How To Get Money Out Of Your Bank Account

:max_bytes(150000):strip_icc()/002_transfer-money-from-paypal-to-bank-account-4582759-ccada152c5dc4c9fa4a38a5d0c536cc0.jpg)

In today's fast-paced world, accessing your funds quickly and securely is more critical than ever. Whether it's for daily expenses, planned purchases, or unforeseen emergencies, understanding the various methods to withdraw money from your bank account is essential for responsible financial management. Knowing the options available empowers you to make informed decisions and manage your finances effectively.

This article provides a comprehensive overview of the different ways to access your bank account funds, from traditional methods like ATMs and in-person withdrawals to modern digital solutions such as online transfers and mobile banking apps. We will explore the intricacies of each method, including associated fees, security considerations, and transaction limits, drawing upon information from reputable financial institutions and regulatory bodies like the Federal Deposit Insurance Corporation (FDIC) and the Consumer Financial Protection Bureau (CFPB).

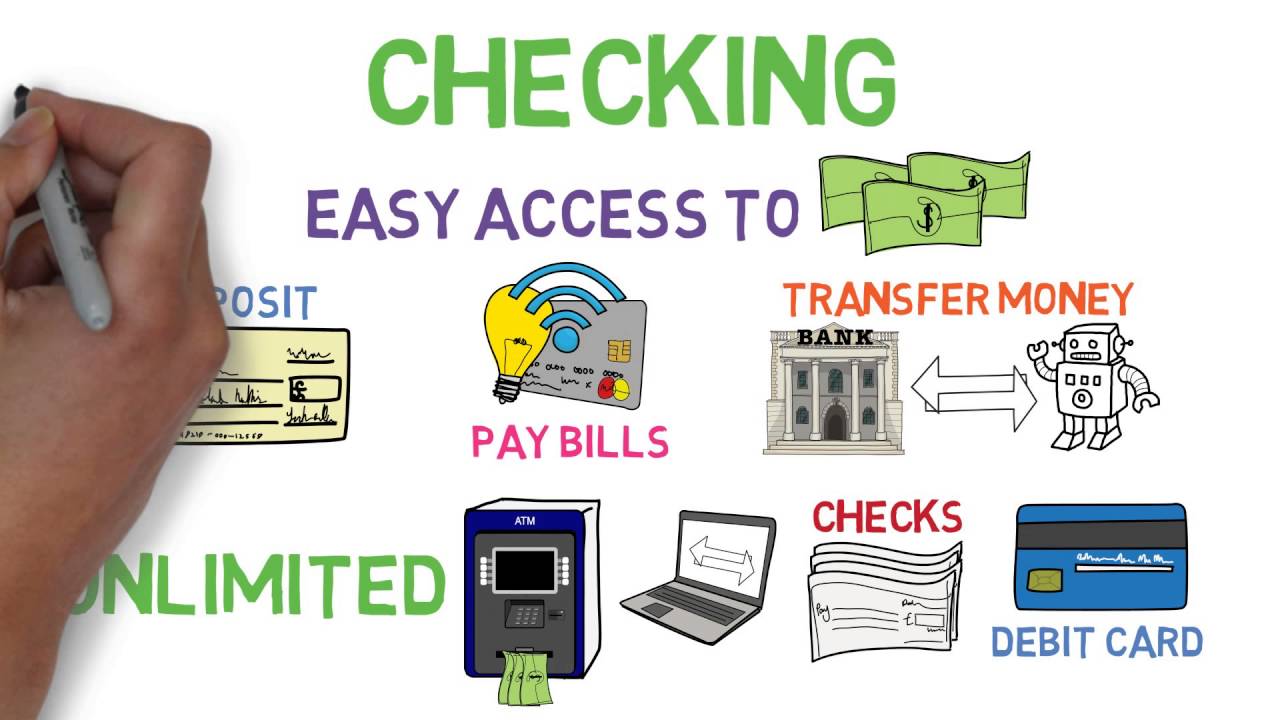

Traditional Withdrawal Methods

Automated Teller Machines (ATMs)

ATMs are a readily available and convenient way to withdraw cash. You can typically use your debit card at any ATM, but fees may apply if you use an ATM outside of your bank's network. Always be aware of your surroundings and protect your PIN when using an ATM.

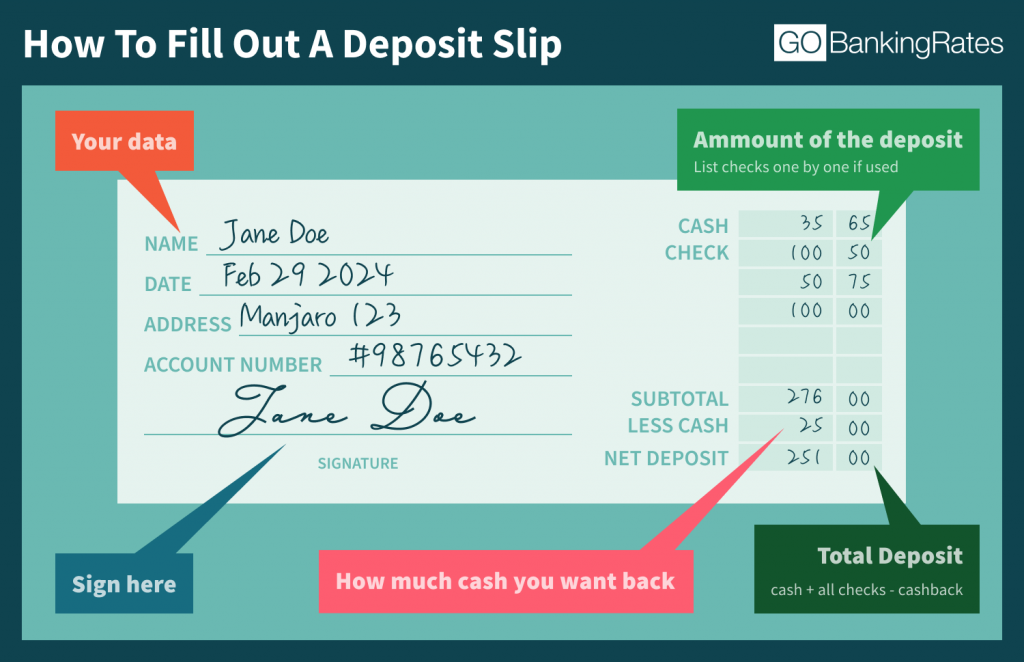

In-Person Withdrawals

Visiting a bank branch allows you to withdraw cash directly from a teller. This method is suitable for larger withdrawals or when you need assistance from a bank employee. Remember to bring a valid form of identification, such as a driver's license or passport.

Digital and Electronic Methods

Online Transfers

Online banking platforms allow you to transfer funds electronically between your accounts or to external accounts at other banks. These transfers are generally secure, but it's important to use strong passwords and enable two-factor authentication for added security. Be mindful of potential transfer limits and processing times.

Mobile Banking Apps

Mobile banking apps provide a convenient way to manage your finances and transfer funds on the go. These apps often include features like mobile check deposit and the ability to pay bills directly from your account. Ensure that you download the official app from your bank and keep your device secure.

Debit Card Purchases

Using your debit card to make purchases at retail stores is a common and convenient way to access your funds. When making debit card purchases, you may be asked to enter your PIN or provide a signature. Review your bank statements regularly to ensure the accuracy of all transactions.

Wire Transfers

Wire transfers are a fast and reliable way to send money electronically, often used for larger amounts or international transactions. Banks typically charge a fee for wire transfers, and the recipient may also incur a fee. Always verify the recipient's account information carefully to avoid errors.

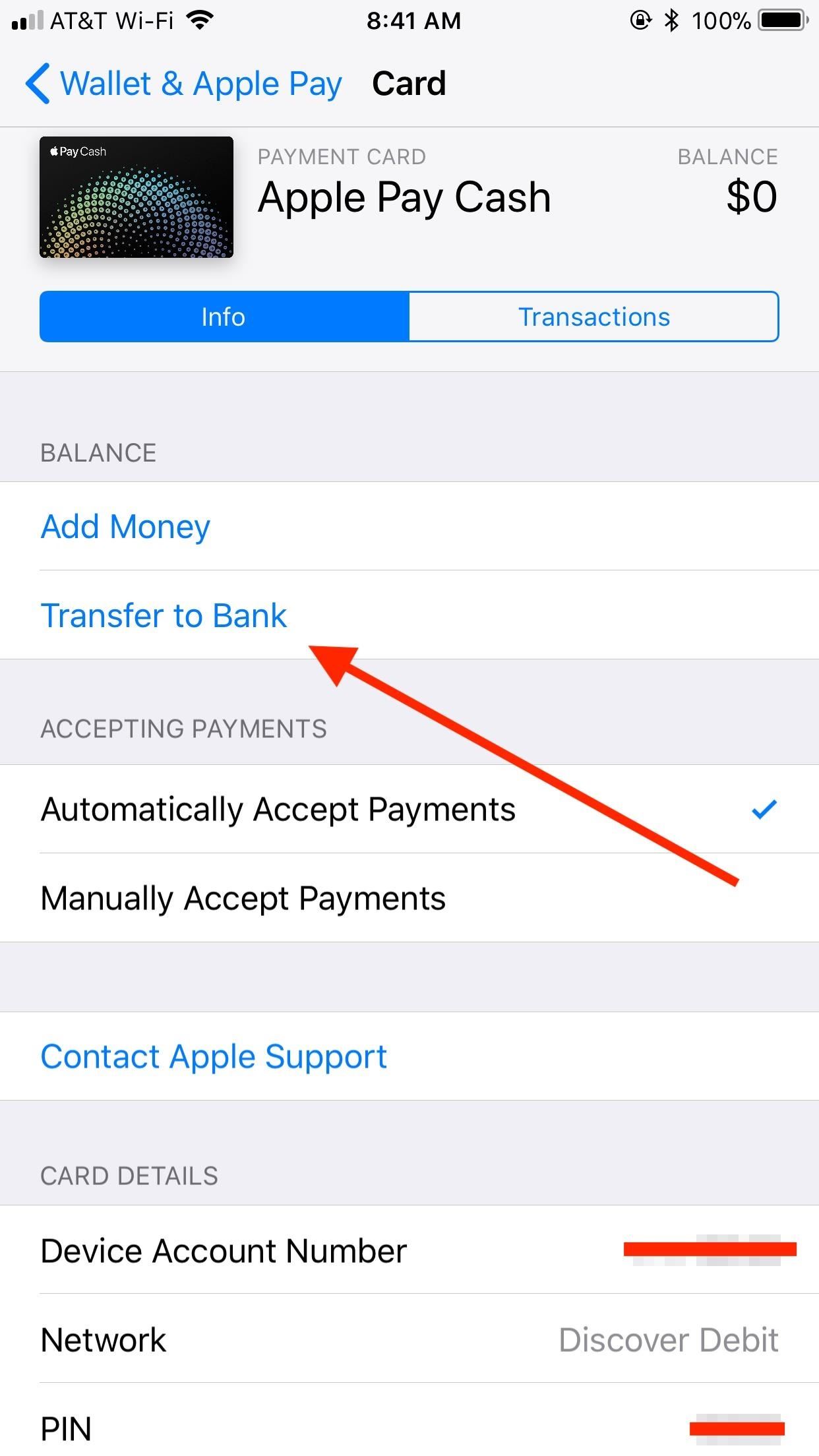

Payment Apps (e.g., Venmo, PayPal)

Payment apps like Venmo and PayPal allow you to send and receive money electronically with friends and family. While convenient, these apps often have transaction limits and may charge fees for certain services. Be cautious when sending money to unknown individuals to avoid scams.

Considerations and Security Tips

Transaction Limits and Fees

Banks often impose daily or monthly transaction limits on withdrawals and transfers. Be aware of these limits to avoid exceeding them and incurring fees. Additionally, understand any fees associated with using ATMs outside your bank's network or for overdrafts.

Security Measures

Protect your bank account information by using strong passwords and enabling two-factor authentication whenever possible. Be cautious of phishing emails and phone calls that attempt to obtain your personal information. Report any suspicious activity to your bank immediately.

FDIC Insurance

The FDIC insures deposits up to $250,000 per depositor, per insured bank. This insurance protects your funds in the event of a bank failure. Make sure your bank is FDIC-insured to safeguard your deposits.

Future Trends

The financial landscape is constantly evolving, with new technologies and payment methods emerging regularly. Cryptocurrencies and blockchain technology may offer alternative ways to access and manage funds in the future. Staying informed about these developments can help you adapt to the changing financial environment.

Accessing your bank account funds is a fundamental aspect of personal finance. By understanding the various withdrawal methods available, along with their associated fees and security considerations, you can make informed decisions and manage your money effectively. Continuously monitoring your accounts and staying updated on financial trends will contribute to your overall financial well-being.

:max_bytes(150000):strip_icc()/003-001-withdraw-money-from-paypal-instantly-4580630-1c0fce114d4149069c8a3c1ba1b154ce.jpg)

/57563502-56a066165f9b58eba4b04319.jpg)