How To Buy A Stock In Td Ameritrade

The stock market, once a domain reserved for seasoned professionals, is now increasingly accessible to everyday individuals. Online brokerage platforms like TD Ameritrade have democratized investing, offering a user-friendly gateway to buying and selling stocks. This guide provides a comprehensive overview of how to purchase stocks through TD Ameritrade, empowering you to participate in the potential growth of publicly traded companies.

Navigating the world of stock trading can seem daunting, especially for beginners. This article will break down the process of buying stock on TD Ameritrade into manageable steps. It will cover everything from opening an account to placing your first trade and beyond.

Opening a TD Ameritrade Account

The first step is to create an account on TD Ameritrade's website or through their mobile app. You will need to provide personal information, including your name, address, Social Security number, and date of birth. This information is required for regulatory purposes and to verify your identity.

Next, you will need to choose the type of account that best suits your investment goals. Options include individual brokerage accounts, retirement accounts like IRAs, and custodial accounts for minors. Each account type has different tax implications and investment restrictions.

After selecting your account type, you will need to fund your account. TD Ameritrade offers various funding options, including electronic bank transfers, checks, and wire transfers. Some methods may have associated fees or processing times.

Researching Stocks

Before buying any stock, it is crucial to conduct thorough research. This involves understanding the company's business model, financial performance, and industry trends. Utilize TD Ameritrade's research tools, which provide access to analyst reports, company profiles, and market news.

Consider factors such as the company's revenue growth, profitability, debt levels, and competitive landscape. You can also use fundamental analysis techniques like ratio analysis to assess the company's financial health. Remember that past performance is not necessarily indicative of future results.

Diversification is a key principle of investing. Avoid putting all your eggs in one basket by spreading your investments across different companies and sectors. This can help mitigate risk and improve your overall portfolio performance.

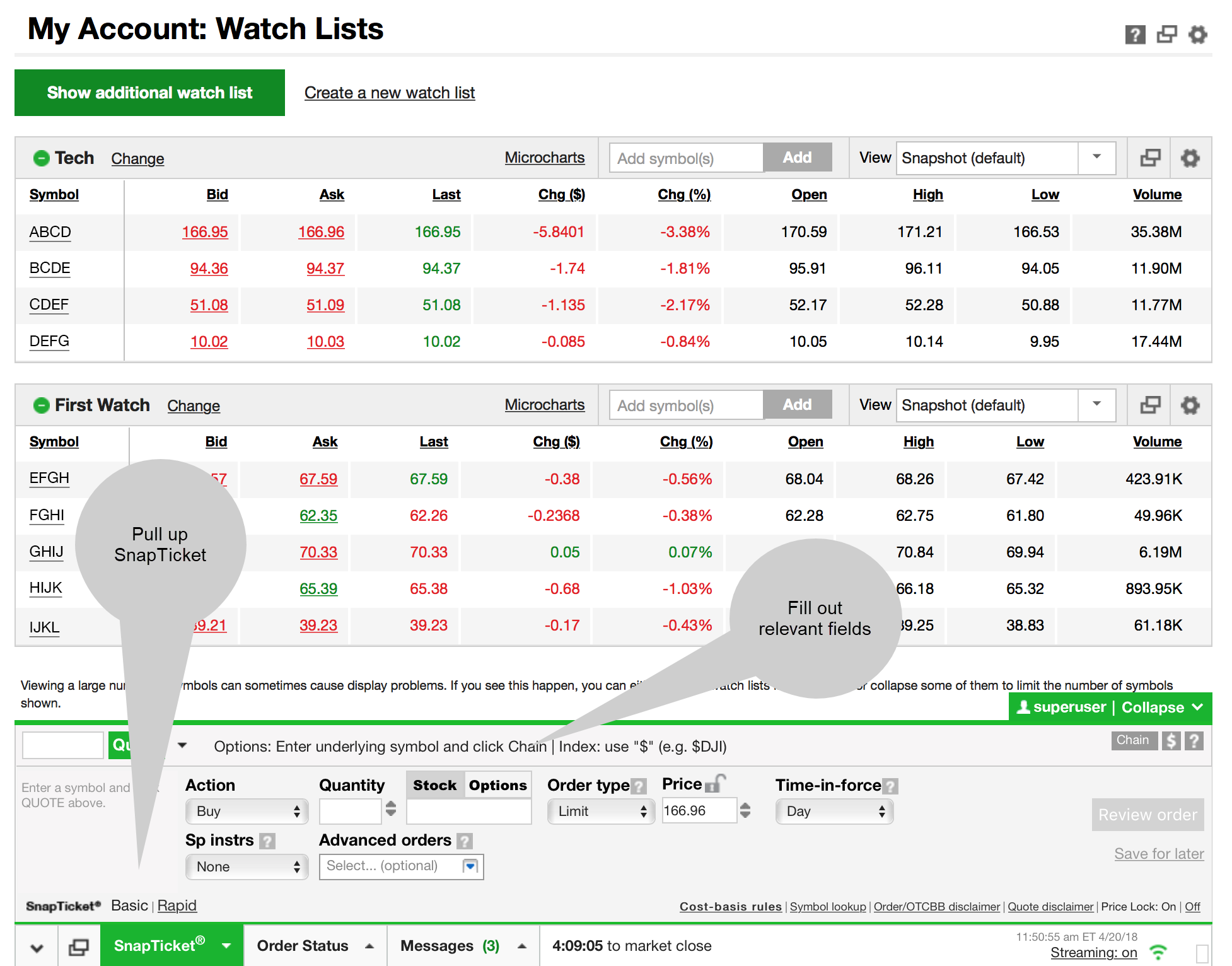

Placing a Trade

Once you have identified a stock you want to buy, you can place a trade through TD Ameritrade's trading platform. You will need to enter the stock's ticker symbol, the number of shares you want to purchase, and the order type.

Market orders execute immediately at the best available price. Limit orders allow you to specify the maximum price you are willing to pay. Stop-loss orders are used to limit potential losses if the stock price declines.

Carefully review your order details before submitting it. Once the order is executed, you will see the shares reflected in your account holdings. Keep in mind that stock prices fluctuate constantly, so the actual execution price may differ slightly from the quoted price.

Understanding Order Types

Choosing the correct order type is critical for managing risk and achieving your investment objectives. Market orders provide speed and certainty of execution, but you may not get the exact price you want. Limit orders offer price control, but there is no guarantee that your order will be filled.

Stop-loss orders are designed to protect your capital by automatically selling your shares if the price falls below a certain level. However, they can also be triggered by short-term market volatility, resulting in you selling at a loss.

TD Ameritrade offers a variety of other order types, such as stop-limit orders and trailing stop orders. Understanding the nuances of each order type can help you refine your trading strategy and manage risk more effectively.

Fees and Commissions

TD Ameritrade, like many online brokers, has eliminated commissions for online stock trades. However, there may still be fees associated with certain transactions, such as options contracts, mutual funds, and broker-assisted trades. Review TD Ameritrade's fee schedule carefully to understand the costs involved.

It's also important to be aware of other potential fees, such as account maintenance fees (though many accounts are fee-free), transfer fees, and inactivity fees. Compare TD Ameritrade's fees to those of other brokers to ensure you are getting the best value for your money.

Remember to factor in any applicable taxes on your investment gains. Consult with a tax advisor to understand the tax implications of your trading activity.

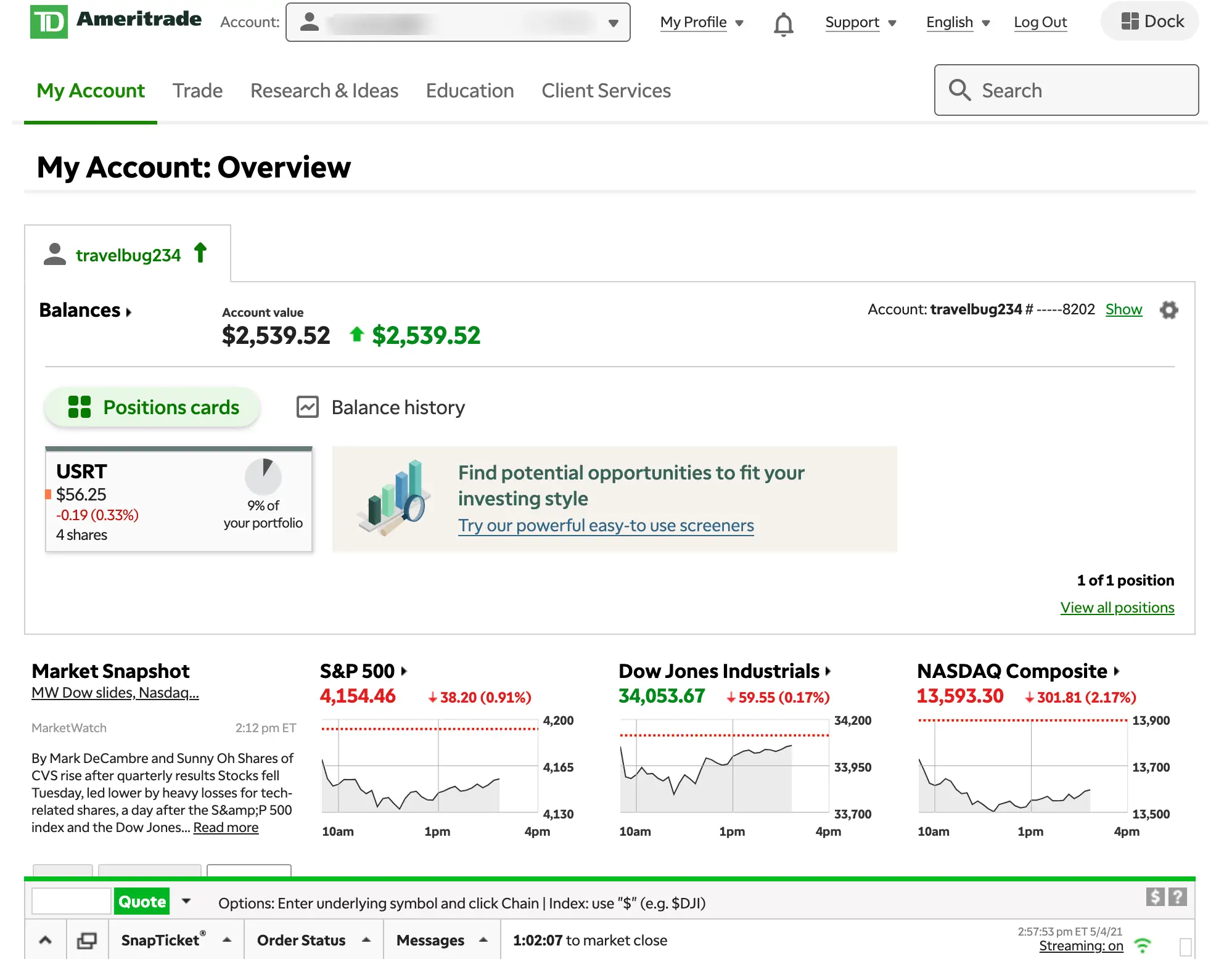

Ongoing Account Management

After buying a stock, it is important to monitor its performance and adjust your portfolio as needed. Regularly review your investment holdings and rebalance your portfolio to maintain your desired asset allocation. This helps ensure your portfolio aligns with your risk tolerance and investment goals.

Stay informed about company news and market trends that could impact your investments. TD Ameritrade provides access to research tools and market commentary to help you stay abreast of developments.

Consider setting up dividend reinvestment plans (DRIPs) to automatically reinvest any dividends you receive back into the stock. This can help accelerate your long-term growth through the power of compounding.

The Future of Investing with TD Ameritrade

TD Ameritrade's integration with Charles Schwab marks a significant shift in the online brokerage landscape. While the TD Ameritrade platform is being phased out, the transition to Schwab aims to provide clients with enhanced resources and a broader range of investment options. Investors should familiarize themselves with the Schwab platform to ensure a smooth transition.

The trend toward commission-free trading is likely to continue, further democratizing access to the stock market. As technology evolves, we can expect to see even more innovative tools and features emerge, making it easier for individuals to invest and manage their finances.

Investing in the stock market involves risk, and it is important to be prepared for potential losses. However, with careful research, a disciplined approach, and a long-term perspective, investing through platforms like TD Ameritrade (and now Schwab) can be a powerful way to build wealth over time.