How To Have Different Streams Of Income

In an era defined by economic uncertainty and rapidly evolving job markets, the concept of relying on a single income stream is becoming increasingly precarious. Layoffs, industry disruptions, and the rising cost of living are forcing individuals to rethink their financial strategies. The pursuit of multiple income streams is no longer a luxury but a necessity for many seeking financial stability and independence.

This article delves into actionable strategies for building diverse revenue channels. We'll explore the various avenues available, from traditional side hustles to passive income investments, and offer insights on how to navigate the challenges and maximize the potential of each stream. Ultimately, the goal is to empower readers with the knowledge and tools to create a more resilient and prosperous financial future.

Understanding the Landscape of Income Streams

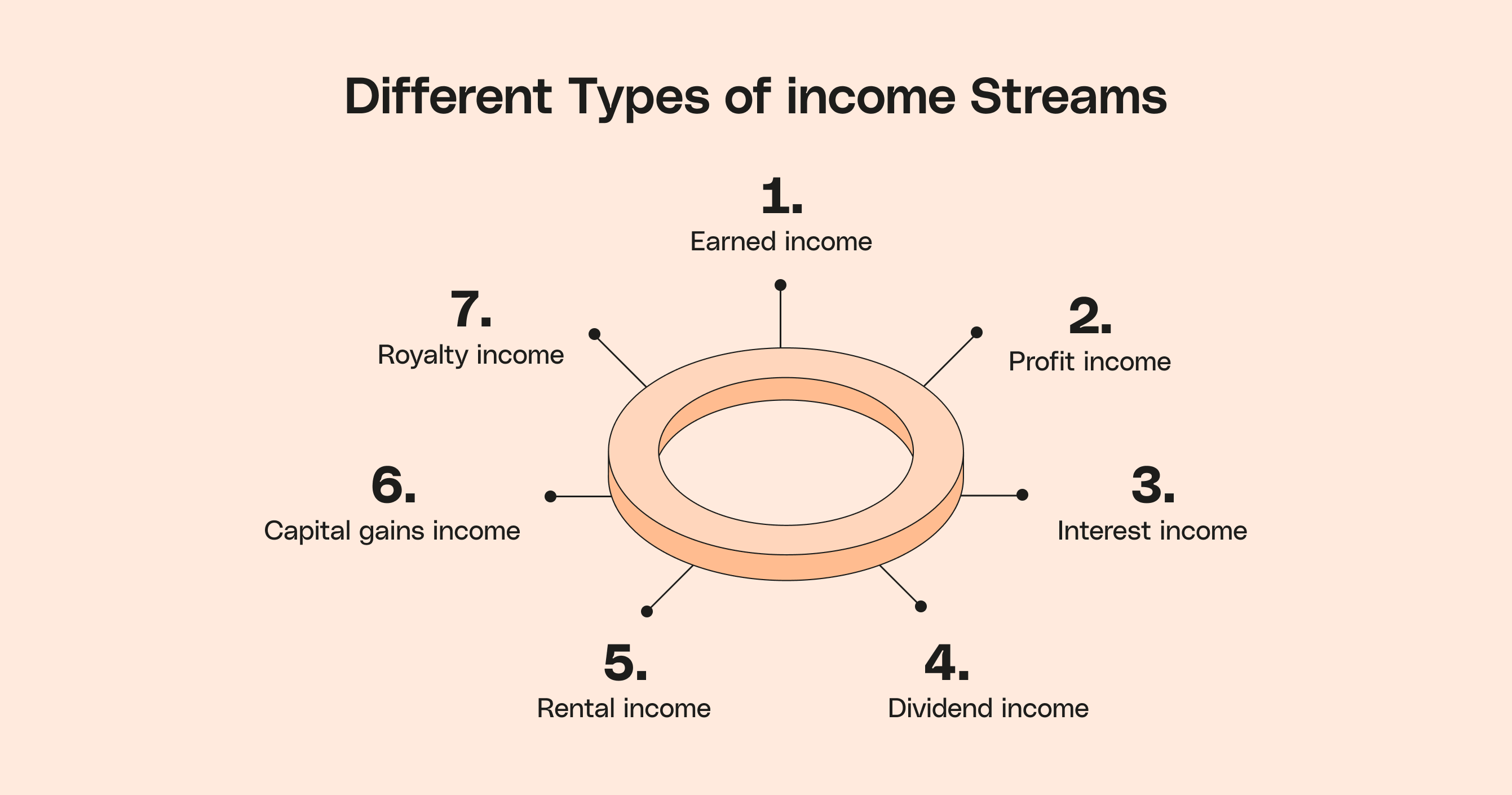

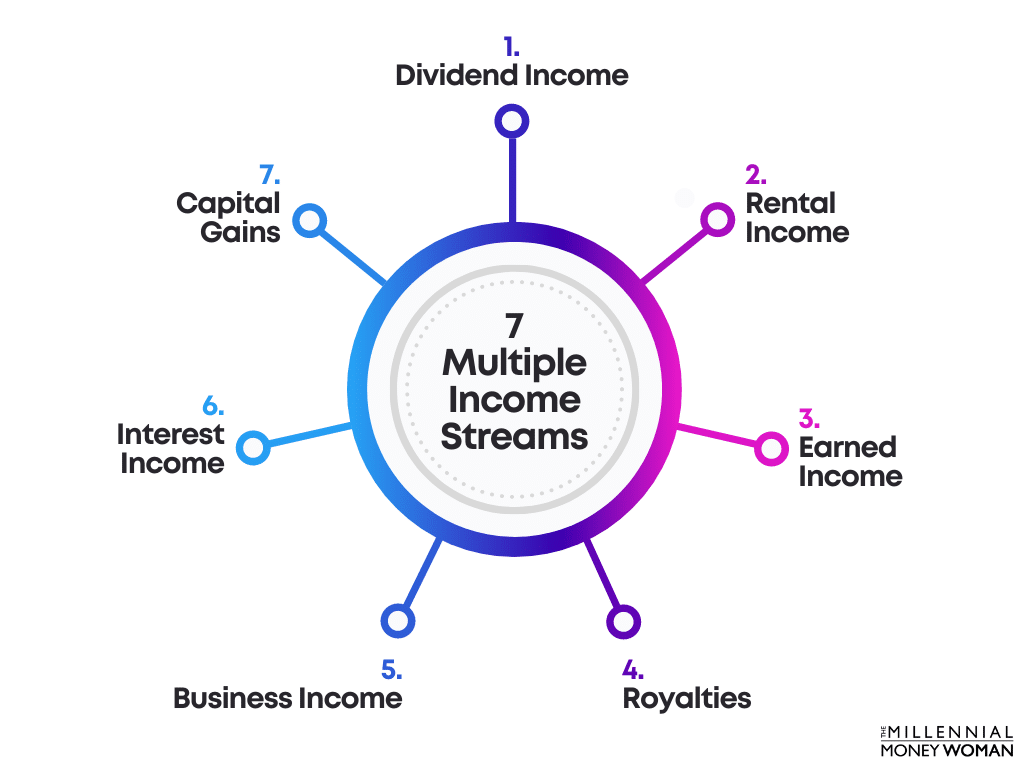

The foundation of a diversified income portfolio rests on understanding the different types of income streams available. Broadly, these can be categorized into active and passive income. Active income requires direct involvement and effort, while passive income generates revenue with minimal ongoing input, after an initial setup period.

Active Income Streams include freelance work, part-time jobs, consulting services, and selling products or services online. These streams often provide immediate income and are a good starting point for building momentum.

Freelancing and Consulting

The rise of the gig economy has made freelancing more accessible than ever. Platforms like Upwork, Fiverr, and Guru connect freelancers with clients across various industries. Individuals can offer their skills in writing, graphic design, web development, marketing, and more.

Consulting offers another avenue for leveraging expertise. Consultants provide specialized advice and solutions to businesses, often commanding higher rates than traditional freelancers. Success hinges on establishing a strong reputation and network.

Part-Time Employment and the Retail Sector

Traditional part-time jobs remain a viable option for supplementing income. The retail and hospitality sectors often offer flexible hours, allowing individuals to balance work with other commitments. However, wages in these sectors may be lower compared to freelancing or consulting.

Passive Income Streams encompass rental properties, dividend-paying investments, royalties from creative works, and online courses. While these streams require an initial investment of time or money, they can generate consistent revenue with less ongoing effort.

Investing in Stocks and Bonds

Investing in stocks and bonds offers the potential for passive income through dividends and interest payments. Diversifying across different asset classes and industries can mitigate risk. However, it is important to consult with a financial advisor to assess risk tolerance and investment goals.

Rental Properties and Real Estate

Investing in rental properties can provide a steady stream of passive income. However, it also entails responsibilities such as property management, tenant screening, and maintenance. Real estate crowdfunding platforms offer an alternative for those seeking exposure to the real estate market without the direct management responsibilities.

The U.S. Census Bureau reported in 2022 that approximately 7.6% of American households receive income from rental properties.

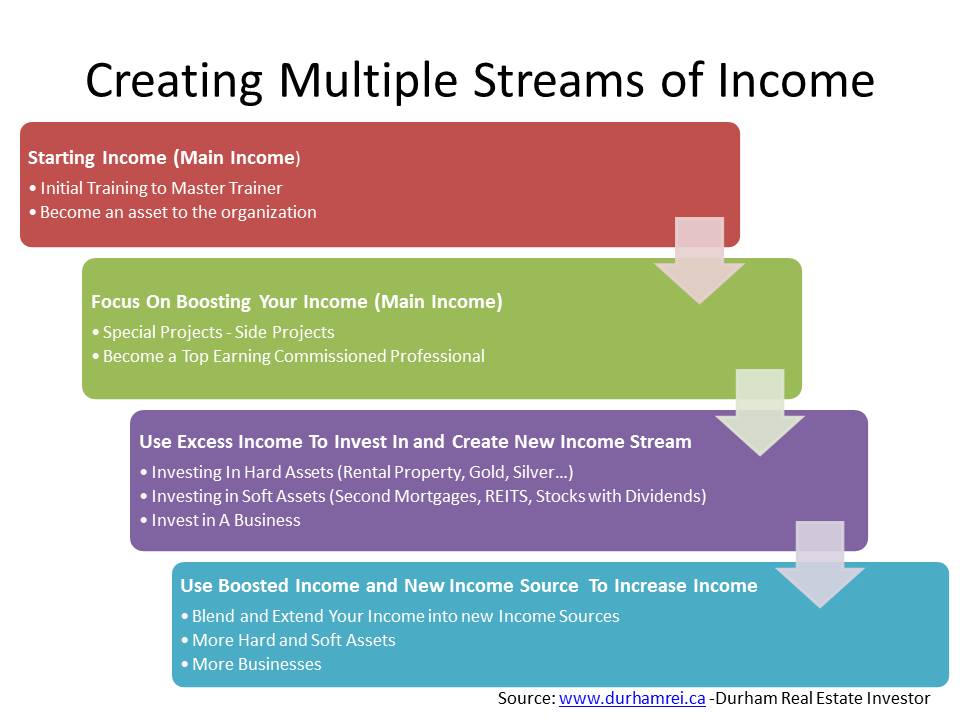

Strategies for Building Multiple Income Streams

Building multiple income streams requires a strategic approach and careful planning. Begin by assessing your skills, interests, and available resources. Identify opportunities that align with your strengths and passions. Research the market demand and competition before investing significant time or money.

Allocate your time and resources wisely. Prioritize income streams with the highest potential return on investment. Leverage technology and automation to streamline processes and maximize efficiency. Remember to track your income and expenses meticulously to monitor your progress and make informed decisions.

Challenges and Considerations

Building multiple income streams is not without its challenges. Time management, burnout, and tax implications are common hurdles. It is crucial to set realistic expectations, prioritize self-care, and seek professional advice when needed.

"Diversification is key, but don't spread yourself too thin," cautions financial advisor, Jane Doe.

Consult with a tax professional to understand the tax implications of different income streams. Properly reporting your income and expenses can help you avoid penalties and maximize your tax benefits. Keep detailed records of all your income and expenses, and consider using accounting software to simplify the process.

The Future of Income Diversification

As the economy continues to evolve, the need for diversified income streams will only intensify. The rise of remote work, online learning, and new technologies are creating new opportunities for individuals to generate income from various sources. Embracing lifelong learning and adapting to changing market conditions will be essential for success. Focusing on building a sustainable and diversified income portfolio is a long-term strategy for financial security.

The future of work is increasingly characterized by flexibility and entrepreneurship. Individuals who can adapt to these changes and embrace new opportunities will be best positioned to thrive in the evolving economic landscape. Investing in your skills, building your network, and exploring different income streams are essential steps for securing your financial future.