How Much Would It Be To Start A Business

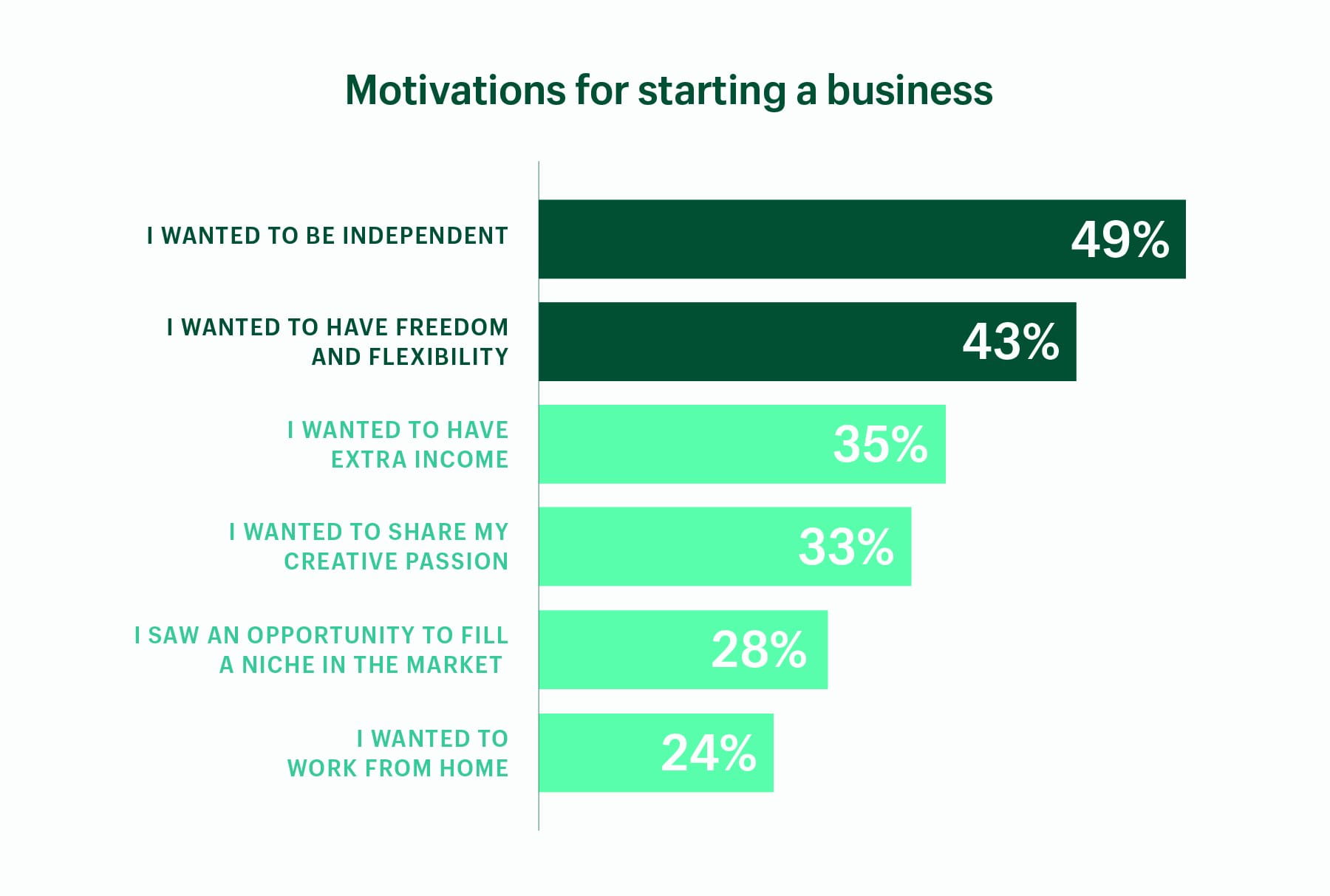

The allure of entrepreneurship is powerful, but the path to launching a successful business is often paved with financial uncertainties. How much capital does it truly take to transform an idea into a thriving enterprise? The answer, unfortunately, is rarely straightforward.

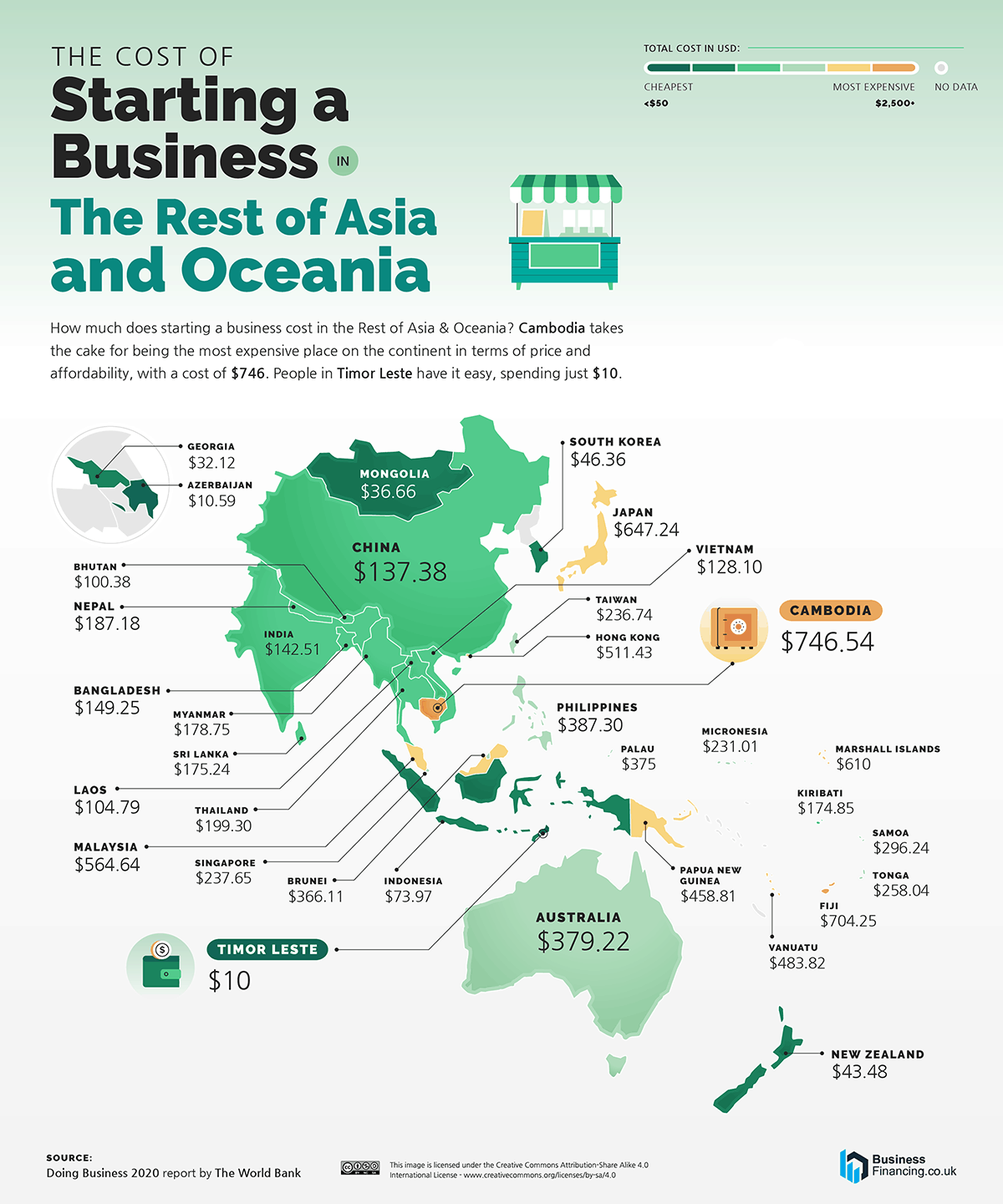

The financial barrier to entry for starting a business varies dramatically based on industry, scale, and business model. While some ventures can launch with minimal upfront investment, others require substantial capital for equipment, inventory, and marketing. This article delves into the real costs of starting a business, examining data from reputable sources and offering insights for aspiring entrepreneurs to navigate the financial landscape.

Startup Costs: A Breakdown

The initial investment needed to start a business encompasses various expenses, each contributing to the overall financial burden. Understanding these categories is crucial for effective budgeting and securing necessary funding.

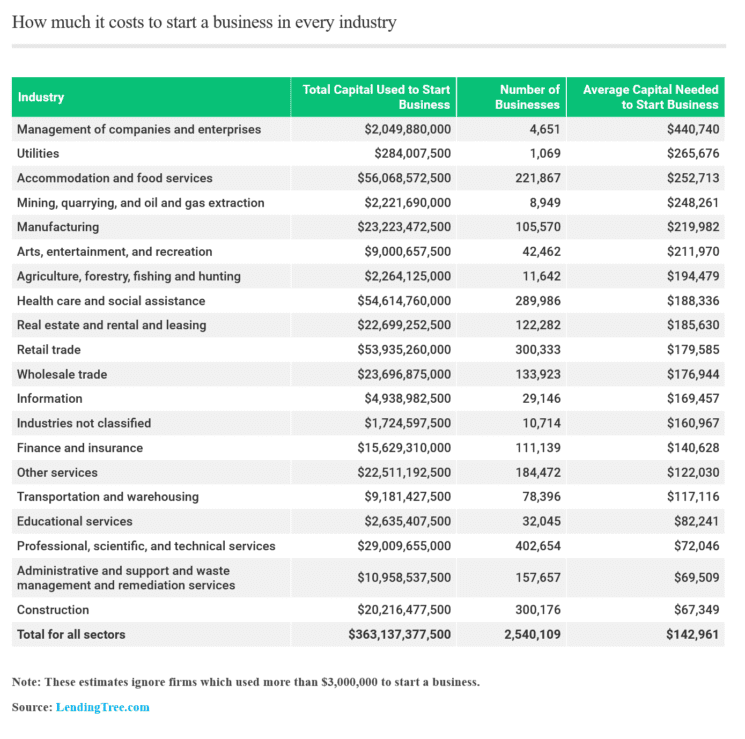

Industry Matters

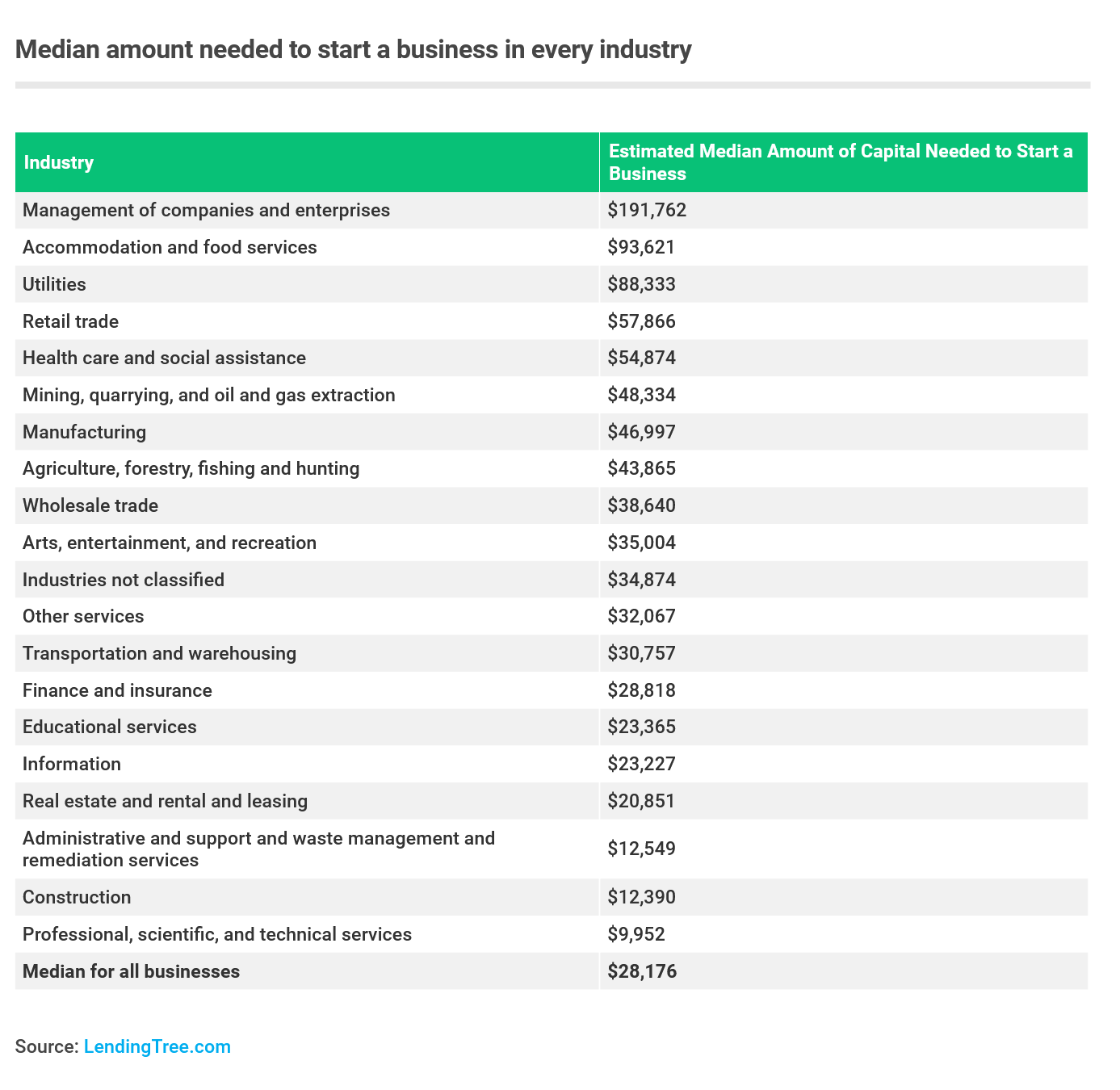

The industry you choose dramatically impacts your startup costs. A home-based online service business can launch with a relatively low investment in website development and marketing. Conversely, opening a restaurant demands significant capital for real estate, equipment, permits, and initial inventory.

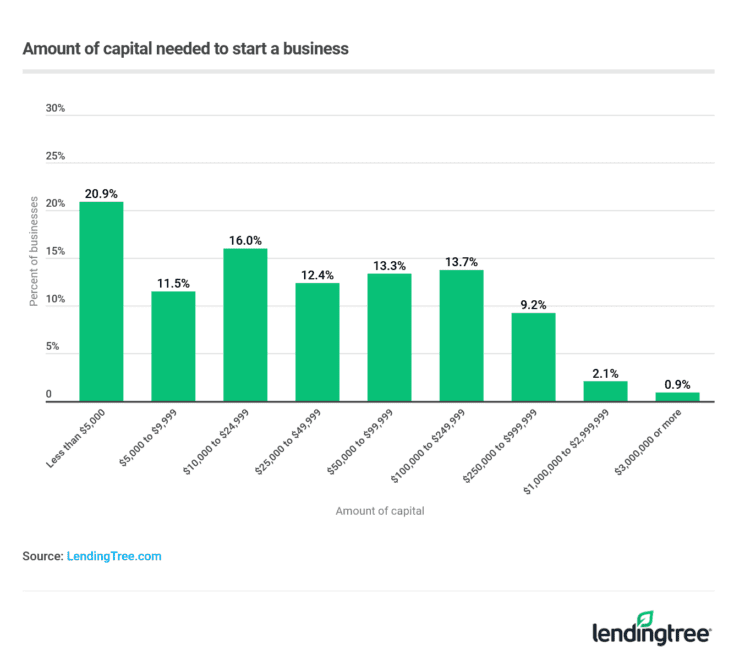

According to the Small Business Administration (SBA), the average startup cost for a small business ranges from $3,000 to $3 million. This wide range underscores the variability across different sectors.

Fixed vs. Variable Costs

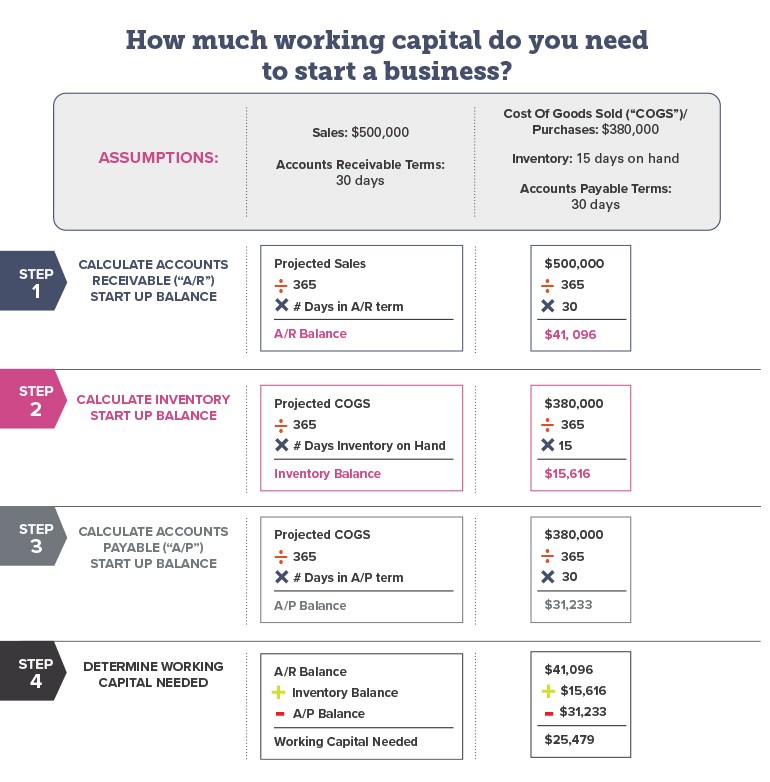

Fixed costs are expenses that remain consistent regardless of your sales volume. These include rent, insurance, and salaries. Variable costs, on the other hand, fluctuate with production and sales. Think of raw materials, direct labor, and shipping expenses.

Balancing these costs is essential for maintaining profitability. Careful planning and cost control are paramount.

Essential Startup Expenses

Several core expenses are common across most startups. Legal fees for business registration, licenses, and permits are unavoidable. Marketing and advertising are vital for attracting customers.

Technology infrastructure, including computers, software, and website development, is essential for modern businesses. Inventory costs apply to businesses that sell physical products, and equipment costs are relevant for manufacturing and service-based businesses.

Funding Your Dream

Securing adequate funding is a critical step in starting a business. Entrepreneurs have several options to explore, each with its own advantages and disadvantages.

Bootstrapping

Bootstrapping involves using personal savings and reinvesting profits to fund the business. This approach minimizes debt and gives the founder complete control. However, it can limit growth potential due to limited capital.

Loans and Grants

Small business loans from banks and credit unions are a common source of funding. Government grants and programs, such as those offered by the SBA, can provide non-repayable funding. Securing these loans and grants often requires a solid business plan and strong credit history.

Angel Investors and Venture Capital

Angel investors are individuals who provide capital to startups in exchange for equity. Venture capital firms invest in high-growth potential companies, typically at a later stage. These options can provide significant funding but often involve giving up a portion of ownership and control.

"According to a report by Fundera, nearly 82% of small businesses fail because of cash flow problems. Proper financial planning is crucial."

Real-World Examples

Examining real-world examples can provide valuable insights into startup costs. A food truck might require an initial investment of $50,000 to $100,000, while a software startup could launch with as little as $10,000 if the founders handle development themselves.

A retail store, on the other hand, could necessitate an investment of $100,000 or more, depending on location and inventory. These figures are estimates and can vary widely based on specific circumstances.

Mitigating Financial Risks

Starting a business involves inherent financial risks, but several strategies can help mitigate these challenges. Thorough market research is essential to validate your business idea and understand your target market.

Developing a detailed business plan with realistic financial projections is crucial for attracting investors and managing cash flow. Starting lean by minimizing unnecessary expenses and focusing on core activities can help conserve capital. Regularly monitoring financial performance and adapting to market changes are essential for long-term sustainability.

The Future of Startup Funding

The landscape of startup funding is constantly evolving. Crowdfunding platforms like Kickstarter and Indiegogo have emerged as viable alternatives for raising capital. The rise of online lending platforms has made it easier for small businesses to access financing.

As technology continues to disrupt traditional industries, new business models and funding opportunities will emerge. Aspiring entrepreneurs should stay informed about these trends and adapt their strategies accordingly. The cost of starting a business will likely remain variable. But with careful planning, strategic funding, and a commitment to financial discipline, the dream of entrepreneurship can become a reality.