How To Get A Loan To Buy An Existing Business

For aspiring entrepreneurs, the dream of owning a business often materializes not through startups, but through acquiring established entities. However, the path to ownership frequently hinges on securing adequate financing. Navigating the loan landscape can be daunting, filled with complex jargon and stringent requirements.

This article serves as a comprehensive guide to obtaining a loan for purchasing an existing business. It dissects the crucial steps, from initial preparation and valuation to identifying suitable loan options and negotiating favorable terms. We will explore the essential components of a strong loan application and examine the due diligence necessary to ensure a sound investment.

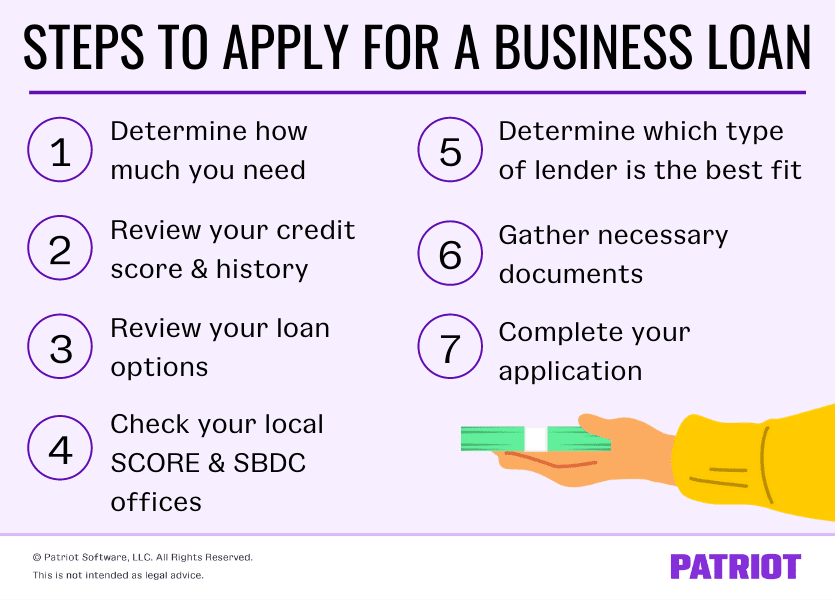

Preparing for the Loan Application

Before approaching lenders, meticulous preparation is paramount. This begins with a comprehensive assessment of your financial standing. Calculate your net worth, analyze your credit score, and document your income and expenses.

A robust business plan is essential. This document should articulate your vision for the acquired business. It must include detailed financial projections, market analysis, and strategies for growth and improvement.

The plan needs to convince lenders of your ability to repay the loan. It must demonstrate that the business will generate sufficient cash flow under your leadership. Seeking guidance from a business consultant or mentor can significantly enhance the quality of your business plan.

Valuing the Target Business

Determining the fair market value of the business is a critical step. An accurate valuation is crucial for both securing financing and avoiding overpayment. There are several valuation methods to consider.

These include asset-based valuation, earnings-based valuation, and market-based valuation. Engaging a professional appraiser is highly recommended to obtain an objective and reliable assessment. The Small Business Administration (SBA) often provides resources for finding qualified appraisers.

Understanding the seller's discretionary earnings (SDE) is vital. SDE represents the true earnings available to a single owner-operator. Lenders often base their lending decisions on SDE.

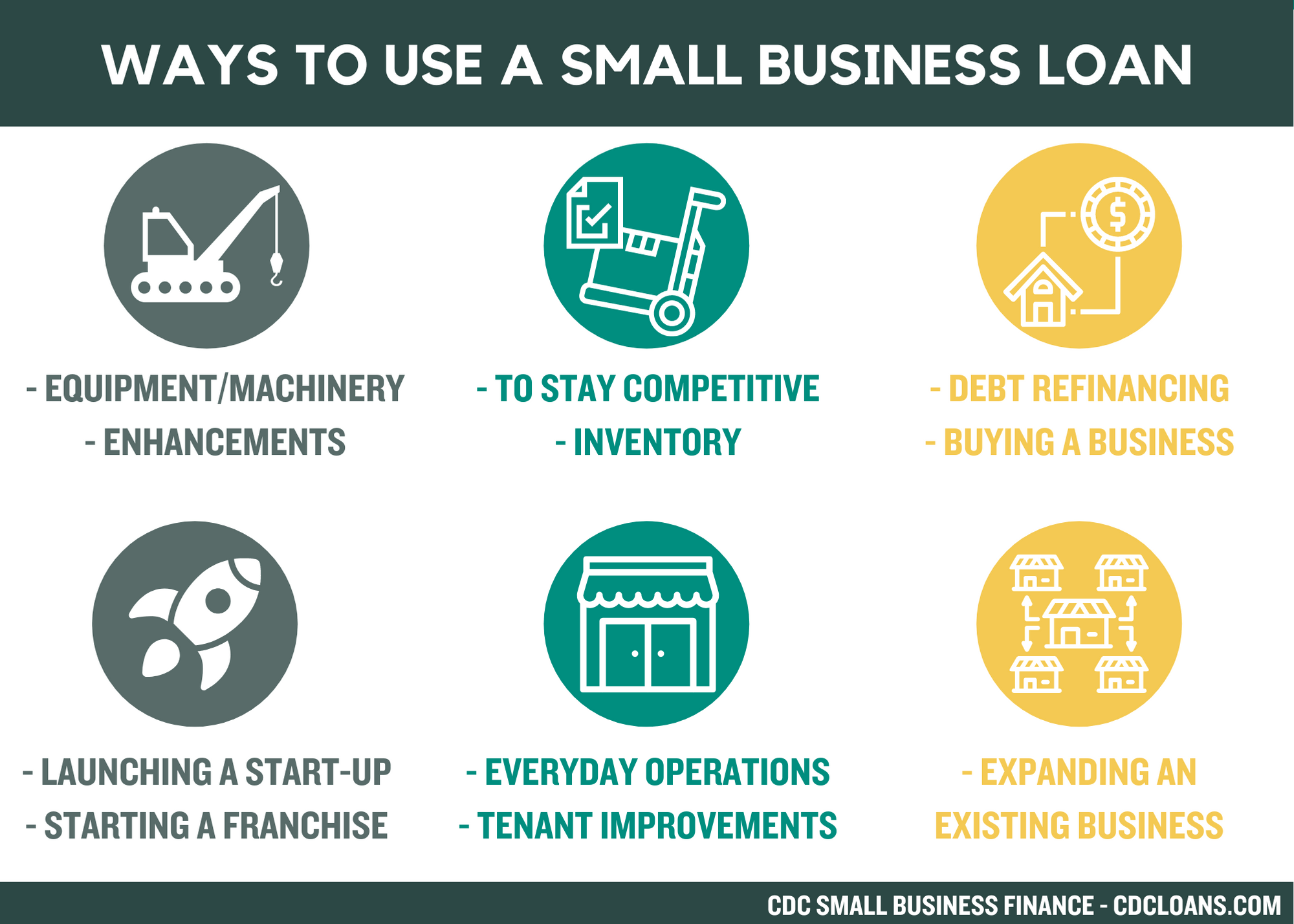

Exploring Loan Options

Several loan options are available for acquiring existing businesses. SBA loans are a popular choice. They offer favorable terms and lower down payments compared to conventional loans.

SBA 7(a) loans are commonly used for business acquisitions. They provide guarantees to lenders, reducing their risk and making them more willing to finance small businesses. Traditional bank loans are another avenue, but typically require stronger credit and collateral.

Seller financing is another option to explore. In this scenario, the seller provides a loan to the buyer. This can be a viable alternative when traditional financing is difficult to obtain.

The Due Diligence Process

Thorough due diligence is essential to uncover any hidden liabilities or potential risks. This involves reviewing the business's financial records, legal documents, and operational procedures. It includes scrutinizing contracts, leases, and customer agreements.

Engaging legal counsel and a certified public accountant (CPA) is highly recommended. These professionals can provide expert guidance in assessing the business's legal and financial health. Ignoring due diligence can lead to significant financial losses.

Verify the accuracy of the seller's representations. Conduct independent research to confirm market trends and competitive landscape.

Negotiating Loan Terms and Closing the Deal

Once you've identified a suitable loan option, carefully negotiate the terms. Pay attention to the interest rate, repayment schedule, and any associated fees. Secured loans typically offer lower interest rates. This is because they are backed by collateral.

Consider working with a loan broker. They can help you navigate the loan landscape and secure the best possible terms. They have access to a wide network of lenders. This increases your chances of finding a suitable loan.

The closing process involves finalizing the loan agreement. It also includes transferring ownership of the business. Ensure all legal and financial documents are properly executed.

Looking Ahead

Obtaining a loan for an existing business requires diligent preparation. It requires thorough research and careful negotiation. The current economic climate, characterized by fluctuating interest rates, requires a proactive approach.

Entrepreneurs should actively monitor market trends. Adapting their strategies accordingly is key to success. The rise of online lending platforms provides additional financing options.

By understanding the nuances of the loan process and conducting thorough due diligence, aspiring business owners can navigate the financing landscape. They can achieve their entrepreneurial dreams. The SBA offers resources and support to help small business owners succeed.