about how much to invest or which investments are right for you, consider seeking advice from a qualified financial advisor. A financial advisor can help you assess your financial situation, set realistic goals, and develop a personalized investment strategy.

They can also provide guidance on asset allocation, risk management, and tax-efficient investing. It is important to choose an advisor who is fiduciary, meaning they are legally obligated to act in your best interest.

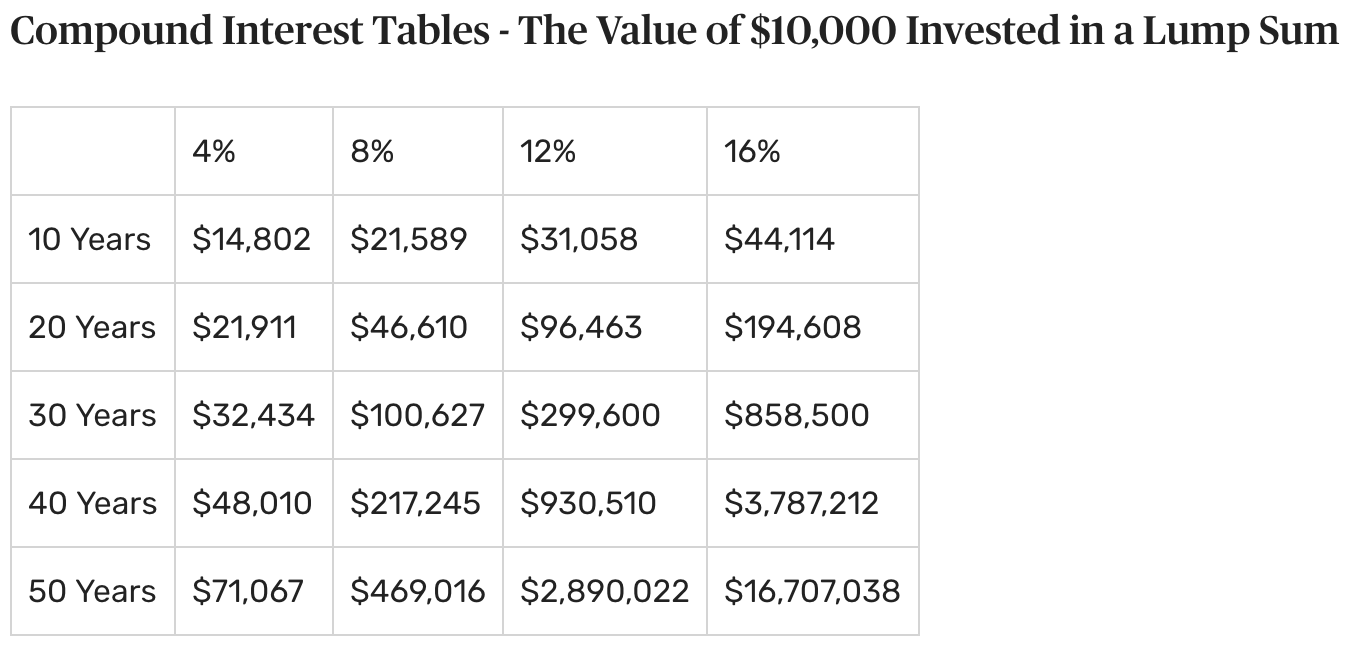

The Long-Term Perspective

Investing in the stock market is a long-term game. It's important to avoid making emotional decisions based on short-term market fluctuations. Stay focused on your investment goals and maintain a diversified portfolio.

While the initial investment amount is important, it's only one piece of the puzzle. Consistent investing, disciplined savings, and a long-term perspective are key to achieving financial success.

/investing-terms-you-should-know-356338_FINAL-5c5af82146e0fb0001be7b2c.png)

:max_bytes(150000):strip_icc()/the-complete-beginner-s-guide-to-investing-in-stock-358114-V2-48e86c11cba147679f38ffb41e948705-f0549867cb7f4ab09c6fa970521349de.jpg)