How Old Do You Need To Get A Bank Account

The question of when a young person can open a bank account is more than just a logistical detail. It's a crucial step towards financial literacy and independence, a milestone often fraught with questions and varying regulations. Understanding the age requirements and available options is paramount for both parents and young adults navigating the world of personal finance.

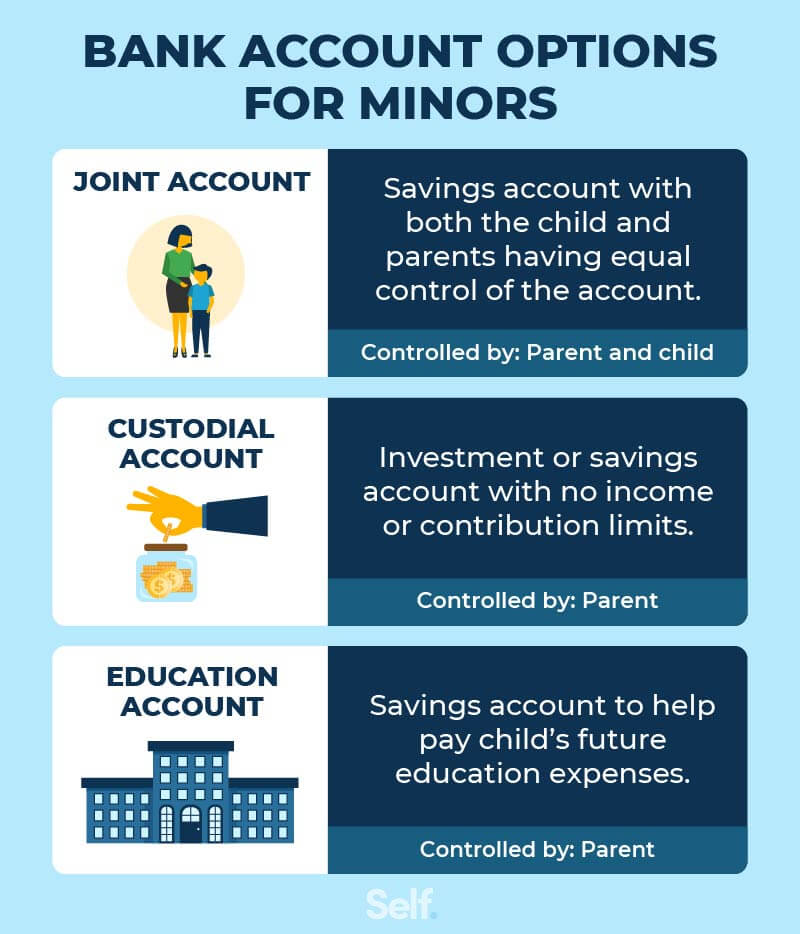

This article delves into the specific age requirements for opening different types of bank accounts in the United States, exploring the nuances of custodial accounts, joint accounts, and individual accounts. We'll examine the roles and responsibilities associated with each type, providing a comprehensive guide to help families make informed decisions about empowering their children with financial tools.

Custodial Accounts: A Stepping Stone to Financial Independence

Custodial accounts, often called Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts, are a common way for minors to start saving and investing. These accounts are established by an adult custodian for the benefit of a minor. There is generally no minimum age requirement to establish a custodial account.

The custodian manages the account until the minor reaches the age of majority, which is typically 18 or 21, depending on the state. At that point, the assets in the account are transferred to the now-adult child.

“Custodial accounts are a fantastic tool for teaching children about saving and investing,” says Sarah Johnson, a certified financial planner at Acme Financial Planning. “They provide a hands-on learning experience with real-world consequences, fostering responsible financial habits early on.”

Joint Accounts: Shared Responsibility and Access

Another option is opening a joint account with a parent or guardian. While specific bank policies vary, most banks allow minors to be joint account holders, though parental consent is always required.

This arrangement allows both the minor and the adult to access and manage the funds in the account. It provides a transparent way for parents to oversee their child’s spending and savings habits.

However, it's crucial to remember that both parties have equal rights to the funds, which can lead to potential conflicts if not managed responsibly. Maintaining open communication and establishing clear expectations are vital for a successful joint account relationship.

Individual Accounts: Gaining Full Financial Control

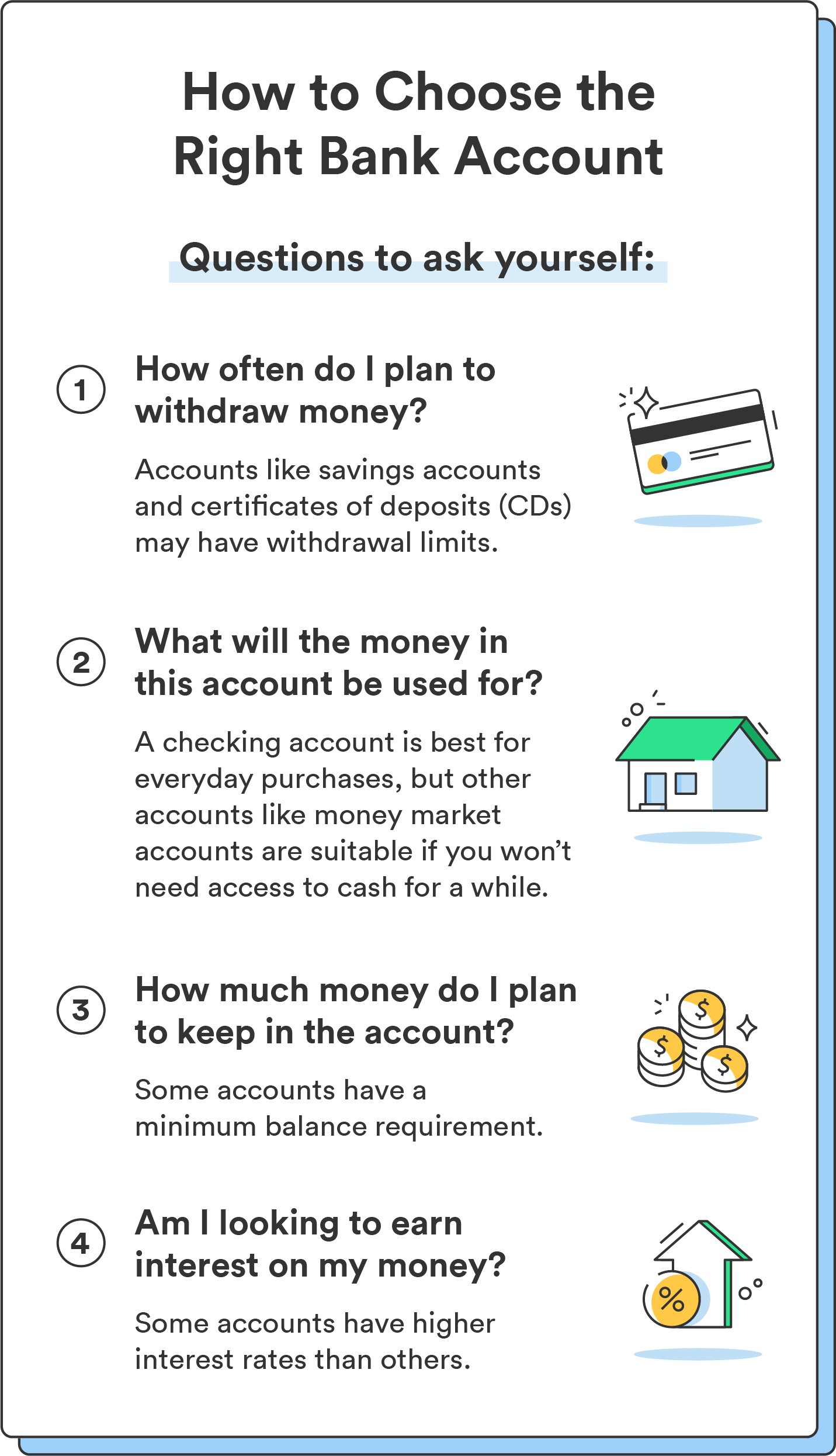

The age at which a minor can open an individual bank account, without a parent or guardian as a co-owner, varies by state and financial institution. Generally, once a person reaches the age of majority (18 in most states), they can open an individual account without any restrictions.

However, some banks may allow minors to open individual accounts even before reaching the age of 18, typically with certain limitations. These accounts may require proof of employment or parental consent, depending on the bank’s specific policies.

Opening an individual account allows young adults to take full control of their finances, managing their own income and expenses. This fosters independence and responsibility, preparing them for the financial challenges of adulthood.

Navigating Bank Policies and Requirements

It’s essential to research the specific policies of different banks and credit unions. Some institutions may offer specialized accounts designed specifically for young people, with features like low fees and educational resources.

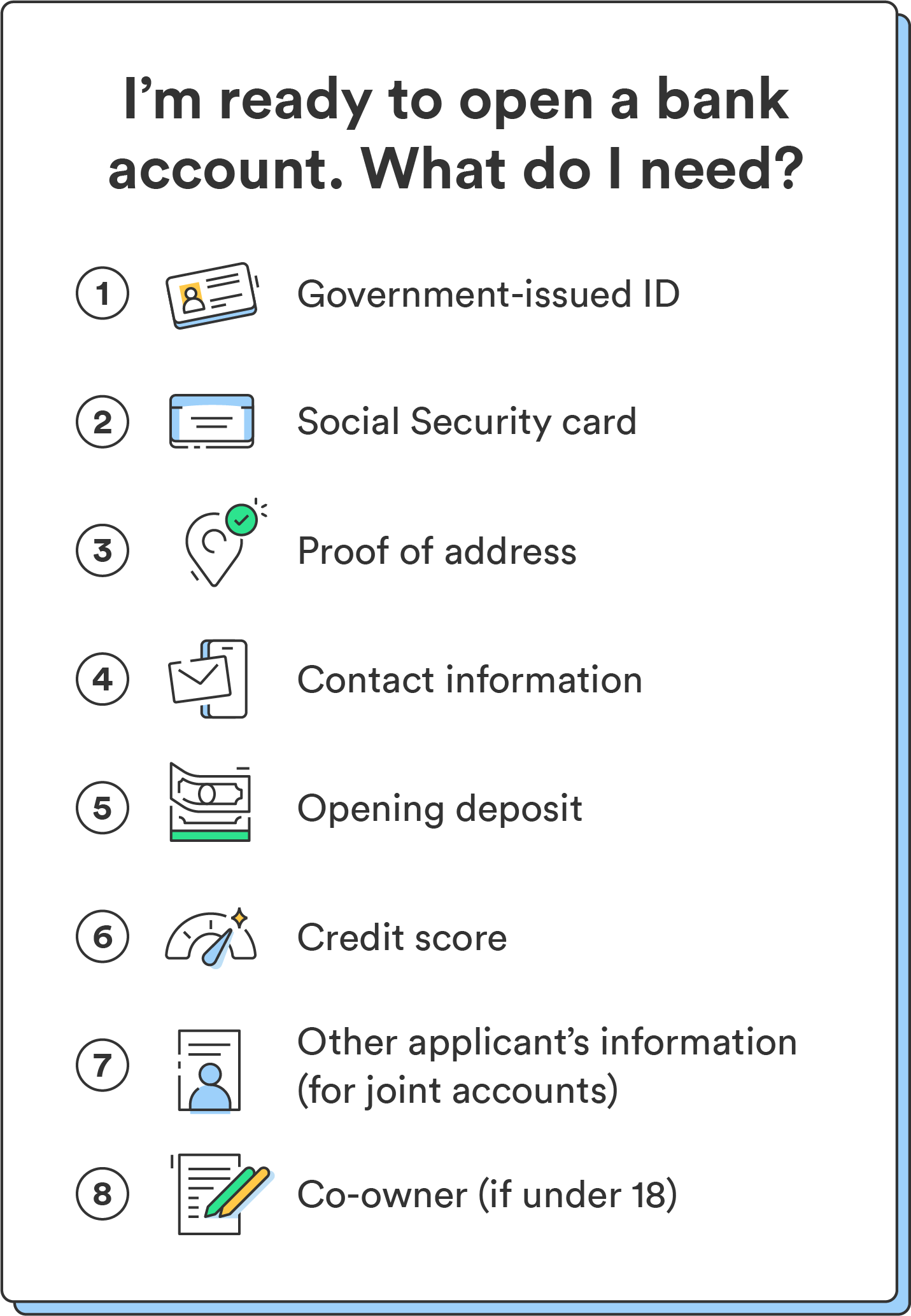

When opening any type of account, be prepared to provide documentation such as a social security number, proof of address, and a valid form of identification. For minors, parental consent and identification for the parent or guardian are also required.

"Different banks have different requirements. Shop around to find one that fits your needs," advises the Consumer Financial Protection Bureau (CFPB).

The Broader Implications of Early Financial Education

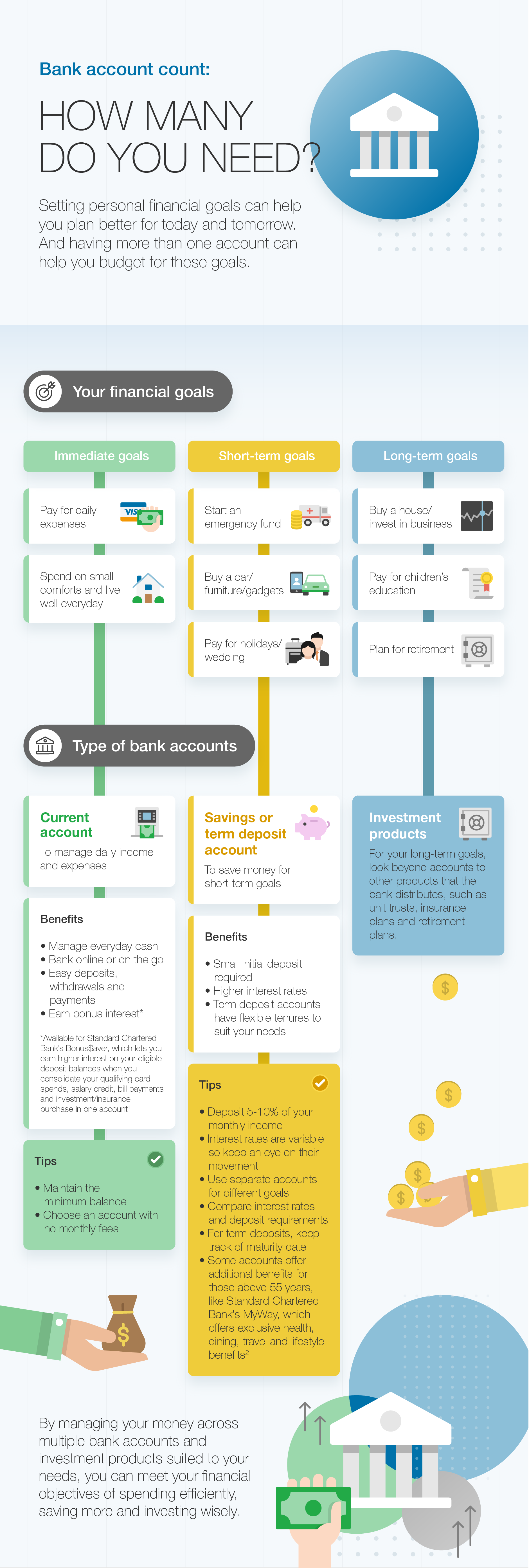

Providing young people with access to bank accounts is just one piece of the puzzle. Equally important is educating them about responsible financial management, including budgeting, saving, and understanding credit.

"Financial literacy is a critical life skill," says John Smith, an economist at the National Bureau of Economic Research. "Empowering young people with the knowledge and tools to manage their finances effectively can have a lasting positive impact on their lives."

Schools, community organizations, and financial institutions are increasingly offering programs and resources to promote financial literacy among young people. By combining access to bank accounts with comprehensive financial education, we can help ensure that the next generation is well-prepared to navigate the complexities of the financial world.

Looking Ahead: Trends in Youth Banking

The landscape of youth banking is constantly evolving, with the rise of digital banking and mobile payment platforms. Many banks now offer online accounts and mobile apps specifically designed for young people, making it easier than ever to manage their finances on the go.

As technology continues to shape the financial industry, it's crucial for parents and educators to stay informed about the latest trends and tools available. By embracing innovation and providing ongoing support, we can empower young people to become confident and responsible financial citizens.

The journey to financial independence begins early, and understanding the age requirements for opening a bank account is a critical first step. By exploring the various options available and fostering financial literacy, we can help young people build a solid foundation for a secure and prosperous future.

![How Old Do You Need To Get A Bank Account How Old Do You Have to Be to Get a Debit Card? [Answered]](https://www.i1.creditdonkey.com/image/1/how-old-get-debit-card1@2x.jpg)

:max_bytes(150000):strip_icc()/how-interest-rates-work-savings-accounts.asp-3644536378554b9ab3ecab2747aa066c.jpg)