How To Handle Finances For A Small Business

The lifeblood of any small business is its financial health. From managing cash flow to navigating taxes, small business owners face a complex landscape that can make or break their ventures. Mastering these financial intricacies isn't just about survival; it's about creating a sustainable and thriving enterprise.

This article delves into the essential strategies for effective financial management in a small business, offering actionable advice and insights to empower entrepreneurs. We'll cover budgeting, cash flow management, accounting practices, tax planning, and investment strategies. Understanding these core principles is paramount to ensuring long-term success and stability for your business.

Building a Solid Financial Foundation

Budgeting: Your Roadmap to Financial Success

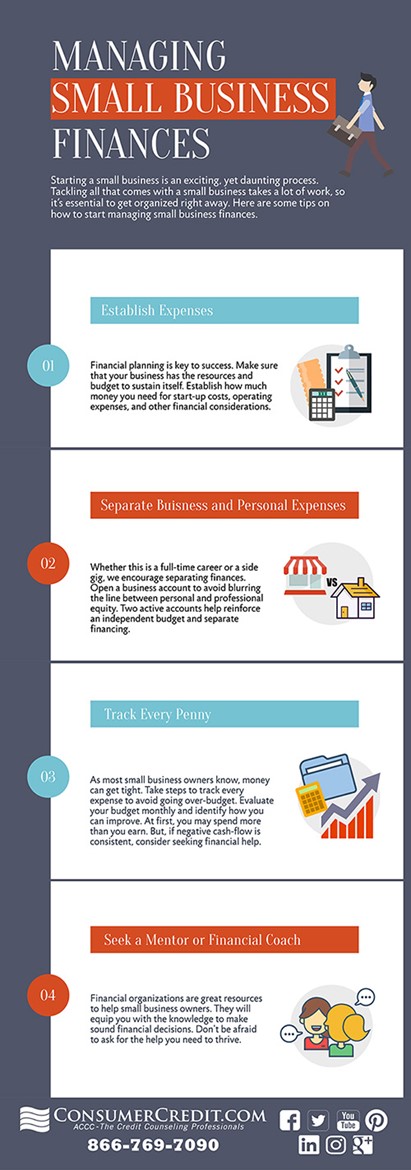

Creating a detailed budget is the first crucial step. Start by forecasting your revenue streams. Include projected sales, service fees, or any other income sources for the upcoming period.

Then, meticulously list all your expenses. Categorize them as fixed (rent, salaries) or variable (marketing, supplies) to better understand your cost structure.

Regularly compare your actual performance against your budget. This helps identify areas where you're overspending or underperforming, allowing you to make timely adjustments.

Cash Flow Management: Keeping Your Business Afloat

Cash flow, the movement of money in and out of your business, is vital. Monitoring it ensures you have enough funds to meet your obligations.

Accurately track all incoming and outgoing payments. Consider using accounting software to streamline this process and avoid costly errors.

Extend payment terms for your accounts payable and shorten them for your accounts receivable. This strategy helps optimize your cash conversion cycle.

Accounting Practices: The Language of Business

Maintaining accurate and up-to-date financial records is non-negotiable. Choose an accounting method that suits your business needs, either cash or accrual.

Hire a qualified accountant or bookkeeper. They can provide invaluable expertise in managing your finances and ensuring compliance with regulations.

Regularly reconcile your bank statements. Reconciling bank statements helps prevent fraud and discrepancies and maintain an accurate view of your financial position.

Navigating the Tax Landscape

Tax Planning: Minimize Your Liabilities

Understanding your tax obligations is essential to avoid penalties. Familiarize yourself with federal, state, and local tax requirements applicable to your business.

Take advantage of all eligible deductions and credits. This can significantly reduce your tax burden and free up capital for reinvestment in your business.

Consult with a tax professional for personalized advice. A professional tax advisor can help you navigate complex tax laws and optimize your tax strategy.

Estimating and Paying Taxes: Stay Compliant

As a small business owner, you're typically responsible for paying estimated taxes. This usually happens quarterly to avoid penalties at the end of the year.

Accurately estimate your income and deductions to determine your tax liability. Tools and resources offered by the IRS can help with this process.

Keep meticulous records of all income and expenses. Having all this recorded will support your tax filings and potential audits.

Investing in the Future

Reinvesting Profits: Fueling Growth

Consider reinvesting a portion of your profits back into your business. This could involve upgrading equipment, expanding marketing efforts, or hiring new talent.

Strategic investments can enhance your business's competitiveness. This can also generate greater returns in the long run.

Carefully evaluate all investment opportunities. Be sure to assess their potential risks and rewards before committing capital.

Building an Emergency Fund: Preparing for the Unexpected

An emergency fund acts as a financial safety net for your business. This can help you weather unexpected storms, such as economic downturns or unforeseen expenses.

Aim to save at least three to six months' worth of operating expenses. This will give you a financial cushion during difficult times.

Choose a safe and liquid investment vehicle for your emergency fund. Easy access to funds when needed is paramount.

Technology and Financial Management

Leveraging Accounting Software

Accounting software streamlines financial management processes. It automates tasks like invoicing, expense tracking, and financial reporting.

Popular options include QuickBooks, Xero, and FreshBooks. These often offer features tailored to small business needs.

Cloud-based accounting software provides added benefits. It provides accessibility from anywhere, automatic data backups, and enhanced collaboration.

Online Banking and Payment Solutions

Online banking offers convenience and efficiency. It allows you to manage your accounts, transfer funds, and pay bills electronically.

Consider using online payment solutions. This facilitates customer payments, reduces transaction costs, and improves cash flow.

Ensure the security of your online banking and payment systems. This can be done by implementing robust security measures and educating your employees about fraud prevention.

Seeking Professional Guidance

The Value of Expert Advice

Don't hesitate to seek professional guidance from financial experts. Financial advisors, accountants, and business consultants can provide invaluable insights.

They can help you develop a tailored financial strategy. Also they can optimize your tax planning, and make informed investment decisions.

The cost of professional advice is often outweighed by the benefits. Especially in terms of improved financial performance and reduced risk.

Building a Strong Financial Team

Surround yourself with a team of financial professionals. This includes an accountant, a bookkeeper, and a financial advisor.

Regularly communicate with your team and seek their input. That way you can stay informed about your business's financial health.

A strong financial team is a valuable asset. Especially because they can provide expert guidance and support at every stage of your business journey.

Mastering small business finances is an ongoing journey that requires dedication and knowledge. By implementing these strategies and seeking professional guidance when needed, entrepreneurs can build a solid financial foundation, navigate challenges, and achieve long-term success.