How To Buy Dividend Stocks On Fidelity

Want to generate passive income? Fidelity Investments offers a robust platform for buying dividend stocks. This guide provides a step-by-step walkthrough of how to navigate Fidelity's tools and invest in dividend-paying companies.

Dividend stocks can be a reliable source of income. They are a great starting point if you want to utilize the power of compounding returns.

Opening a Fidelity Account

First, you need an account. If you don't already have one, head to Fidelity's website (Fidelity.com) and click "Open an Account."

You'll be guided through the process, providing personal information like your Social Security number and employment details. Account types include individual brokerage accounts, Roth IRAs, and traditional IRAs.

Choose the account that best aligns with your investment goals.

Funding Your Account

Once your account is open, you'll need to fund it. You can transfer funds electronically from a bank account or through a wire transfer.

Fidelity typically doesn't charge fees for electronic transfers.

Navigate to the "Accounts & Trade" section and select "Transfers" to initiate the process.

Researching Dividend Stocks

Before buying, research! Fidelity provides numerous resources to help you identify potentially lucrative dividend stocks.

Use the "Research" tab to access stock screeners, analyst reports, and market insights.

Consider factors like dividend yield, payout ratio, and the company's financial stability. Look for stocks with a history of consistently paying and increasing dividends.

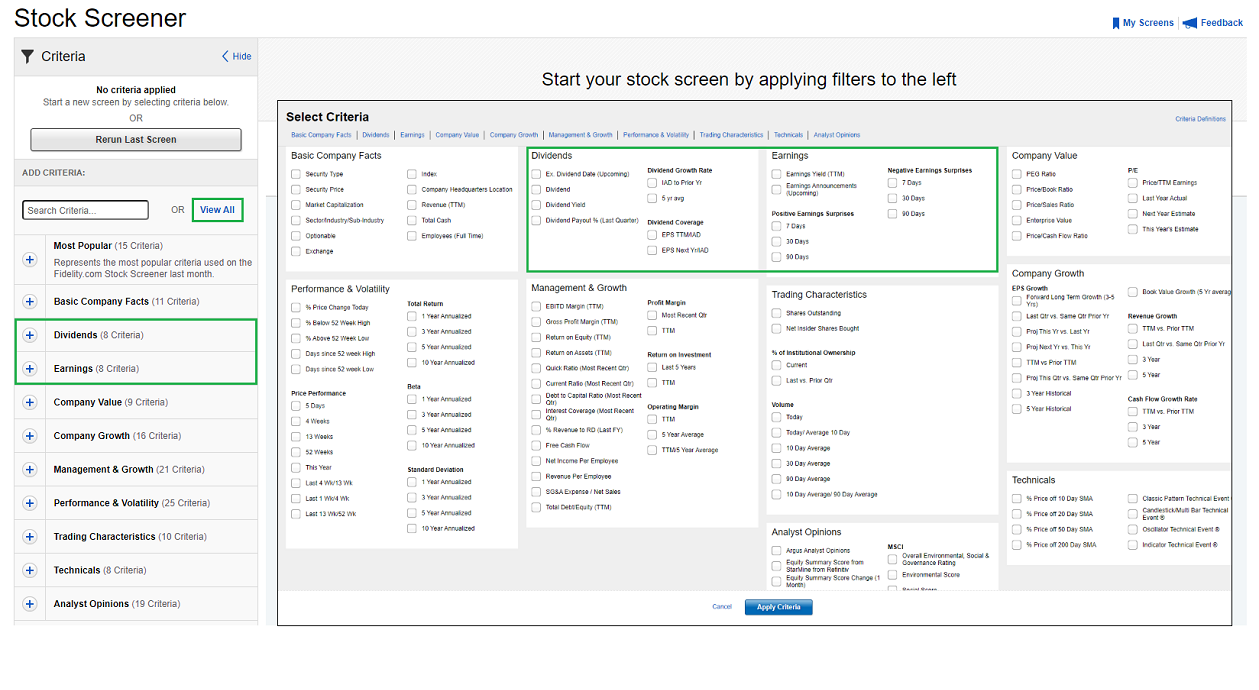

Using Fidelity's Stock Screener

Fidelity's stock screener is an invaluable tool. Access it under the "Research" tab.

You can filter stocks based on dividend yield, market capitalization, and other metrics. Enter your desired criteria to narrow down your search.

For example, you might search for stocks with a dividend yield above 3% and a history of consistent dividend payments for the past 5 years.

Placing Your Order

After researching, it's time to buy. Enter the stock's ticker symbol into the search bar at the top of the Fidelity website.

This will bring you to the stock's quote page. Then click on "Trade."

Specify the number of shares you want to purchase and choose your order type (market order or limit order). Review your order carefully before submitting.

Understanding Order Types

A market order executes immediately at the current market price. This guarantees your order will be filled, but you may not get the exact price you want.

A limit order allows you to specify the maximum price you're willing to pay. Your order will only be filled if the stock price reaches that level. This gives you more control over the price but doesn't guarantee execution.

Choose the order type that aligns with your risk tolerance and investment strategy.

Monitoring Your Investments

After purchasing dividend stocks, monitor their performance regularly. Track the dividend payments you receive and the stock's price fluctuations.

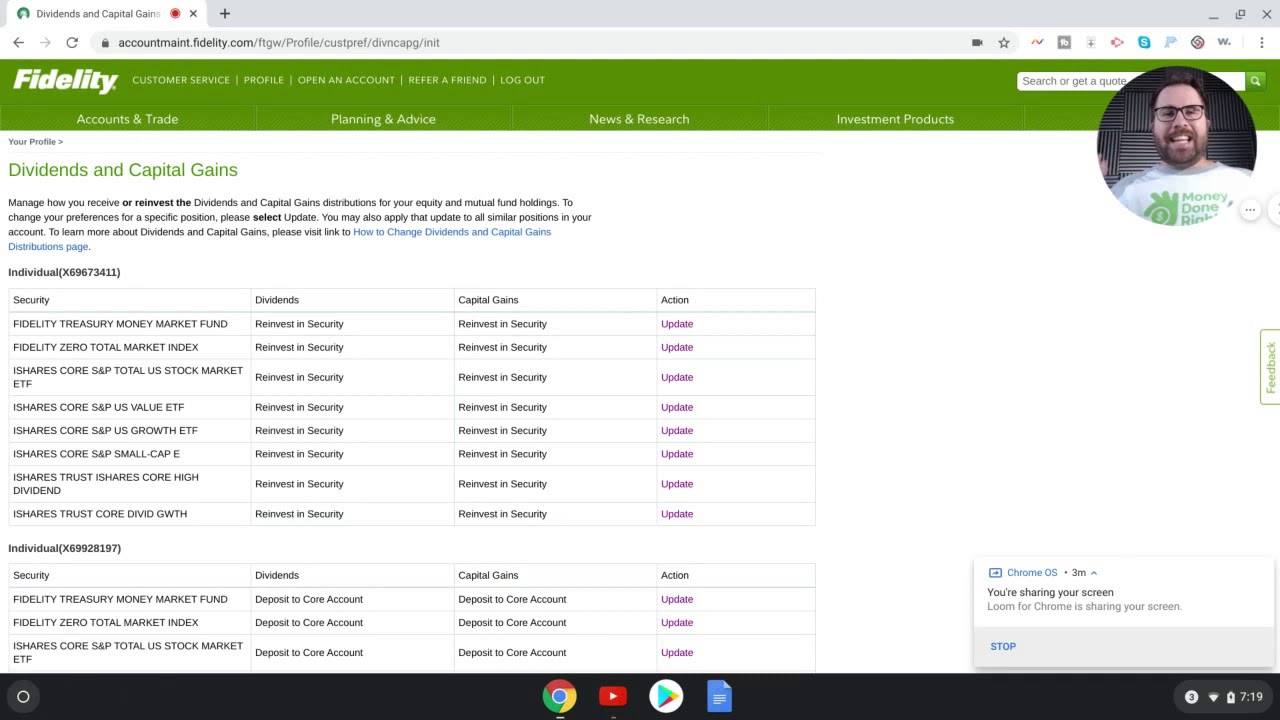

Fidelity provides tools to track your portfolio's performance and manage your investments. Consider setting up dividend reinvestment (DRIP) to automatically reinvest your dividends back into the stock. This can help accelerate your returns over time.

Review your portfolio periodically and make adjustments as needed to stay aligned with your financial goals.

Key Considerations and Next Steps

Before investing in dividend stocks, understand the risks involved. Dividend payments are not guaranteed and can be reduced or suspended at any time.

Diversify your portfolio across different sectors and industries to mitigate risk.

Regularly review Fidelity's resources for updated market analysis and investment recommendations. Take the time to thoroughly research each dividend stock before investing and seek professional financial advice if needed. Continue to monitor your investments and adjust your strategy as needed to achieve your financial goals.

![How To Buy Dividend Stocks On Fidelity [Fidelity Guide] 🟢 How To Find Total Dividend & Projected Income](https://usefidelity.com/wp-content/uploads/2023/09/fidelity-year-to-date-dividend.jpg)