How To Buy Stocks On Robinhood

Imagine yourself sipping coffee on a sunny Saturday morning, scrolling through your phone, not just checking social media, but taking a step towards building your financial future. The stock market, once perceived as an exclusive club for seasoned investors, is now increasingly accessible to everyone, thanks to platforms like Robinhood. It’s no longer about stuffy boardrooms and complicated jargon; it’s about empowerment and taking control of your financial destiny from the comfort of your own home.

This article serves as a friendly guide to help you navigate the world of investing with Robinhood. We'll break down the process step-by-step, from setting up your account to making your first investment, so you can confidently embark on your journey toward financial independence.

What is Robinhood?

Robinhood is a commission-free online brokerage that allows users to trade stocks, ETFs, options, and cryptocurrencies. Founded in 2013 by Vlad Tenev and Baiju Bhatt, its mission is to democratize finance for all. They wanted to make investing more accessible, especially for younger generations and those who might have been intimidated by traditional brokerage firms.

Before Robinhood, many brokerages charged commission fees for each trade, which could eat into potential profits, especially for smaller investors. By eliminating these fees, Robinhood lowered the barrier to entry, allowing individuals to invest with even small amounts of money.

Getting Started: Setting Up Your Robinhood Account

The first step to buying stocks on Robinhood is creating an account. The process is relatively straightforward and can be completed in a matter of minutes.

1. Download the App and Create an Account

Download the Robinhood app from the App Store (for iOS users) or Google Play Store (for Android users). Once the app is installed, open it and click "Sign Up."

You'll need to provide some personal information, including your name, email address, date of birth, and Social Security number. Robinhood is required to collect this information for identity verification and tax purposes, as mandated by U.S. regulations.

2. Verify Your Identity

Robinhood will verify your identity by asking you to upload a picture of your driver's license, passport, or other government-issued ID. This is a standard security measure to protect against fraud and ensure compliance with regulations.

You may also be asked to provide additional information, such as your employment status and annual income. This information helps Robinhood understand your investment profile and risk tolerance.

3. Link Your Bank Account

To deposit funds into your Robinhood account, you'll need to link your bank account. You can do this by providing your bank account number and routing number, or by using a service like Plaid, which allows you to securely connect your bank account to Robinhood.

Once your bank account is linked, you can transfer funds into your Robinhood account. Transfers typically take 1-3 business days to process.

Funding Your Account and Placing Your First Trade

Now that your account is set up and verified, it's time to fund it and start investing. Remember, it's wise to only invest money you can afford to lose.

1. Depositing Funds

To deposit funds, navigate to the "Account" section of the app and select "Transfers." From there, choose "Transfer to Robinhood" and enter the amount you wish to deposit.

Keep in mind that Robinhood offers instant deposits up to a certain limit, depending on your account type and history. This allows you to start trading immediately, even before the funds have fully cleared from your bank account.

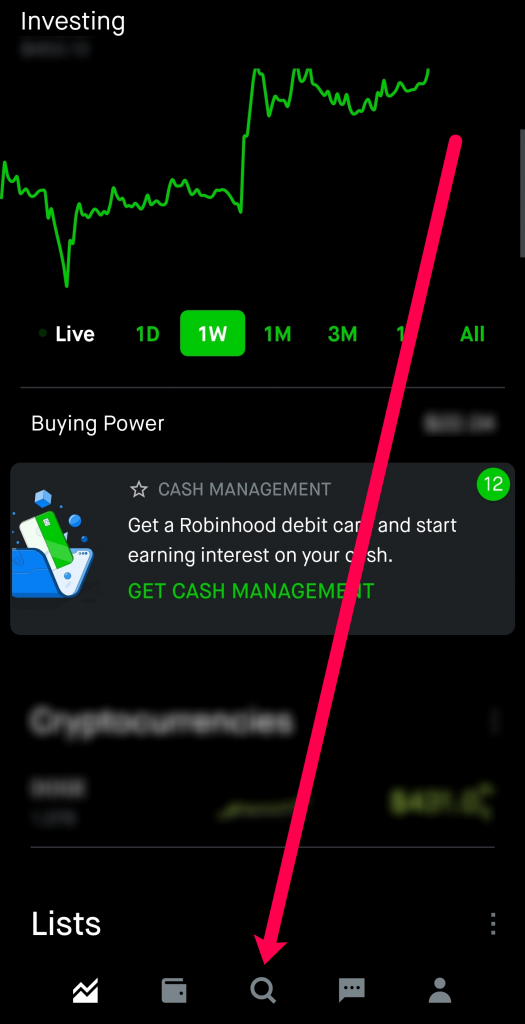

2. Finding Stocks

Robinhood makes it easy to search for stocks. Use the search bar at the top of the app to enter the name or ticker symbol of the company you're interested in. For example, if you're interested in investing in Apple, you can search for "Apple" or "AAPL."

Once you've found the stock you're looking for, you can view its price chart, key statistics, news articles, and analyst ratings. Take some time to research the company and understand its business model before investing.

3. Placing a Trade

To buy a stock, tap the "Trade" button on the stock's detail page. You'll then be presented with a few options.

You can choose to buy shares of the stock or fractional shares. Fractional shares allow you to buy a portion of a share, which is particularly useful if the stock price is high and you don't want to invest a large sum of money. You can also choose the order type such as Market Order or Limit Order. A Market Order executes your trade immediately at the current market price. A Limit Order allows you to set a specific price at which you want to buy or sell the stock.

Enter the number of shares or the dollar amount you want to invest and review your order. Once you're satisfied, swipe up to submit your order. Robinhood will then execute your trade as quickly as possible.

Understanding Different Order Types

Choosing the right order type is crucial to ensuring your trades are executed according to your strategy and risk tolerance.

Market Orders

As mentioned earlier, a Market Order is the simplest type of order and is executed immediately at the best available market price. This is a good option if you want to buy or sell a stock quickly and are not too concerned about the price.

However, keep in mind that the market price can fluctuate rapidly, especially during periods of high volatility. This means that the price you ultimately pay or receive for your shares may be slightly different from the price you saw when you placed your order.

Limit Orders

A Limit Order allows you to set a specific price at which you want to buy or sell a stock. If you're buying a stock, your order will only be executed if the stock price falls to or below your limit price. If you're selling a stock, your order will only be executed if the stock price rises to or above your limit price.

Limit Orders give you more control over the price at which your trades are executed, but there's also a risk that your order may not be filled if the stock price never reaches your limit price.

Tips for Successful Investing on Robinhood

Investing in the stock market involves risk, and there are no guarantees of success. However, by following a few key principles, you can increase your chances of achieving your financial goals.

Do Your Research

Before investing in any stock, take the time to research the company and understand its business model, financial performance, and competitive landscape. Read news articles, analyze financial statements, and consult with financial professionals if needed.

Don't rely solely on tips from friends or online forums. Investing should be based on sound research and analysis, not speculation or hype.

Diversify Your Portfolio

Don't put all your eggs in one basket. Diversifying your portfolio across different stocks, sectors, and asset classes can help reduce your overall risk. Robinhood allows you to easily build a diversified portfolio with even small amounts of money.

Consider investing in ETFs (exchange-traded funds), which are baskets of stocks that track a specific index or sector. ETFs can provide instant diversification and are a cost-effective way to gain exposure to a wide range of companies.

Invest for the Long Term

The stock market can be volatile in the short term, but historically, it has delivered strong returns over the long term. Don't try to time the market or get caught up in short-term trends. Instead, focus on investing in quality companies and holding them for the long term.

Warren Buffet, a legendary investor, once said that "Our favorite holding period is forever".

Start Small

You don't need a lot of money to start investing. Robinhood allows you to buy fractional shares, which means you can invest in even expensive stocks with just a few dollars. Start small and gradually increase your investments as you become more comfortable.

The important thing is to get started and develop good investing habits. Over time, even small investments can grow into a significant amount of wealth.

Potential Downsides of Using Robinhood

While Robinhood offers several advantages, it's important to be aware of its potential downsides as well.

While Robinhood doesn't charge commission fees, they do generate revenue through other means, such as payment for order flow. This practice has come under scrutiny because it potentially creates a conflict of interest, where Robinhood prioritizes profit over getting the best execution price for its customers.

Another concern is Robinhood's minimalist user interface, which, while user-friendly, may not provide investors with all the tools and research resources they need to make informed decisions. Active traders may find Robinhood's platform too basic for their needs.

Conclusion: Empowering Your Financial Future

Robinhood has undoubtedly democratized investing, making it more accessible and affordable for a wider range of individuals. It has encouraged countless people to take control of their financial futures and participate in the stock market. The platform offers a user-friendly interface, commission-free trading, and access to fractional shares, making it a great option for beginner investors.

However, it's crucial to remember that investing involves risk, and it's essential to do your research, diversify your portfolio, and invest for the long term. While Robinhood provides the tools to get started, ultimately, your success depends on your own knowledge, discipline, and investment strategy.

So, download the app, do your research, and take the first step toward building your financial future. With patience, diligence, and a little bit of knowledge, you can achieve your financial goals and create a brighter future for yourself and your loved ones. It's time to take control, learn, and invest wisely. The future is in your hands.