How To Calculate Cash Flow To Stockholders

Businesses need to understand how funds flow back to their investors. Calculating cash flow to stockholders (CFS) reveals a company's ability to provide returns to its owners, a key indicator of financial health.

This article provides a clear, concise guide on how to calculate CFS, a crucial metric for investors and financial analysts.

Understanding Cash Flow to Stockholders

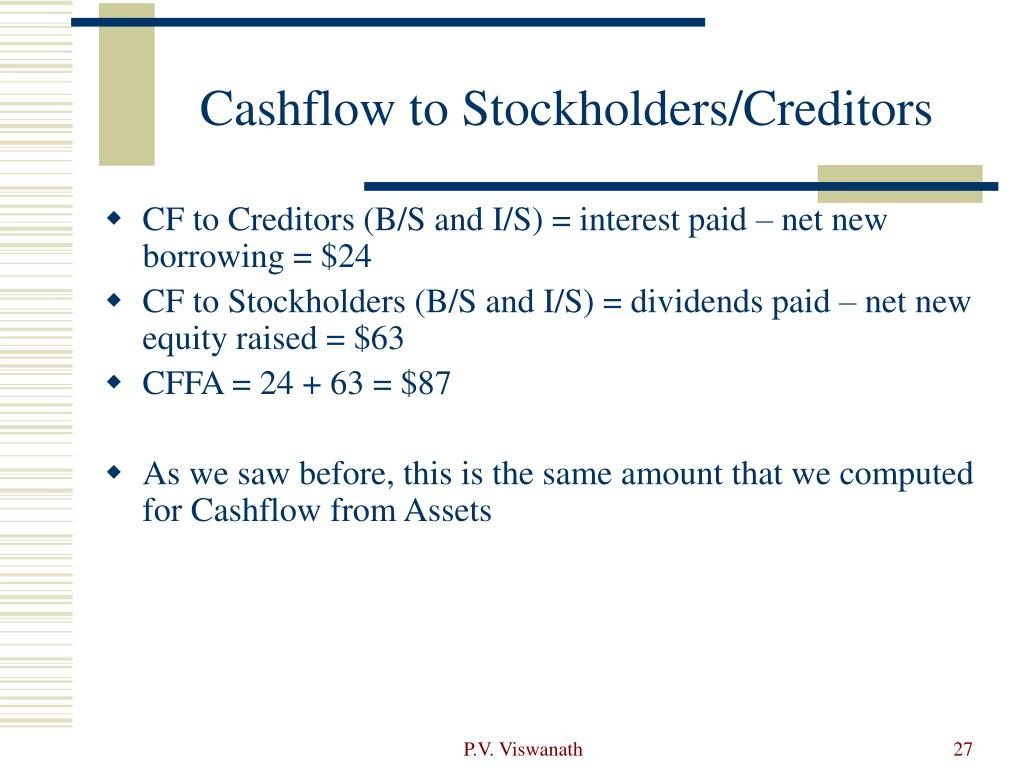

CFS represents the net cash a company distributes to its shareholders during a specific period. A positive CFS indicates a company is returning cash to its owners through dividends and stock repurchases. A negative CFS might mean the company is raising capital by issuing new stock.

Why is this important? Understanding cash flow to stockholders is vital because it directly reflects a company's financial decisions regarding shareholder value.

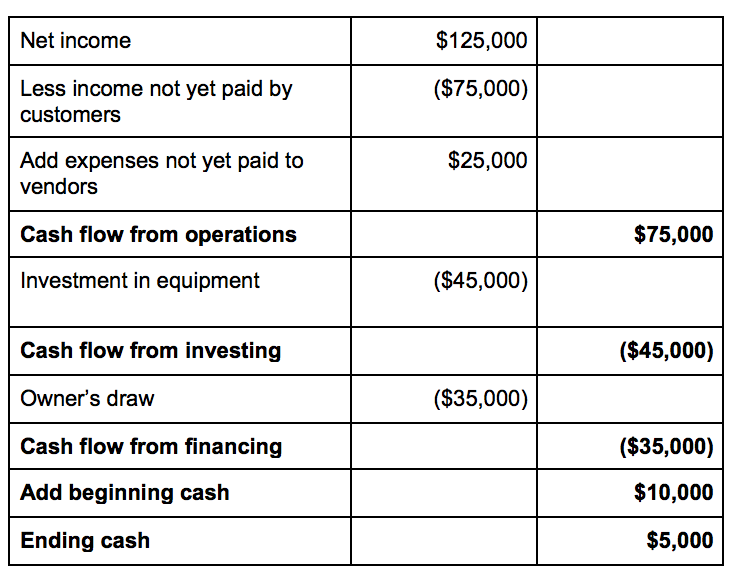

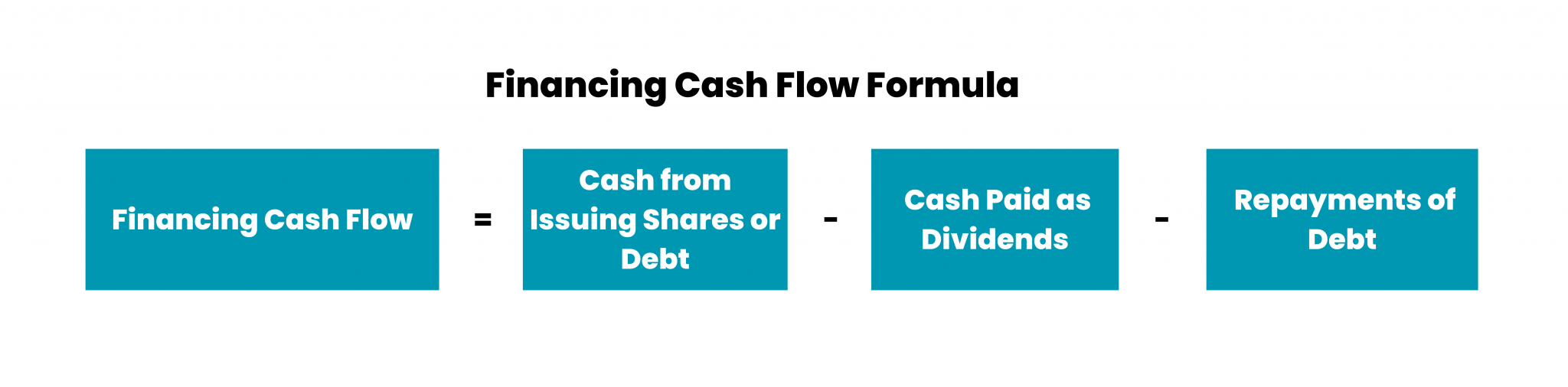

The Direct Method: A Simplified Approach

The direct method focuses on the actual cash inflows and outflows related to stockholders.

The basic formula is: CFS = Dividends Paid + Stock Repurchases - Proceeds from Stock Issuance.

Gathering the Data

You'll need access to the company's financial statements, specifically the statement of cash flows and the statement of changes in equity. These documents provide the necessary data.

Locate the following figures: Dividends Paid, Stock Repurchases (also known as Share Buybacks), and Proceeds from Stock Issuance.

Calculating CFS using the Direct Method

Let's say Company X paid out $1 million in dividends. It also repurchased $500,000 worth of its own stock. Finally, it issued new stock, generating $200,000 in proceeds.

Using the formula, CFS = $1,000,000 + $500,000 - $200,000 = $1,300,000.

Therefore, Company X's cash flow to stockholders is $1.3 million.

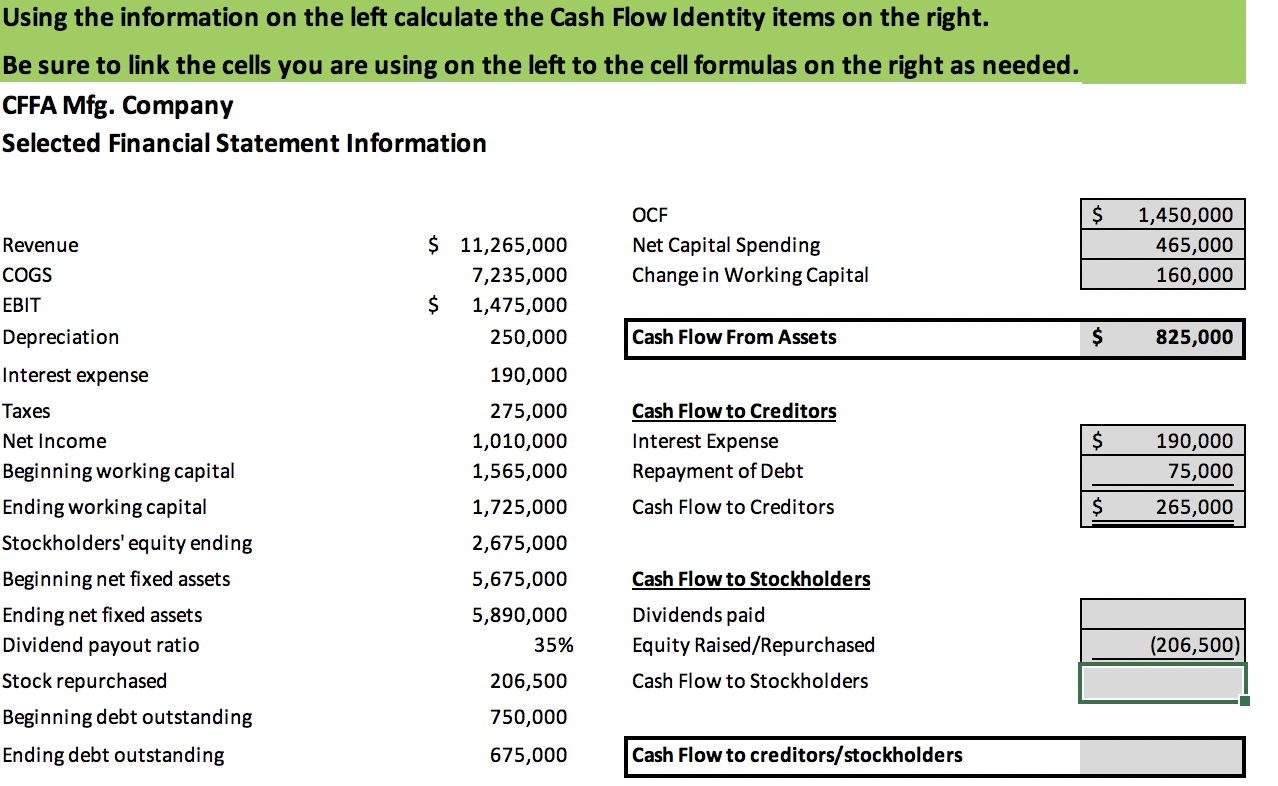

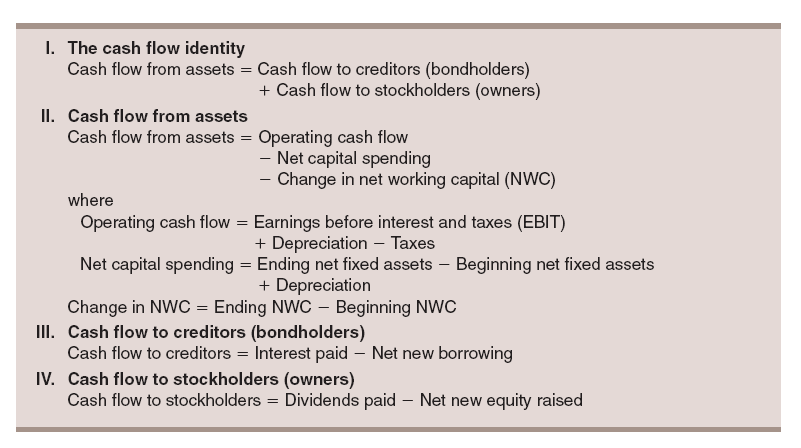

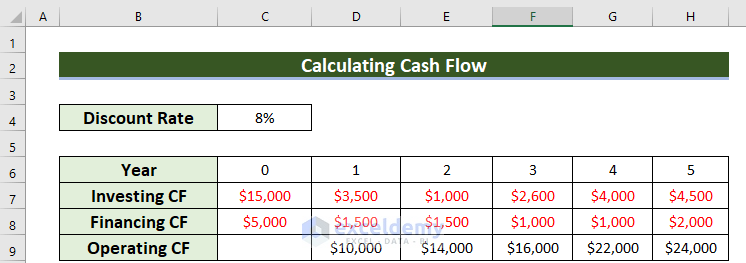

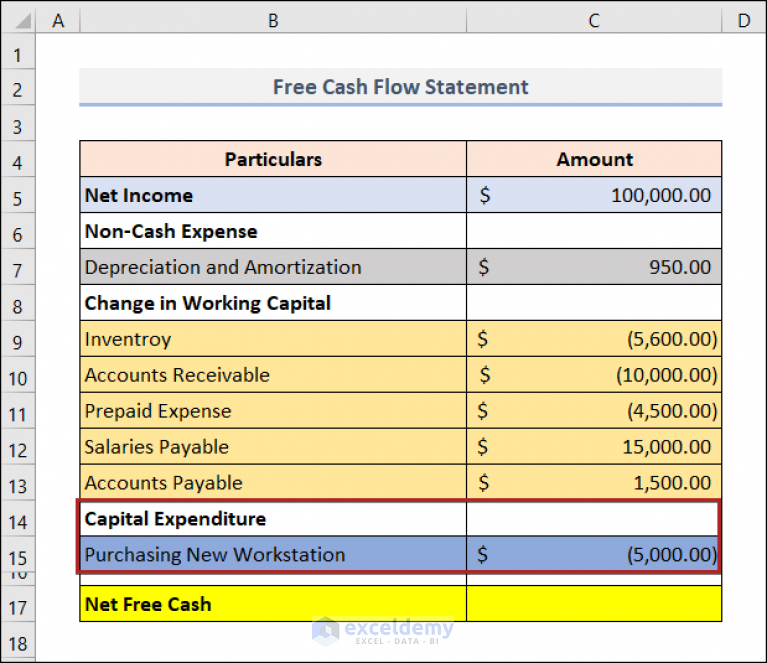

The Indirect Method: Using Net Income as a Starting Point

The indirect method uses net income as a starting point and adjusts for non-cash items and changes in balance sheet accounts to arrive at CFS. This method is more complex, but often used.

The formula is: CFS = Net Income + Non-Cash Charges - Increase in Working Capital - Capital Expenditures + Debt Issuance - Debt Repayment + Dividends Paid + Stock Repurchases - Stock Issuance.

Breaking Down the Components

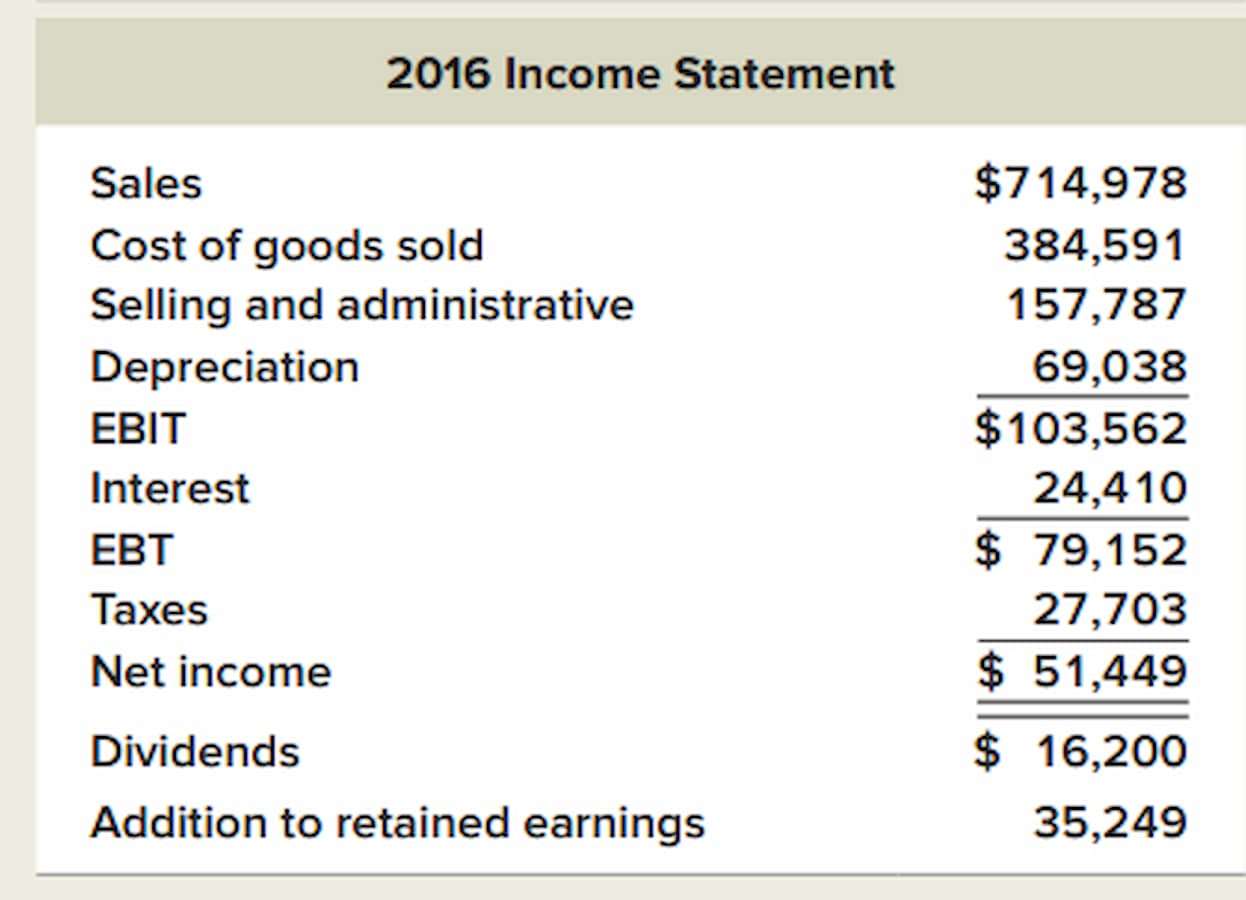

Net Income: This is the company's profit after all expenses and taxes.

Non-Cash Charges: Includes depreciation, amortization, and other expenses that don't involve an actual outflow of cash.

Increase in Working Capital: Represents the difference between current assets and current liabilities.

Capital Expenditures (CapEx): Investments in fixed assets like property, plant, and equipment.

Debt Issuance: Proceeds from issuing new debt.

Debt Repayment: Cash used to pay down existing debt.

Dividends Paid: Cash distributed to shareholders as dividends.

Stock Repurchases: Cash used to buy back outstanding shares.

Stock Issuance: Proceeds from issuing new shares of stock.

Calculating CFS using the Indirect Method

For Company Y, imagine we have the following data: Net Income = $2 million; Non-Cash Charges = $300,000; Increase in Working Capital = $100,000; Capital Expenditures = $400,000; Debt Issuance = $200,000; Debt Repayment = $100,000; Dividends Paid = $500,000; Stock Repurchases = $200,000; and Stock Issuance = $50,000.

CFS = $2,000,000 + $300,000 - $100,000 - $400,000 + $200,000 - $100,000 + $500,000 + $200,000 - $50,000 = $2,550,000.

Company Y's cash flow to stockholders is therefore $2.55 million.

Key Considerations and Cautions

Always use consistent accounting periods when comparing CFS across different companies or periods. Understanding accounting rules and principles is crucial for accurate analysis.

Cash flow to stockholders should be analyzed in conjunction with other financial metrics for a holistic view of the company's financial health.

Next Steps

Start practicing calculating CFS using real company data. Analyze trends in CFS over time to understand how a company's shareholder policies evolve.

Continuously monitor financial news and resources for updates on accounting standards that may impact CFS calculations.

![How To Calculate Cash Flow To Stockholders [Solved] Calculate cash flow to stockholders Incom | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/11/6541d7a17d505_1698857080355.jpg)