How To Add Money To Your Bank Account

In today's complex financial landscape, understanding how to effectively manage and replenish your bank account is more crucial than ever. Whether you're striving to meet monthly expenses, save for a long-term goal, or simply bolster your financial security, knowing the various methods for adding funds is essential. The process might seem straightforward, but a detailed understanding of each option can lead to making informed decisions that best suit your individual circumstances.

This article will delve into the diverse methods available for adding money to your bank account, providing a comprehensive guide for individuals seeking to optimize their financial practices. We will explore traditional approaches like direct deposits and cash deposits, as well as modern alternatives like mobile transfers and online payment platforms. Each method carries its own advantages and considerations, from accessibility and speed to potential fees and security measures.

Traditional Methods: The Foundation of Banking

Direct Deposit: A Consistent Income Stream

Direct deposit remains a cornerstone of modern banking, providing a seamless and reliable way to receive regular income. Employers typically offer direct deposit as the standard method for payroll distribution. Government benefits, such as Social Security payments, are also frequently delivered via direct deposit.

Setting up direct deposit usually involves providing your bank account number and routing number to the payer. This information allows the payer to electronically transfer funds directly into your account. Direct deposit eliminates the need to physically deposit checks and often results in faster access to your funds.

Cash Deposits: Immediate Access to Funds

Depositing cash directly into your bank account is a traditional and straightforward method. You can visit a local branch of your bank or use an ATM that accepts cash deposits. The process usually involves inserting the cash into the designated slot and following the on-screen instructions.

Depositing cash provides immediate access to your funds, which can be particularly useful for individuals who frequently deal with cash transactions. It is important to be mindful of any deposit limits or fees associated with cash deposits, which can vary depending on the bank.

Modern Alternatives: Embracing Digital Convenience

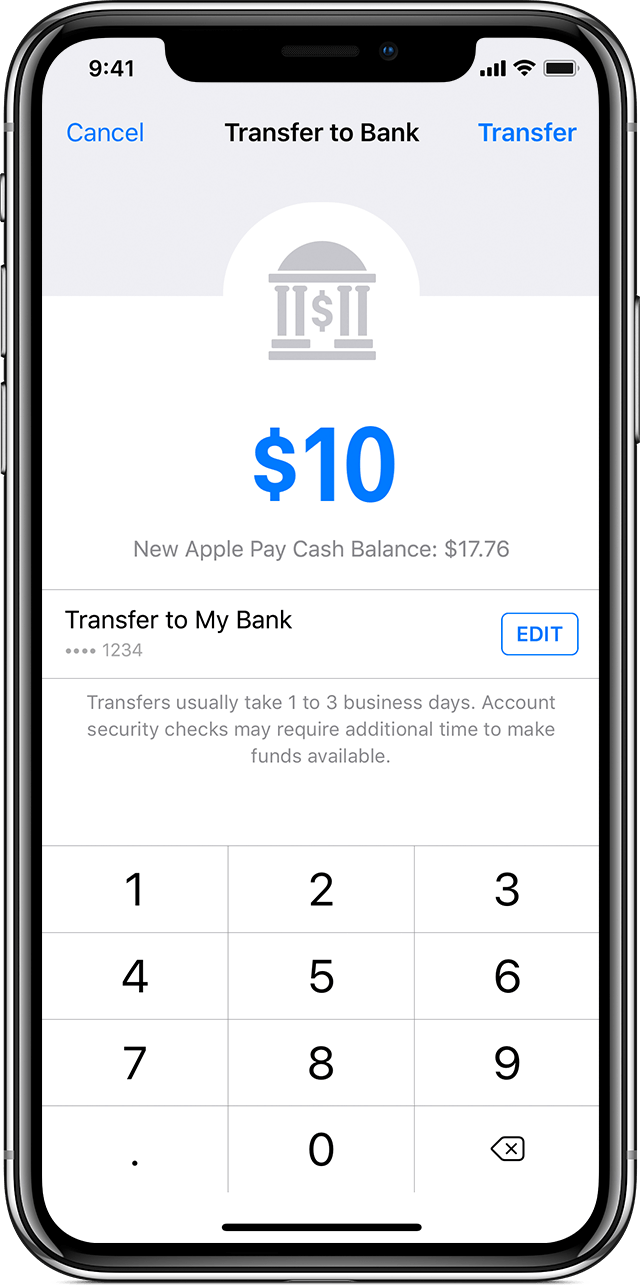

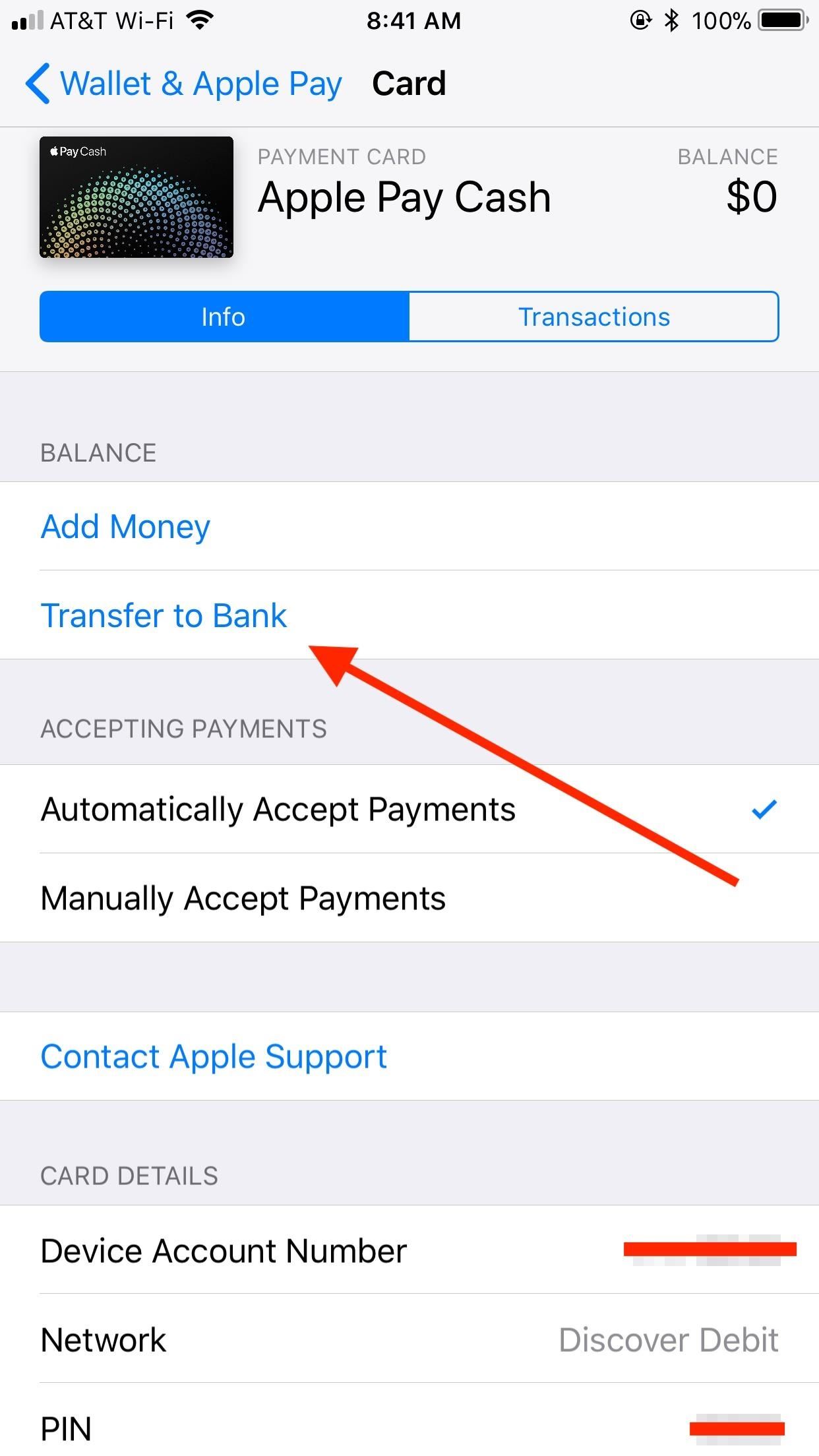

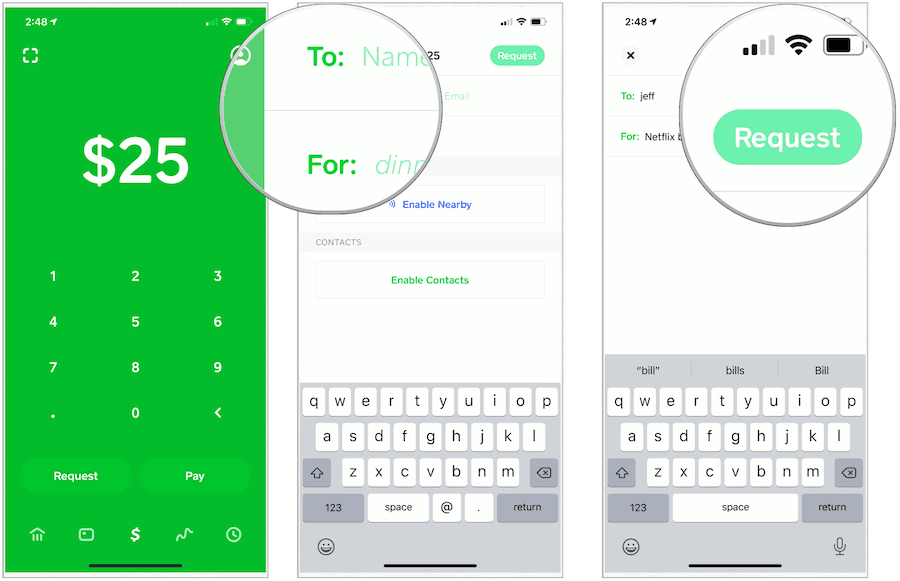

Mobile Transfers: Banking at Your Fingertips

Mobile banking apps have revolutionized the way we manage our finances, making it easier than ever to transfer funds. Most banks offer mobile apps that allow you to transfer money between your own accounts or to other individuals. Popular platforms like Venmo and Cash App facilitate peer-to-peer transfers.

To transfer money via a mobile app, you typically need the recipient's email address, phone number, or bank account information. Mobile transfers offer convenience and speed, making them a popular choice for splitting bills or sending money to friends and family.

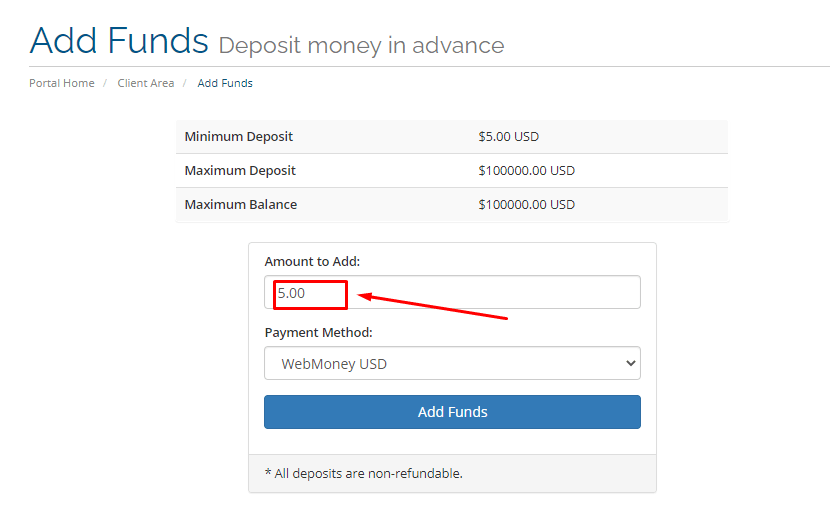

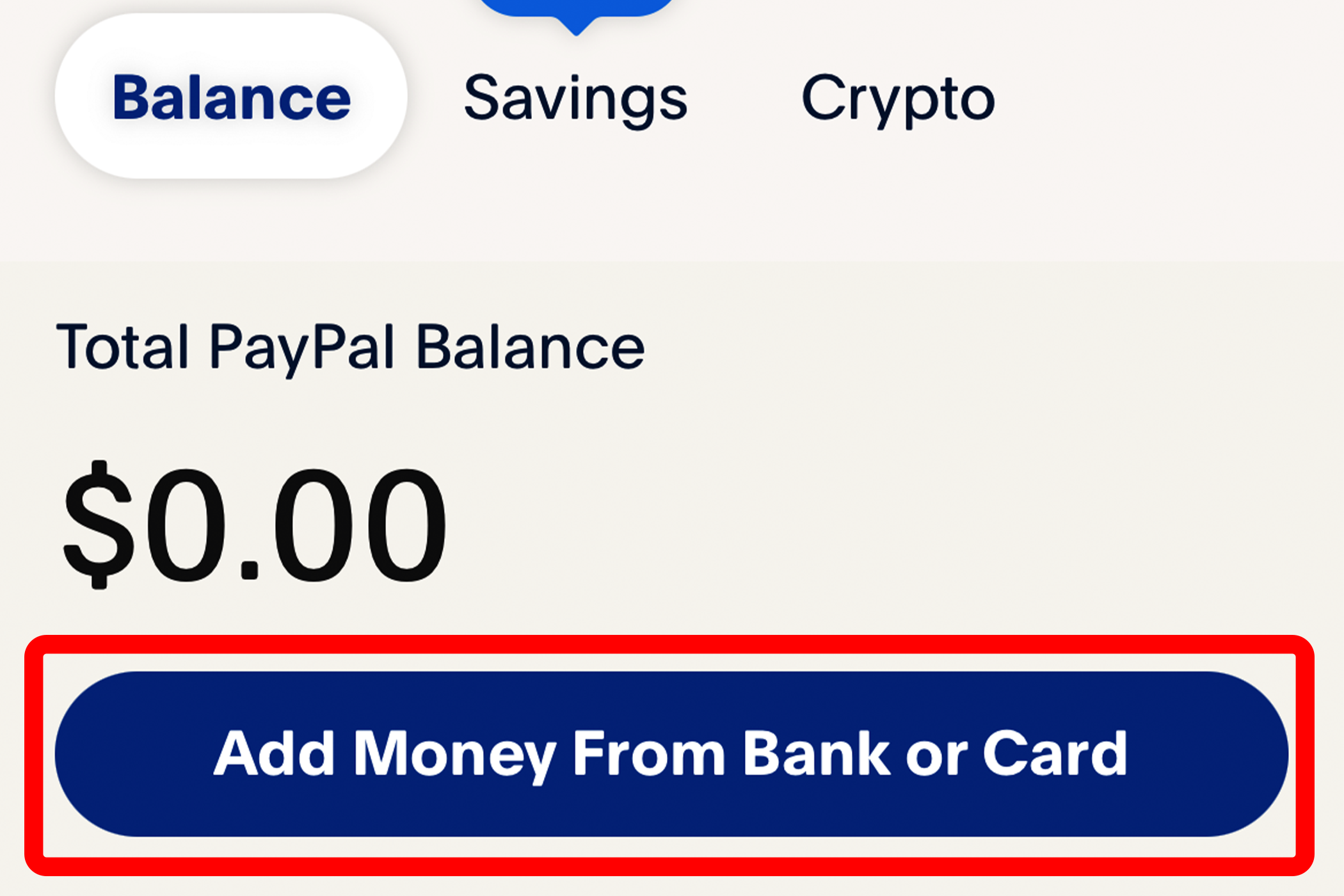

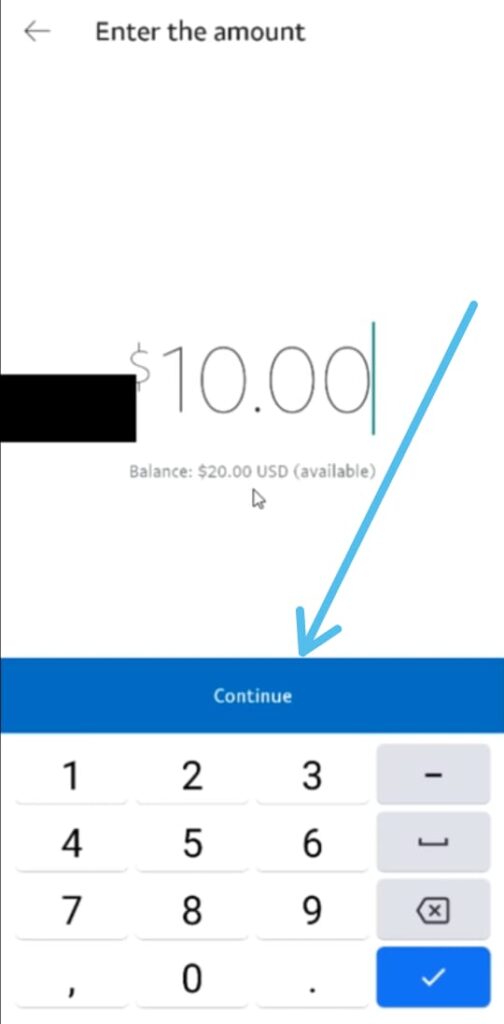

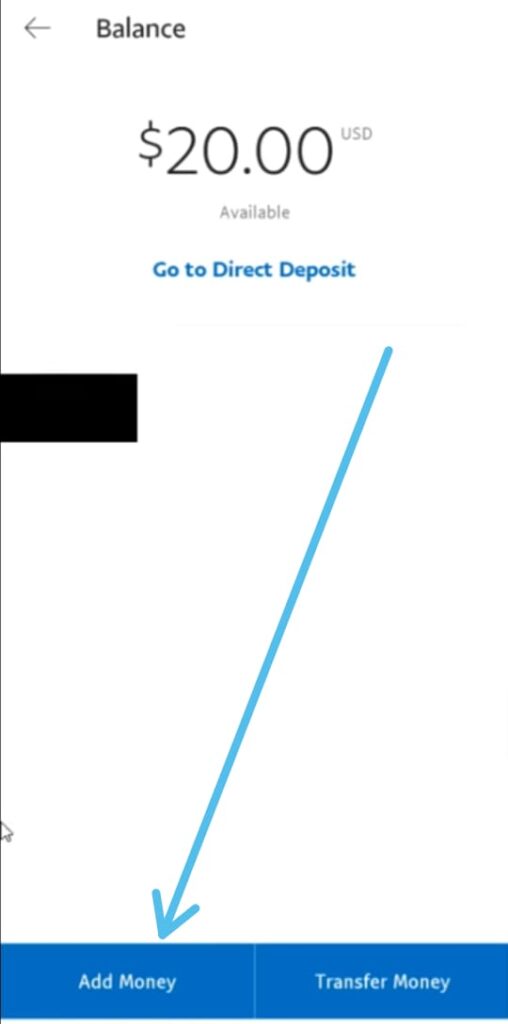

Online Payment Platforms: Versatile Money Management

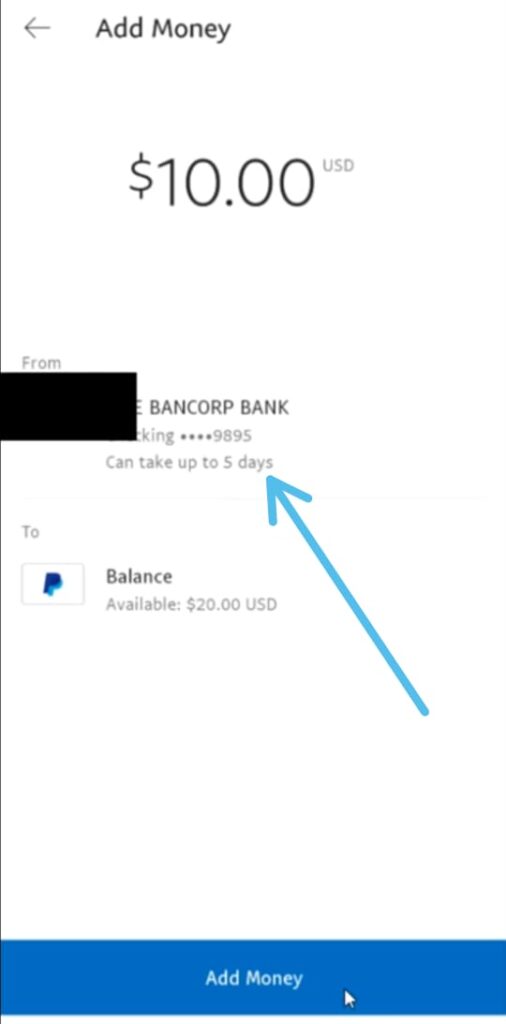

Online payment platforms like PayPal provide a versatile way to send and receive money online. These platforms often offer features like invoicing, recurring payments, and the ability to link multiple bank accounts and credit cards. They act as an intermediary between you and the payer.

Funds received through these platforms can typically be transferred to your bank account, though some fees may apply depending on the platform and the speed of transfer.

"These are good options for people who frequently work as freelancers," says Jane Doe, a personal finance advisor.

Wire Transfers: Secure, Large-Sum Transfers

Wire transfers are a secure method for transferring large sums of money, often used for international transactions. They involve transferring funds electronically from one bank account to another through a network of banks. Wire transfers typically involve fees, which can vary depending on the bank and the amount being transferred.

Wire transfers are generally considered a safe and reliable way to send money, but it is important to verify the recipient's information carefully to avoid fraud. According to the Federal Trade Commission, you should always confirm the details of the wire transfer with the recipient through a secure channel before initiating the transfer.

Considerations and Best Practices

Before adding money to your bank account, it's essential to be aware of potential fees, deposit limits, and security measures. Some banks may charge fees for certain types of transactions, such as wire transfers or excessive withdrawals. It is crucial to review your bank's fee schedule to avoid unexpected charges.

Protecting your account information is paramount. Be cautious of phishing scams and other fraudulent attempts to obtain your banking details. Regularly monitor your account activity and report any unauthorized transactions to your bank immediately.

The Consumer Financial Protection Bureau offers resources and guidance on protecting yourself from financial fraud. Always use strong passwords and enable two-factor authentication whenever possible to enhance the security of your online banking accounts. You should NEVER give your banking details to someone you don't know.

Looking Ahead: The Future of Banking Transactions

The landscape of banking transactions continues to evolve, with new technologies and platforms emerging regularly. Cryptocurrency and blockchain technology, for example, are offering alternative methods for transferring value, though these remain relatively new and carry their own set of risks and regulations. As technology continues to advance, it is expected that mobile and online banking will become even more integrated and seamless.

Staying informed about the latest trends and security measures is crucial for effectively managing your finances in the digital age. By understanding the various methods for adding money to your bank account and adopting best practices for security, you can take control of your financial well-being and achieve your financial goals. Adapting to these changes is crucial for those looking to bolster their financial security.

:max_bytes(150000):strip_icc()/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

:max_bytes(150000):strip_icc()/002_transfer-money-from-paypal-to-bank-account-4582759-ccada152c5dc4c9fa4a38a5d0c536cc0.jpg)

(1).png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max)